-

France's huge wildfire will burn for days: authorities

France's huge wildfire will burn for days: authorities

-

Bolivia right-wing presidential hopeful vows 'radical change'

-

Trump says would meet Putin without Zelensky sit-down

Trump says would meet Putin without Zelensky sit-down

-

Trump offers data to justify firing of labor stats chief

-

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

-

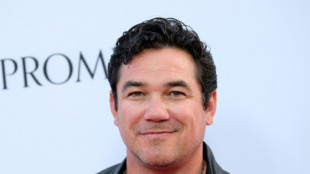

Disney settles Trump-supporting 'Star Wars' actor lawsuit

-

Trump moves to kill $7 billion in solar panel grants

Trump moves to kill $7 billion in solar panel grants

-

Venus Williams falls at first hurdle in Cincinnati

-

Mixed day for global stocks as latest Trump levies take effect

Mixed day for global stocks as latest Trump levies take effect

-

SpaceX agrees to take Italian experiments to Mars

-

US judge orders temporary halt to new 'Alligator Alcatraz' construction

US judge orders temporary halt to new 'Alligator Alcatraz' construction

-

US uses war rhetoric, Superman to recruit for migrant crackdown

-

US to rewrite its past national climate reports

US to rewrite its past national climate reports

-

U can't pay this: MC Hammer sued over delinquent car loan

-

WHO says nearly 100,000 struck with cholera in Sudan

WHO says nearly 100,000 struck with cholera in Sudan

-

Huge wildfire in southern France now under control

-

Kane scores as Bayern thump Spurs in pre-season friendly

Kane scores as Bayern thump Spurs in pre-season friendly

-

France strikes down return of banned bee-killing pesticide

-

Canada sends troops to eastern province as fire damage grows

Canada sends troops to eastern province as fire damage grows

-

OpenAI releases ChatGPT-5 as AI race accelerates

-

Plastic pollution treaty talks deadlocked

Plastic pollution treaty talks deadlocked

-

A French sailor's personal 'Plastic Odyssey'

-

Netanyahu says Israel to control not govern Gaza

Netanyahu says Israel to control not govern Gaza

-

Partey signs for Villarreal while on bail for rape charges

-

Wales have the talent to rise again, says rugby head coach Tandy

Wales have the talent to rise again, says rugby head coach Tandy

-

US partners seek relief as Trump tariffs upend global trade

-

Five England players nominated for women's Ballon d'Or

Five England players nominated for women's Ballon d'Or

-

PSG dominate list of men's Ballon D'Or nominees

-

Americans eating (slightly) less ultra-processed food

Americans eating (slightly) less ultra-processed food

-

Man Utd agree 85m euro deal to sign Sesko: reports

-

France to rule on controversial bee-killing pesticide bill

France to rule on controversial bee-killing pesticide bill

-

Germany factory output falls to lowest since pandemic in 2020

-

Swiss to seek more talks with US as 'horror' tariffs kick in

Swiss to seek more talks with US as 'horror' tariffs kick in

-

Barcelona strip Ter Stegen of captain's armband

-

Trump demands new US census as redistricting war spreads

Trump demands new US census as redistricting war spreads

-

'How much worse could it get?' Gazans fear full occupation

-

France seeks to 'stabilise' wildfire raging in south

France seeks to 'stabilise' wildfire raging in south

-

Ski world champion Venier quits, saying hunger has gone

-

Israel security cabinet to discuss Gaza war plans

Israel security cabinet to discuss Gaza war plans

-

Deadly Indian Himalayan flood likely caused by glacier collapse, experts say

-

UK pensioner, student arrested for backing Palestine Action

UK pensioner, student arrested for backing Palestine Action

-

Israeli security cabinet to discuss future Gaza war plans

-

Antonio to leave West Ham after car crash

Antonio to leave West Ham after car crash

-

Kremlin says Trump-Putin meeting agreed for 'coming days'

-

Bank of England cuts rate as keeps watch over tariffs

Bank of England cuts rate as keeps watch over tariffs

-

Maddison set to miss most of Spurs season after knee injury

-

Plastic pollution treaty talks stuck in 'dialogue of the deaf'

Plastic pollution treaty talks stuck in 'dialogue of the deaf'

