-

Israel to 'take control' of Gaza City after approving new war plan

Israel to 'take control' of Gaza City after approving new war plan

-

Australian A-League side Western United stripped of licence

-

'Back home': family who fled front buried after Kyiv strike

'Back home': family who fled front buried after Kyiv strike

-

Indonesia cracks down on pirate protest flag

-

Israeli army will 'take control' of Gaza City: PM's office

Israeli army will 'take control' of Gaza City: PM's office

-

Australian mushroom murderer accused of poisoning husband

-

Coventry's mettle tested by Russian Olympic debate, say former IOC figures

Coventry's mettle tested by Russian Olympic debate, say former IOC figures

-

Library user borrows rare Chinese artwork, returns fakes: US officials

-

Parisians hot under the collar over A/C in apartments

Parisians hot under the collar over A/C in apartments

-

Crypto group reportedly says it planned sex toy tosses at WNBA games

-

American Shelton tops Khachanov to win first ATP Masters title in Toronto

American Shelton tops Khachanov to win first ATP Masters title in Toronto

-

Tokyo soars on trade deal relief as Asian markets limp into weekend

-

New species teem in Cambodia's threatened karst

New species teem in Cambodia's threatened karst

-

Australian mushroom murderer accused of poisoning husband: police

-

Solid gold, royal missives and Nobel noms: how to win Trump over

Solid gold, royal missives and Nobel noms: how to win Trump over

-

Canadian teen Mboko outlasts Osaka to win WTA Montreal crown

-

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

-

Israeli airline's Paris offices daubed with red paint, slogans

-

US raises bounty on Venezuela's Maduro to $50 mn

US raises bounty on Venezuela's Maduro to $50 mn

-

Lebanon cabinet meets again on Hezbollah disarmament

-

France's huge wildfire will burn for days: authorities

France's huge wildfire will burn for days: authorities

-

Bolivia right-wing presidential hopeful vows 'radical change'

-

Trump says would meet Putin without Zelensky sit-down

Trump says would meet Putin without Zelensky sit-down

-

Trump offers data to justify firing of labor stats chief

-

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

-

Disney settles Trump-supporting 'Star Wars' actor lawsuit

-

Trump moves to kill $7 billion in solar panel grants

Trump moves to kill $7 billion in solar panel grants

-

Venus Williams falls at first hurdle in Cincinnati

-

Mixed day for global stocks as latest Trump levies take effect

Mixed day for global stocks as latest Trump levies take effect

-

SpaceX agrees to take Italian experiments to Mars

-

US judge orders temporary halt to new 'Alligator Alcatraz' construction

US judge orders temporary halt to new 'Alligator Alcatraz' construction

-

US uses war rhetoric, Superman to recruit for migrant crackdown

-

US to rewrite its past national climate reports

US to rewrite its past national climate reports

-

U can't pay this: MC Hammer sued over delinquent car loan

-

WHO says nearly 100,000 struck with cholera in Sudan

WHO says nearly 100,000 struck with cholera in Sudan

-

Huge wildfire in southern France now under control

-

Kane scores as Bayern thump Spurs in pre-season friendly

Kane scores as Bayern thump Spurs in pre-season friendly

-

France strikes down return of banned bee-killing pesticide

-

Canada sends troops to eastern province as fire damage grows

Canada sends troops to eastern province as fire damage grows

-

OpenAI releases ChatGPT-5 as AI race accelerates

-

Plastic pollution treaty talks deadlocked

Plastic pollution treaty talks deadlocked

-

A French sailor's personal 'Plastic Odyssey'

