-

Ex-Zimbabwe cricket captain Williams treated for 'drug addiction'

Ex-Zimbabwe cricket captain Williams treated for 'drug addiction'

-

Padres ace Darvish to miss 2026 MLB season after surgery

-

Diaz hero and villain as Bayern beat PSG in Champions League showdown

Diaz hero and villain as Bayern beat PSG in Champions League showdown

-

Liverpool master Real Madrid on Alexander-Arnold's return

-

Van de Ven back in favour as stunning strike fuels Spurs rout

Van de Ven back in favour as stunning strike fuels Spurs rout

-

Juve held by Sporting Lisbon in stalling Champions League campaign

-

New lawsuit alleges Spotify allows streaming fraud

New lawsuit alleges Spotify allows streaming fraud

-

Stocks mostly drop as tech rally fades

-

LIV Golf switching to 72-hole format in 2026: official

LIV Golf switching to 72-hole format in 2026: official

-

'At home' Djokovic makes winning return in Athens

-

Manchester City have become 'more beatable', says Dortmund's Gross

Manchester City have become 'more beatable', says Dortmund's Gross

-

Merino brace sends Arsenal past Slavia in Champions League

-

Djokovic makes winning return in Athens

Djokovic makes winning return in Athens

-

Napoli and Eintracht Frankfurt in Champions League stalemate

-

Arsenal's Dowman becomes youngest-ever Champions League player

Arsenal's Dowman becomes youngest-ever Champions League player

-

Cheney shaped US like no other VP. Until he didn't.

-

Pakistan edge South Africa in tense ODI finish in Faisalabad

Pakistan edge South Africa in tense ODI finish in Faisalabad

-

Brazil's Lula urges less talk, more action at COP30 climate meet

-

Barca's Lewandowski says his season starting now after injury struggles

Barca's Lewandowski says his season starting now after injury struggles

-

Burn urges Newcastle to show their ugly side in Bilbao clash

-

French pair released after 3-year Iran jail ordeal

French pair released after 3-year Iran jail ordeal

-

EU scrambles to seal climate targets before COP30

-

Getty Images largely loses lawsuit against UK AI firm

Getty Images largely loses lawsuit against UK AI firm

-

Cement maker Lafarge on trial in France over jihadist funding

-

Sculpture of Trump strapped to a cross displayed in Switzerland

Sculpture of Trump strapped to a cross displayed in Switzerland

-

Pakistan's Rauf and Indian skipper Yadav punished over Asia Cup behaviour

-

Libbok welcomes 'healthy' Springboks fly-half competition

Libbok welcomes 'healthy' Springboks fly-half competition

-

Reeling from earthquakes, Afghans fear coming winter

-

Ronaldo reveals emotional retirement will come 'soon'

Ronaldo reveals emotional retirement will come 'soon'

-

Munich's surfers stunned after famed river wave vanishes

-

Iran commemorates storming of US embassy with missile replicas, fake coffins

Iran commemorates storming of US embassy with missile replicas, fake coffins

-

Gauff sweeps Paolini aside to revitalise WTA Finals defence

-

Shein vows to cooperate with France in probe over childlike sex dolls

Shein vows to cooperate with France in probe over childlike sex dolls

-

Young leftist Mamdani on track to win NY vote, shaking up US politics

-

US government shutdown ties record for longest in history

US government shutdown ties record for longest in history

-

King Tut's collection displayed for first time at Egypt's grand museum

-

Typhoon flooding kills over 40, strands thousands in central Philippines

Typhoon flooding kills over 40, strands thousands in central Philippines

-

Trent mural defaced ahead of Liverpool return

-

Sabalenka to face Kyrgios in 'Battle of Sexes' on December 28

Sabalenka to face Kyrgios in 'Battle of Sexes' on December 28

-

Experts call for global panel to tackle 'inequality crisis'

