-

US judge orders temporary halt to new 'Alligator Alcatraz' construction

US judge orders temporary halt to new 'Alligator Alcatraz' construction

-

US uses war rhetoric, Superman to recruit for migrant crackdown

-

US to rewrite its past national climate reports

US to rewrite its past national climate reports

-

U can't pay this: MC Hammer sued over delinquent car loan

-

WHO says nearly 100,000 struck with cholera in Sudan

WHO says nearly 100,000 struck with cholera in Sudan

-

Huge wildfire in southern France now under control

-

Kane scores as Bayern thump Spurs in pre-season friendly

Kane scores as Bayern thump Spurs in pre-season friendly

-

France strikes down return of banned bee-killing pesticide

-

Canada sends troops to eastern province as fire damage grows

Canada sends troops to eastern province as fire damage grows

-

OpenAI releases ChatGPT-5 as AI race accelerates

-

Plastic pollution treaty talks deadlocked

Plastic pollution treaty talks deadlocked

-

A French sailor's personal 'Plastic Odyssey'

-

Netanyahu says Israel to control not govern Gaza

Netanyahu says Israel to control not govern Gaza

-

Partey signs for Villarreal while on bail for rape charges

-

Wales have the talent to rise again, says rugby head coach Tandy

Wales have the talent to rise again, says rugby head coach Tandy

-

US partners seek relief as Trump tariffs upend global trade

-

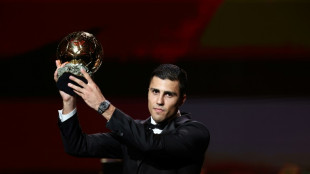

Five England players nominated for women's Ballon d'Or

Five England players nominated for women's Ballon d'Or

-

PSG dominate list of men's Ballon D'Or nominees

-

Americans eating (slightly) less ultra-processed food

Americans eating (slightly) less ultra-processed food

-

Man Utd agree 85m euro deal to sign Sesko: reports

-

France to rule on controversial bee-killing pesticide bill

France to rule on controversial bee-killing pesticide bill

-

Germany factory output falls to lowest since pandemic in 2020

-

Swiss to seek more talks with US as 'horror' tariffs kick in

Swiss to seek more talks with US as 'horror' tariffs kick in

-

Barcelona strip Ter Stegen of captain's armband

-

Trump demands new US census as redistricting war spreads

Trump demands new US census as redistricting war spreads

-

'How much worse could it get?' Gazans fear full occupation

-

France seeks to 'stabilise' wildfire raging in south

France seeks to 'stabilise' wildfire raging in south

-

Ski world champion Venier quits, saying hunger has gone

-

Israel security cabinet to discuss Gaza war plans

Israel security cabinet to discuss Gaza war plans

-

Deadly Indian Himalayan flood likely caused by glacier collapse, experts say

-

UK pensioner, student arrested for backing Palestine Action

UK pensioner, student arrested for backing Palestine Action

-

Israeli security cabinet to discuss future Gaza war plans

-

Antonio to leave West Ham after car crash

Antonio to leave West Ham after car crash

-

Kremlin says Trump-Putin meeting agreed for 'coming days'

-

Bank of England cuts rate as keeps watch over tariffs

Bank of England cuts rate as keeps watch over tariffs

-

Maddison set to miss most of Spurs season after knee injury

-

Plastic pollution treaty talks stuck in 'dialogue of the deaf'

Plastic pollution treaty talks stuck in 'dialogue of the deaf'

-

Stock markets brush aside higher US tariffs

-

Siemens warns US tariffs causing investment caution

Siemens warns US tariffs causing investment caution

-

Influx of Afghan returnees fuels Kabul housing crisis

-

Israeli security cabinet to hold talks over future Gaza war plans

Israeli security cabinet to hold talks over future Gaza war plans

-

Macron urges tougher line in standoff with Algeria

-

UK says first migrants held under return deal with France

UK says first migrants held under return deal with France

-

Ukraine's funeral workers bearing the burden of war

-

India exporters say 50% Trump levy a 'severe setback'

India exporters say 50% Trump levy a 'severe setback'

-

Germany factory output lowest since pandemic in 2020

-

Thailand and Cambodia agree to extend peace pact

Thailand and Cambodia agree to extend peace pact

-

Third-hottest July on record wreaks climate havoc

-

Trump-Putin meeting agreed for 'coming days', venue set: Kremlin

Trump-Putin meeting agreed for 'coming days', venue set: Kremlin

-

Frankfurt sign Japan winger Doan until 2030

| SCU | 0% | 12.72 | $ | |

| RBGPF | 1.42% | 76 | $ | |

| JRI | 0.52% | 13.41 | $ | |

| CMSC | 0.04% | 22.96 | $ | |

| NGG | -0.31% | 72.08 | $ | |

| BCC | 0.32% | 83.19 | $ | |

| BCE | 2.23% | 23.78 | $ | |

| CMSD | -0.09% | 23.52 | $ | |

| SCS | 0.06% | 16 | $ | |

| RYCEF | -0.21% | 14.45 | $ | |

| RIO | 1.12% | 60.77 | $ | |

| VOD | -0.36% | 11.26 | $ | |

| GSK | 2.21% | 37.58 | $ | |

| RELX | 1.03% | 49.32 | $ | |

| BTI | 0.51% | 56.69 | $ | |

| AZN | 1.3% | 74.57 | $ | |

| BP | 0.91% | 34.19 | $ |

Trump says mulling privatizing Fannie Mae and Freddie Mac

President Donald Trump said Wednesday he was considering selling off US mortgage-backing giants Fannie Mae and Freddie Mac almost two decades after they were brought under government control during a global financial crisis.

The move, if confirmed, could resolve an issue that has dogged administrations as far back as Barack Obama's, offering possible dividends for investors, but risking driving up borrowing rates for homebuyers.

"I am giving very serious consideration to bringing Fannie Mae and Freddie Mac public," Trump wrote on his Truth Social website.

"I will be speaking with Treasury Secretary Scott Bessent, Secretary of Commerce Howard Lutnick, and the Director of the Federal Housing Finance Agency, William Pulte, among others, and will be making a decision in the near future.

"Fannie Mae and Freddie Mac are doing very well, throwing off a lot of CASH, and the time would seem to be right. Stay tuned!"

The firms do not originate consumer mortages, but buy them on the secondary market from banks and other lending institutions, then bundle them and sell them on as investment products, guaranteeing the principal and the interest.

That protects investors, and injects liquidity into the mortgage market, permitting institutions to offer the kind of long, fixed-rate mortgages popular with American buyers.

The US government took around 80 percent ownership of Fannie Mae and Freddie Mac in 2008 when the world's financial systems were upended by a crisis that began in the American subprime mortgage sector.

The firms had to be bailed out because of their exposure to so many mortgages that had gone into default, and the US government at the time intervened as part of a mammoth effort to unstick global liquidity.

They have since paid back their debts to the US taxpayer and now have tens of billions of dollars on hand.

Advocates for privatizing them say it would promote competition and move risk from taxpayers to private investors.

But opponents say the process could reduce liquidity in the mortgage market, which would drive up interest rates and reduce availability of home loans to lower income borrowers.

I.Saadi--SF-PST