-

'Magic' Jalibert guides Bordeaux-Begles past Scarlets

'Magic' Jalibert guides Bordeaux-Begles past Scarlets

-

Teenage pair Ndjantou and Mbaye star as PSG beat Metz to go top

-

Anglo-French star Jane Birkin gets name on bridge over Paris canal

Anglo-French star Jane Birkin gets name on bridge over Paris canal

-

US troops in Syria killed in alleged IS ambush

-

Jalibert masterclass guides Bordeaux-Begles past Scarlets

Jalibert masterclass guides Bordeaux-Begles past Scarlets

-

M23 marches on in east DR Congo as US vows action against Rwanda

-

Raphinha double stretches Barca's Liga lead in Osasuna win

Raphinha double stretches Barca's Liga lead in Osasuna win

-

Terrific Terrier returns Leverkusen to fourth

-

Colts activate 44-year-old Rivers for NFL game at Seattle

Colts activate 44-year-old Rivers for NFL game at Seattle

-

US troops in Syria killed in IS ambush attack

-

Liverpool's Slot says 'no issue to resolve' with Salah after outburst

Liverpool's Slot says 'no issue to resolve' with Salah after outburst

-

'Stop the slaughter': French farmers block roads over cow disease cull

-

Stormers see off La Rochelle, Sale stun Clermont in Champions Cup

Stormers see off La Rochelle, Sale stun Clermont in Champions Cup

-

Maresca hails Palmer as Chelsea return to winning ways against Everton

-

Hungarian protesters demand Orban quits over abuse cases

Hungarian protesters demand Orban quits over abuse cases

-

Belarus frees protest leader Kolesnikova, Nobel winner Bialiatski

-

Salah sets up goal on return to Liverpool action

Salah sets up goal on return to Liverpool action

-

Palmer strikes as Chelsea return to winning ways against Everton

-

Pogacar targets Tour de France Paris-Roubaix and Milan-San Remo in 2026

Pogacar targets Tour de France Paris-Roubaix and Milan-San Remo in 2026

-

Salah back in action for Liverpool after outburst

-

Atletico recover Liga momentum with battling win over Valencia

Atletico recover Liga momentum with battling win over Valencia

-

Meillard leads 'perfect' Swiss sweep in Val d'Isere giant slalom

-

Salah on Liverpool bench for Brighton match

Salah on Liverpool bench for Brighton match

-

Meillard leads Swiss sweep in Val d'Isere giant slalom

-

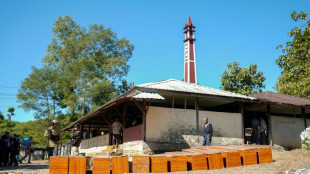

Indonesia flood death toll passes 1,000 as authorities ramp up aid

Indonesia flood death toll passes 1,000 as authorities ramp up aid

-

Cambodia shuts Thailand border crossings over deadly fighting

-

First urban cable car unveiled outside Paris

First urban cable car unveiled outside Paris

-

Vonn second behind Aicher in World Cup downhill at St Moritz

-

Aicher pips Vonn to downhill win at St Moritz

Aicher pips Vonn to downhill win at St Moritz

-

Thailand says 4 soldiers killed in Cambodia conflict, denies Trump truce claim

-

Fans vandalise India stadium after Messi's abrupt exit

Fans vandalise India stadium after Messi's abrupt exit

-

Women sommeliers are cracking male-dominated wine world open

-

Exhibition of Franco-Chinese print master Zao Wou-Ki opens in Hong Kong

Exhibition of Franco-Chinese print master Zao Wou-Ki opens in Hong Kong

-

Myanmar junta denies killing civilians in hospital strike

-

Why SpaceX IPO plan is generating so much buzz

Why SpaceX IPO plan is generating so much buzz

-

Thailand continues Cambodia strikes despite Trump truce calls

-

US envoy to meet Zelensky, Europe leaders in Berlin this weekend

US envoy to meet Zelensky, Europe leaders in Berlin this weekend

-

North Korea acknowledges its troops cleared mines for Russia

-

US unseals warrant for tanker seized off Venezuelan coast

US unseals warrant for tanker seized off Venezuelan coast

-

Cambodia says Thailand still bombing hours after Trump truce call

-

Machado urges pressure so Maduro understands 'he has to go'

