-

FIFA announce new peace prize to be awarded at World Cup draw in Washington

FIFA announce new peace prize to be awarded at World Cup draw in Washington

-

Australia's Cummins hints at return for second Ashes Test

-

Boeing settles with one plaintiff in 737 MAX crash trial

Boeing settles with one plaintiff in 737 MAX crash trial

-

Man City win as Inter stay perfect, Barca held in Champions League

-

French superstar DJ Snake wants new album to 'build bridges'

French superstar DJ Snake wants new album to 'build bridges'

-

Barca rescue draw at Club Brugge in six-goal thriller

-

Foden hits top form as Man City thrash Dortmund

Foden hits top form as Man City thrash Dortmund

-

NBA officials brief Congress committee over gambling probe

-

Inter beat Kairat Almaty to maintain Champions League perfection

Inter beat Kairat Almaty to maintain Champions League perfection

-

Newcastle sink Bilbao to extend Champions League winning run

-

Wall Street stocks rebound after positive jobs data

Wall Street stocks rebound after positive jobs data

-

LPGA, European tour partner with Saudis for new Vegas event

-

Eyes turn to space to feed power-hungry data centers

Eyes turn to space to feed power-hungry data centers

-

Jazz lose Kessler for season with shoulder injury

-

League scoring leader Messi among MLS Best XI squad

League scoring leader Messi among MLS Best XI squad

-

MLS bans Suarez for Miami's winner-take-all playoff match

-

McIlroy appreciates PGA of America apology for Ryder Cup abuse

McIlroy appreciates PGA of America apology for Ryder Cup abuse

-

Garnacho equaliser saves Chelsea in Qarabag draw

-

Promotions lift McDonald's sales in tricky consumer market

Promotions lift McDonald's sales in tricky consumer market

-

Five things to know about New York's new mayor

-

Anisimova beats Swiatek to reach WTA Finals last four

Anisimova beats Swiatek to reach WTA Finals last four

-

US Supreme Court appears skeptical of Trump tariff legality

-

AC Milan post third straight annual profit on day of San Siro purchase

AC Milan post third straight annual profit on day of San Siro purchase

-

Angelina Jolie visits Ukrainian frontline city, media reports say

-

UN says forests should form key plank of COP30

UN says forests should form key plank of COP30

-

Star designer Rousteing quits fashion group Balmain

-

Mexico's Sheinbaum steps up cartel fight after murder of anti-narco mayor

Mexico's Sheinbaum steps up cartel fight after murder of anti-narco mayor

-

Attack on funeral in Sudan's Kordofan region kills 40: UN

-

Key PSG trio set for spell on sidelines

Key PSG trio set for spell on sidelines

-

Democrats punch back in US elections - and see hope for 2026

-

BMW reports rising profitability, shares jump

BMW reports rising profitability, shares jump

-

US Supreme Court debates legality of Trump's tariffs

-

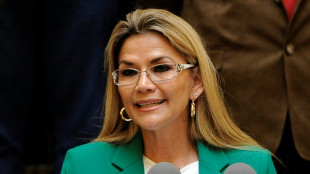

Bolivia Supreme Court orders release of jailed ex-president Jeanine Anez

Bolivia Supreme Court orders release of jailed ex-president Jeanine Anez

-

Wall Street stocks rise after positive jobs data

-

'Hostage diplomacy': longstanding Iran tactic presenting dilemma for West

'Hostage diplomacy': longstanding Iran tactic presenting dilemma for West

-

Rybakina stays perfect at WTA Finals with win over alternate Alexandrova

-

Le Garrec welcomes Dupont help in training for Springboks showdown

Le Garrec welcomes Dupont help in training for Springboks showdown

-

Brussels wants high-speed rail linking EU capitals by 2040

-

Swiss business chiefs met Trump on tariffs: Bern

Swiss business chiefs met Trump on tariffs: Bern

-

At least 9 dead after cargo plane crashes near Louisville airport

-

France moves to suspend Shein website as first store opens in Paris

France moves to suspend Shein website as first store opens in Paris

-

Spain's exiled king recounts history, scandals in wistful memoir

-

Wall Street stocks steady after positive jobs data

Wall Street stocks steady after positive jobs data

-

Trump blasts Democrats as government shutdown becomes longest ever

-

Indian pilgrims find 'warm welcome' in Pakistan despite tensions

Indian pilgrims find 'warm welcome' in Pakistan despite tensions

-

Inter and AC Milan complete purchase of San Siro

-

Swedish authorities inspect worksite conditions at steel startup Stegra

