-

American Shelton tops Khachanov to win first ATP Masters title in Toronto

American Shelton tops Khachanov to win first ATP Masters title in Toronto

-

Tokyo soars on trade deal relief as Asian markets limp into weekend

-

New species teem in Cambodia's threatened karst

New species teem in Cambodia's threatened karst

-

Australian mushroom murderer accused of poisoning husband: police

-

Solid gold, royal missives and Nobel noms: how to win Trump over

Solid gold, royal missives and Nobel noms: how to win Trump over

-

Canadian teen Mboko outlasts Osaka to win WTA Montreal crown

-

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

-

Israeli airline's Paris offices daubed with red paint, slogans

-

US raises bounty on Venezuela's Maduro to $50 mn

US raises bounty on Venezuela's Maduro to $50 mn

-

Lebanon cabinet meets again on Hezbollah disarmament

-

France's huge wildfire will burn for days: authorities

France's huge wildfire will burn for days: authorities

-

Bolivia right-wing presidential hopeful vows 'radical change'

-

Trump says would meet Putin without Zelensky sit-down

Trump says would meet Putin without Zelensky sit-down

-

Trump offers data to justify firing of labor stats chief

-

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

-

Disney settles Trump-supporting 'Star Wars' actor lawsuit

-

Trump moves to kill $7 billion in solar panel grants

Trump moves to kill $7 billion in solar panel grants

-

Venus Williams falls at first hurdle in Cincinnati

-

Mixed day for global stocks as latest Trump levies take effect

Mixed day for global stocks as latest Trump levies take effect

-

SpaceX agrees to take Italian experiments to Mars

-

US judge orders temporary halt to new 'Alligator Alcatraz' construction

US judge orders temporary halt to new 'Alligator Alcatraz' construction

-

US uses war rhetoric, Superman to recruit for migrant crackdown

-

US to rewrite its past national climate reports

US to rewrite its past national climate reports

-

U can't pay this: MC Hammer sued over delinquent car loan

-

WHO says nearly 100,000 struck with cholera in Sudan

WHO says nearly 100,000 struck with cholera in Sudan

-

Huge wildfire in southern France now under control

-

Kane scores as Bayern thump Spurs in pre-season friendly

Kane scores as Bayern thump Spurs in pre-season friendly

-

France strikes down return of banned bee-killing pesticide

-

Canada sends troops to eastern province as fire damage grows

Canada sends troops to eastern province as fire damage grows

-

OpenAI releases ChatGPT-5 as AI race accelerates

-

Plastic pollution treaty talks deadlocked

Plastic pollution treaty talks deadlocked

-

A French sailor's personal 'Plastic Odyssey'

