-

Australian A-League side Western United stripped of licence

Australian A-League side Western United stripped of licence

-

'Back home': family who fled front buried after Kyiv strike

-

Indonesia cracks down on pirate protest flag

Indonesia cracks down on pirate protest flag

-

Israeli army will 'take control' of Gaza City: PM's office

-

Australian mushroom murderer accused of poisoning husband

Australian mushroom murderer accused of poisoning husband

-

Coventry's mettle tested by Russian Olympic debate, say former IOC figures

-

Library user borrows rare Chinese artwork, returns fakes: US officials

Library user borrows rare Chinese artwork, returns fakes: US officials

-

Parisians hot under the collar over A/C in apartments

-

Crypto group reportedly says it planned sex toy tosses at WNBA games

Crypto group reportedly says it planned sex toy tosses at WNBA games

-

American Shelton tops Khachanov to win first ATP Masters title in Toronto

-

Tokyo soars on trade deal relief as Asian markets limp into weekend

Tokyo soars on trade deal relief as Asian markets limp into weekend

-

New species teem in Cambodia's threatened karst

-

Australian mushroom murderer accused of poisoning husband: police

Australian mushroom murderer accused of poisoning husband: police

-

Solid gold, royal missives and Nobel noms: how to win Trump over

-

Canadian teen Mboko outlasts Osaka to win WTA Montreal crown

Canadian teen Mboko outlasts Osaka to win WTA Montreal crown

-

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

-

Israeli airline's Paris offices daubed with red paint, slogans

Israeli airline's Paris offices daubed with red paint, slogans

-

US raises bounty on Venezuela's Maduro to $50 mn

-

Lebanon cabinet meets again on Hezbollah disarmament

Lebanon cabinet meets again on Hezbollah disarmament

-

France's huge wildfire will burn for days: authorities

-

Bolivia right-wing presidential hopeful vows 'radical change'

Bolivia right-wing presidential hopeful vows 'radical change'

-

Trump says would meet Putin without Zelensky sit-down

-

Trump offers data to justify firing of labor stats chief

Trump offers data to justify firing of labor stats chief

-

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

-

Disney settles Trump-supporting 'Star Wars' actor lawsuit

Disney settles Trump-supporting 'Star Wars' actor lawsuit

-

Trump moves to kill $7 billion in solar panel grants

-

Venus Williams falls at first hurdle in Cincinnati

Venus Williams falls at first hurdle in Cincinnati

-

Mixed day for global stocks as latest Trump levies take effect

-

SpaceX agrees to take Italian experiments to Mars

SpaceX agrees to take Italian experiments to Mars

-

US judge orders temporary halt to new 'Alligator Alcatraz' construction

-

US uses war rhetoric, Superman to recruit for migrant crackdown

US uses war rhetoric, Superman to recruit for migrant crackdown

-

US to rewrite its past national climate reports

-

U can't pay this: MC Hammer sued over delinquent car loan

U can't pay this: MC Hammer sued over delinquent car loan

-

WHO says nearly 100,000 struck with cholera in Sudan

-

Huge wildfire in southern France now under control

Huge wildfire in southern France now under control

-

Kane scores as Bayern thump Spurs in pre-season friendly

-

France strikes down return of banned bee-killing pesticide

France strikes down return of banned bee-killing pesticide

-

Canada sends troops to eastern province as fire damage grows

-

OpenAI releases ChatGPT-5 as AI race accelerates

OpenAI releases ChatGPT-5 as AI race accelerates

-

Plastic pollution treaty talks deadlocked

-

A French sailor's personal 'Plastic Odyssey'

A French sailor's personal 'Plastic Odyssey'

