-

Three Russia-themed anti-war films shortlisted for Oscars

Three Russia-themed anti-war films shortlisted for Oscars

-

US oil blockade of Venezuela: what we know

-

Palace boss Glasner says contract talks on hold due to hectic schedule

Palace boss Glasner says contract talks on hold due to hectic schedule

-

Netflix to launch FIFA World Cup video game

-

Venezuela says oil exports continue normally despite Trump 'blockade'

Venezuela says oil exports continue normally despite Trump 'blockade'

-

German MPs approve 50 bn euros in military purchases

-

India v South Africa 4th T20 abandoned due to fog

India v South Africa 4th T20 abandoned due to fog

-

Hydrogen plays part in global warming: study

-

EU's Mercosur trade deal hits French, Italian roadblock

EU's Mercosur trade deal hits French, Italian roadblock

-

What next for Belarus after US deal on prisoners, sanctions?

-

Brazil Senate debates bill that could slash Bolsonaro jail term

Brazil Senate debates bill that could slash Bolsonaro jail term

-

Coe shares 'frustration' over marathon record despite Kenyan's doping ban

-

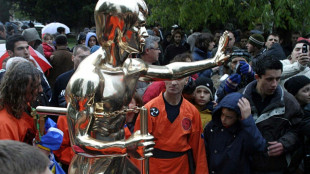

Stolen Bruce Lee statue 'returns' to Bosnia town

Stolen Bruce Lee statue 'returns' to Bosnia town

-

Veteran Suarez signs new Inter Miami contract

-

Warner Bros rejects Paramount bid, sticks with Netflix

Warner Bros rejects Paramount bid, sticks with Netflix

-

Crude prices surge after Trump orders Venezuela oil blockade

-

Balkan nations offer lessons on handling cow virus sowing turmoil

Balkan nations offer lessons on handling cow virus sowing turmoil

-

French readers lap up Sarkozy's prison diaries

-

UK PM warns Abramovich 'clock is ticking' over Chelsea sale fund

UK PM warns Abramovich 'clock is ticking' over Chelsea sale fund

-

Warner Bros. Discovery rejects Paramount bid

-

Winners of 2026 World Cup to pocket $50 million in prize money

Winners of 2026 World Cup to pocket $50 million in prize money

-

World no. 1 Alcaraz ends 'incredible ride' with coach Ferrero

-

World number one Alcaraz announces 'difficult' split with coach Ferrero

World number one Alcaraz announces 'difficult' split with coach Ferrero

-

Iran boxer sentenced to death at 'imminent' risk of execution: rights groups

-

Snicko operator admits error that led to Carey's Ashes reprieve

Snicko operator admits error that led to Carey's Ashes reprieve

-

Finland PM apologises to Asian countries over MPs' mocking posts

-

Doctors in England go on strike for 14th time

Doctors in England go on strike for 14th time

-

Romania journalists back media outlet that sparked graft protests

-

Rob Reiner's son awaiting court appearance on murder charges

Rob Reiner's son awaiting court appearance on murder charges

-

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

Hundreds queue at Louvre museum as strike vote delays opening

-

Bondi shooting shocks, angers Australia's Jewish community

-

Markets rise even as US jobs data fail to boost rate cut bets

Markets rise even as US jobs data fail to boost rate cut bets

-

Senegal talisman Mane overcame grief to become an African icon

-

Carey pays tribute to late father after home Ashes century

Carey pays tribute to late father after home Ashes century

-

'Many lessons to be learned' from Winter Games preparations, says ski chief

-

Emotional Carey slams ton to give Australia upper hand in 3rd Ashes Test

Emotional Carey slams ton to give Australia upper hand in 3rd Ashes Test

-

Asian markets mixed as US jobs data fails to boost rate cut hopes

-

Carey slams ton as Australia seize upper hand in third Ashes Test

Carey slams ton as Australia seize upper hand in third Ashes Test

-

Bondi shooting shocks, angers Australia Jewish community

-

Myanmar junta seeks to prosecute hundreds for election 'disruption'

Myanmar junta seeks to prosecute hundreds for election 'disruption'

