-

Trump says to name new labor statistics chief this week

Trump says to name new labor statistics chief this week

-

England v India: Three talking points

-

Exceptional Nordic heatwave stumps tourists seeking shade

Exceptional Nordic heatwave stumps tourists seeking shade

-

'Musical cocoon': Polish mountain town hosts Chopin fest

-

A 'Thinker' drowns in plastic garbage as UN treaty talks open

A 'Thinker' drowns in plastic garbage as UN treaty talks open

-

India's Siraj 'woke up believing' ahead of Test heroics

-

Israeli PM says to brief army on Gaza war plan

Israeli PM says to brief army on Gaza war plan

-

Frustrated Stokes refuses to blame Brook for England collapse

-

Moscow awaits 'important' Trump envoy visit before sanctions deadline

Moscow awaits 'important' Trump envoy visit before sanctions deadline

-

Schick extends Bayer Leverkusen contract until 2030

-

Tesla approves $29 bn in shares to Musk as court case rumbles on

Tesla approves $29 bn in shares to Musk as court case rumbles on

-

Stocks rebound on US rate cut bets

-

Swiss eye 'more attractive' offer for Trump after tariff shock

Swiss eye 'more attractive' offer for Trump after tariff shock

-

Trump says will name new economics data official this week

-

Three things we learned from the Hungarian Grand Prix

Three things we learned from the Hungarian Grand Prix

-

Lions hooker Sheehan banned over Lynagh incident

-

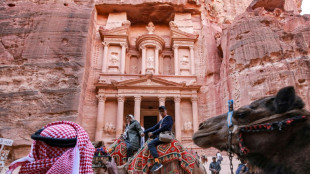

Jordan sees tourism slump over Gaza war

Jordan sees tourism slump over Gaza war

-

China's Baidu to deploy robotaxis on rideshare app Lyft

-

Israel wants world attention on hostages held in Gaza

Israel wants world attention on hostages held in Gaza

-

Pacific algae invade Algeria beaches, pushing humans and fish away

-

Siraj stars as India beat England by six runs in fifth-Test thriller

Siraj stars as India beat England by six runs in fifth-Test thriller

-

Stocks mostly rise as traders boost US rate cut bets

-

S.Africa eyes new markets after US tariffs: president

S.Africa eyes new markets after US tariffs: president

-

Trump envoy's visit will be 'important', Moscow says

-

BP makes largest oil, gas discovery in 25 years off Brazil

BP makes largest oil, gas discovery in 25 years off Brazil

-

South Korea removing loudspeakers on border with North

-

Italy fines fast-fashion giant Shein for 'green' claims

Italy fines fast-fashion giant Shein for 'green' claims

-

Shares in UK banks jump after car loan court ruling

-

Beijing issues new storm warning after deadly floods

Beijing issues new storm warning after deadly floods

-

Most markets rise as traders US data boosts rate cut bets

-

17 heat records broken in Japan

17 heat records broken in Japan

-

Most markets rise as traders weigh tariffs, US jobs

-

Tycoon who brought F1 to Singapore pleads guilty in graft case

Tycoon who brought F1 to Singapore pleads guilty in graft case

-

Australian police charge Chinese national with 'foreign interference'

-

Torrential rain in Taiwan kills four over past week

Torrential rain in Taiwan kills four over past week

-

Rwanda bees being wiped out by pesticides

-

Tourism boom sparks backlash in historic heart of Athens

Tourism boom sparks backlash in historic heart of Athens

-

Doctors fight vaccine mistrust as Romania hit by measles outbreak

-

Fritz fights through to reach ATP Toronto Masters quarters

Fritz fights through to reach ATP Toronto Masters quarters

-

Trump confirms US envoy Witkoff to travel to Russia in coming week

-

Mighty Atom: how the A-bombs shaped Japanese arts

Mighty Atom: how the A-bombs shaped Japanese arts

-

'Let's go fly a kite': Capturing wind for clean energy in Ireland

-

Pakistan beat West Indies by 13 runs to capture T20 series

Pakistan beat West Indies by 13 runs to capture T20 series

-

80 years on, Korean survivors of WWII atomic bombs still suffer

-

Teenage kicks: McIntosh, 12-year-old Yu set to rule the pool at LA 2028

Teenage kicks: McIntosh, 12-year-old Yu set to rule the pool at LA 2028

-

New Zealand former top cop charged over material showing child abuse and bestiality

