-

Trump tells Iranians to 'keep protesting', says 'help on its way'

Trump tells Iranians to 'keep protesting', says 'help on its way'

-

Italian Olympians 'insulted' by torch relay snub

-

Davos braces for Trump's 'America First' onslaught

Davos braces for Trump's 'America First' onslaught

-

How AI 'deepfakes' became Elon Musk's latest scandal

-

Albania's waste-choked rivers worsen deadly floods

Albania's waste-choked rivers worsen deadly floods

-

Cancelo rejoins Barca on loan from Al-Hilal

-

India hunts rampaging elephant that killed 20 people

India hunts rampaging elephant that killed 20 people

-

Nuuk, Copenhagen mull Greenland independence in Trump's shadow

-

WHO says sugary drinks, alcohol getting cheaper, should be taxed more

WHO says sugary drinks, alcohol getting cheaper, should be taxed more

-

Arteta urges Arsenal to learn from League Cup pain ahead of Chelsea semi

-

Davos elite, devotees of multilateralism, brace for Trump

Davos elite, devotees of multilateralism, brace for Trump

-

Spanish star Julio Iglesias accused of sexual assault by two ex-employees

-

Trump's Iran tariff threat pushes oil price higher

Trump's Iran tariff threat pushes oil price higher

-

US consumer inflation holds steady as affordability worries linger

-

Iran to press capital crime charges for 'rioters': prosecutors

Iran to press capital crime charges for 'rioters': prosecutors

-

Denmark, Greenland set for high-stake talks at White House

-

Iranian goes on trial in France ahead of possible prisoner swap

Iranian goes on trial in France ahead of possible prisoner swap

-

Cold winter and AI boom pushed US emissions increase in 2025

-

Hong Kong activist investor David Webb dies at 60

Hong Kong activist investor David Webb dies at 60

-

Try to be Mourinho and I'll fail: new Real Madrid coach Arbeloa

-

Vingegaard targets Giro d'Italia and Tour de France double

Vingegaard targets Giro d'Italia and Tour de France double

-

South Korean prosecutors demand death penalty for ex-leader Yoon

-

Iwobi hails Nigerian 'unity' with Super Eagles set for Morocco AFCON semi

Iwobi hails Nigerian 'unity' with Super Eagles set for Morocco AFCON semi

-

Le Pen appeal trial opens with French presidential bid at stake

-

Iran ex-empress urges security forces to join protesters

Iran ex-empress urges security forces to join protesters

-

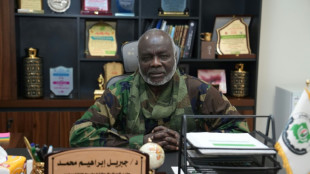

Sudan 'lost all sources of revenue' in the war: finance minister to AFP

-

Freezing rain hampers transport in Central Europe

Freezing rain hampers transport in Central Europe

-

Nuuk, Copenhagen cautiously mull Greenland independence

-

'Proving the boys wrong': Teenage racers picked for elite driver programme

'Proving the boys wrong': Teenage racers picked for elite driver programme

-

Mbappe absent from training as Arbeloa takes charge at Real Madrid

-

Iran worries push up oil price as world stocks diverge

Iran worries push up oil price as world stocks diverge

-

Volvo Cars pauses battery factory after fruitless partner search

-

Social media harms teens, watchdog warns, as France weighs ban

Social media harms teens, watchdog warns, as France weighs ban

-

Central bank chiefs voice 'full solidarity' with US Fed, Powell

-

Greece airspace shutdown exposes badly outdated systems

Greece airspace shutdown exposes badly outdated systems

-

France climate goals off track as emissions cuts slow again

-

Boeing sells 50 737 MAX jets to leasing group ACG

Boeing sells 50 737 MAX jets to leasing group ACG

-

Freezing rain paralyses transport in Central Europe

-

Man Utd reach deal to appoint Carrick as interim boss: reports

Man Utd reach deal to appoint Carrick as interim boss: reports

-

Trump hits Iran trade partners with tariffs as protest toll soars

-

Is China a threat to Greenland as Trump argues?

Is China a threat to Greenland as Trump argues?

