-

EU orders Musk's Grok AI to keep data after nudes outcry

EU orders Musk's Grok AI to keep data after nudes outcry

-

Venezuela announces release of 'large number' of prisoners

-

Rare gorilla twins born in conflict-hit DR Congo nature park

Rare gorilla twins born in conflict-hit DR Congo nature park

-

Dolphins fire head coach McDaniel after four seasons

-

Three ships head to US with Venezuela oil as capacity concerns grow

Three ships head to US with Venezuela oil as capacity concerns grow

-

Trump says US could run Venezuela and its oil for years

-

Heavy wind, rain, snow to batter Europe

Heavy wind, rain, snow to batter Europe

-

Morocco coach Regragui aims to shift pressure to Cameroon before AFCON clash

-

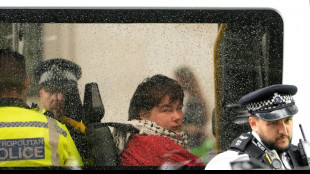

HRW warns right to protest 'under attack' in UK

HRW warns right to protest 'under attack' in UK

-

French farmers rage against EU-Mercosur trade deal

-

Humanoid robots go for knockout in high-tech Vegas fight night

Humanoid robots go for knockout in high-tech Vegas fight night

-

Brazil's Lula vetoes law reducing Bolsonaro's sentence

-

New protests, strikes hit Iran as security forces open fire

New protests, strikes hit Iran as security forces open fire

-

Macron accuses US of 'turning away' from allies, breaking rules

-

Joshua pays tribute to close friends killed in crash

Joshua pays tribute to close friends killed in crash

-

Protesters, US law enforcement clash after immigration officer kills woman

-

French ex-spy chief cops suspended jail term for 15 mn euro shakedown

French ex-spy chief cops suspended jail term for 15 mn euro shakedown

-

UN climate chief says Trump scores 'own goal' with treaty retreat

-

Syria bombs Kurdish areas in city of Aleppo

Syria bombs Kurdish areas in city of Aleppo

-

Confusion reigns over Venezuela's oil industry as US looms

-

Stocks retrench as traders eye geopolitics, US jobs data

Stocks retrench as traders eye geopolitics, US jobs data

-

US trade gap shrinks to smallest since 2009 as imports fall

-

Russia releases French researcher in prisoner exchange

Russia releases French researcher in prisoner exchange

-

Spain signs agreement with Church to compensate abuse victims

-

Macron accuses US of 'breaking free from international rules'

Macron accuses US of 'breaking free from international rules'

