-

Kane scores as Bayern thump Spurs in pre-season friendly

Kane scores as Bayern thump Spurs in pre-season friendly

-

France strikes down return of banned bee-killing pesticide

-

Canada sends troops to eastern province as fire damage grows

Canada sends troops to eastern province as fire damage grows

-

OpenAI releases ChatGPT-5 as AI race accelerates

-

Plastic pollution treaty talks deadlocked

Plastic pollution treaty talks deadlocked

-

A French sailor's personal 'Plastic Odyssey'

-

Netanyahu says Israel to control not govern Gaza

Netanyahu says Israel to control not govern Gaza

-

Partey signs for Villarreal while on bail for rape charges

-

Wales have the talent to rise again, says rugby head coach Tandy

Wales have the talent to rise again, says rugby head coach Tandy

-

US partners seek relief as Trump tariffs upend global trade

-

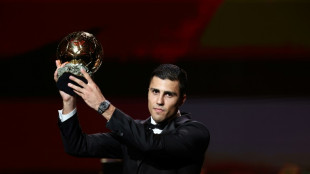

Five England players nominated for women's Ballon d'Or

Five England players nominated for women's Ballon d'Or

-

PSG dominate list of men's Ballon D'Or nominees

-

Americans eating (slightly) less ultra-processed food

Americans eating (slightly) less ultra-processed food

-

Man Utd agree 85m euro deal to sign Sesko: reports

-

France to rule on controversial bee-killing pesticide bill

France to rule on controversial bee-killing pesticide bill

-

Germany factory output falls to lowest since pandemic in 2020

-

Swiss to seek more talks with US as 'horror' tariffs kick in

Swiss to seek more talks with US as 'horror' tariffs kick in

-

Barcelona strip Ter Stegen of captain's armband

-

Trump demands new US census as redistricting war spreads

Trump demands new US census as redistricting war spreads

-

'How much worse could it get?' Gazans fear full occupation

-

France seeks to 'stabilise' wildfire raging in south

France seeks to 'stabilise' wildfire raging in south

-

Ski world champion Venier quits, saying hunger has gone

-

Israel security cabinet to discuss Gaza war plans

Israel security cabinet to discuss Gaza war plans

-

Deadly Indian Himalayan flood likely caused by glacier collapse, experts say

-

UK pensioner, student arrested for backing Palestine Action

UK pensioner, student arrested for backing Palestine Action

-

Israeli security cabinet to discuss future Gaza war plans

-

Antonio to leave West Ham after car crash

Antonio to leave West Ham after car crash

-

Kremlin says Trump-Putin meeting agreed for 'coming days'

-

Bank of England cuts rate as keeps watch over tariffs

Bank of England cuts rate as keeps watch over tariffs

-

Maddison set to miss most of Spurs season after knee injury

-

Plastic pollution treaty talks stuck in 'dialogue of the deaf'

Plastic pollution treaty talks stuck in 'dialogue of the deaf'

-

Stock markets brush aside higher US tariffs

-

Siemens warns US tariffs causing investment caution

Siemens warns US tariffs causing investment caution

-

Influx of Afghan returnees fuels Kabul housing crisis

-

Israeli security cabinet to hold talks over future Gaza war plans

Israeli security cabinet to hold talks over future Gaza war plans

-

Macron urges tougher line in standoff with Algeria

-

UK says first migrants held under return deal with France

UK says first migrants held under return deal with France

-

Ukraine's funeral workers bearing the burden of war

-

India exporters say 50% Trump levy a 'severe setback'

India exporters say 50% Trump levy a 'severe setback'