-

Takaichi says urged S. Korea's Lee to help 'ensure regional stability'

-

South Korean prosecutors set to demand heavy sentence for Yoon

South Korean prosecutors set to demand heavy sentence for Yoon

-

Honduras electoral authorities reject vote recount

-

Tractors in Paris to protest EU's trade deal with S. America

Tractors in Paris to protest EU's trade deal with S. America

-

Asian markets rise, Iran worries push up oil

-

Williams loses golden oldie clash in final Australian Open warm-up

Williams loses golden oldie clash in final Australian Open warm-up

-

Kyrgios stands by decision to skip Australian Open singles

-

Disaster losses drop in 2025, picture still 'alarming': Munich Re

Disaster losses drop in 2025, picture still 'alarming': Munich Re

-

Williams, 45, loses in first round of final Australian Open warm-up

| SCS | 0.12% | 16.14 | $ | |

| CMSC | -0.21% | 23.26 | $ | |

| BCC | -0.21% | 82.79 | $ | |

| RIO | 1.07% | 83.775 | $ | |

| NGG | -2.7% | 77.66 | $ | |

| GSK | -0.9% | 49.94 | $ | |

| RBGPF | 1.13% | 82.5 | $ | |

| CMSD | -0.44% | 23.761 | $ | |

| BCE | -0.32% | 23.765 | $ | |

| JRI | -0.15% | 13.79 | $ | |

| RYCEF | -0.06% | 17.28 | $ | |

| VOD | -2.61% | 13.205 | $ | |

| BP | 1.95% | 35.095 | $ | |

| AZN | 0.39% | 94 | $ | |

| BTI | 1.51% | 56.535 | $ | |

| RELX | -1.6% | 42.095 | $ |

Alibaba seeks dual-primary listing in Hong Kong

E-commerce giant Alibaba said Tuesday it will seek a primary listing in Hong Kong, potentially giving access to China's vast pool of investors, as mainland officials indicate a long-running crackdown on the tech sector could be coming to an end.

The move also comes as Chinese tech companies traded in New York grow increasingly worried about a regulatory drive by US authorities amid simmering tensions between the superpowers.

While Alibaba has a secondary listing in Hong Kong, that does not allow it to join a popular Stock Connect programme that links to bourses in Shanghai and Shenzhen.

The primary listing, which is expected to take place before the end of the year, would open that door.

News of the plan sent shares in Alibaba soaring more than five percent Tuesday, boosting other tech firms and helping drag the broader Hang Seng Index higher.

The Hangzhou-based group is one of a number of tech behemoths ensnared in a wide-ranging regulatory crackdown on alleged anti-competitive practices since late 2020.

The campaign has been driven by fears in Beijing that massive internet companies control too much data and have expanded too quickly.

But officials appear to be taking a lighter touch as they grapple with a slowing economy. And in May, Premier Li Keqiang urged support for tech companies to list both domestically and abroad.

But there is still a strict regulatory environment: President Xi Jinping last month called for stronger oversight and better security in the financial tech arena.

CEO and group chairman Daniel Zhang said on Tuesday the primary listing aimed to foster "a wider and more diversified investor base to share in Alibaba’s growth and future, especially from China and other markets in Asia".

"Hong Kong is also the launch pad for Alibaba’s globalisation strategy, and we are fully confident in China’s economy and future."

Alibaba said on Tuesday it had an average daily trading volume of $3.2 billion in the United States in the first six months of the year, while its Hong Kong secondary listing saw around $700 million.

Hong Kong's Stock Connect programme allows firms to take advantage of liquidity from mainland China for easier financing and higher valuations, but to qualify they must conduct a majority of their annual trading in the Chinese finance hub.

Alibaba is among a category of "innovative" Chinese firms with weighted voting rights or variable interest entities that would be eligible for dual-primary listing in Hong Kong, following a rule change by the bourse in January.

Analyst Willer Chen, at Forsyth Barr Asia, told Bloomberg that the move would be "massive" for Alibaba, adding that inclusion in Stock Connect could lead to a "more diversified investor base".

Beijing has opposed an attempt by US regulators to inspect the audit papers of Chinese firms listed there, and Alibaba is among 250 companies that face potential removal if no deal is reached.

Domestically, Alibaba is still reeling from the tech crackdown as well as China's slowing economy caused by the fallout from strict Covid curbs.

The company was hit with a record $2.75 billion fine for alleged unfair practices last year, and a planned 2020 IPO by Alibaba's financial arm Ant Group -- which would have been the world's largest public offering at the time -- was cancelled at the last minute.

Alibaba has lost around two-thirds of its value since a 2020 peak, according to Bloomberg, and in May the firm reported that profit fell 59 percent in the last fiscal year.

K.AbuDahab--SF-PST