Swedish authorities inspect worksite conditions at steel startup Stegra

-

Keys withdraws from WTA Finals with illness

-

Prince Harry says proud to be British despite new life in US

Prince Harry says proud to be British despite new life in US

-

BMW boosts profitability, welcomes Nexperia signals

Accumulating bitcoin a risky digital rush by companies?

US President Donald Trump's media group and Tesla, the electric carmaker owned by tech billionaire Elon Musk, are among an increasing number of companies buying huge amounts of bitcoin.

The aim? To diversify reserves, counter inflation and attract investors, analysts say.

- Who also invests? -

Companies frequently own bitcoin -- the largest cryptocurrency by market capitalisation -- to take part in sector activities such as "mining", which refers to the process of validating transactions in exchange for digital tokens.

Tesla has previously accepted payments in bitcoin, while Trump Media soon plans to offer crypto investment products.

Other players who had core operations totally unrelated to cryptocurrency, such as Japanese hotel business MetaPlanet, have switched to buying bitcoin.

US firm Strategy, initially a seller of software under the name MicroStrategy, holds more than three percent of all bitcoin tokens, or over 600,000.

Its co-founder Michael Saylor "created real value for its original set of investors" by offering the opportunity to invest in shares linked to cryptocurrencies, Andy Constan, chief executive of financial analysts Damped Spring Advisors, told AFP.

This was five years ago when other financial products allowing investment in cryptocurrencies, without a need to directly own tokens, were not permitted.

- Why invest? -

Companies collect bitcoins "to diversify" their cash flow and "counter the effects of inflation", said Eric Benoist, a tech and data research expert for Natixis bank.

Some struggling companies are riding the trend in a bid to "restore their image" by "backing themselves with an asset perceived as solid and one that appreciates over time", he added.

Strategy's current focus is on accumulating bitcoin, simply to attract investors interested in the currency's potential.

Bitcoin can also have a simple practical use, as in the case of the Coinbase exchange, which uses its own reserves as collateral for its users.

- The risks? -

Bitcoin's value has soared around ninefold in five years, fuelled recently by US regulatory changes under Trump, a strong backer of the crypto sector.

However, the unit's volatility is four times greater than that of the main US stock index, the S&P 500, according to Campbell Harvey, a professor of finance at Duke University in the United States.

Harvey warns against using a company's cash reserves, "their safe haven", to buy crypto.

Bitcoin's price, currently around $117,000, has in recent years been boosted by large holders of cryptocurrency, referred to as "whales".

Harvey argues that in the case of "major buyer" Strategy, liquidating all their 600,000 bitcoin tokens is no simple task owing to the high value.

"Assuming that you could liquidate all of those bitcoin at the market price is a heroic assumption," he told AFP, adding such a deal would see the cryptocurrency's price plummet.

Jack Mallers, chief executive and co-founder of bitcoin-focused company Twenty One Capital, said his business embraced the sector's volatility, adding the market would need to be flooded for the token's price to crash.

- A bubble? -

According to its own calculation, Strategy's stock is selling at about 70 percent above the value of its bitcoin reserves.

The company -- which did not answer AFP's request for comment -- is growing thanks to bitcoin purchases, which in turn is attracting investors and pushing up its share price.

But ultimately it will need to monetise these crypto assets, for example by linking them to financial products, for its business to be sustained.

Should Strategy and other so-called "bitcoin treasury funds" fail to do so, Benoist fears the crypto investment bubble will burst.

He points out that the strategy of accumulation runs counter to the original philosophy of bitcoin, which was conceived in 2008 as a decentralised means of payment.

Today, "bitcoins end up in electronic safes that are left untouched", he said.

K.AbuDahab--SF-PST