-

US judge orders temporary halt to new 'Alligator Alcatraz' construction

US judge orders temporary halt to new 'Alligator Alcatraz' construction

-

US uses war rhetoric, Superman to recruit for migrant crackdown

-

US to rewrite its past national climate reports

US to rewrite its past national climate reports

-

U can't pay this: MC Hammer sued over delinquent car loan

-

WHO says nearly 100,000 struck with cholera in Sudan

WHO says nearly 100,000 struck with cholera in Sudan

-

Huge wildfire in southern France now under control

-

Kane scores as Bayern thump Spurs in pre-season friendly

Kane scores as Bayern thump Spurs in pre-season friendly

-

France strikes down return of banned bee-killing pesticide

-

Canada sends troops to eastern province as fire damage grows

Canada sends troops to eastern province as fire damage grows

-

OpenAI releases ChatGPT-5 as AI race accelerates

-

Plastic pollution treaty talks deadlocked

Plastic pollution treaty talks deadlocked

-

A French sailor's personal 'Plastic Odyssey'

-

Netanyahu says Israel to control not govern Gaza

Netanyahu says Israel to control not govern Gaza

-

Partey signs for Villarreal while on bail for rape charges

-

Wales have the talent to rise again, says rugby head coach Tandy

Wales have the talent to rise again, says rugby head coach Tandy

-

US partners seek relief as Trump tariffs upend global trade

-

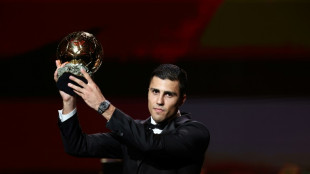

Five England players nominated for women's Ballon d'Or

Five England players nominated for women's Ballon d'Or

-

PSG dominate list of men's Ballon D'Or nominees

-

Americans eating (slightly) less ultra-processed food

Americans eating (slightly) less ultra-processed food

-

Man Utd agree 85m euro deal to sign Sesko: reports

-

France to rule on controversial bee-killing pesticide bill

France to rule on controversial bee-killing pesticide bill

-

Germany factory output falls to lowest since pandemic in 2020

-

Swiss to seek more talks with US as 'horror' tariffs kick in

Swiss to seek more talks with US as 'horror' tariffs kick in

-

Barcelona strip Ter Stegen of captain's armband

-

Trump demands new US census as redistricting war spreads

Trump demands new US census as redistricting war spreads

-

'How much worse could it get?' Gazans fear full occupation

-

France seeks to 'stabilise' wildfire raging in south

France seeks to 'stabilise' wildfire raging in south

-

Ski world champion Venier quits, saying hunger has gone

-

Israel security cabinet to discuss Gaza war plans

Israel security cabinet to discuss Gaza war plans

-

Deadly Indian Himalayan flood likely caused by glacier collapse, experts say

-

UK pensioner, student arrested for backing Palestine Action

UK pensioner, student arrested for backing Palestine Action

-

Israeli security cabinet to discuss future Gaza war plans

-

Antonio to leave West Ham after car crash

Antonio to leave West Ham after car crash

-

Kremlin says Trump-Putin meeting agreed for 'coming days'

-

Bank of England cuts rate as keeps watch over tariffs

Bank of England cuts rate as keeps watch over tariffs

-

Maddison set to miss most of Spurs season after knee injury

-

Plastic pollution treaty talks stuck in 'dialogue of the deaf'

Plastic pollution treaty talks stuck in 'dialogue of the deaf'

-

Stock markets brush aside higher US tariffs

-

Siemens warns US tariffs causing investment caution

Siemens warns US tariffs causing investment caution

-

Influx of Afghan returnees fuels Kabul housing crisis

-

Israeli security cabinet to hold talks over future Gaza war plans

Israeli security cabinet to hold talks over future Gaza war plans

-

Macron urges tougher line in standoff with Algeria

-

UK says first migrants held under return deal with France

UK says first migrants held under return deal with France

-

Ukraine's funeral workers bearing the burden of war

-

India exporters say 50% Trump levy a 'severe setback'

India exporters say 50% Trump levy a 'severe setback'

-

Germany factory output lowest since pandemic in 2020

-

Thailand and Cambodia agree to extend peace pact

Thailand and Cambodia agree to extend peace pact

-

Third-hottest July on record wreaks climate havoc

-

Trump-Putin meeting agreed for 'coming days', venue set: Kremlin

Trump-Putin meeting agreed for 'coming days', venue set: Kremlin

-

Frankfurt sign Japan winger Doan until 2030

| SCU | 0% | 12.72 | $ | |

| RBGPF | 1.42% | 76 | $ | |

| JRI | 0.52% | 13.41 | $ | |

| CMSC | 0.04% | 22.96 | $ | |

| NGG | -0.31% | 72.08 | $ | |

| BCC | 0.32% | 83.19 | $ | |

| BCE | 2.23% | 23.78 | $ | |

| CMSD | -0.09% | 23.52 | $ | |

| SCS | 0.06% | 16 | $ | |

| RYCEF | -0.21% | 14.45 | $ | |

| RIO | 1.12% | 60.77 | $ | |

| VOD | -0.36% | 11.26 | $ | |

| GSK | 2.21% | 37.58 | $ | |

| RELX | 1.03% | 49.32 | $ | |

| BTI | 0.51% | 56.69 | $ | |

| AZN | 1.3% | 74.57 | $ | |

| BP | 0.91% | 34.19 | $ |

Canal+ buyout of S.Africa's MultiChoice one step closer

South Africa's competition authority announced Wednesday it had approved the buyout of Africa's largest pay TV enterprise MultiChoice by France's Canal+, which wants to expand its footprint on the continent.

The merger, which has been in the works for nearly a year, needs the final go-ahead from the commission's Competition Tribunal, it said in a statement.

Canal+ holds around 45 percent of MultiChoice's shares and offered last year to acquire the remainder for 125 rand (6.16 euro) per share.

Canal+ is present in 25 African countries through 16 subsidiaries and has eight million subscribers, according to the French group.

MultiChoice operates in 50 countries across sub-Saharan Africa and has 19.3 million subscribers, it says. It includes Africa's premier sports broadcaster, SuperSport, and the DStv satellite television service.

"This is a major step forward in our ambition to create a global media and entertainment company with Africa at its heart," Canal+ CEO Maxime Saada said in a statement.

The commission said its approval of the merger was subject to public-interest conditions worth about 26 billion rand over three years, including increasing the shareholding of people disadvantaged under South Africa's white-minority apartheid regime.

It will also maintain the MultiChoice headquarters in South Africa.

A date for the Tribunal's decision on the merger has not been announced but Canal+ said it was aiming for the deal to be completed by early October.

F.AbuZaid--SF-PST