-

Liverpool's Slot says 'no issue to resolve' with Salah after outburst

Liverpool's Slot says 'no issue to resolve' with Salah after outburst

-

'Stop the slaughter': French farmers block roads over cow disease cull

-

Stormers see off La Rochelle, Sale stun Clermont in Champions Cup

Stormers see off La Rochelle, Sale stun Clermont in Champions Cup

-

Maresca hails Palmer as Chelsea return to winning ways against Everton

-

Hungarian protesters demand Orban quits over abuse cases

Hungarian protesters demand Orban quits over abuse cases

-

Belarus frees protest leader Kolesnikova, Nobel winner Bialiatski

-

Salah sets up goal on return to Liverpool action

Salah sets up goal on return to Liverpool action

-

Palmer strikes as Chelsea return to winning ways against Everton

-

Pogacar targets Tour de France Paris-Roubaix and Milan-San Remo in 2026

Pogacar targets Tour de France Paris-Roubaix and Milan-San Remo in 2026

-

Salah back in action for Liverpool after outburst

-

Atletico recover Liga momentum with battling win over Valencia

Atletico recover Liga momentum with battling win over Valencia

-

Meillard leads 'perfect' Swiss sweep in Val d'Isere giant slalom

-

Salah on Liverpool bench for Brighton match

Salah on Liverpool bench for Brighton match

-

Meillard leads Swiss sweep in Val d'Isere giant slalom

-

Indonesia flood death toll passes 1,000 as authorities ramp up aid

Indonesia flood death toll passes 1,000 as authorities ramp up aid

-

Cambodia shuts Thailand border crossings over deadly fighting

-

First urban cable car unveiled outside Paris

First urban cable car unveiled outside Paris

-

Vonn second behind Aicher in World Cup downhill at St Moritz

-

Aicher pips Vonn to downhill win at St Moritz

Aicher pips Vonn to downhill win at St Moritz

-

Thailand says 4 soldiers killed in Cambodia conflict, denies Trump truce claim

-

Fans vandalise India stadium after Messi's abrupt exit

Fans vandalise India stadium after Messi's abrupt exit

-

Women sommeliers are cracking male-dominated wine world open

-

Exhibition of Franco-Chinese print master Zao Wou-Ki opens in Hong Kong

Exhibition of Franco-Chinese print master Zao Wou-Ki opens in Hong Kong

-

Myanmar junta denies killing civilians in hospital strike

-

Why SpaceX IPO plan is generating so much buzz

Why SpaceX IPO plan is generating so much buzz

-

Thailand continues Cambodia strikes despite Trump truce calls

-

US envoy to meet Zelensky, Europe leaders in Berlin this weekend

US envoy to meet Zelensky, Europe leaders in Berlin this weekend

-

North Korea acknowledges its troops cleared mines for Russia

-

US unseals warrant for tanker seized off Venezuelan coast

US unseals warrant for tanker seized off Venezuelan coast

-

Cambodia says Thailand still bombing hours after Trump truce call

-

Machado urges pressure so Maduro understands 'he has to go'

Machado urges pressure so Maduro understands 'he has to go'

-

Leinster stutter before beating Leicester in Champions Cup

-

World stocks mostly slide, consolidating Fed-fuelled gains

World stocks mostly slide, consolidating Fed-fuelled gains

-

Crypto firm Tether bids for Juventus, is quickly rebuffed

-

Union sink second-placed Leipzig to climb in Bundesliga

Union sink second-placed Leipzig to climb in Bundesliga

-

US Treasury lifts sanctions on Brazil Supreme Court justice

-

UK king shares 'good news' that cancer treatment will be reduced in 2026

UK king shares 'good news' that cancer treatment will be reduced in 2026

-

Wembanyama expected to return for Spurs in NBA Cup clash with Thunder

-

Five takeaways from Luigi Mangione evidence hearings

Five takeaways from Luigi Mangione evidence hearings

-

UK's king shares 'good news' that cancer treatment will be reduced in 2026

-

Steelers' Watt undergoes surgery to repair collapsed lung

Steelers' Watt undergoes surgery to repair collapsed lung

-

Iran detains Nobel-prize winner in 'brutal' arrest

-

NBA Cup goes from 'outside the box' idea to smash hit

NBA Cup goes from 'outside the box' idea to smash hit

-

UK health service battles 'super flu' outbreak

-

Can Venezuela survive US targeting its oil tankers?