-

Backed by Brussels, Zelensky urges Orban to drop veto on EU bid

Backed by Brussels, Zelensky urges Orban to drop veto on EU bid

-

After ECHR ruling, Turkey opposition urges pro-Kurd leader's release

-

Stocks drop as tech rally fades

Stocks drop as tech rally fades

-

UK far-right activist Robinson cleared of terror offence over phone access

-

World on track to dangerous warming as emissions hit record high: UN

World on track to dangerous warming as emissions hit record high: UN

-

Nvidia, Deutsche Telekom unveil 1-bn-euro AI industrial hub

-

Which record? Haaland warns he can get even better

Which record? Haaland warns he can get even better

-

Football star David Beckham hails knighthood as 'proudest moment'

-

Laurent Mauvignier wins France's top literary award for family saga

Laurent Mauvignier wins France's top literary award for family saga

-

Indian Sikh pilgrims enter Pakistan, first major crossing since May conflict

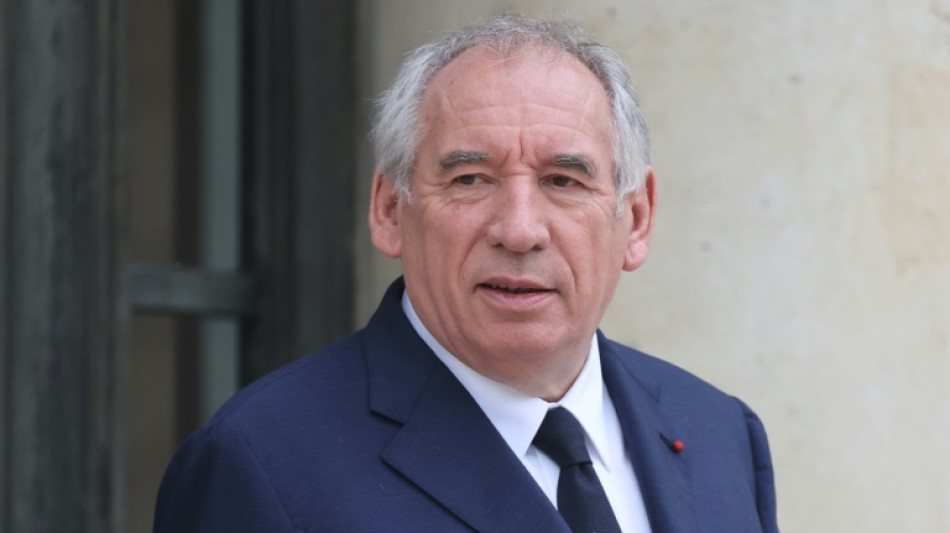

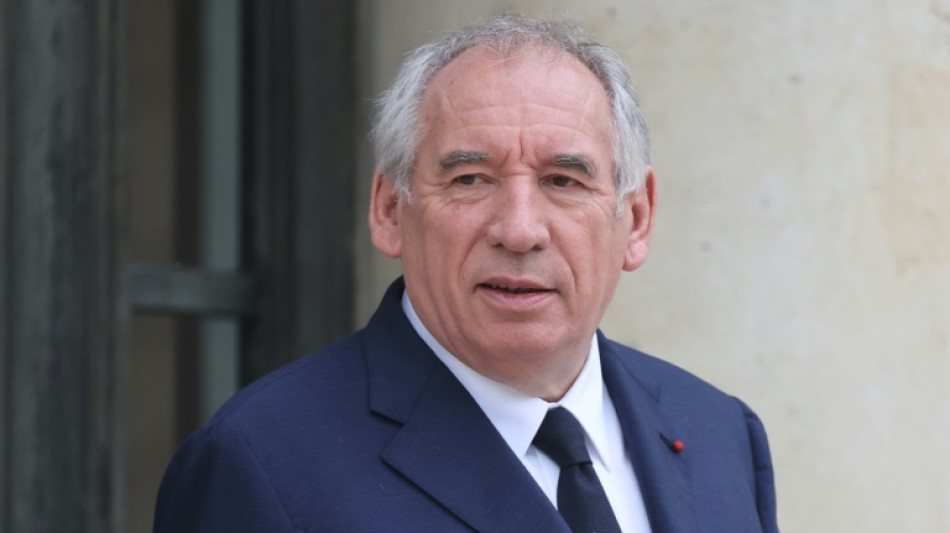

The massive debt behind France's political turmoil

France's growing debt pile is at the heart of the confidence vote that could topple the government of Prime Minister Francois Bayrou next week.

