-

Apple to invest additional $100 bn in US

Apple to invest additional $100 bn in US

-

Trump says likely to meet Putin 'very soon'

-

Major climate-GDP study under review after facing challenge

Major climate-GDP study under review after facing challenge

-

Lebanon's Hezbollah rejects cabinet decision to disarm it

-

Rare 'Hobbit' first edition auctioned for £43,000

Rare 'Hobbit' first edition auctioned for £43,000

-

Sinner lukewarm on expanded Cincinnati format

-

Rested Scheffler ready to tackle US PGA Tour playoffs

Rested Scheffler ready to tackle US PGA Tour playoffs

-

Sudan says army destroys Emirati aircraft, killing 40 mercenaries

-

White House says Trump open to meeting Putin and Zelensky

White House says Trump open to meeting Putin and Zelensky

-

Grok, is that Gaza? AI image checks mislocate news photographs

-

'Global icon' Son Heung-min joins LAFC from Tottenham

'Global icon' Son Heung-min joins LAFC from Tottenham

-

In Cuba, Castro's 'influencer' grandson causes a stir

-

Mexican president backs threatened female football referee

Mexican president backs threatened female football referee

-

France wildfire kills one as Spanish resort blaze 'stabilised'

-

German great Mueller signs with MLS Whitecaps

German great Mueller signs with MLS Whitecaps

-

US government gets a year of ChatGPT Enterprise for $1

-

Trump calls Putin-Witkoff talks 'highly productive' but sanctions still due

Trump calls Putin-Witkoff talks 'highly productive' but sanctions still due

-

Egypt sets opening of $1 bn Pyramids museum for Nov 1

-

Prince Harry, African charity row rumbles on as watchdog blames 'all parties'

Prince Harry, African charity row rumbles on as watchdog blames 'all parties'

-

Brazil seeks WTO relief against Trump tariffs

-

Isak told to train alone by Newcastle - reports

Isak told to train alone by Newcastle - reports

-

McDonald's sees US rebound but says low-income diners remain stressed

-

Trump hikes India levy over Russian oil as tariff deadline approaches

Trump hikes India levy over Russian oil as tariff deadline approaches

-

Swiss president hopes Washington talks avert surprise tariff

-

France wildfire kills one as Spanish resort evacuated

France wildfire kills one as Spanish resort evacuated

-

Stocks higher with eyes on earnings, US tariff deadline

-

Vonn appoints Svindal as coach ahead of 2026 Olympics

Vonn appoints Svindal as coach ahead of 2026 Olympics

-

Backlash after 'interview' with AI avatar of US school shooting victim

-

Darth Vader's lightsaber could cost you an arm and a leg

Darth Vader's lightsaber could cost you an arm and a leg

-

Swiss president to meet Rubio as surprise tariff hike looms

-

Israel orders army to execute govt decisions on Gaza

Israel orders army to execute govt decisions on Gaza

-

Berlin wary as Berlusconi group closer to German media takeover

-

Italy approves plans for world's longest suspension bridge

Italy approves plans for world's longest suspension bridge

-

Arsenal have 'belief' to end trophy drought, says Arteta

-

Putin decree allows Russia to increase greenhouse gas emissions

Putin decree allows Russia to increase greenhouse gas emissions

-

Putin holds 'constructive' talks with US envoy Witkoff ahead of sanctions deadline: Kremlin

-

Liverpool set to cut losses with Nunez move to Saudi: reports

Liverpool set to cut losses with Nunez move to Saudi: reports

-

Stocks tick up with eyes on earnings, US tariff deadline

-

German broadcast giant backs takeover by Berlusconi group

German broadcast giant backs takeover by Berlusconi group

-

Pro-Trump nationalist becomes Poland's new president

-

Putin meets US envoy Witkoff ahead of sanctions deadline

Putin meets US envoy Witkoff ahead of sanctions deadline

-

UK watchdog bans Zara ads over 'unhealthily thin' model photos

-

Natural disasters caused $135 bn in economic losses in first half of 2025: Swiss Re

Natural disasters caused $135 bn in economic losses in first half of 2025: Swiss Re

-

Rebuilding in devastated Mariupol under Russia's thumb

-

One dead, nine injured in huge France wildfire

One dead, nine injured in huge France wildfire

-

German factory orders fall amid tariff, growth woes

-

Turkmenistan's methane-spewing 'Gateway to Hell' loses its anger

Turkmenistan's methane-spewing 'Gateway to Hell' loses its anger

-

Markets tick up but traders wary as Trump tariffs temper rate hopes

-

A year on, Ugandans still suffering from deadly garbage collapse

A year on, Ugandans still suffering from deadly garbage collapse

-

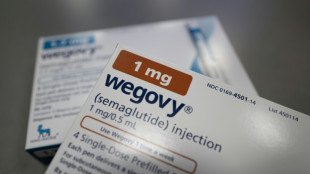

Ozempic maker Novo Nordisk posts strong results but competition weighs

| SCU | 0% | 12.72 | $ | |

| RBGPF | 1.42% | 76 | $ | |

| RYCEF | 0.9% | 14.48 | $ | |

| CMSC | -0.52% | 22.95 | $ | |

| NGG | 0.03% | 72.3 | $ | |

| SCS | 0.19% | 15.99 | $ | |

| GSK | -1.55% | 36.75 | $ | |

| CMSD | 0.13% | 23.54 | $ | |

| VOD | 1.77% | 11.3 | $ | |

| RIO | 0.65% | 60.09 | $ | |

| BTI | 0.99% | 56.4 | $ | |

| JRI | 0.6% | 13.34 | $ | |

| BCC | -4.64% | 82.92 | $ | |

| RELX | -3.65% | 48.81 | $ | |

| BCE | -1.33% | 23.25 | $ | |

| AZN | -1.2% | 73.6 | $ | |

| BP | 0.83% | 33.88 | $ |

Developing nations face 'tidal wave' of China debt: report

The world's poorest nations face a "tidal wave of debt" as repayments to China hit record highs in 2025, an Australian think tank warned Tuesday in a new report.

China's Belt and Road Initiative lending spree of the 2010s has paid for shipping ports, railways, roads and more from the deserts of Africa to the tropical South Pacific.

But new lending is drying up, according to Australia's Lowy Institute, and is now outweighed by the debts that developing countries must pay back.

"Developing countries are grappling with a tidal wave of debt repayments and interest costs to China," researcher Riley Duke said.

"Now, and for the rest of this decade, China will be more debt collector than banker to the developing world."

The Lowy Institute sifted through World Bank data to calculate developing nations' repayment obligations.

It found that the poorest 75 countries were set to make "record high debt repayments" to China in 2025 of a combined US$22 billion.

"As a result, China's net lending position has shifted rapidly," Duke said.

"Moving from being a net provider of financing -- where it lent more than it received in repayments -- to a net drain, with repayments now exceeding loan disbursements."

Paying off debts was starting to jeopardise spending on hospitals, schools, and climate change, the Lowy report found.

"Pressure from Chinese state lending, along with surging repayments to a range of international private creditors, is putting enormous financial strain on developing economies."

The report also raised questions about whether China could seek to parlay these debts for "geopolitical leverage", especially after the United States slashed foreign aid.

While Chinese lending was falling almost across the board, the report said there were two areas that seemed to be bucking the trend.

The first was in nations such as Honduras and Solomon Islands, which received massive new loans after switching diplomatic recognition from Taiwan to China.

The other was in countries such as Indonesia or Brazil, where China has signed new loan deals to secure battery metals or other critical minerals.

W.AbuLaban--SF-PST