-

US could run Venezuela, tap its oil for years, Trump says

-

England to stick with Stokes and McCullum despite Ashes flop

England to stick with Stokes and McCullum despite Ashes flop

-

Nobel laureate Bialiatski tells AFP 'important' to keep pressure on Belarus

-

Russia slams Western peacekeeping plan for Ukraine

Russia slams Western peacekeeping plan for Ukraine

-

Bordeaux's Du Preez wary of Northampton's Champions Cup revenge mission

-

Romero apologises for Spurs slump as crisis deepens

Romero apologises for Spurs slump as crisis deepens

-

Former Premier League referee Coote gets suspended sentence for indecent image

-

New clashes hit Iran as opposition urges protests, strikes

New clashes hit Iran as opposition urges protests, strikes

-

Stocks retreat as traders eye geopolitics, US jobs data

-

'Girl with a Pearl Earring' to be shown in Japan, in rare trip abroad

'Girl with a Pearl Earring' to be shown in Japan, in rare trip abroad

-

Syria tells civilians to leave Aleppo's Kurdish areas

-

Farmers enter Paris on tractors to rage against trade deal

Farmers enter Paris on tractors to rage against trade deal

-

'Sign of life': defence boom lifts German factory orders

-

China confirms extradition of accused scam boss from Cambodia

China confirms extradition of accused scam boss from Cambodia

-

Japan's Fast Retailing raises profit forecast after China growth

-

Olympic champion Zheng out of Australian Open

Olympic champion Zheng out of Australian Open

-

England's Brook 'deeply sorry' for nightclub fracas

-

New clashes in Iran as opposition urges more protests

New clashes in Iran as opposition urges more protests

-

Equity markets mostly down as traders eye US jobs data

-

England cricket board launches immediate review into Ashes debacle

England cricket board launches immediate review into Ashes debacle

-

Dancing isn't enough: industry pushes for practical robots

-

Asian markets mostly down as traders eye US jobs data

Asian markets mostly down as traders eye US jobs data

-

Australia to hold royal commission inquiry into Bondi Beach shooting

-

Sabalenka accuses tour chiefs over 'insane' tennis schedule

Sabalenka accuses tour chiefs over 'insane' tennis schedule

-

Cambodia to liquidate bank founded by accused scam boss

| SCS | 0.12% | 16.14 | $ | |

| RBGPF | -0.27% | 81.57 | $ | |

| CMSC | 0.17% | 23.039 | $ | |

| BCC | 6.69% | 78.735 | $ | |

| BTI | 0.84% | 53.739 | $ | |

| RIO | -1.06% | 83.99 | $ | |

| BCE | 1.62% | 23.715 | $ | |

| GSK | -0.76% | 50.24 | $ | |

| NGG | 0.06% | 79.434 | $ | |

| BP | 0.87% | 33.965 | $ | |

| RYCEF | 0.29% | 17.05 | $ | |

| AZN | -0.84% | 94.37 | $ | |

| CMSD | -0.21% | 23.55 | $ | |

| JRI | 0.66% | 13.73 | $ | |

| RELX | 0.42% | 42.36 | $ | |

| VOD | -1.23% | 13.805 | $ |

Oil extends losses as Trump flags Venezuela shipments, stocks wobble

Oil extended losses Wednesday after Donald Trump said Venezuela would turn over millions of barrels to the United States, while equities wobbled after a record-breaking start to the year.

Crude has seen wild swings since the US president ordered the toppling Saturday of Nicolas Maduro, his counterpart in Caracas, and said Washington would run the country while demanding "total access" to its key resource.

But it sank as much as two percent Tuesday and around one percent Wednesday after Trump announced the latest development.

"The Interim Authorities in Venezuela will be turning over between 30 and 50 MILLION Barrels of High Quality, Sanctioned Oil, to the United States of America," he wrote on his Truth Social platform.

"This oil will be sold at its market price, and that money will be controlled by me, as President of the United States of America, to ensure it is used to benefit the people of Venezuela and the United States."

Analysts said the shipments lowered the risk that Caracas would have to cut output owing to its limited storage capacity, easing supply concerns, but added that the outlook for the commodity was lower prices.

That comes as the crude market remains well stocked after OPEC+ agreed to boost output.

Venezuela sits on about a fifth of the world's oil reserves, but observers pointed out that a quick ramp-up of output would be hamstrung by several issues including its creaking infrastructure, low prices and political uncertainty.

Equity markets fluctuated after a strong start to the year that has already seen Seoul following London and New York in hitting record highs thanks to the relentless rush into all things artificial intelligence.

South Korea's Kospi index continued its run-up Wednesday, while Sydney, Singapore, Shanghai, Wellington and Jakarta also rose.

However, Hong Kong dipped along with Taipei and Manila, while Tokyo slid after China imposed tougher export controls on products sent to Japan with potential military uses.

Still, despite rising geopolitical tensions, analysts remain upbeat about the outlook for equities this year.

"Participants remained squarely focused on what remains a robust bull case of resilient economic growth and robust earnings growth, largely in keeping with that which powered the market higher last year," wrote Michael Brown at Pepperstone.

He pointed to "expectations for considerably looser monetary and fiscal backdrops through the next twelve months".

"My view remains that the 'path of least resistance' continues to lead to the upside, and that any dips -- were they to occur -- continue to represent buying opportunities."

- Key figures at around 0230 GMT -

West Texas Intermediate: DOWN 1.2 percent at $56.47 per barrel

Brent North Sea Crude: DOWN 1.0 percent at $60.10 per barrel

Tokyo - Nikkei 225: DOWN 0.5 percent at 52,257.11 (break)

Hong Kong - Hang Seng Index: DOWN 1.0 percent at 26,431.70

Shanghai - Composite: UP 0.1 percent at 4,088.40

Euro/dollar: UP at $1.1700 from $1.1693 on Tuesday

Pound/dollar: UP at $1.3511 from $1.3503

Dollar/yen: UP at 156.68 yen from 156.59 yen

Euro/pound: UP at 86.60 pence from 86.58 pence

New York - Dow: UP 1.0 percent at 49,462.08 (close)

London - FTSE 100: UP 1.2 percent at 10,122.73 (close)

Q.Jaber--SF-PST