-

West Indies hope Christmas comes early in must-win New Zealand Test

-

Knicks beat Spurs in NBA Cup final to end 52-year trophy drought

Knicks beat Spurs in NBA Cup final to end 52-year trophy drought

-

Khawaja revels in late lifeline as Australia 194-5 in 3rd Ashes Test

-

Grief and fear as Sydney's Jewish community mourns 'Bondi rabbi'

Grief and fear as Sydney's Jewish community mourns 'Bondi rabbi'

-

Trump orders blockade of 'sanctioned' Venezuela oil tankers

Asian markets drift as US jobs data fails to boost rate cut hopes

Asian equities fluctuated on Wednesday as mixed US jobs data did little to boost expectations for another interest rate cut next month, while oil rallied after Donald Trump ordered the blockade of "sanctioned" Venezuelan tankers.

With Federal Reserve officials indicating they were unlikely to lower borrowing costs for a fourth successive meeting, sentiment on trading floors has been subdued of late, compounded by worries over tech valuations and AI spending.

Focus had been on the delayed release of key non-farm payrolls reports, which showed Tuesday that the unemployment rate had jumped to a four-year high of 4.6 percent in November, reinforcing views that the labour market was slowing.

However, a forecast-beating 105,000 drop in jobs in October was blamed on the extended government shutdown -- with many expected to return -- while November's rise of 64,000 was more than estimated.

Analysts said the figures did little to move the dial on rate-cut bets, with Bloomberg saying markets had priced in about a 20 percent chance of such a move next month.

"The bleed higher in the unemployment rate plays to the (Fed policy board's) concern about the labour market, which has supported the adjustment over the past three meetings," wrote National Australia Bank senior economist Taylor Nugent.

"But it is unlikely to be enough to push them to further near-term easing," he added. "It would take another jump (in unemployment) next month to shift things much on a January cut."

Wall Street investors largely shrugged at the data, with many concerned that the tech-led rally over the past two years may have gone too far and that the vast sums invested in AI might not see returns as soon as hoped.

Asian markets, having dropped at the start of the week, struggled to make big inroads higher.

Tokyo, Seoul, Taipei, Manila and Jakarta rose, but Hong Kong and Shanghai were flat, while Sydney, Singapore and Wellington fell.

Oil prices jumped more than one percent after Trump said on his Truth Social platform that he was "ordering A TOTAL AND COMPLETE BLOCKADE OF ALL SANCTIONED OIL TANKERS going into, and out of, Venezuela".

The announcement sharply escalates his campaign against the country -- while issuing new demands for the country's crude -- after months of building military forces in the Caribbean with the stated goal of combating drug trafficking in Latin America.

Caracas views the operation as a pressure campaign to oust leftist strongman Nicolas Maduro, whom Washington and many nations view as an illegitimate president.

The gains pared some of the 2.7 percent in losses suffered Tuesday after the US president said a deal to end the war in Ukraine was closer than ever.

An end to the war could ease sanctions on Russian oil, adding to oversupply concerns already weighing on the market.

On currency markets, the yen strengthened further against the dollar following the US jobs data and days before the Bank of Japan is expected to hike interest rates to a 30-year high on Friday.

In corporate news, Chinese chipmaker MetaX Integrated Circuits Shanghai soared more than 550 percent on its home city debut Wednesday, having raised $585.8 million in an initial public offering.

The jump comes after semiconductor company Moore Threads also rocketed more than 500 percent on its first day earlier in the month, having taken $1.1 billion in its IPO.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 0.4 percent at 49,553.71 (break)

Hong Kong - Hang Seng Index: FLAT at 25,239.12

Shanghai - Composite: FLAT at 3,825.79

Dollar/yen: DOWN at 154.52 yen from 154.80 on Tuesday

Euro/dollar: UP at $1.1751 from $1.1747

Pound/dollar: UP at $1.3424 from $1.3422

Euro/pound: UP at 87.54 pence from 87.52

West Texas Intermediate: UP 1.2 percent at $55.91 per barrel

Brent North Sea Crude: UP 1.1 percent at $59.53 per barrel

New York - Dow: DOWN 0.6 percent at 48,114.26 (close)

London - FTSE 100: DOWN 0.7 percent at 9,684.79 (close)

I.Yassin--SF-PST