-

Netanyahu says Israel to control not govern Gaza

Netanyahu says Israel to control not govern Gaza

-

Partey signs for Villarreal while on bail for rape charges

-

Wales have the talent to rise again, says rugby head coach Tandy

Wales have the talent to rise again, says rugby head coach Tandy

-

US partners seek relief as Trump tariffs upend global trade

-

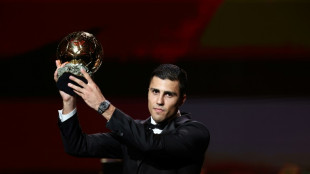

Five England players nominated for women's Ballon d'Or

Five England players nominated for women's Ballon d'Or

-

PSG dominate list of men's Ballon D'Or nominees

-

Americans eating (slightly) less ultra-processed food

Americans eating (slightly) less ultra-processed food

-

Man Utd agree 85m euro deal to sign Sesko: reports

-

France to rule on controversial bee-killing pesticide bill

France to rule on controversial bee-killing pesticide bill

-

Germany factory output falls to lowest since pandemic in 2020

-

Swiss to seek more talks with US as 'horror' tariffs kick in

Swiss to seek more talks with US as 'horror' tariffs kick in

-

Barcelona strip Ter Stegen of captain's armband

-

Trump demands new US census as redistricting war spreads

Trump demands new US census as redistricting war spreads

-

'How much worse could it get?' Gazans fear full occupation

-

France seeks to 'stabilise' wildfire raging in south

France seeks to 'stabilise' wildfire raging in south

-

Ski world champion Venier quits, saying hunger has gone

-

Israel security cabinet to discuss Gaza war plans

Israel security cabinet to discuss Gaza war plans

-

Deadly Indian Himalayan flood likely caused by glacier collapse, experts say

| RBGPF | -5.79% | 71.84 | $ | |

| RYCEF | -0.42% | 14.44 | $ | |

| VOD | -0.36% | 11.26 | $ | |

| CMSC | 0.04% | 22.96 | $ | |

| BCC | 0.32% | 83.19 | $ | |

| SCS | 0.06% | 16 | $ | |

| RELX | 1.03% | 49.32 | $ | |

| NGG | -0.31% | 72.08 | $ | |

| SCU | 0% | 12.72 | $ | |

| RIO | 1.12% | 60.77 | $ | |

| BCE | 2.23% | 23.78 | $ | |

| CMSD | -0.09% | 23.52 | $ | |

| AZN | 1.3% | 74.57 | $ | |

| GSK | 2.21% | 37.58 | $ | |

| JRI | 0.52% | 13.41 | $ | |

| BTI | 0.51% | 56.69 | $ | |

| BP | 0.91% | 34.19 | $ |

China's Alibaba posts annual revenue increase despite spending slump

Internet giant Alibaba posted on Thursday a six percent increase in annual revenue, the latest positive sign for China's tech sector despite persisting economic uncertainties that include sluggish spending and threatened trade.

The Hangzhou-based company is one of the biggest players in China's tech industry, with operations spanning retail, digital payment, artificial intelligence and entertainment.

This year has seen its share price rollercoaster on a wave of investor enthusiasm about Chinese AI capabilities that began in January, followed by a steep drop last month triggered by US President Donald Trump's global tariff blitz.

The firm's revenue during the fiscal year ended March 31 totalled 996.3 billion yuan ($138.2 billion), according to results posted to the Hong Kong Stock Exchange, up six percent from the previous 12-month period.

Net income attributable to ordinary shareholders rose to 129.5 billion yuan, the statement showed, a jump of 62 percent year-on-year according to AFP calculations.

In the final quarter alone, Alibaba saw revenue of 236.5 billion yuan, narrowly coming up short of a Bloomberg forecast.

Net income attributable to ordinary shareholders during the quarter reached 12.4 billion yuan, surging 279 percent from the low base of 3.3 billion yuan recorded during the same period last year.

"Our results this quarter and for the full fiscal year demonstrate the ongoing effectiveness of our 'user first, AI-driven' strategy, with core business growth continuing to accelerate," CEO Eddie Wu said in a statement.

The growth is another positive sign for China's tech sector, which has garnered revamped interest from investors since the shock release in January of advanced AI chatbot DeepSeek -- apparently developed at a fraction of the cost thought necessary.

Alibaba and fellow tech giants Tencent and Baidu are now funnelling large sums into a new race to develop and integrate the most cutting-edge AI applications.

- Spending slump -

As the Chinese economy strains under sluggish spending and a tumultuous trade relationship with the United States, Beijing is increasingly looking to platforms operated by domestic internet giants as a cushion for employment and consumption.

Prospects improved Monday when Beijing and Washington announced plans to significantly scale back sky-high tariffs that had severely threatened trade between the two nations.

However, economists say that the Chinese economy may still struggle to achieve the official growth target set by leaders of around five percent this year.

Alibaba's announcement on Thursday came after Tencent and e-commerce giant JD.com posted moderate increases in first-quarter revenue earlier this week, indicating a possible rebound in spending.

But official figures released on Saturday showed that consumer prices remained mired in a slump last month, reflecting continued deflationary pressure.

Alibaba was once a key subject of the aggressive regulatory crackdown launched in late 2020 on the domestic tech sector, attributed to worries in Beijing that top firms had become too powerful.

Jack Ma, the firm's charismatic co-founder who had spoken boldly about the shortcomings of China's financial and regulatory system, kept a low profile during the lengthy campaign.

He reappeared in February during a meeting with President Xi Jinping and other business luminaries -- a shock development that suggested a warmer stance from Beijing and sent Alibaba stocks soaring.

Ma is no longer an executive at Alibaba but is believed to retain a significant shareholding in the company.

W.Mansour--SF-PST