-

'Emotional' Yu, 12, celebrates historic world swimming medal

'Emotional' Yu, 12, celebrates historic world swimming medal

-

Stocks struggle as Trump's new tariff sweep offsets earnings

-

Stocks struggle as Trump unveils new tariff sweep offsets earnings

Stocks struggle as Trump unveils new tariff sweep offsets earnings

-

Landslide-prone Nepal tests AI-powered warning system

-

El Salvador parliament adopts reform to allow Bukele to run indefinitely

El Salvador parliament adopts reform to allow Bukele to run indefinitely

-

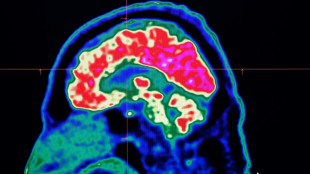

What are all these microplastics doing to our brains?

-

Zverev rallies in Toronto to claim milestone 500th ATP match win

Zverev rallies in Toronto to claim milestone 500th ATP match win

-

Farrell says debate over Australia as Lions destination 'insulting'

-

After stadium delays, African Nations Championship kicks off

After stadium delays, African Nations Championship kicks off

-

US tech titan earnings rise on AI as economy roils

-

Nvidia says no 'backdoors' in chips as China questions security

Nvidia says no 'backdoors' in chips as China questions security

-

Wallabies' Tizzano absent from third Lions Test after online abuse

-

Famed union leader Dolores Huerta urges US to mobilize against Trump

Famed union leader Dolores Huerta urges US to mobilize against Trump

-

Richardson, Lyles ease through 100m heats at US trials

-

Correa returning to Astros in blockbuster MLB trade from Twins

Correa returning to Astros in blockbuster MLB trade from Twins

-

Trump orders tariffs on dozens of countries in push to reshape global trade

-

Trump to build huge $200mn ballroom at White House

Trump to build huge $200mn ballroom at White House

-

Heathrow unveils £49 bn expansion plan for third runway

-

'Peaky Blinders' creator to pen new James Bond movie: studio

'Peaky Blinders' creator to pen new James Bond movie: studio

-

Top seed Gauff rallies to reach WTA Montreal fourth round

-

Amazon profits surge 35% but forecast sinks share price

Amazon profits surge 35% but forecast sinks share price

-

Gas workers uncover 1,000-year-old mummy in Peru

-

Brazil vows to fight Trump tariff 'injustice'

Brazil vows to fight Trump tariff 'injustice'