-

Netanyahu says Israel to control not govern Gaza

Netanyahu says Israel to control not govern Gaza

-

Partey signs for Villarreal while on bail for rape charges

-

Wales have the talent to rise again, says rugby head coach Tandy

Wales have the talent to rise again, says rugby head coach Tandy

-

US partners seek relief as Trump tariffs upend global trade

-

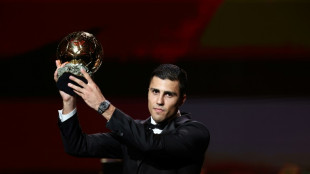

Five England players nominated for women's Ballon d'Or

Five England players nominated for women's Ballon d'Or

-

PSG dominate list of men's Ballon D'Or nominees

-

Americans eating (slightly) less ultra-processed food

Americans eating (slightly) less ultra-processed food

-

Man Utd agree 85m euro deal to sign Sesko: reports

| RBGPF | -5.79% | 71.84 | $ | |

| RYCEF | -0.42% | 14.44 | $ | |

| CMSC | 0.04% | 22.96 | $ | |

| CMSD | -0.09% | 23.52 | $ | |

| NGG | -0.31% | 72.08 | $ | |

| RIO | 1.12% | 60.77 | $ | |

| GSK | 2.21% | 37.58 | $ | |

| SCS | 0.06% | 16 | $ | |

| BCC | 0.32% | 83.19 | $ | |

| SCU | 0% | 12.72 | $ | |

| BCE | 2.23% | 23.78 | $ | |

| VOD | -0.36% | 11.26 | $ | |

| RELX | 1.03% | 49.32 | $ | |

| JRI | 0.52% | 13.41 | $ | |

| AZN | 1.3% | 74.57 | $ | |

| BTI | 0.51% | 56.69 | $ | |

| BP | 0.91% | 34.19 | $ |

Chinese EV battery giant CATL aims to raise $4 bn in Hong Kong IPO

Chinese EV battery giant CATL aims to raise $4 billion in its Hong Kong listing scheduled for May 20, said a statement filed to the bourse Monday, making it the largest IPO expected in the city so far this year.

A global leader in the sector, CATL produces more than a third of all electric vehicle (EV) batteries sold worldwide, working with major brands including Tesla, Mercedes-Benz, BMW and Volkswagen.

The company is already listed in Shenzhen, and its plan for a secondary listing in Hong Kong was announced in a December filing with the stock exchange.

According to a prospectus filed Monday, CATL will offer approximately 117.9 million units priced at up to HK$263 per share ($33.8) for total expected proceeds of HK$31.01 billion.

The listing is set to take place next Tuesday (May 20).

Cornerstone investors, including Sinopec and Kuwait Investment Authority, agreed to buy shares worth HK$2.62 billion, the prospectus shows.

Founded in 2011 in the eastern Chinese city of Ningde, Contemporary Amperex Technology Co., Limited (CATL) was initially propelled to success by rapid growth in the domestic market.

But the world's largest EV market has more recently begun to show signs of flagging sales amid a broader slowdown in consumption.

The trends have fuelled a fierce price war in China's expansive EV sector, putting smaller firms under huge pressure to compete while remaining financially viable.

But CATL continues to post solid performances, with its net profit jumping 32.9 percent in the first quarter.

Funds raised from a secondary listing could be used to accelerate CATL's overseas expansion, particularly in Europe.

The battery giant is building its second factory on the continent in Hungary after launching its first in Germany in January 2023.

In December, CATL announced that it would work with automotive giant Stellantis on a $4.3 billion factory to make EV batteries in Spain, with production slated to begin by the end of 2026.

- 'Military-linked company' -

Earlier analysts said CATL's float could be a blockbuster initial public offering that could boost Hong Kong's fortunes as a listing hub.

Hong Kong's stock exchange is eager for the return of big-name Chinese listings in hopes of regaining its crown as the world's top IPO venue.

The Chinese finance hub saw a steady decline in new offerings since Beijing's regulatory crackdown starting in 2020 led some Chinese mega-companies to put their plans on hold.

In a list issued in January by the US Defense Department, CATL was designated as a "Chinese military company".

The United States House Select Committee on the Chinese Communist Party highlighted this inclusion in letters to two American banks in April, urging them to withdraw from the IPO deal with the "Chinese military-linked company".

But the two American banks -- JPMorgan and Bank of America -- are still on the deal.

Beijing has denounced the list as "suppression", while CATL denied engaging "in any military related activities".

According to Bloomberg, CATL plans to make the deal as a "Reg S" offering, which doesn't allow sales to US onshore investors, limiting the company's exposure to legal risks in the United States.

V.AbuAwwad--SF-PST