-

CK Hutchison launches arbitration over Panama Canal port ruling

CK Hutchison launches arbitration over Panama Canal port ruling

-

Stocks mostly rise as traders ignore AI-fuelled sell-off on Wall St

-

Acclaimed Iraqi film explores Saddam Hussein's absurd birthday rituals

Acclaimed Iraqi film explores Saddam Hussein's absurd birthday rituals

-

On rare earth supply, Trump for once seeks allies

-

Ukrainian chasing sumo greatness after meteoric rise

Ukrainian chasing sumo greatness after meteoric rise

-

Draper to make long-awaited return in Davis Cup qualifier

-

Can Ilia Malinin fulfil his promise at the Winter Olympics?

Can Ilia Malinin fulfil his promise at the Winter Olympics?

-

CK Hutchison begins arbitration against Panama over annulled canal contract

-

UNESCO recognition inspires hope in Afghan artist's city

UNESCO recognition inspires hope in Afghan artist's city

-

Ukraine, Russia, US negotiators gather in Abu Dhabi for war talks

-

WTO must 'reform or die': talks facilitator

WTO must 'reform or die': talks facilitator

-

Doctors hope UK archive can solve under-50s bowel cancer mystery

-

Stocks swing following latest AI-fuelled sell-off on Wall St

Stocks swing following latest AI-fuelled sell-off on Wall St

-

Demanding Dupont set to fire France in Ireland opener

-

Britain's ex-prince Andrew leaves Windsor home: BBC

Britain's ex-prince Andrew leaves Windsor home: BBC

-

Coach plots first South Africa World Cup win after Test triumph

-

Spin-heavy Pakistan hit form, but India boycott risks early T20 exit

Spin-heavy Pakistan hit form, but India boycott risks early T20 exit

-

Japan eyes Premier League parity by aligning calendar with Europe

-

Whack-a-mole: US academic fights to purge his AI deepfakes

Whack-a-mole: US academic fights to purge his AI deepfakes

-

Love in a time of war for journalist and activist in new documentary

-

'Unprecedented mass killing': NGOs battle to quantify Iran crackdown scale

'Unprecedented mass killing': NGOs battle to quantify Iran crackdown scale

-

Seahawks kid Cooper Kupp seeks new Super Bowl memories

-

Thousands of Venezuelans march to demand Maduro's release

Thousands of Venezuelans march to demand Maduro's release

-

AI, manipulated images falsely link some US politicians with Epstein

-

Move on, says Trump as Epstein files trigger probe into British politician

Move on, says Trump as Epstein files trigger probe into British politician

-

Arteta backs Arsenal to build on 'magical' place in League Cup final

-

Evil Empire to underdogs: Patriots eye 7th Super Bowl

Evil Empire to underdogs: Patriots eye 7th Super Bowl

-

UBS grilled on Capitol Hill over Nazi-era probe

-

Guardiola 'hurt' by suffering caused in global conflicts

Guardiola 'hurt' by suffering caused in global conflicts

-

Marseille do their work early to beat Rennes in French Cup

-

Colombia's Petro, Trump hail talks after bitter rift

Colombia's Petro, Trump hail talks after bitter rift

-

Trump signs spending bill ending US government shutdown

-

Arsenal sink Chelsea to reach League Cup final

Arsenal sink Chelsea to reach League Cup final

-

Leverkusen sink St Pauli to book spot in German Cup semis

-

'We just need something positive' - Monks' peace walk across US draws large crowds

'We just need something positive' - Monks' peace walk across US draws large crowds