-

Netanyahu says Israel to control not govern Gaza

-

Partey signs for Villarreal while on bail for rape charges

Partey signs for Villarreal while on bail for rape charges

-

Wales have the talent to rise again, says rugby head coach Tandy

-

US partners seek relief as Trump tariffs upend global trade

US partners seek relief as Trump tariffs upend global trade

-

Five England players nominated for women's Ballon d'Or

-

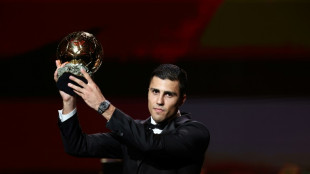

PSG dominate list of men's Ballon D'Or nominees

PSG dominate list of men's Ballon D'Or nominees

-

Americans eating (slightly) less ultra-processed food

-

Man Utd agree 85m euro deal to sign Sesko: reports

Man Utd agree 85m euro deal to sign Sesko: reports

-

France to rule on controversial bee-killing pesticide bill

| RBGPF | -5.79% | 71.84 | $ | |

| RYCEF | -0.42% | 14.44 | $ | |

| BTI | 0.51% | 56.69 | $ | |

| CMSC | 0.04% | 22.96 | $ | |

| CMSD | -0.09% | 23.52 | $ | |

| BCC | 0.32% | 83.19 | $ | |

| RIO | 1.12% | 60.77 | $ | |

| SCS | 0.06% | 16 | $ | |

| NGG | -0.31% | 72.08 | $ | |

| SCU | 0% | 12.72 | $ | |

| RELX | 1.03% | 49.32 | $ | |

| VOD | -0.36% | 11.26 | $ | |

| JRI | 0.52% | 13.41 | $ | |

| BP | 0.91% | 34.19 | $ | |

| GSK | 2.21% | 37.58 | $ | |

| BCE | 2.23% | 23.78 | $ | |

| AZN | 1.3% | 74.57 | $ |

Protection racket? Asian semiconductor giants fear looming tariffs

Inside one of South Korea's oldest semiconductor research institutes, the cleanrooms and workshops are calm and immaculate, but outside the Seoul National University campus, a chip storm is brewing.

Last month, Washington announced a national security probe into imports of semiconductor technology, which could put the industry in the crosshairs of President Donald Trump's trade bazooka and inflict potentially devastating levies.

For chipmaking powerhouses South Korea and Taiwan, the consequences could be enormous.

South Korea is home to Samsung Electronics and SK hynix, while Taiwan hosts the world's largest contract chipmaker, TSMC. Collectively, they produce a significant chunk of high-end chips that have become the lifeblood of the global economy, powering everything from smartphones to missiles.

Taiwan exported $7.4 billion worth of semiconductors to the United States in 2024, while South Korea's exports surged to $10.7 billion, a historic high.

Experts say the spectre of looming tariffs has spurred stockpiling, with fears levies will drive up consumer prices and hurt chipmakers.

The clear intention of Trump's policies is to force the Asian chip giants to relocate production stateside, a former engineer at Taiwanese chip firm MediaTek told AFP.

"TSMC going overseas to the US to build fabs is like paying protection money," they said, adding that the projects barely made a profit with margins "super low" in high-cost America.

"From the American point of view, it's logical to sacrifice the rest of the world for its own interests, only that we happen to be the ones being sacrificed," the engineer said.

- A 'heavy blow' -

The US president's tolls could be "quite complex", Kim Yang-paeng, senior researcher at Korea Institute for Industrial Economics and Trade (KIET), told AFP.

Rather than hitting the industry with a blanket levy, the United States could target different products such as HBM, which is essential for high-speed computing, and DRAM, which is used for memory.

Any significant tariffs on the sector, which relies on complex manufacturing chains to produce high-end tech products, would be a "heavy blow", the MediaTek engineer said.

Samsung, the world's largest memory chipmaker, and leading memory chip supplier SK hynix rely heavily on indirect exports to the United States via China, Taiwan and Vietnam.

For example, Samsung produces television panels in South Korea, which are then assembled into finished televisions in Vietnam before being shipped to the United States.

For these companies, there is "concern about a decline in demand due to rising prices in other sectors using semiconductors", said Jung Jae-wook, professor at Sogang University.

Meanwhile, Seoul and Washington are negotiating a "trade package" aimed at preventing new US tariffs before the July 8 expiration of Trump's pause in his "reciprocal" levies.

- Few alternatives -

US Trade Representative Jamieson Greer is expected to visit South Korea for the APEC trade ministers' meeting this week.

Experts say that in the short term, chips like HBM are less likely to be impacted by tariff wars owing to strong demand driven by artificial intelligence.

And unlike many other sectors such as the auto industry -- which is already hit by tariffs -- "semiconductors have no substitutes from the US perspective", said Kim Dae-jong, a professor at Sejong University.

It is also not feasible to shift chip production entirely stateside, given America's limited capacity, so any measures "are unlikely to be sustained in the long run", said Sogang University's Jung.

"There are not many alternative countries (the United States) can rely on for imports, making price increases inevitable if tariffs are imposed," he said.

While Washington is eager to bolster domestic production, South Korea and Taiwan are keenly aware of the strategic significance of the industry and are not likely to give up capacity.

For Taiwan, semiconductors are a matter of national security, said Kim from KIET.

"Taiwan may expand its manufacturing presence in the United States, but significant changes to its domestic semiconductor ecosystem are unlikely."

Back at the Seoul National University semiconductor institute, its director, Lee Hyuk-jae -- who is also an outside director for Samsung -- spends his days urging the government to invest more in the sector, which he says "holds great importance" for the country.

F.Qawasmeh--SF-PST