-

Germany factory output lowest since pandemic in 2020

-

Thailand and Cambodia agree to extend peace pact

Thailand and Cambodia agree to extend peace pact

-

Third-hottest July on record wreaks climate havoc

-

Trump-Putin meeting agreed for 'coming days', venue set: Kremlin

Trump-Putin meeting agreed for 'coming days', venue set: Kremlin

-

Frankfurt sign Japan winger Doan until 2030

-

Swiss reel from 'horror scenario' after US tariff blow

Swiss reel from 'horror scenario' after US tariff blow

-

Apple to hike investment in US to $600 bn over four years

-

Asian markets rise as traders look past Trump chip threat

Asian markets rise as traders look past Trump chip threat

-

Higher US tariffs kick in for dozens of trading partners

-

Deliveroo slips back into loss on DoorDash takeover costs

Deliveroo slips back into loss on DoorDash takeover costs

-

'Dog ate my passport': All Black rookie in Argentina trip pickle

| CMSC | 0% | 22.95 | $ | |

| JRI | 0.52% | 13.41 | $ | |

| AZN | 0.69% | 74.11 | $ | |

| SCU | 0% | 12.72 | $ | |

| BCC | 0.55% | 83.38 | $ | |

| RBGPF | 1.42% | 76 | $ | |

| BTI | 0.34% | 56.59 | $ | |

| GSK | 2.14% | 37.555 | $ | |

| SCS | 0.65% | 16.095 | $ | |

| CMSD | 0.02% | 23.545 | $ | |

| RYCEF | -0.21% | 14.45 | $ | |

| NGG | -0.22% | 72.14 | $ | |

| RIO | 1.07% | 60.74 | $ | |

| VOD | -0.62% | 11.23 | $ | |

| BCE | 2.06% | 23.74 | $ | |

| RELX | 0.88% | 49.245 | $ | |

| BP | 0.88% | 34.18 | $ |

Stocks firm, dollar drops at end of rocky week

Major stock markets mostly firmed and the dollar slid Friday following volatility this week triggered by concerns over high US debt.

Investors have been on edge after Moody's stripped the United States of its top-tier credit rating and the House of Representative approved President Donald Trump's tax cut plan, which critics say would add to the country's debt pile.

A tepid auction of 20-year Treasuries on Wednesday ramped up those concerns, dealing a blow to stocks that had just recovered from the April fireworks of Trump's tariff blitz.

Still, sentiment stabilised on Thursday, with bond yields pulling back after the Republican-led House narrowly passed Trump's "One Big, Beautiful Bill Act", which shrinks social safety net programmes to pay for a 10-year extension of his 2017 tax cuts.

"The tax bill won't lead to default but it means more debt and the markets are cagey about this and about the US economy," said Neil Wilson, UK investor strategist at Saxo Markets.

"Stock markets are in wait-and-see mode for the moment after Wednesday's sharp pullback," he added.

A mixed showing Thursday on Wall Street was followed by slightly better performances Friday in Asia and Europe, which was boosted by news that Germany's economy grew more than previously thought at the start of 2025.

Trump's tax package, which now goes to the Senate, had faced scepticism from fiscal hawks who fear the country is headed for bankruptcy.

Independent analysts warn it would increase the deficit by as much as $4 trillion over a decade.

But the White House insists it will spur growth of up to 5.2 percent, ensuring it adds nothing to the $36 trillion national debt -- growth projections that are well outside the mainstream consensus.

There is a feeling that "perhaps the fiscal worries have gone a bit too far", said Chris Weston, analyst at broker Pepperstone.

"Many have crunched the numbers on the tax bill and see the raft of measures to not be overly stimulatory and to therefore result in a major blowout of the deficit in 2026 and 2027 and is, in fact, quite neutral in its effect."

The drop in Treasury yields -- suggesting improving demand for US debt -- was helped by upbeat data on the American jobs market, home sales and factory activity, suggesting the country's economy remained healthy.

- Key figures at around 1020 GMT -

London - FTSE 100: UP 0.1 percent at 8,748.08 points

Paris - CAC 40: DOWN 0.5 percent at 7,824.16

Frankfurt - DAX: UP 0.2 percent at 24,041.23

Tokyo - Nikkei 225: UP 0.5 percent at 37,160.47 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 23,601.26 (close)

Shanghai - Composite: DOWN 0.9 percent at 3,348.37 (close)

New York - Dow: FLAT at 41,859.09 (close)

Euro/dollar: UP at $1.1356 from $1.1281 on Thursday

Pound/dollar: UP at $1.3499 from $1.3419

Dollar/yen: DOWN at 143.27 yen from 143.99 yen

Euro/pound: UP at 84.12 pence from 84.07 pence

Brent North Sea Crude: UP 0.1 percent at $64.35 per barrel

West Texas Intermediate: UP 0.2 percent at $61.10 per barrel

X.AbuJaber--SF-PST