Machado urges pressure so Maduro understands 'he has to go'

-

Leinster stutter before beating Leicester in Champions Cup

-

World stocks mostly slide, consolidating Fed-fuelled gains

World stocks mostly slide, consolidating Fed-fuelled gains

-

Crypto firm Tether bids for Juventus, is quickly rebuffed

-

Union sink second-placed Leipzig to climb in Bundesliga

Union sink second-placed Leipzig to climb in Bundesliga

-

US Treasury lifts sanctions on Brazil Supreme Court justice

-

UK king shares 'good news' that cancer treatment will be reduced in 2026

UK king shares 'good news' that cancer treatment will be reduced in 2026

-

Wembanyama expected to return for Spurs in NBA Cup clash with Thunder

-

Five takeaways from Luigi Mangione evidence hearings

Five takeaways from Luigi Mangione evidence hearings

-

UK's king shares 'good news' that cancer treatment will be reduced in 2026

Asian stocks rise as US rate hopes soothe nerves after torrid week

Asian markets mostly rose Monday as fresh hopes for a US interest rate cut provided some calm after last week's rollercoaster ride fuelled by worries of a tech bubble.

The scramble to snap up all things AI has helped propel equities skywards this year, pushing several companies to records -- with chip titan Nvidia last month becoming the first to top $5 trillion.

But investors have grown increasingly fearful that the vast sums pumped into the sector may have been overdone and could take some time to see profits realised, leading to warnings of a possible market correction.

That has been compounded in recent weeks by falling expectations the Federal Reserve will cut rates for a third successive time next month as stubbornly high inflation overshadows weakness in the labour market.

However, risk appetite was given a much-needed shot in the arm Friday when New York Fed boss John Williams said he still sees "room for a further adjustment" at the bank's December 9-10 policy meeting.

The remarks saw the chances of a cut shoot up to about 70 percent, from 35 percent earlier.

Focus is now on the release this week of the producer price index, which will be one of the last major data points before officials gather, with other key reports postponed or missed because of the government shutdown.

"The reading carries heightened importance following the postponement of October's personal consumption expenditures report, originally scheduled for 26 November, which removes a key datapoint from policymakers' assessment framework," wrote IG market analyst Fabien Yip.

"A substantially stronger-than-expected PPI outcome could reinforce concerns that inflationary pressures remain entrenched, potentially constraining the Fed's capacity to reduce rates in December despite recent labour market softening."

After Wall Street's rally Friday capped a torrid week for markets, Asia mostly started on the front foot.

Hong Kong and Seoul jumped more than one percent, while Sydney, Singapore, Wellington and Taipei were also well up, though Shanghai and Manila retreated. US futures advanced.

Tokyo was closed for a holiday.

But while the mood is a little less fractious than last week, uncertainty continues to weigh on riskier assets, with bitcoin hovering around $87,000.

While that is up from its seven-month low of $80,553, it is still sharply down from its record $126,200 hit last month.

- Key figures at around 0230 GMT -

Hong Kong - Hang Seng Index: UP 1.4 percent at 25,568.08

Shanghai - Composite: DOWN 0.1 percent at 3,829.71

Tokyo - Nikkei 225: Closed for a holiday

Dollar/yen: UP at 156.70 yen from 156.39 yen on Friday

Euro/dollar: DOWN at $1.1515 from $1.1519

Pound/dollar: DOWN at $1.3096 from $1.3107

Euro/pound: UP at 87.92 pence from 87.88 pence

West Texas Intermediate: DOWN 0.2 percent at $57.93 per barrel

Brent North Sea Crude: DOWN 0.2 percent at $62.44 per barrel

New York - Dow: UP 1.1 percent at 46,245.41 (close)

London - FTSE 100: UP 0.1 percent at 9,539.71 (close)

J.AbuHassan--SF-PST