-

US judge orders temporary halt to new 'Alligator Alcatraz' construction

US judge orders temporary halt to new 'Alligator Alcatraz' construction

-

US uses war rhetoric, Superman to recruit for migrant crackdown

-

US to rewrite its past national climate reports

US to rewrite its past national climate reports

-

U can't pay this: MC Hammer sued over delinquent car loan

-

WHO says nearly 100,000 struck with cholera in Sudan

WHO says nearly 100,000 struck with cholera in Sudan

-

Huge wildfire in southern France now under control

-

Kane scores as Bayern thump Spurs in pre-season friendly

Kane scores as Bayern thump Spurs in pre-season friendly

-

France strikes down return of banned bee-killing pesticide

-

Canada sends troops to eastern province as fire damage grows

Canada sends troops to eastern province as fire damage grows

-

OpenAI releases ChatGPT-5 as AI race accelerates

-

Plastic pollution treaty talks deadlocked

Plastic pollution treaty talks deadlocked

-

A French sailor's personal 'Plastic Odyssey'

-

Netanyahu says Israel to control not govern Gaza

Netanyahu says Israel to control not govern Gaza

-

Partey signs for Villarreal while on bail for rape charges

-

Wales have the talent to rise again, says rugby head coach Tandy

Wales have the talent to rise again, says rugby head coach Tandy

-

US partners seek relief as Trump tariffs upend global trade

-

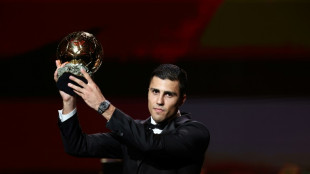

Five England players nominated for women's Ballon d'Or

Five England players nominated for women's Ballon d'Or

-

PSG dominate list of men's Ballon D'Or nominees

-

Americans eating (slightly) less ultra-processed food

Americans eating (slightly) less ultra-processed food

-

Man Utd agree 85m euro deal to sign Sesko: reports

-

France to rule on controversial bee-killing pesticide bill

France to rule on controversial bee-killing pesticide bill

-

Germany factory output falls to lowest since pandemic in 2020

-

Swiss to seek more talks with US as 'horror' tariffs kick in

Swiss to seek more talks with US as 'horror' tariffs kick in

-

Barcelona strip Ter Stegen of captain's armband

-

Trump demands new US census as redistricting war spreads

Trump demands new US census as redistricting war spreads

-

'How much worse could it get?' Gazans fear full occupation

-

France seeks to 'stabilise' wildfire raging in south

France seeks to 'stabilise' wildfire raging in south

-

Ski world champion Venier quits, saying hunger has gone

-

Israel security cabinet to discuss Gaza war plans

Israel security cabinet to discuss Gaza war plans

-

Deadly Indian Himalayan flood likely caused by glacier collapse, experts say

-

UK pensioner, student arrested for backing Palestine Action

UK pensioner, student arrested for backing Palestine Action

-

Israeli security cabinet to discuss future Gaza war plans

-

Antonio to leave West Ham after car crash

Antonio to leave West Ham after car crash

-

Kremlin says Trump-Putin meeting agreed for 'coming days'

-

Bank of England cuts rate as keeps watch over tariffs

Bank of England cuts rate as keeps watch over tariffs

-

Maddison set to miss most of Spurs season after knee injury

-

Plastic pollution treaty talks stuck in 'dialogue of the deaf'

Plastic pollution treaty talks stuck in 'dialogue of the deaf'

-

Stock markets brush aside higher US tariffs

-

Siemens warns US tariffs causing investment caution

Siemens warns US tariffs causing investment caution

-

Influx of Afghan returnees fuels Kabul housing crisis

-

Israeli security cabinet to hold talks over future Gaza war plans

Israeli security cabinet to hold talks over future Gaza war plans

-

Macron urges tougher line in standoff with Algeria

-

UK says first migrants held under return deal with France

UK says first migrants held under return deal with France

-

Ukraine's funeral workers bearing the burden of war

-

India exporters say 50% Trump levy a 'severe setback'

India exporters say 50% Trump levy a 'severe setback'

