-

Israel to 'take control' of Gaza City after approving new war plan

Israel to 'take control' of Gaza City after approving new war plan

-

Australian A-League side Western United stripped of licence

-

'Back home': family who fled front buried after Kyiv strike

'Back home': family who fled front buried after Kyiv strike

-

Indonesia cracks down on pirate protest flag

-

Israeli army will 'take control' of Gaza City: PM's office

Israeli army will 'take control' of Gaza City: PM's office

-

Australian mushroom murderer accused of poisoning husband

-

Coventry's mettle tested by Russian Olympic debate, say former IOC figures

Coventry's mettle tested by Russian Olympic debate, say former IOC figures

-

Library user borrows rare Chinese artwork, returns fakes: US officials

-

Parisians hot under the collar over A/C in apartments

Parisians hot under the collar over A/C in apartments

-

Crypto group reportedly says it planned sex toy tosses at WNBA games

-

American Shelton tops Khachanov to win first ATP Masters title in Toronto

American Shelton tops Khachanov to win first ATP Masters title in Toronto

-

Tokyo soars on trade deal relief as Asian markets limp into weekend

-

New species teem in Cambodia's threatened karst

New species teem in Cambodia's threatened karst

-

Australian mushroom murderer accused of poisoning husband: police

-

Solid gold, royal missives and Nobel noms: how to win Trump over

Solid gold, royal missives and Nobel noms: how to win Trump over

-

Canadian teen Mboko outlasts Osaka to win WTA Montreal crown

-

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

-

Israeli airline's Paris offices daubed with red paint, slogans

-

US raises bounty on Venezuela's Maduro to $50 mn

US raises bounty on Venezuela's Maduro to $50 mn

-

Lebanon cabinet meets again on Hezbollah disarmament

-

France's huge wildfire will burn for days: authorities

France's huge wildfire will burn for days: authorities

-

Bolivia right-wing presidential hopeful vows 'radical change'

-

Trump says would meet Putin without Zelensky sit-down

Trump says would meet Putin without Zelensky sit-down

-

Trump offers data to justify firing of labor stats chief

-

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

-

Disney settles Trump-supporting 'Star Wars' actor lawsuit

-

Trump moves to kill $7 billion in solar panel grants

Trump moves to kill $7 billion in solar panel grants

-

Venus Williams falls at first hurdle in Cincinnati

-

Mixed day for global stocks as latest Trump levies take effect

Mixed day for global stocks as latest Trump levies take effect

-

SpaceX agrees to take Italian experiments to Mars

-

US judge orders temporary halt to new 'Alligator Alcatraz' construction

US judge orders temporary halt to new 'Alligator Alcatraz' construction

-

US uses war rhetoric, Superman to recruit for migrant crackdown

-

US to rewrite its past national climate reports

US to rewrite its past national climate reports

-

U can't pay this: MC Hammer sued over delinquent car loan

-

WHO says nearly 100,000 struck with cholera in Sudan

WHO says nearly 100,000 struck with cholera in Sudan

-

Huge wildfire in southern France now under control

-

Kane scores as Bayern thump Spurs in pre-season friendly

Kane scores as Bayern thump Spurs in pre-season friendly

-

France strikes down return of banned bee-killing pesticide

-

Canada sends troops to eastern province as fire damage grows

Canada sends troops to eastern province as fire damage grows

-

OpenAI releases ChatGPT-5 as AI race accelerates

-

Plastic pollution treaty talks deadlocked

Plastic pollution treaty talks deadlocked

-

A French sailor's personal 'Plastic Odyssey'

