-

Ethiopia set to host UN's 2027 climate summit, 2026 undecided

Ethiopia set to host UN's 2027 climate summit, 2026 undecided

-

Close Zelensky ally accused of orchestrating major graft scheme

-

'Trump is temporary': California governor Newsom seizes COP30 spotlight

'Trump is temporary': California governor Newsom seizes COP30 spotlight

-

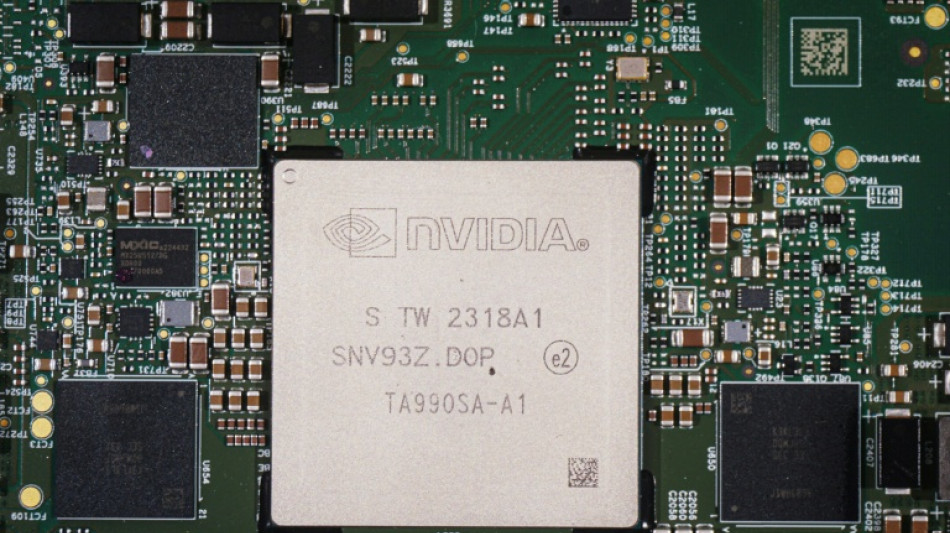

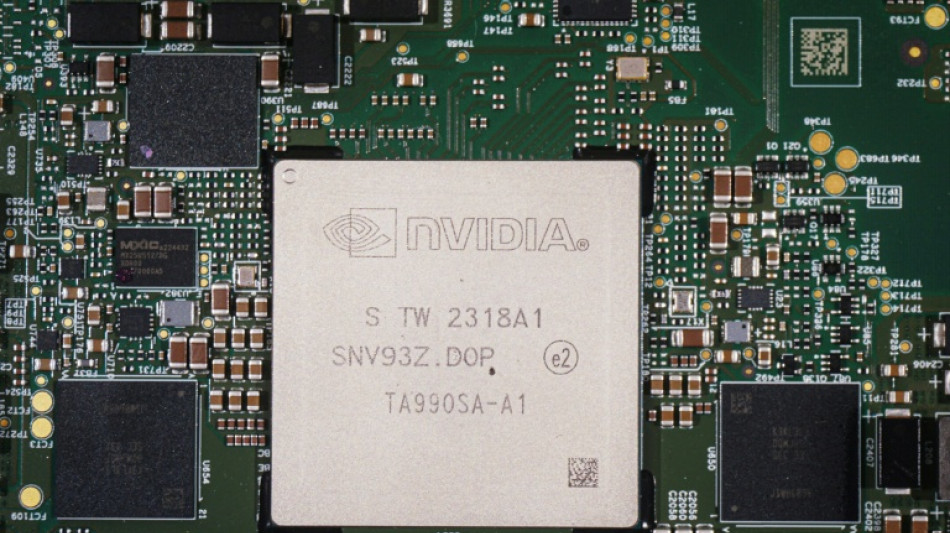

US stocks end mostly higher despite drop in Nvidia

-

Arrival of US aircraft carrier fuels Venezuelan fears of attack

Arrival of US aircraft carrier fuels Venezuelan fears of attack

-

Iraqi voters turn out in numbers as region watches on

-

Pakistan upstage Sri Lanka in first ODI as Agha and Rauf shine

Pakistan upstage Sri Lanka in first ODI as Agha and Rauf shine

-

Macron warns any planned West Bank annexation a 'red line'

-

BBC must fight, says outgoing chief as Trump threatens to sue

BBC must fight, says outgoing chief as Trump threatens to sue

-

UN aid chief hails talks with Sudan army leader

-

Mellon Blue diamond sells for $25.6 million

Mellon Blue diamond sells for $25.6 million

-

Google unveils $6.4 bn investment in Germany

-

US aircraft carrier in Latin America fuels Venezuelan fears of attack

US aircraft carrier in Latin America fuels Venezuelan fears of attack

-

For many Syrians, Sharaa's US visit marks new beginning

-

Monumental art displayed in shade of Egypt's pyramids

Monumental art displayed in shade of Egypt's pyramids

-

Stocks mixed as tech titans struggle

-

California governor Newsom slams Trump at COP30

California governor Newsom slams Trump at COP30

-

Alcaraz fights back to beat Fritz at ATP Finals

-

Russia offers US nuclear talks in bid to ease tensions

Russia offers US nuclear talks in bid to ease tensions

-

Turkey seeks more than 2,000 years behind bars for Erdogan rival

-

UK court jails Chinese bitcoin fraudster for over 11 years

UK court jails Chinese bitcoin fraudster for over 11 years

-

Fanfare as Guinea launches enormous Simandou iron ore mine

-

Iraqis vote in general election at crucial regional moment

Iraqis vote in general election at crucial regional moment

-

Shock follows carnage after suicide bombing in Islamabad

-

Ford returns to pull England strings against All Blacks

Ford returns to pull England strings against All Blacks

-

Stocks mixed as end to US shutdown appears closer

-

BBC must 'fight' for its journalism, outgoing chief says amid Trump lawsuit threat

