-

France's huge wildfire will burn for days: authorities

France's huge wildfire will burn for days: authorities

-

Bolivia right-wing presidential hopeful vows 'radical change'

-

Trump says would meet Putin without Zelensky sit-down

Trump says would meet Putin without Zelensky sit-down

-

Trump offers data to justify firing of labor stats chief

-

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

-

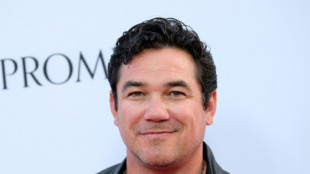

Disney settles Trump-supporting 'Star Wars' actor lawsuit

-

Trump moves to kill $7 billion in solar panel grants

Trump moves to kill $7 billion in solar panel grants

-

Venus Williams falls at first hurdle in Cincinnati

-

Mixed day for global stocks as latest Trump levies take effect

Mixed day for global stocks as latest Trump levies take effect

-

SpaceX agrees to take Italian experiments to Mars

-

US judge orders temporary halt to new 'Alligator Alcatraz' construction

US judge orders temporary halt to new 'Alligator Alcatraz' construction

-

US uses war rhetoric, Superman to recruit for migrant crackdown

-

US to rewrite its past national climate reports

US to rewrite its past national climate reports

-

U can't pay this: MC Hammer sued over delinquent car loan

-

WHO says nearly 100,000 struck with cholera in Sudan

WHO says nearly 100,000 struck with cholera in Sudan

-

Huge wildfire in southern France now under control

-

Kane scores as Bayern thump Spurs in pre-season friendly

Kane scores as Bayern thump Spurs in pre-season friendly

-

France strikes down return of banned bee-killing pesticide

-

Canada sends troops to eastern province as fire damage grows

Canada sends troops to eastern province as fire damage grows

-

OpenAI releases ChatGPT-5 as AI race accelerates

-

Plastic pollution treaty talks deadlocked

Plastic pollution treaty talks deadlocked

-

A French sailor's personal 'Plastic Odyssey'

-

Netanyahu says Israel to control not govern Gaza

Netanyahu says Israel to control not govern Gaza

-

Partey signs for Villarreal while on bail for rape charges

-

Wales have the talent to rise again, says rugby head coach Tandy

Wales have the talent to rise again, says rugby head coach Tandy

-

US partners seek relief as Trump tariffs upend global trade

-

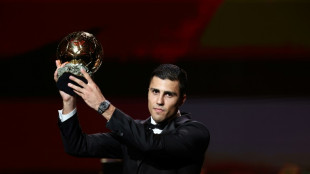

Five England players nominated for women's Ballon d'Or

Five England players nominated for women's Ballon d'Or

-

PSG dominate list of men's Ballon D'Or nominees

-

Americans eating (slightly) less ultra-processed food

Americans eating (slightly) less ultra-processed food

-

Man Utd agree 85m euro deal to sign Sesko: reports

-

France to rule on controversial bee-killing pesticide bill

France to rule on controversial bee-killing pesticide bill

-

Germany factory output falls to lowest since pandemic in 2020

-

Swiss to seek more talks with US as 'horror' tariffs kick in

Swiss to seek more talks with US as 'horror' tariffs kick in

-

Barcelona strip Ter Stegen of captain's armband

-

Trump demands new US census as redistricting war spreads

Trump demands new US census as redistricting war spreads

-

'How much worse could it get?' Gazans fear full occupation

-

France seeks to 'stabilise' wildfire raging in south

France seeks to 'stabilise' wildfire raging in south

-

Ski world champion Venier quits, saying hunger has gone

-

Israel security cabinet to discuss Gaza war plans

Israel security cabinet to discuss Gaza war plans

-

Deadly Indian Himalayan flood likely caused by glacier collapse, experts say

-

UK pensioner, student arrested for backing Palestine Action

UK pensioner, student arrested for backing Palestine Action

-

Israeli security cabinet to discuss future Gaza war plans

-

Antonio to leave West Ham after car crash

Antonio to leave West Ham after car crash

-

Kremlin says Trump-Putin meeting agreed for 'coming days'

-

Bank of England cuts rate as keeps watch over tariffs

Bank of England cuts rate as keeps watch over tariffs

-

Maddison set to miss most of Spurs season after knee injury

-

Plastic pollution treaty talks stuck in 'dialogue of the deaf'

Plastic pollution treaty talks stuck in 'dialogue of the deaf'

-

Stock markets brush aside higher US tariffs

-

Siemens warns US tariffs causing investment caution

Siemens warns US tariffs causing investment caution

-

Influx of Afghan returnees fuels Kabul housing crisis

| SCU | 0% | 12.72 | $ | |

| CMSD | -0.09% | 23.52 | $ | |

| BCC | 0.32% | 83.19 | $ | |

| JRI | 0.52% | 13.41 | $ | |

| SCS | 0.06% | 16 | $ | |

| NGG | -0.31% | 72.08 | $ | |

| RBGPF | 1.42% | 76 | $ | |

| RIO | 1.12% | 60.77 | $ | |

| GSK | 2.21% | 37.58 | $ | |

| CMSC | 0.04% | 22.96 | $ | |

| AZN | 1.3% | 74.57 | $ | |

| BCE | 2.23% | 23.78 | $ | |

| BTI | 0.51% | 56.69 | $ | |

| RYCEF | -0.21% | 14.45 | $ | |

| VOD | -0.36% | 11.26 | $ | |

| RELX | 1.03% | 49.32 | $ | |

| BP | 0.91% | 34.19 | $ |

Stocks, dollar drop after US loses last triple-A credit rating

Stocks fell with the dollar Monday after Moody's removed the United States' last gold standard sovereign bond rating, citing the growing debt pile that it warned could balloon further.

