-

American Shelton tops Khachanov to win first ATP Masters title in Toronto

American Shelton tops Khachanov to win first ATP Masters title in Toronto

-

Tokyo soars on trade deal relief as Asian markets limp into weekend

-

New species teem in Cambodia's threatened karst

New species teem in Cambodia's threatened karst

-

Australian mushroom murderer accused of poisoning husband: police

-

Solid gold, royal missives and Nobel noms: how to win Trump over

Solid gold, royal missives and Nobel noms: how to win Trump over

-

Canadian teen Mboko outlasts Osaka to win WTA Montreal crown

-

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

-

Israeli airline's Paris offices daubed with red paint, slogans

-

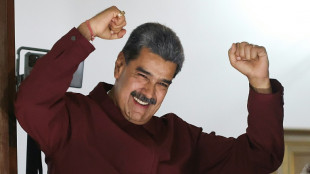

US raises bounty on Venezuela's Maduro to $50 mn

US raises bounty on Venezuela's Maduro to $50 mn

-

Lebanon cabinet meets again on Hezbollah disarmament

-

France's huge wildfire will burn for days: authorities

France's huge wildfire will burn for days: authorities

-

Bolivia right-wing presidential hopeful vows 'radical change'

-

Trump says would meet Putin without Zelensky sit-down

Trump says would meet Putin without Zelensky sit-down

-

Trump offers data to justify firing of labor stats chief

-

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

-

Disney settles Trump-supporting 'Star Wars' actor lawsuit

-

Trump moves to kill $7 billion in solar panel grants

Trump moves to kill $7 billion in solar panel grants

-

Venus Williams falls at first hurdle in Cincinnati

-

Mixed day for global stocks as latest Trump levies take effect

Mixed day for global stocks as latest Trump levies take effect

-

SpaceX agrees to take Italian experiments to Mars

-

US judge orders temporary halt to new 'Alligator Alcatraz' construction

US judge orders temporary halt to new 'Alligator Alcatraz' construction

-

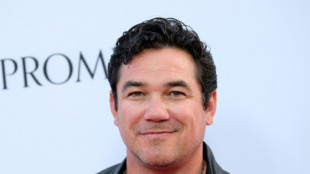

US uses war rhetoric, Superman to recruit for migrant crackdown

-

US to rewrite its past national climate reports

US to rewrite its past national climate reports

-

U can't pay this: MC Hammer sued over delinquent car loan

-

WHO says nearly 100,000 struck with cholera in Sudan

WHO says nearly 100,000 struck with cholera in Sudan

-

Huge wildfire in southern France now under control

-

Kane scores as Bayern thump Spurs in pre-season friendly

Kane scores as Bayern thump Spurs in pre-season friendly

-

France strikes down return of banned bee-killing pesticide

-

Canada sends troops to eastern province as fire damage grows

Canada sends troops to eastern province as fire damage grows

-

OpenAI releases ChatGPT-5 as AI race accelerates

-

Plastic pollution treaty talks deadlocked

Plastic pollution treaty talks deadlocked

-

A French sailor's personal 'Plastic Odyssey'

