-

Lens sign France international Thauvin from Udinese

Lens sign France international Thauvin from Udinese

-

Gold futures hit record on US tariff shock, stocks wobble

-

Man Utd training ground upgrade will foster 'winning culture': Ratcliffe

Man Utd training ground upgrade will foster 'winning culture': Ratcliffe

-

Two tourists die at sea in Greece amid gale-force winds

-

'Optimistic': Champagne growers hope for US tariff shift

'Optimistic': Champagne growers hope for US tariff shift

-

French firefighters optimistic after controlling vast wildfire

-

Germany suspends arms exports to Israel for use in Gaza

Germany suspends arms exports to Israel for use in Gaza

-

Stocks waver, gold futures hit record on US tariff updates

-

Guessand says he jumped at chance to join Aston Villa after sealing move

Guessand says he jumped at chance to join Aston Villa after sealing move

-

Israel to 'take control' of Gaza City, sparking wave of criticism

-

Accumulating bitcoin a risky digital rush by companies?

Accumulating bitcoin a risky digital rush by companies?

-

Liverpool's Slot hints at fresh Isak bid despite 'attacking power'

-

PSG to sign Lille goalkeeper Lucas Chevalier: source

PSG to sign Lille goalkeeper Lucas Chevalier: source

-

Oil industry presence surges at UN plastic talks: NGOs

-

Kipyegon says a woman will run a sub-four minute mile

Kipyegon says a woman will run a sub-four minute mile

-

Tokyo soars on trade deal relief as most Asian markets limp into weekend

-

Israel to 'take control' of Gaza City after approving new war plan

Israel to 'take control' of Gaza City after approving new war plan

-

Australian A-League side Western United stripped of licence

-

'Back home': family who fled front buried after Kyiv strike

'Back home': family who fled front buried after Kyiv strike

-

Indonesia cracks down on pirate protest flag

-

Israeli army will 'take control' of Gaza City: PM's office

Israeli army will 'take control' of Gaza City: PM's office

-

Australian mushroom murderer accused of poisoning husband

-

Coventry's mettle tested by Russian Olympic debate, say former IOC figures

Coventry's mettle tested by Russian Olympic debate, say former IOC figures

-

Library user borrows rare Chinese artwork, returns fakes: US officials

-

Parisians hot under the collar over A/C in apartments

Parisians hot under the collar over A/C in apartments

-

Crypto group reportedly says it planned sex toy tosses at WNBA games

-

American Shelton tops Khachanov to win first ATP Masters title in Toronto

American Shelton tops Khachanov to win first ATP Masters title in Toronto

-

Tokyo soars on trade deal relief as Asian markets limp into weekend

-

New species teem in Cambodia's threatened karst

New species teem in Cambodia's threatened karst

-

Australian mushroom murderer accused of poisoning husband: police

-

Solid gold, royal missives and Nobel noms: how to win Trump over

Solid gold, royal missives and Nobel noms: how to win Trump over

-

Canadian teen Mboko outlasts Osaka to win WTA Montreal crown

-

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

-

Israeli airline's Paris offices daubed with red paint, slogans

-

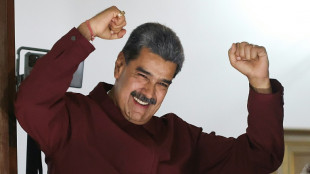

US raises bounty on Venezuela's Maduro to $50 mn

US raises bounty on Venezuela's Maduro to $50 mn

-

Lebanon cabinet meets again on Hezbollah disarmament

-

France's huge wildfire will burn for days: authorities

France's huge wildfire will burn for days: authorities

-

Bolivia right-wing presidential hopeful vows 'radical change'