-

Netanyahu says Israel to control not govern Gaza

Netanyahu says Israel to control not govern Gaza

-

Partey signs for Villarreal while on bail for rape charges

-

Wales have the talent to rise again, says rugby head coach Tandy

Wales have the talent to rise again, says rugby head coach Tandy

-

US partners seek relief as Trump tariffs upend global trade

-

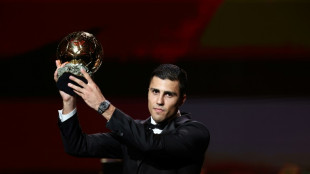

Five England players nominated for women's Ballon d'Or

Five England players nominated for women's Ballon d'Or

-

PSG dominate list of men's Ballon D'Or nominees

-

Americans eating (slightly) less ultra-processed food

Americans eating (slightly) less ultra-processed food

-

Man Utd agree 85m euro deal to sign Sesko: reports

| RBGPF | -5.79% | 71.84 | $ | |

| RYCEF | -0.42% | 14.44 | $ | |

| CMSC | 0.04% | 22.96 | $ | |

| CMSD | -0.09% | 23.52 | $ | |

| NGG | -0.31% | 72.08 | $ | |

| RIO | 1.12% | 60.77 | $ | |

| GSK | 2.21% | 37.58 | $ | |

| SCS | 0.06% | 16 | $ | |

| BCC | 0.32% | 83.19 | $ | |

| SCU | 0% | 12.72 | $ | |

| BCE | 2.23% | 23.78 | $ | |

| VOD | -0.36% | 11.26 | $ | |

| RELX | 1.03% | 49.32 | $ | |

| JRI | 0.52% | 13.41 | $ | |

| AZN | 1.3% | 74.57 | $ | |

| BTI | 0.51% | 56.69 | $ | |

| BP | 0.91% | 34.19 | $ |

Markets rally after China and US slash tariffs for 90 days

Stocks rallied Monday after Chinese and US officials held "substantial" trade talks and slashed their tit-for-tat tariffs for 90 days, fuelling hopes the two sides will pull back from a standoff that has rattled global markets.

Investors have been on a rollercoaster ride since Donald Trump unveiled eye-watering tolls on trading partners on April 2, with the heftiest saved for Beijing, raising concerns of a trade war between the economic superpowers.

The US president eventually hiked the measures against China to 145 percent, which were met with retaliatory rates of 125 percent.

However, there have been signs of an easing of tensions and after two days of highly anticipated negotiations in Geneva, the two countries hailed progress towards ending a crisis that fuelled fears of a global recession.

On Monday the two said they would slash their levies to cool tensions and give officials time to resolve their differences.

In a joint statement the US side said it would reduce tolls to 30 percent while Chinese tariffs would be cut to 10 percent.

That came after US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer met Chinese Vice Premier He Lifeng and international trade representative Li Chenggang in the first known talks since Trump's "Liberation Day" announcement.

"We've made substantial progress between the United States and China in the very important trade talks," Bessent told reporters, while the White House has hailed what it called a new "trade deal".

China's He said the atmosphere in the talks was "candid, in-depth and constructive", adding that they were "an important first step".

Asian markets jumped, with Hong Kong up more than three percent while Shanghai also enjoyed healthy buying interest.

Tokyo, Sydney, Seoul, Taipei and Wellington were all in the green.

London, Paris and Frankfurt all rose more than one percent.

US futures surged more than one percent.

Mumbai jumped more than three percent after India and Pakistan agreed a ceasefire at the weekend following four days of missile, drone and artillery attacks between the two countries which killed at least 60 people and sent thousands fleeing.

Pakistan's stock exchange rocketed more than nine percent.

Oil prices jumped more than three percent owing to speculation easing China-US tensions would help demand. The dollar also advanced one percent against the euro and yen.

Gold, which rallied last month over a rush to safe havens, extended losses.

"The initial reaction to the weekend US-China talks (is) predictably encouraging," said Chris Weston at Pepperstone.

However, Karsten Junius at Bank J. Safra Sarasin was cautious.

"We expect financial markets to remain volatile over the coming months, as they have almost fully priced out negative economic surprises and could once again be disrupted by more serious obstacles in trade negotiations," he said in a commentary.

"In all likelihood, things may still get worse before they get better."

Investors are also awaiting the release this week of data on US inflation and retail sales, which will provide a fresh snapshot of the world's biggest economy since the tariffs were first unveiled.

- Key figures at around 0715 GMT -

Tokyo - Nikkei 225: UP 0.4 percent at 37,644.26 (close)

Hong Kong - Hang Seng Index: UP 3.3 percent at 23,630.68

Shanghai - Composite: UP 0.8 percent at 3,369.24 (close)

London - FTSE 100: UP 1.1 percent at 8,645.25

Euro/dollar: DOWN at $1.1104 from $1.1257 on Friday

Pound/dollar: DOWN at $1.3289 from $1.3308

Dollar/yen: UP at 147.89 yen from 145.31 yen

Euro/pound: DOWN at 84.44 pence from 84.57 pence

West Texas Intermediate: UP 3.6 percent at $63.24 per barrel

Brent North Sea Crude: UP 3.4 percent at $66.11 per barrel

New York - Dow: DOWN 0.3 percent at 41,249.38 (close)

H.Jarrar--SF-PST