The move dealt a blow to markets, which had enjoyed a healthy run-up last week after Washington and China hammered out a deal to temporarily slash tit-for-tat tariffs.

After the rout sparked by Donald Trump's Liberation Day tariffs bazooka, investors have in recent weeks raced back to buy up beaten-down stocks as the White House tempered its hardball tariff approach.

But selling returned Monday after Moody's cut its rating on US debt to Aa1 from Aaa, noting "the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns".

It added that it expected federal deficits to widen to almost nine percent of economic output by 2035, from 6.4 percent last year, "driven mainly by increased interest payments on debt, rising entitlement spending, and relatively low revenue generation".

Analysts said the cut -- which follows S&P in 2011 and Fitch in 2023 -- could indicate investors will want higher yields on Treasuries, pushing up the cost of government debt. Yields rose on Monday.

Treasury Secretary Scott Bessent dismissed the announcement, saying it was "a lagging indicator" and blaming Trump's predecessor Joe Biden.

"We didn't get here in the past 100 days," he told CNN. "It's the Biden administration and the spending that we have seen over the past four years that we inherited, 6.7 percent deficit-to-GDP, the highest when we weren't in a recession, not in a war."

White House communications director Steven Cheung hit out at Moody's Analytics on X, singling out its chief economist Mark Zandi.

"Nobody takes his 'analysis' seriously. He has been proven wrong time and time again," Cheung posted.

The news added to a frustrating time for the US president after Congress failed to pass his "big, beautiful bill" to extend tax cuts passed in his first term and impose new restrictions on welfare programmes.

Independent congressional analysts say the package would add more than $4.8 trillion to the federal deficit over the coming decade.

The bill came up short in a key vote owing to several Republican fiscal hawks, with congressman French Hill, who chairs the House Financial Services Committee, saying the downgrade "is a strong reminder that our nation's fiscal house is not in order".

However, it cleared a key hurdle Sunday, progressing out of the House Budget Committee after several lawmakers holding up the legislation dropped their opposition, though one, Josh Brecheen, said it "still required tweaking".

Tokyo, Sydney, Seoul, Singapore, Wellington, Mumbai, Bangkok and Taipei all fell, while US futures were also well down.

Equities in Hong Kong pared initial losses and Shanghai was flat despite below-forecast Chinese retail sales figures reinforcing the view that the world's number two economy continues to struggle even after officials unveiled fresh stimulus measures. The reading offset figures showing factory output picked up more than expected.

London, Paris and Frankfurt fell as British and European Union chiefs meet for a landmark summit designed to usher in a closer relationship between the two sides, five years after Brexit.

Ahead of the "reset" summit, diplomats said they had resolved key hurdles to an agreement.

The dollar was also down against its peers and gold recovered some recent losses owing to its safe haven appeal, rising to $3,223 per ounce.

National Australia Bank's Ray Attrill said: "Moody's actions will have zero impact on any investor's ability or willingness to continue holding US Treasuries -- that would likely require downgrades of four or five more notches."

And SPI Asset Management's Stephen Innes said investors would be more interested in upcoming data.

"Moody's may have dropped the mic, but for equity traders, the real test this week will be Main Street," he wrote in a note.

"We're heading into a make-or-break retail earnings slate -- Target, Home Depot, Lowe's, TJX, Ralph Lauren all report -- and this is where tariff theory collides with checkout-line reality.

"Yes, the S&P has clawed back 18 percent since the 'Liberation Day' tariff blitz, but the consumer has been the market's unsung hero. Now they're about to be audited."

- Key figures at around 0810 GMT -

Tokyo - Nikkei 225: DOWN 0.7 percent at 37,498.63 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 23,332.72 (close)

Shanghai - Composite: FLAT at 3,367.58 (close)

London - FTSE 100: DOWN 0.5 percent at 8,642.15

Euro/dollar: UP at $1.1243 from $1.1154 on Friday

Pound/dollar: UP at $1.3367 from $1.3278

Dollar/yen: DOWN at 144.85 yen from 145.92 yen

Euro/pound: UP at 84.08 from 83.97 pence

West Texas Intermediate: DOWN 0.6 percent at $62.11 per barrel

Brent North Sea Crude: DOWN 0.6 percent at $65.00 per barrel

New York - Dow: UP 0.8 percent at 42,654.74 (close)

K.AbuDahab--SF-PST