-

Trump says would meet Putin without Zelensky sit-down

Trump says would meet Putin without Zelensky sit-down

-

Trump offers data to justify firing of labor stats chief

-

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

Bhatia leads by one at PGA St. Jude, Scheffler five adrift

-

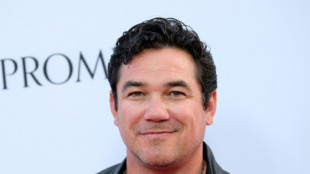

Disney settles Trump-supporting 'Star Wars' actor lawsuit

-

Trump moves to kill $7 billion in solar panel grants

Trump moves to kill $7 billion in solar panel grants

-

Venus Williams falls at first hurdle in Cincinnati

-

Mixed day for global stocks as latest Trump levies take effect

Mixed day for global stocks as latest Trump levies take effect

-

SpaceX agrees to take Italian experiments to Mars

-

US judge orders temporary halt to new 'Alligator Alcatraz' construction

US judge orders temporary halt to new 'Alligator Alcatraz' construction

-

US uses war rhetoric, Superman to recruit for migrant crackdown

-

US to rewrite its past national climate reports

US to rewrite its past national climate reports

-

U can't pay this: MC Hammer sued over delinquent car loan

| RBGPF | -5.79% | 71.84 | $ | |

| AZN | -0.89% | 73.4 | $ | |

| CMSC | 0.13% | 22.99 | $ | |

| BTI | 0.69% | 57.085 | $ | |

| RIO | 1.35% | 61.6 | $ | |

| CMSD | -0.13% | 23.49 | $ | |

| NGG | -0.91% | 71.43 | $ | |

| SCS | -0.63% | 15.9 | $ | |

| BP | -0.15% | 34.14 | $ | |

| SCU | 0% | 12.72 | $ | |

| RYCEF | -0.35% | 14.4 | $ | |

| GSK | 0.78% | 37.875 | $ | |

| RELX | -1.93% | 48.13 | $ | |

| BCC | -0.65% | 82.655 | $ | |

| VOD | 1.01% | 11.375 | $ | |

| BCE | 2.8% | 24.465 | $ | |

| JRI | 0.15% | 13.43 | $ |

Oil prices slide after OPEC+ output hike

Oil prices slumped on Monday after OPEC+ countries announced a sharp production increase despite oversupply concerns and growing fears that US President Donald Trump's trade war could weaken demand.

Saudi Arabia, Russia and six other members of the oil cartel announced over the weekend an output increase of 411,000 barrels a day for June, a month after a similar move had already caused prices to fall.

The price of crude has also been sliding because of fears of a global economic slowdown on the back of Trump's tariff onslaught.

The OPEC+ move "confirms a stark turnaround away from the production cuts that have persisted since 2022", said a Deutsche Bank research note.

Oil prices fell almost four percent before paring back some losses.

Brent, the international benchmark, was trading at just under $60 per barrel at around 0715 GMT.

Some analysts pointed to pressure from Trump to lower prices and expectations of declining Iranian oil exports amid tighter sanctions, as possible reasons for the unexpected move.

Others said the motivation was unclear.

"The weekend news wasn't a shocker but the reasons behind the move remain uncertain," said Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

"The official communication says the group is bringing barrels back to the market because 'fundamentals are healthy and inventories are low'," Ozkardeskaya said.

"Yet global growth expectations have been crumbling due to a heated trade war between the US and the rest of the world, and rising output only worsens oversupply concerns. So the real reason must be something else," she added.

She said some argued that the Saudis were "punishing" OPEC members who had not complied fully with the previous policy of cutting production.

Other theories include that Trump wants to lower oil prices to hurt Russian finances and speed up the end of the Ukraine war, or that Riyadh wants to push out US shale businesses and increase its market share.

"We don't know for sure. The exact motive remains unclear," Ozkardeskaya said.

- Fed move -

On stock markets, Paris was down in early deals while Frankfurt was up in holiday-thinned trading, with London, Tokyo and Hong Kong closed.

Investors are waiting for interest rate decisions this week, with the US Federal Reserve and Bank of England holding policy meetings on Wednesday and Thursday respectively.

"Our US economists expect the Fed to keep rates steady and avoid explicit forward guidance about the policy path ahead," Deutsche Bank analysts said.

Among the few Asian markets that were open, Taiwan was in the red while the Jakarta Composite Index rose.

The Australian dollar gained against the US dollar after Prime Minister Anthony Albanese's election victory on Saturday, while the S&P/ASX 200 fell almost one percent.

The dollar fell against other major currencies.

Wall Street stocks concluded a strong week on a winning note on Friday, notching solid gains on good US jobs data and improving sentiment about US-China trade talks.

- Key figures at around 0725 GMT -

Paris - CAC 40: DOWN 0.4 percent at 7,741.31 points

Frankfurt - DAX: UP 0.3 percent at 23,155.25

London - FTSE 100: closed for holiday

Tokyo - Nikkei 225: closed for holiday

Hong Kong - Hang Seng Index: closed for holiday

Shanghai - Composite: closed for holiday

Euro/dollar: UP at $1.1321 from $1.1299 on Friday

Pound/dollar: UP at $1.3286 from $1.3268

Dollar/yen: DOWN at 144.35 yen from 144.97

Euro/pound: UP at 85.22 pence from 85.14

West Texas Intermediate: DOWN 2.4 percent at $56.88 per barrel

Brent North Sea Crude: DOWN 2.2 percent at $59.94 per barrel

New York - Dow: UP 1.4 percent at 41,317.43 (close Friday)

J.AbuShaban--SF-PST