BBC must 'fight' for its journalism, outgoing chief says amid Trump lawsuit threat

-

Atalanta turn to Palladino after Juric sacking

-

'Sayyid says': Influential Shiite cleric's supporters boycott Iraq vote

'Sayyid says': Influential Shiite cleric's supporters boycott Iraq vote

-

'It's un-British': lawmakers raise concerns about aquarium penguins

-

Prosecutor files 142 charges against Istanbul mayor, a top Erdogan critic

Prosecutor files 142 charges against Istanbul mayor, a top Erdogan critic

-

Agha hundred lifts Pakistan to 299-5 in 1st Sri Lanka ODI

-

German court rules against OpenAI in copyright case

German court rules against OpenAI in copyright case

-

Calls for 'mano dura' as crime-rattled Chile votes for president

-

Pakistani Taliban claim deadly suicide attack in Islamabad

Pakistani Taliban claim deadly suicide attack in Islamabad

-

BBC grapples with response to Trump legal threat

-

Cristiano Ronaldo says 2026 World Cup 'definitely' his last

Cristiano Ronaldo says 2026 World Cup 'definitely' his last

-

Trump says 'we've had a lot of problems' with France

-

Stocks mostly rise as end to US shutdown appears closer

Stocks mostly rise as end to US shutdown appears closer

-

'Splinternets' threat to be avoided, says web address controller

-

Yamal released from World Cup qualifiers by 'upset' Spanish federation

Yamal released from World Cup qualifiers by 'upset' Spanish federation

-

China's 'Singles Day' shopping fest loses its shine for weary consumers

-

Suicide bombing in Islamabad kills 12, wounds 27

Suicide bombing in Islamabad kills 12, wounds 27

-

Philippines digs out from Typhoon Fung-wong as death toll climbs

-

Iraqis vote in general election at a crucial regional moment

Iraqis vote in general election at a crucial regional moment

-

Asian stocks wobble as US shutdown rally loses steam

-

UK unemployment jumps to 5% before key govt budget

UK unemployment jumps to 5% before key govt budget

-

Japanese 'Ran' actor Tatsuya Nakadai dies at 92

-

AI stock boom delivers bumper quarter for Japan's SoftBank

AI stock boom delivers bumper quarter for Japan's SoftBank

-

Asian stocks struggle as US shutdown rally loses steam

US stocks end mostly higher despite drop in Nvidia

Wall Street stocks mostly rose Tuesday as optimism over a likely end to the US government shutdown offset weakness in some leading technology equities.

After Monday's rally, US stocks opened mostly lower on lingering unease about the stratospheric valuation growth of major players in artificial intelligence.

Those worries ebbed a bit as the session progressed, with some large tech equities finishing in positive territory. But the tech-heavy Nasdaq Composite was down 0.3 percent, the only one of the three main US indices to retreat.

"There's definitely concern over valuations but that valuations don't mean the market's going to sell off," said Tim Urbanowicz of Innovator Capital Management, adding "it just leaves a lot less room for bad news."

Japan's SoftBank announced it sold $5.8 billion worth of shares in US chip giant Nvidia last month. SoftBank did not give a reason for the Nvidia stock sale in its earnings statement.

Shares in Nvidia, whose processors are prized by companies training and operating AI models, fell 3.0 percent.

"For the wider investment community, when big investors cash out of their AI positions, they will take notice, and this is why the stock is declining today," said Kathleen Brooks, research director at XTB trading group.

More broadly, Brooks said tech stocks were no longer providing market momentum.

"Without momentum helping US indices move higher, volatility could take hold, so we are not expecting stocks to move in a straight line for now, and the market correction may not be over," she said in a note to clients.

Some market watchers viewed Tuesday's strong rise in the Dow as evidence of a rotation to industrial names from tech.

Investors have been cheered by the progress on legislation on Capitol Hill to reopen the government.

On Monday night several Democratic senators broke ranks to join Republicans in a 60-40 vote passing legislation to reopen the government, which would trigger a release of US economic reports on labor, consumer prices and other key benchmarks in the coming weeks.

Tuesday's session was held on Veteran's Day, a US holiday, resulting in lower volumes than normal.

Europe's main stock markets climbed Tuesday.

London's top-tier FTSE 100 index reached a fresh record high as a weakening pound boosted multi-nationals earning in dollars, while Paris won solid gains in a day that is also a public holiday in France.

- Key figures at 2110 GMT -

New York - Dow: UP 1.2 percent at 47,927.96 (close)

New York - S&P 500: UP 0.2 percent at 6,846.61 (close)

New York - Nasdaq Composite: DOWN 0.3 percent at 23,468.30 (close)

London - FTSE 100: UP 1.2 percent at 9,899.60 (close)

Paris - CAC 40: UP 1.3 percent at 8,156.23 (close)

Frankfurt - DAX: UP 0.5 percent at 24,088.06 (close)

Tokyo - Nikkei 225: DOWN 0.1 percent at 50,842.93 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 26,696.41 (close)

Shanghai - Composite: DOWN 0.4 percent at 4,002.76 (close)

Euro/dollar: UP at $1.1588 from $1.1557 on Monday

Pound/dollar: DOWN at $1.3168 from $1.3175

Dollar/yen: DOWN at 154.10 yen from 154.15 yen

Euro/pound: UP at 87.99 pence from 87.72 pence

Brent North Sea Crude: UP 1.7 percent at $65.16 per barrel

West Texas Intermediate: UP 1.5 percent at $61.04 per barrel

burs-jmb/jgc

M.Qasim--SF-PST