-

Solid gold, royal missives and Nobel noms: how to win Trump over

Solid gold, royal missives and Nobel noms: how to win Trump over

-

Canadian teen Mboko outlasts Osaka to win WTA Montreal crown

-

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

-

Israeli airline's Paris offices daubed with red paint, slogans

-

US raises bounty on Venezuela's Maduro to $50 mn

US raises bounty on Venezuela's Maduro to $50 mn

-

Lebanon cabinet meets again on Hezbollah disarmament

-

France's huge wildfire will burn for days: authorities

France's huge wildfire will burn for days: authorities

-

Bolivia right-wing presidential hopeful vows 'radical change'

-

Trump says would meet Putin without Zelensky sit-down

Trump says would meet Putin without Zelensky sit-down

-

Trump offers data to justify firing of labor stats chief

-

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

-

Disney settles Trump-supporting 'Star Wars' actor lawsuit

-

Trump moves to kill $7 billion in solar panel grants

Trump moves to kill $7 billion in solar panel grants

-

Venus Williams falls at first hurdle in Cincinnati

-

Mixed day for global stocks as latest Trump levies take effect

Mixed day for global stocks as latest Trump levies take effect

-

SpaceX agrees to take Italian experiments to Mars

-

US judge orders temporary halt to new 'Alligator Alcatraz' construction

US judge orders temporary halt to new 'Alligator Alcatraz' construction

-

US uses war rhetoric, Superman to recruit for migrant crackdown

-

US to rewrite its past national climate reports

US to rewrite its past national climate reports

-

U can't pay this: MC Hammer sued over delinquent car loan

-

WHO says nearly 100,000 struck with cholera in Sudan

WHO says nearly 100,000 struck with cholera in Sudan

-

Huge wildfire in southern France now under control

-

Kane scores as Bayern thump Spurs in pre-season friendly

Kane scores as Bayern thump Spurs in pre-season friendly

-

France strikes down return of banned bee-killing pesticide

-

Canada sends troops to eastern province as fire damage grows

Canada sends troops to eastern province as fire damage grows

-

OpenAI releases ChatGPT-5 as AI race accelerates

-

Plastic pollution treaty talks deadlocked

Plastic pollution treaty talks deadlocked

-

A French sailor's personal 'Plastic Odyssey'

-

Netanyahu says Israel to control not govern Gaza

Netanyahu says Israel to control not govern Gaza

-

Partey signs for Villarreal while on bail for rape charges

-

Wales have the talent to rise again, says rugby head coach Tandy

Wales have the talent to rise again, says rugby head coach Tandy

-

US partners seek relief as Trump tariffs upend global trade

-

Five England players nominated for women's Ballon d'Or

Five England players nominated for women's Ballon d'Or

-

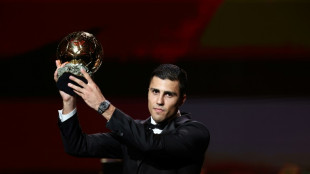

PSG dominate list of men's Ballon D'Or nominees

-

Americans eating (slightly) less ultra-processed food

Americans eating (slightly) less ultra-processed food

-

Man Utd agree 85m euro deal to sign Sesko: reports

-

France to rule on controversial bee-killing pesticide bill

France to rule on controversial bee-killing pesticide bill

-

Germany factory output falls to lowest since pandemic in 2020

-

Swiss to seek more talks with US as 'horror' tariffs kick in

Swiss to seek more talks with US as 'horror' tariffs kick in

-

Barcelona strip Ter Stegen of captain's armband

-

Trump demands new US census as redistricting war spreads

Trump demands new US census as redistricting war spreads

-

'How much worse could it get?' Gazans fear full occupation

-

France seeks to 'stabilise' wildfire raging in south

France seeks to 'stabilise' wildfire raging in south

-

Ski world champion Venier quits, saying hunger has gone

-

Israel security cabinet to discuss Gaza war plans

Israel security cabinet to discuss Gaza war plans

-

Deadly Indian Himalayan flood likely caused by glacier collapse, experts say

-

UK pensioner, student arrested for backing Palestine Action

UK pensioner, student arrested for backing Palestine Action

-

Israeli security cabinet to discuss future Gaza war plans

-

Antonio to leave West Ham after car crash

Antonio to leave West Ham after car crash

-

Kremlin says Trump-Putin meeting agreed for 'coming days'

| RBGPF | 1.42% | 76 | $ | |

| VOD | -0.36% | 11.26 | $ | |

| BTI | 0.51% | 56.69 | $ | |

| CMSC | 0.04% | 22.96 | $ | |

| BP | 0.91% | 34.19 | $ | |

| GSK | 2.21% | 37.58 | $ | |

| SCU | 0% | 12.72 | $ | |

| RYCEF | -0.21% | 14.45 | $ | |

| RIO | 1.12% | 60.77 | $ | |

| RELX | 1.03% | 49.32 | $ | |

| SCS | 0.06% | 16 | $ | |

| NGG | -0.31% | 72.08 | $ | |

| BCC | 0.32% | 83.19 | $ | |

| CMSD | -0.09% | 23.52 | $ | |

| BCE | 2.23% | 23.78 | $ | |

| JRI | 0.52% | 13.41 | $ | |

| AZN | 1.3% | 74.57 | $ |

US Fed chair warns of potential for 'more persistent' supply shocks

Federal Reserve Chair Jerome Powell on Thursday warned of the possibility of "more persistent" supply shocks, as US central bankers met for talks against a backdrop of uncertainty kicked up by Donald Trump's tariff rollout.

The US president's on-again, off-again approach to tariffs has caused a surge in volatility, with sharp movements in both US and global financial markets.

Before a de-escalation this week,steep US tariffs on China and retaliatory measures by Beijing also raised fears of potentially major trade disruptions between the two countries.

"We may be entering a period of more frequent, and potentially more persistent, supply shocks -- a difficult challenge for the economy and for central banks," Powell told his colleagues in Washington.

Powell's remarks acknowledged the post-pandemic supply shock, when temporary supply chain problems caused a surge in inflation that the Fed has previously admitted it was too late to address.

In the speech, which came at the start of the Fed's first public strategy review for five years, Powell said the economic landscape had changed since the last meeting, when interest rates were far lower than they are today.

The Fed's key lending rate currently sits at between 4.25 percent and 4.50 percent as the policymakers look to cool inflation without pushing up unemployment.

"Longer-term interest rates are a good deal higher now, driven largely by real rates given the stability of longer-term inflation expectations," he said, referring to "real," inflation-adjusted interest rates.

The higher rates could also reflect fears of higher volatility going forward, he added.

Powell also said the Fed may reconsider its focus on targeting average inflation over time -- an approach which gives policymakers the leeway to take a longer-term view if inflation deviations from its long-run two percent target for short periods.

But while Fed could tweak its approach to monetary policy, its key long-term inflation target will remain unchanged, Powell told his colleagues.

"Anchored expectations are critical to everything we do, and we remain fully committed to the two percent target today," he said.

Y.Zaher--SF-PST