-

Germany factory output lowest since pandemic in 2020

-

Thailand and Cambodia agree to extend peace pact

Thailand and Cambodia agree to extend peace pact

-

Third-hottest July on record wreaks climate havoc

-

Trump-Putin meeting agreed for 'coming days', venue set: Kremlin

Trump-Putin meeting agreed for 'coming days', venue set: Kremlin

-

Frankfurt sign Japan winger Doan until 2030

| SCU | 0% | 12.72 | $ | |

| RBGPF | 1.42% | 76 | $ | |

| JRI | 0.52% | 13.41 | $ | |

| CMSC | 0.04% | 22.96 | $ | |

| NGG | -0.31% | 72.08 | $ | |

| BCC | 0.32% | 83.19 | $ | |

| BCE | 2.23% | 23.78 | $ | |

| CMSD | -0.09% | 23.52 | $ | |

| SCS | 0.06% | 16 | $ | |

| RYCEF | -0.21% | 14.45 | $ | |

| RIO | 1.12% | 60.77 | $ | |

| VOD | -0.36% | 11.26 | $ | |

| GSK | 2.21% | 37.58 | $ | |

| RELX | 1.03% | 49.32 | $ | |

| BTI | 0.51% | 56.69 | $ | |

| AZN | 1.3% | 74.57 | $ | |

| BP | 0.91% | 34.19 | $ |

Dollar, US bonds under pressure as Trump pushes tax bill

A bond sell-off and declining dollar signalled investor unease Wednesday as Washington lawmakers contemplated a tax-cut bill that could push up the US deficit.

Wall Street was trading lower, while European share markets were mixed at their close. The US dip extended losses from Tuesday, which had ended a six-day rally.

Much US attention on Wednesday was focused on a push by Republicans to pass US President Donald Trump's "big, beautiful bill" to cut taxes. They are aiming for a vote in the House of Representatives later this week.

The US bill has "helped to push tariff and trade war concerns off the front pages", David Morrison, senior market analyst at Trade Nation, said.

While New York stock market losses were restrained -- and the tech-heavy Nasdaq was trading higher -- analysts worried that the US bond market, already weakened by a credit-rating downgrade by Moody's, could deepen a months-long slump.

"A bond market crisis is exactly the sort of event that could send stocks tumbling and volatility surging," said Kathleen Brooks, research director at XTB.

"It's also harder to recover from compared to the man-made tariff crisis," she added.

US and Japanese finance ministers were likely to touch on their currency policies at a G7 meeting going on in Canada, he said.

Bitcoin on Wednesday hit a new record high, of $109,499.90, as investors eyed new US legislation on cryptocurrency with optimism.

In Europe, London's FTSE closed slightly up, despite inflation data coming in higher than expected, which analysts said could slow the pace of interest rate cuts by the Bank of England.

Germany's DAX also ended in positive territory. But the CAC in Paris ended lower.

An initial surge in crude prices spurred by a CNN report that Israel was planning a strike on Iranian nuclear sites reversed direction after a surprise announcement by the US Energy Information Administration that the country's oil stocks had risen last week.

There was also speculation the report had been a leak designed to put pressure on Iran in its negotiations with Washington on rolling back its nuclear programme.

Worries over the impact of Trump's tariffs -- and what will happen when a suspension of the more extreme ones expires -- were still reflected in the markets.

But Mexico said on Wednesday it had obtained a cut in the duties levelled at its auto imports into the United States.

Economy Minister Marcelo Ebrard said Washington had agreed to levy 15 percent instead of 25 percent.

- Key figures at around 1530 GMT -

New York - S&P 500: DOWN 0.2 percent at 5,927.06 points

New York - Dow: DOWN 0.8 percent at 42,338.80

New York - Nasdaq Composite: UP 0.3 percent at 19,195.58

London - FTSE 100: UP 0.1 percent at 8,786.46 (close)

Paris - CAC 40: DOWN 0.4 percent at 7,910.49 (close)

Frankfurt - DAX: UP 0.4 percent at 24,122.40 (close)

Tokyo - Nikkei 225: DOWN 0.6 percent at 37,298.98 (close)

Hong Kong - Hang Seng Index: UP 0.6 percent at 23,827.78 (close)

Shanghai - Composite: UP 0.2 percent at 3,387.57 (close)

New York - Dow: DOWN 0.3 percent at 42,677.24 (close)

Bitcoin: UP, new record at $109,499.80

Euro/dollar: UP at $1.1336 from $1.1284 on Tuesday

Pound/dollar: UP at $1.3440 from $1.3391

Dollar/yen: DOWN at 143.67 yen from 144.47 yen

Euro/pound: UP at 84.36 pence from 84.26 pence

Brent North Sea Crude: DOWN 0.6 percent at $64.98 per barrel

West Texas Intermediate: DOWN 0.6 percent at $61.66 per barrel

Z.Ramadan--SF-PST