-

Netanyahu says Israel to control not govern Gaza

Netanyahu says Israel to control not govern Gaza

-

Partey signs for Villarreal while on bail for rape charges

-

Wales have the talent to rise again, says rugby head coach Tandy

Wales have the talent to rise again, says rugby head coach Tandy

-

US partners seek relief as Trump tariffs upend global trade

-

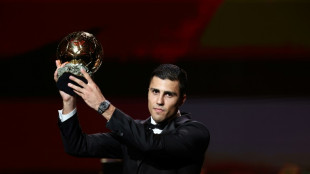

Five England players nominated for women's Ballon d'Or

Five England players nominated for women's Ballon d'Or

-

PSG dominate list of men's Ballon D'Or nominees

-

Americans eating (slightly) less ultra-processed food

Americans eating (slightly) less ultra-processed food

-

Man Utd agree 85m euro deal to sign Sesko: reports

-

France to rule on controversial bee-killing pesticide bill

France to rule on controversial bee-killing pesticide bill

-

Germany factory output falls to lowest since pandemic in 2020

-

Swiss to seek more talks with US as 'horror' tariffs kick in

Swiss to seek more talks with US as 'horror' tariffs kick in

-

Barcelona strip Ter Stegen of captain's armband

-

Trump demands new US census as redistricting war spreads

Trump demands new US census as redistricting war spreads

-

'How much worse could it get?' Gazans fear full occupation

-

France seeks to 'stabilise' wildfire raging in south

France seeks to 'stabilise' wildfire raging in south

-

Ski world champion Venier quits, saying hunger has gone

-

Israel security cabinet to discuss Gaza war plans

Israel security cabinet to discuss Gaza war plans

-

Deadly Indian Himalayan flood likely caused by glacier collapse, experts say

| RBGPF | -5.79% | 71.84 | $ | |

| RYCEF | -0.42% | 14.44 | $ | |

| VOD | -0.36% | 11.26 | $ | |

| CMSC | 0.04% | 22.96 | $ | |

| BCC | 0.32% | 83.19 | $ | |

| SCS | 0.06% | 16 | $ | |

| RELX | 1.03% | 49.32 | $ | |

| NGG | -0.31% | 72.08 | $ | |

| SCU | 0% | 12.72 | $ | |

| RIO | 1.12% | 60.77 | $ | |

| BCE | 2.23% | 23.78 | $ | |

| CMSD | -0.09% | 23.52 | $ | |

| AZN | 1.3% | 74.57 | $ | |

| GSK | 2.21% | 37.58 | $ | |

| JRI | 0.52% | 13.41 | $ | |

| BTI | 0.51% | 56.69 | $ | |

| BP | 0.91% | 34.19 | $ |

Stocks drop as fresh trade news awaited, oil down on Iran hopes

Equities stuttered Thursday as investors await fresh developments in trade talks, with US partners looking to reach deals to avoid Donald Trump's tariff blitz, while oil extended losses on hopes for an Iran nuclear deal.

With excitement from the China-US detente running out of legs, the search is on for fresh catalysts to drive a rally that has pushed markets back above the levels seen before US President Trump's April 2 "Liberation Day" bombshell.

News that Beijing was suspending some non-tariff countermeasures on US entities for 90 days following the superpowers' weekend truce did little to inject much more enthusiasm.

With the tariffs crisis calmed for now, dealers can turn their attention to hard economic data, hoping for an idea about the initial impact of Washington's trade policies.

After figures Tuesday showing US inflation came in a little below forecasts in April, eyes are on wholesale prices and retail sales due later Thursday, as well as earnings from retail giant Walmart.

However, analysts pointed out that the real impact would not be seen until May's figures are released and warned that there were still plenty of bumps in the road ahead.

"The trade truce may hold for now, but the tariffs announced -- many still around 30 percent -- are not disappearing," said Charu Chanana, chief investment strategist at Saxo.

"These are 'sticky' policies that can reshape supply chains, corporate margins, and even inflation. In fact, the market is now preparing for a second shock: weaker economic and earnings data in the third quarter as tariffs bite."

She added that "the muted market reaction the day after the truce suggests investors may be digesting the idea that 'the best news may already be out'".

While Wall Street enjoyed a broadly positive day, with the S&P and Nasdaq up but the Dow down, Asia largely reversed.

Tokyo, Hong Kong, Shanghai, Sydney, Seoul, Wellington, Taipei and Manila were all down.

Oil prices sank around two percent on signs that Iran could agree to certain US demands to reach a nuclear deal.

An adviser to supreme leader Ayatollah Ali Khamenei said Wednesday that Tehran could accept far-reaching curbs on its atomic programme in exchange for sanctions relief, according to NBC News.

Ali Shamkhani said in an interview that his country could agree to never develop nuclear weapons, give up stockpiles of highly enriched uranium and allow inspectors to nuclear sites -- among other steps -- if economic sanctions were lifted, NBC said.

The commodity had already dropped Wednesday on bets that demand would increase as tensions between China and the United States ease and the tariffs are wound back.

- Key figures at around 0200 GMT -

Tokyo - Nikkei 225: DOWN 1.2 percent at 37,670.38

Hong Kong - Hang Seng Index: DOWN 0.5 percent at 23,518.02

Shanghai - Composite: DOWN 0.2 percent at 3,397.09

Euro/dollar: UP at $1.1198 from $1.1178 on Wednesday

Pound/dollar: UP at $1.3281 from $1.3268

Dollar/yen: DOWN at 146.19 yen from 146.65 yen

Euro/pound: UP at 84.31 pence from 84.21 pence

West Texas Intermediate: DOWN 2.0 percent at $61.88 per barrel

Brent North Sea Crude: DOWN 1.9 percent at $64.89 per barrel

New York - Dow: DOWN 0.2 percent at 42,051.06 (close)

London - FTSE 100: DOWN 0.2 percent at 8,585.01 (close)

T.Samara--SF-PST