-

Stock markets brush aside higher US tariffs

-

Siemens warns US tariffs causing investment caution

Siemens warns US tariffs causing investment caution

-

Influx of Afghan returnees fuels Kabul housing crisis

| SCU | 0% | 12.72 | $ | |

| CMSD | -0.09% | 23.52 | $ | |

| BCC | 0.32% | 83.19 | $ | |

| JRI | 0.52% | 13.41 | $ | |

| SCS | 0.06% | 16 | $ | |

| NGG | -0.31% | 72.08 | $ | |

| RBGPF | 1.42% | 76 | $ | |

| RIO | 1.12% | 60.77 | $ | |

| GSK | 2.21% | 37.58 | $ | |

| CMSC | 0.04% | 22.96 | $ | |

| AZN | 1.3% | 74.57 | $ | |

| BCE | 2.23% | 23.78 | $ | |

| BTI | 0.51% | 56.69 | $ | |

| RYCEF | -0.21% | 14.45 | $ | |

| VOD | -0.36% | 11.26 | $ | |

| RELX | 1.03% | 49.32 | $ | |

| BP | 0.91% | 34.19 | $ |

Equities rebound to track Wall St up as China cuts rates

Most markets rose Tuesday as risk appetite returned following the previous day's US rating-fuelled losses, with sentiment also boosted after China cut interest rates to historic lows.

The rally tracked advances on Wall Street, where the initial selloff sparked by Moody's removal of Washington's triple-A grade soon gave way to a push back into beaten-down equities amid hopes about US trade talks.

After Donald Trump's April 2 tariff blitz sowed global turmoil, the deal between China and the United States last week -- which slashed eye-watering tit-for-tat levies -- has re-energised dealers and pushed most markets back to levels before the US president's "Liberation Day" duties.

Trump suspended his harshest measures for 90 days until mid-July, and while few solid agreements have been reached so far there is optimism that the worst of the crisis has passed.

Traders are also hoping the Federal Reserve will cut interest rates this year, with two reductions expected, according to Bloomberg News.

However, two central bank officials remained cautious about when to resume their monetary easing, amid worries that the tariffs and possible tax cuts will reignite inflation.

New York Fed boss John Williams indicated decision-makers might not be able to move before September, while the central bank's vice chairman Philip Jefferson urged patience, adding that it was crucial to make sure any price increases do not become entrenched.

Hong Kong stocks rose more than one percent, while Shanghai, Tokyo, Sydney, Singapore, Taipei, Bangkok, Wellington and Jakarta were all up.

London, Paris and Frankfurt also opened on the front foot.

However, Neil Wilson at Saxo markets warned that traders were not yet out of the woods as US Treasury yields remain elevated.

"Markets are clearly perturbed by ongoing trade uncertainty, economic policy uncertainty and the potential to lock in sweeping tax cuts in the US, undermining the fiscal position further," he wrote in a commentary.

"The question now is what policy moves can be engineered to tame yields, which could be a worry for equity markets."

The gains came as China's central bank cut two key interest rates as officials battle to kickstart the economy, which faces persistent headwinds from a long-term domestic spending slump, a protracted debt crisis in the property sector and high youth unemployment.

The People's Bank of China lowered its one-year Loan Prime Rate, the benchmark for the most advantageous rates lenders can offer to businesses and households, to 3.0 percent from 3.1 percent.

The five-year LPR, the benchmark for mortgage loans, was cut to 3.5 percent to 3.6 percent.

Both rates were last cut in October to what were then record lows.

"The rate cuts will reduce interest payments on existing loans, taking some pressure off indebted firms. It will also reduce the price of new loans," Zichun Huang, China economist at Capital Economics, said in a note.

However, she added that "modest rate cuts alone are unlikely to meaningfully boost loan demand or wider economic activity".

The "reductions... probably won't be the last this year", she said.

The move came a day after data showed Chinese retail sales came in below expectations in April, highlighting a continued lack of confidence among consumers.

In Hong Kong, Chinese battery giant CATL soared more than 18 percent on its debut, having raised US$4.6 billion in the world's biggest initial public offering this year.

The firm, which produces more than a third of all electric vehicle batteries sold worldwide, saw strong demand even after it was designated as a "Chinese military company" on a US list in January.

The US House Select Committee on the Chinese Communist Party even highlighted this inclusion in letters to two US banks in April, urging them to withdraw from the IPO deal with the "Chinese military-linked company".

But the two banks -- JPMorgan and Bank of America -- are still onboard.

- Key figures at around 0715 GMT -

Tokyo - Nikkei 225: UP 0.1 percent at 37,529.44 (close)

Hong Kong - Hang Seng Index: UP 1.4 percent at 23,658.90

Shanghai - Composite: UP 0.4 percent at 3,380.48 (close)

London - FTSE 100: UP 0.3 percent at 8,720.81

Euro/dollar: UP at $1.1265 from $1.1244 on Monday

Pound/dollar: UP at $1.3379 from $1.3360

Dollar/yen: DOWN at 144.41 yen from 144.87 yen

Euro/pound: UP at 84.20 pence from 84.14 pence

West Texas Intermediate: UP 0.1 percent at $62.72 per barrel

Brent North Sea Crude: DOWN 0.1 percent at $65.57 per barrel

New York - Dow: UP 0.3 percent at 42,792.07 (close)

U.AlSharif--SF-PST