-

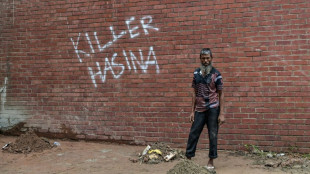

Bangladesh ex-PM palace becomes revolution museum

Bangladesh ex-PM palace becomes revolution museum

-

South Korea begins removing loudspeakers on border with North

-

Asian markets fluctuate as traders weigh tariffs, US jobs

Asian markets fluctuate as traders weigh tariffs, US jobs

-

Italy's fast fashion hub becomes Chinese mafia battlefield

| RBGPF | 0.08% | 75 | $ | |

| CMSC | 0.69% | 23.03 | $ | |

| BCC | -0.3% | 83.1 | $ | |

| RIO | 0.48% | 59.94 | $ | |

| NGG | 1.03% | 72.57 | $ | |

| SCS | 39.35% | 16.785 | $ | |

| GSK | -0.28% | 37.455 | $ | |

| BTI | 2.16% | 55.55 | $ | |

| BCE | -0.6% | 23.43 | $ | |

| RELX | 0.4% | 51.799 | $ | |

| JRI | 0.98% | 13.23 | $ | |

| RYCEF | 2% | 14.49 | $ | |

| CMSD | 0.6% | 23.49 | $ | |

| AZN | 0.46% | 74.29 | $ | |

| SCU | 0% | 12.72 | $ | |

| VOD | 0.36% | 11 | $ | |

| BP | 1.87% | 32.355 | $ |

Swiss central bank cuts interest rates to zero percent

The Swiss National Bank cut interest rates to zero percent on Thursday as inflation cools and the franc strengthens, while the economic outlook has deteriorated.

The SNB, however, held off a decision to return to its era of negative rates -- a policy that helped to curb the Swiss franc's rise but was unpopular among pension funds and other investors.

The franc's movement is also under scrutiny in the United States, as the US Treasury Department added Switzerland to its watch list of countries likely to manipulate their currencies earlier this month.

The SNB says its interventions in the foreign exchange market aim to ensure price stability, not unduly increase the Swiss economy's competitiveness.

The Swiss currency is a safe haven investment that has climbed against the dollar since US President Donald Trump launched his tariff blitz in April.

In Thursday's statement, the SNB -- which has denied manipulating the franc -- said it "remains willing to be active in the foreign exchange market as necessary".

The SNB cited easing inflationary pressure in its decision to cut rates by a quarter point, but it also pointed to a gloomy economic forecast.

"The global economic outlook for the coming quarters has deteriorated due to the increase in trade tensions," the central bank said, adding that the outlook for Switzerland remained uncertain.

"Developments abroad continue to represent the main risk," it said, expecting growth in the global economy to weaken over the coming quarters.

- Cooling inflation -

The SNB said Swiss gross domestic product growth was strong in the first quarter of the year -- largely due to exports to the United States being brought forward ahead of Trump's tariff manoeuvres.

But stripping that factor out, growth was more moderate, and is likely to slow again and remain subdued for the rest of the year, the SNB said.

The SNB expects GDP growth of one percent to 1.5 percent for 2025, and for 2026 too.

It said Swiss unemployment was likely to continue to rise slightly.

The bank lowered its inflation forecast for 2025 from 0.4 percent to 0.2 percent, and for 2026 from 0.8 percent to 0.5 percent.

The consumer price index even fell into negative territory in May, at minus 0.1 percent.

- Negative rates -

Between 2015 and 2022, the SNB's monetary policy was based on a negative interest rate of minus 0.75 percent -- which increased the cost of deposits held by banks and financial institutions relative to the amounts they were required to entrust to the central bank.

Those seven years left a bitter memory for major savers, who bore the brunt in fees, while pension funds were forced into riskier investments.

Negative rates make the Swiss franc less attractive to investors as it reduces returns on investments.

Thursday's decision was widely expected by analysts.

Adrian Prettejohn, Europe economist at the London-based research group Capital Economics, said the SNB is expected to move rates to negative 0.25 percent at its September meeting due to deflation.

"There are also significant downside risks to inflation from trade tensions as well as heightened geopolitical uncertainty, which could push up the value of the franc further," he said.

He said the central bank's language on currency interventions "supports our view that the SNB is not planning to use foreign exchange interventions as its main tool for loosening monetary policy anytime soon".

T.Samara--SF-PST