-

Argentina's Milei pelted with stones on campaign trail

Argentina's Milei pelted with stones on campaign trail

-

Stock markets waver before Nvidia reports profits climb

-

Argentina hunts Nazi-looted painting revealed in property ad

Argentina hunts Nazi-looted painting revealed in property ad

-

NGO says starving Gaza children too weak to cry

-

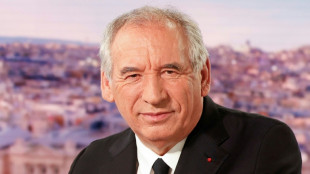

French PM warns against snap polls to end political crisis

French PM warns against snap polls to end political crisis

-

Gunman kills two children in Minneapolis church, injures 17 others

-

Djokovic advances at US Open as Sabalenka, Alcaraz step up title bids

Djokovic advances at US Open as Sabalenka, Alcaraz step up title bids

-

Venice Film Festival opens with star power, and Gaza protesters

-

Ex-Fed chief says Trump bid to oust US governor Cook 'dangerous'

Ex-Fed chief says Trump bid to oust US governor Cook 'dangerous'

-

Globetrotting German director Herzog honoured at Venice festival

-

Djokovic fights off qualifier to make US Open third round

Djokovic fights off qualifier to make US Open third round

-

Gunman kills two children in Minneapolis church, injures 17

-

Duplantis, Olyslagers seal Diamond League final wins

Duplantis, Olyslagers seal Diamond League final wins

-

Israel demands UN-backed monitor retract Gaza famine report

-

Vingegaard reclaims lead as UAE win Vuelta time trial

Vingegaard reclaims lead as UAE win Vuelta time trial

-

Shooter kills 2 children in Minneapolis church, 17 people injured

-

Defence giant Rheinmetall opens mega-plant as Europe rearms

Defence giant Rheinmetall opens mega-plant as Europe rearms

-

Van Gogh Museum 'could close' without more help from Dutch govt

-

Indonesia's Tjen exits US Open as Raducanu moves on

Indonesia's Tjen exits US Open as Raducanu moves on

-

Trump administration takes control of Washington rail hub

-

Stock markets waver ahead of Nvidia earnings

Stock markets waver ahead of Nvidia earnings

-

Conservationists call for more data to help protect pangolins

-

US Ryder Cup captain Bradley won't have playing role

US Ryder Cup captain Bradley won't have playing role

-

French star chef to 'step back' after domestic abuse complaint

-

Rudiger returns, Sane dropped for Germany World Cup qualifiers

Rudiger returns, Sane dropped for Germany World Cup qualifiers

-

S.Africa calls US welcome for white Afrikaners 'apartheid 2.0'

-

'Resident Evil' makers marvel at 'miracle' longevity

'Resident Evil' makers marvel at 'miracle' longevity

-

Denmark apologises for Greenland forced contraception

-

Hungary web users lap up footage of PM Orban's family estate

Hungary web users lap up footage of PM Orban's family estate

-

Alexander Isak selected by Sweden despite Newcastle standoff

-

Italy's Sorrentino embraces doubt in euthanasia film at Venice

Italy's Sorrentino embraces doubt in euthanasia film at Venice

-

Trump urges criminal charges against George Soros, son

-

Wildfires pile pressure on Spanish PM

Wildfires pile pressure on Spanish PM

-

Stock markets mixed ahead of Nvidia earnings

-

Football's loss as hurdles sensation Tinch eyes Tokyo worlds

Football's loss as hurdles sensation Tinch eyes Tokyo worlds

-

Pakistan blows up dam embankment as it braces for flood surge

-

Lego posts record sales, sees market share growing further: CEO

Lego posts record sales, sees market share growing further: CEO

-

France overlook Ekitike for World Cup qualifiers, Akliouche called up

-

Rain no obstacle, Lyles insists ahead of Diamond League finals

Rain no obstacle, Lyles insists ahead of Diamond League finals

-

Record-breaking rain fuels deadly floods in India's Jammu region

-

Showtime for Venice Film Festival where stars and Gaza protesters gather

Showtime for Venice Film Festival where stars and Gaza protesters gather

-

Almodovar urges Spain cut ties with Israel over Gaza

-

Macron gives 'full support' to embattled PM as crisis looms in France

Macron gives 'full support' to embattled PM as crisis looms in France

-

Stock markets diverge awaiting Nvidia earnings

-

German cabinet agrees steps to boost army recruitment

German cabinet agrees steps to boost army recruitment

-

Denmark summons US diplomat over Greenland 'interference'

-

German factory outfitters warn of 'crisis' from US tariffs

German factory outfitters warn of 'crisis' from US tariffs

-

Israel ups pressure on Gaza City as Trump eyes post-war plan

-

Floods, landslides kill at least 30 in India's Jammu region

Floods, landslides kill at least 30 in India's Jammu region

-

Former player comes out as bisexual in Australian Rules first

Stocks mixed after Trump accuses China of violating tariff deal

Global stocks finished mixed on Friday after President Donald Trump put US-China trade tensions back on the boil by claiming Beijing had "totally violated" an agreement with Washington.