Bayrou called the vote to settle a fight over the budget as he seeks 44 billion euros ($51 billion) in savings to cut the debt.

But his plan, which includes reducing the number of holidays, has proved unpopular.

Here is a look at the country's fiscal situation ahead of Monday's vote in parliament:

- How big is it? -

France's public debt has steadily risen for decades, fuelled by chronic budget deficits financed through borrowing on bond markets.

The debt grew to 3.3 trillion euros ($3.9 trillion) in the first three months of this year, or over 48,000 euros per French national.

The debt amounts to 114 percent of France's annual gross domestic product (GDP, a measure of economic output) -- the third highest debt ratio in the eurozone after Greece and Italy.

The debt ratio is almost double the limit of 60 percent allowed by the European Union.

By comparison, the debt-to-GDP ratio was at 57.8 percent in 1995, but financial crises, the Covid pandemic and high inflation have fuelled its rise.

It's not great, but it could be worse.

The Avant-Garde Institute, a think tank, noted that France's debt ratio was as high as 300 percent of GDP between World War I and World War II.

Eric Heyer, an economist at the French Economic Observatory think tank, told AFP that "many countries are above" France's 114 percent debt-to-GDP ratio.

- What's the problem? -

More debt means more of the country's taxpayer money goes into paying interest to creditors.

The growth of state spending on servicing the debt has been one the threats cited by the government.

The government's debt burden, or interest payments, totals 53 billion euros in 2025, according to the medium-term budget plan presented in April.

Bayrou has warned that the number will grow to 66 billion euros in 2026, making it the government's main spending item ahead of education.

"The consequence for French people is that we can't do other things," Pierre Moscovici, president of the national audit body, told news channel LCI on Sunday.

But economists from Attac, a French activist group campaigning for financial justice, and the Copernic Foundation, a left-leaning organisation, recently argued in Le Monde that France’s debt isn’t as alarming as the government suggests.

The government spent just two percent of the country's GDP on interest payments last year, the groups said in a joint column in Le Monde newspaper.

Other experts, including Heyer, also question the government’s presentation of interest costs, saying it does not take inflation into account.

When prices rise, inflation can reduce the real burden of debt because the government collects more in taxes and the economy grows, giving it more room to manoeuvre financially.

- Is there a risk of crisis? -

Some, including the French government itself, have raised the spectre of a scenario reminiscent of the Greek debt crisis that rocked the eurozone more than a decade ago.

France's long-term borrowing cost jumped to its highest level since 2011 on Tuesday as the yield on 30-year government bonds topped 4.5 percent.

The yield on 10-year sovereign bonds exceeded 3.6 percent this week, the highest since March and approaching the same level as Italy, long seen as a budget laggard in Europe.

The rates, however, do not suggest that another Greek-like crisis is in the offing, said Ipek Ozkardeskaya, analyst at Swissquote Bank.

"The contagion risk remains limited. But France must find a way to tidy up its finances before gaining investors confidence back," Ozkardeskaya said.

There is still strong demand for French debt: On Thursday, the state raised 7.3 billion euros in a sale of 10-year bonds.

The European Central Bank also provides a safety net by intervening in bond markets to buy government debt, said Christopher Dembik, a strategist at Pictet investment firm.

He predicted, however, that ratings agencies will downgrade France's debt.

F.AbuZaid--SF-PST