-

Michelsen stuns Musetti as Ruud rallies in Toronto

-

Oscars group picks 'A Star is Born' producer as new president

Oscars group picks 'A Star is Born' producer as new president

-

Global stocks mostly fall ahead of big Trump tariff deadline

-

Apple profit beats forecasts on strong iPhone sales

Apple profit beats forecasts on strong iPhone sales

-

Michelsen stuns Musetti at ATP Toronto Masters

-

Peru's president rejects court order on police amnesty

Peru's president rejects court order on police amnesty

-

Google must open Android to rival app stores: US court

-

Amazon profits surge 35% as AI investments drive growth

Amazon profits surge 35% as AI investments drive growth

-

Zelensky urges allies to seek 'regime change' in Russia

-

Trump envoy to inspect Gaza aid as pressure mounts on Israel

Trump envoy to inspect Gaza aid as pressure mounts on Israel

-

US theater and opera legend Robert Wilson dead at 83

-

EA shooter 'Battlefield 6' to appear in October

EA shooter 'Battlefield 6' to appear in October

-

Heavyweight shooter 'Battlefield 6' to appear in October

-

Justin Timberlake says he has Lyme disease

Justin Timberlake says he has Lyme disease

-

Atkinson and Tongue strike as India struggle in England decider

-

US theater and opera auteur Bob Wilson dead at 83

US theater and opera auteur Bob Wilson dead at 83

-

Trump envoy to visit Gaza as pressure mounts on Israel

-

In Darwin's wake: Two-year global conservation voyage sparks hope

In Darwin's wake: Two-year global conservation voyage sparks hope

-

Microsoft valuation surges above $4 trillion as AI lifts stocks

-

Verstappen quells speculation by committing to Red Bull for 2026

Verstappen quells speculation by committing to Red Bull for 2026

-

Study reveals potato's secret tomato past

-

Trump's envoy in Israel as Gaza criticism mounts

Trump's envoy in Israel as Gaza criticism mounts

-

Squiban solos to Tour de France stage win, Le Court maintains lead

-

Max Verstappen confirms he is staying at Red Bull next year

Max Verstappen confirms he is staying at Red Bull next year

-

Mitchell keeps New Zealand on top against Zimbabwe

-

Vasseur signs new contract as Ferrari team principal

Vasseur signs new contract as Ferrari team principal

-

French cities impose curfews for teens to curb crime

| CMSC | 1.09% | 22.85 | $ | |

| SCU | 0% | 12.72 | $ | |

| RIO | 0.47% | 59.77 | $ | |

| NGG | 0.28% | 70.39 | $ | |

| GSK | -4.9% | 37.15 | $ | |

| BTI | 0.97% | 53.68 | $ | |

| RBGPF | 0.69% | 74.94 | $ | |

| BP | -0.31% | 32.15 | $ | |

| BCC | -1.29% | 83.81 | $ | |

| JRI | 0.15% | 13.13 | $ | |

| CMSD | 0.9% | 23.27 | $ | |

| SCS | 0% | 10.33 | $ | |

| BCE | -0.86% | 23.33 | $ | |

| RYCEF | 7.62% | 14.18 | $ | |

| AZN | -4.79% | 73.09 | $ | |

| RELX | 0.21% | 51.89 | $ | |

| VOD | -2.31% | 10.81 | $ |

ECB holds rates with US tariffs decision on horizon

The European Central Bank held interest rates steady Thursday as policymakers waited to see whether the eurozone would be hit by higher US tariffs threatened by President Donald Trump.

The pause brought to an end a streak of consecutive cuts stretching back to September 2024 that has seen the ECB slash its benchmark deposit rate to two percent.

The swift reduction in borrowing costs for businesses and households in the 20 members of the single-currency bloc has come as inflation has fallen back from the double-digit peaks seen at the end of 2022.

Consumer prices in the eurozone rose at a pace of two percent in June, exactly in line with the ECB's target for inflation.

The sinking price pressures have opened the way for the ECB to lower interest rates, while concerns over the outlook for the eurozone have mounted.

In its rates announcement the ECB said that the economic environment remained "exceptionally uncertain, especially because of trade disputes".

Trump has set a deadline of August 1 to impose a basic tariff rate of 30 percent on goods from the EU, but negotiations to find a compromise deal have progressed.

A spokesman for the European Commission said earlier on Thursday a deal with the United States is "within reach", while diplomats said Wednesday the US had tabled a deal for a general 15-percent tariff.

While waiting for a resolution to the trade dispute -- or an unsuccessful end to talks -- the ECB would want "more clarity" before making their next move, UniCredit analysts said.

- Trade talks -

"Neither the economic data nor latest data regarding price dynamics demand an immediate response from the ECB," according to Dirk Schumacher, chief economist at German public lender KfW.

Eurozone inflation came in at exactly two percent in June and economic indicators including rising factory output have encouraged more optimism about the health of the economy.

The ECB would also want to "keep some powder dry for the case of emergency" if Trump were to apply harsh tariffs, Berenberg analyst Felix Schmidt said.

"A further escalation in the trade dispute would have a significant negative impact on the eurozone economy," leading to more rate cuts, Schmidt said.

The increased strength of the euro against the dollar as a result of tariff uncertainty could also encourage policymakers to further soften the ECB's monetary policy stance.

The euro has surged almost 14 percent against the dollar since the start of the year, boosted by investor moves to dump US assets in the face of Trump's impetuous policymaking and attacks on the US Federal Reserve.

-Strong euro-

A stronger euro would make imports cheaper and further suppress inflation. The ECB is already predicting the indicator to dip to 1.6 percent in 2026 before returning to target in 2027.

Investors will be listening closely to ECB President Christine Lagarde's comments in Frankfurt at 2:45 pm (1245 GMT) for indications of what could come next.

Lagarde dropped a strong hint that the ECB's cutting cycle was "getting to the end" at the last meeting in June, while stressing a data-dependent and meeting-by-meeting approach in the face of uncertainty.

After Thursday's pause, observers will turn their attention to how ECB thinking is developing ahead of its next gathering in September.

"A relatively quiet July meeting could feature some heightened scrutiny on how comfortable policymakers would be with another euro rally," according to ING bank analyst Carsten Brzeski.

Worries over currency fluctuations "may not make their way to official communication, but could help tilt the balance to a more dovish overall tone," Brzeski said.

B.Khalifa--SF-PST