-

Milan close gap on Inter with 3-0 win over Bologna

-

No US immigration agents at Super Bowl: security chief

No US immigration agents at Super Bowl: security chief

-

NASA Moon mission launch delayed to March after test

-

'You are great': Trump makes up with Colombia's Petro in fireworks-free meeting

'You are great': Trump makes up with Colombia's Petro in fireworks-free meeting

-

Spain to seek social media ban for under-16s

-

X hits back after France summons Musk, raids offices in deepfake probe

X hits back after France summons Musk, raids offices in deepfake probe

-

LIV Golf events to receive world ranking points: official

-

Russia resumes large-scale Ukraine strikes in glacial weather

Russia resumes large-scale Ukraine strikes in glacial weather

-

US House passes spending bill ending government shutdown

-

US jet downs Iran drone but talks still on course

US jet downs Iran drone but talks still on course

-

UK police launching criminal probe into ex-envoy Mandelson

-

US-Iran talks 'still scheduled' after drone shot down: White House

US-Iran talks 'still scheduled' after drone shot down: White House

-

Chomsky sympathized with Epstein over 'horrible' press treatment

-

French prosecutors stick to demand for five-year ban for Le Pen

French prosecutors stick to demand for five-year ban for Le Pen

-

Russia's economic growth slowed to 1% in 2025: Putin

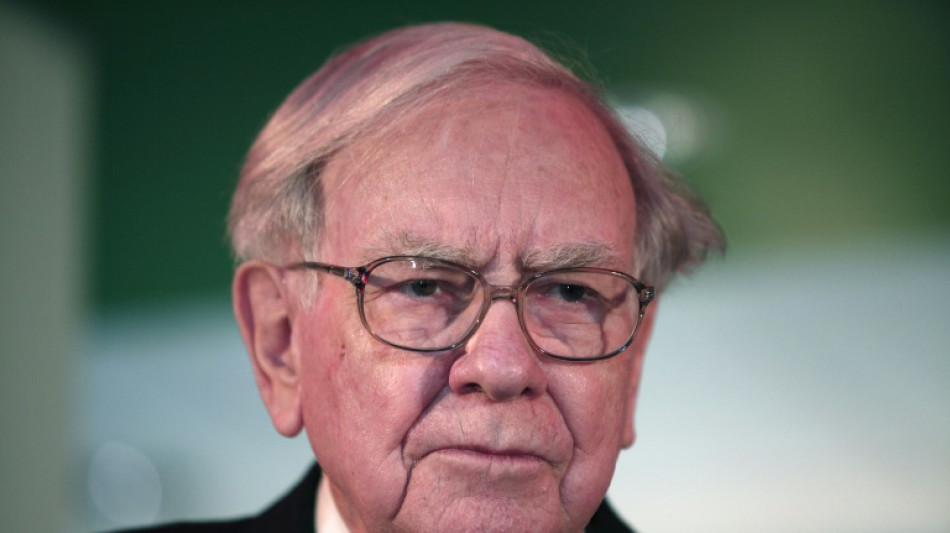

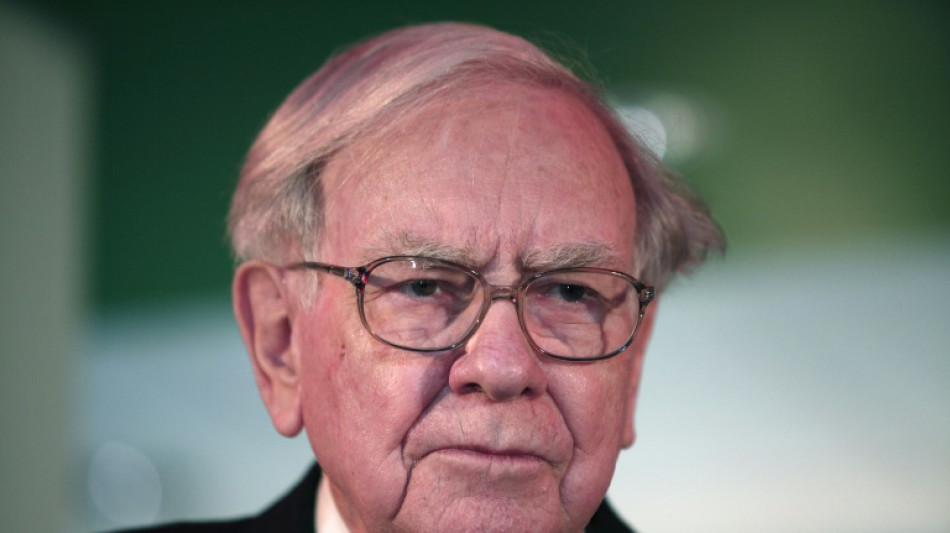

Chinese electric carmaker BYD plummets after Buffett sale

Shares in Chinese electric carmaker BYD plunged on Wednesday after its largest backer, Warren Buffett's Berkshire Hathaway, reduced its stake amid speculation of a potential exit.

Hong Kong-listed shares of the EV manufacturer fell by as much as 13 percent, a day after a regulatory filing showed Berkshire reducing its holdings from 20.04 percent to 19.92 percent.

It ended the day 7.9 percent lower, while its Shenzhen-listed stock finished 7.4 percent down.

The sale of around 1.33 million securities was valued at approximately $47 million.

Electronic carmakers in China were left scrambling after the government response to coronavirus outbreaks this year disrupted supply chains, with plants across the country suspending production for weeks.

While the Shenzhen-based firm reported strong earnings this week, rumours have swelled that the legendary American investor behind Berkshire may be looking to offload his entire stake.

Berkshire first bought 225 million BYD shares in 2008 and has been the biggest stakeholder in the company, now China's largest EV manufacturer and a major rival to Tesla.

Berkshire sold around 6.3 million shares in BYD between June 30 and August 24, Bloomberg News reported, citing filings from both companies.

BYD told Chinese media that there was "no need to over-interpret" the stake sale, adding that the company was operating normally and had no major moves to disclose.

On Monday, the Shenzhen-based company reported that net income had tripled to 3.6 billion yuan ($521 million) from a year earlier, overcoming supply chain disruptions caused by the pandemic and China's economic slowdown.

BYD said in a filing that it achieved record output and sales in the first half, with revenue jumping 66 percent year-on-year to 151 billion yuan.

The carmaker added that it was leading the domestic new energy vehicle sector with 24.7 percent market share in the first six months, citing data from the China Automobile Association.

"Investors could interpret this as the beginning of Berkshire closing its position in BYD," Bridget McCarthy, a market research analyst at hedge fund Snow Bull Capital, told Bloomberg.

"I would expect arguably one of the world's greatest investors to take some profits after over a decade, especially on his highest-returning investment, percentage-wise."

Some analysts have argued that BYD's strong fundamentals, coupled with Beijing's push to develop its domestic green energy sector, means the company still has room to grow.

"Despite the short term share price struggle, there is value to invest in the company with its solid business model in the medium to long term," Andy Wong, fund manager at LW Asset Management Advisors in Hong Kong, said.

Last month, a stake identical to the size of Berkshire's holdings was entered into Hong Kong's Central Clearing and Settlement System.

Hong Kong requires anyone who owns more than five percent of a listed company to notify the stock exchange when initiating a trade that changes the stake percentage into the next whole number.

P.Tamimi--SF-PST