His social media post came hours after US Treasury Secretary Scott Bessent said trade talks with China aimed at putting to bed sky-high mutual tariffs -- currently suspended -- were "a bit stalled."

The development risks renewed trade tensions between the world's two biggest economies.

On Wall Street, the Dow Jones Industrial Average closed higher, while the S&P 500 index was flat, and the tech-focused Nasdaq Composite fell 0.3 percent.

"If it weren't for the trade war, the market would be feeling pretty good," said Tom Cahill of Ventura Wealth Management.

"Inflation is definitely moving in the right direction," he added, referencing the Federal Reserve's favored inflation gauge, which cooled more than expected last month, according to fresh data published Friday.

In Europe, London and Germany's major indices ended higher, while France's CAC40 closed lower, following declines in Asian markets earlier in the day.

- 'Undiplomatic approach' -

"If President Trump does slap tariffs back on Chinese imports to the US... we may see demand for US assets, and the dollar, severely impaired by a chaotic and undiplomatic approach to trade policy," said Kathleen Brooks, research director at XTB.

Despite rumbling concerns about the US-China economic relationship, the markets were little changed by Trump's criticism on social media, with investors appearing to be largely inured to the US president's now-familiar cycle of making dramatic trade threats and then retreating.

Investors, traders and analysts instead focused on the Commerce Department's personal consumption expenditures (PCE) price index data, which rose 2.1 percent in the 12 months to April -- cooling slightly more than expected.

Despite the good news for the Fed, which is looking to bring inflation down to its long-term target of two percent, analysts warned that the fuller inflationary effects of Trump's tariffs were yet to come, and could cause the Fed to maintain its watch-and-wait stance.

"The true weight of these policies is likely to emerge more fully in the months ahead," said FOREX.com market analyst Fawad Razaqzada.

Investors were also assessing the impact of a US court ruling that invalidated most of Trump's sweeping tariffs -- though an appeals court suspended that order and the White House vowed that its tariffs goals would be pursued one way or another.

The result leaves Trump's tariff plans in something of "a legal limbo" said Stephen Innes, of SPI Asset Management, adding that this sort of legal impasse was "the kind that keeps traders awake at night."

In the eurozone, interest rates were in focus after official data showed inflation hovering around the European Central Bank's two-percent target.

Consumer prices in top EU economy Germany showed a 2.1 percent rise in May -- the same as the previous month -- while they fell to 1.9 percent in Spain, and to 1.7 percent in Italy.

The ECB looks set to lower interest rates again on Thursday.

The dollar gained against major currencies, while oil prices were down ahead of a Saturday meeting of eight key OPEC+ members to decide production quotas for July, with some analysts predicting that the cartel could make a larger-than-expected supply hike.

- Key figures at around 2030 GMT -

New York - Dow: UP 0.1 percent at 42,270.07 points (close)

New York - S&P 500: DOWN less than 0.1 percent at 5,911.69 (close)

New York - Nasdaq Composite: DOWN 0.3 percent at 19,113.77 (close)

London - FTSE 100: UP 0.6 percent at 8,772.38 (close)

Paris - CAC 40: DOWN 0.4 percent at 7,751.89 (close)

Frankfurt - DAX: UP 0.3 percent at 23,997.48 (close)

Tokyo - Nikkei 225: DOWN 1.2 percent at 37,965.10 (close)

Hong Kong - Hang Seng Index: DOWN 1.2 percent at 23,289.77 (close)

Shanghai - Composite: DOWN 0.5 percent at 3,347.49 (close)

Euro/dollar: DOWN at $1.1349 from $1.1368 on Thursday

Pound/dollar: DOWN at $1.3463 from $1.3494

Dollar/yen: DOWN at 143.97 yen from 144.19 yen

Euro/pound: UP at 84.30 pence from 84.22 pence

Brent North Sea Crude: DOWN 0.4 percent at $63.90 per barrel

West Texas Intermediate: DOWN 0.3 percent at $60.79 per barrel

burs-da/bgs

A.Suleiman--SF-PST