Can Venezuela survive US targeting its oil tankers?

-

Democrats release new cache of Epstein photos

-

Colombia's ELN guerrillas place communities in lockdown citing Trump 'intervention' threats

Colombia's ELN guerrillas place communities in lockdown citing Trump 'intervention' threats

-

'Don't use them': Tanning beds triple skin cancer risk, study finds

-

Nancy aims to restore Celtic faith with Scottish League Cup final win

Nancy aims to restore Celtic faith with Scottish League Cup final win

-

Argentina fly-half Albornoz signs for Toulon until 2030

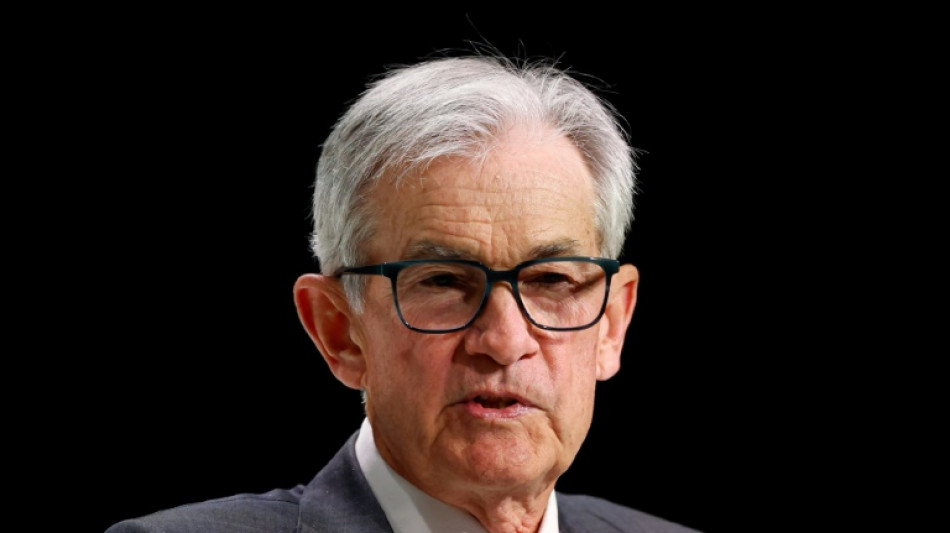

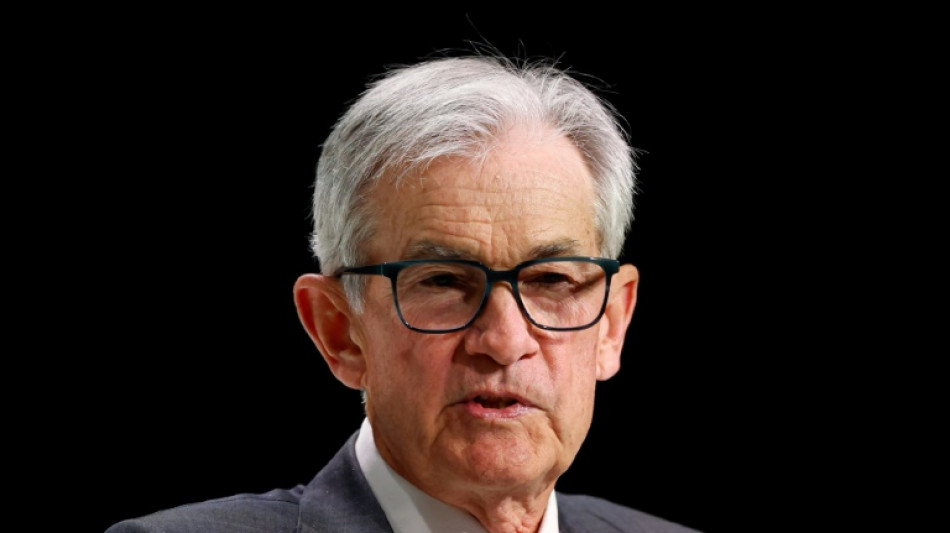

US Fed expected to pause rate cuts again, await clarity on tariffs

The US Federal Reserve is widely expected to extend a recent pause in rate cuts this week as it waits to see how President Donald Trump's stop-start tariff rollout affects the health of the world's largest economy.

Trump has imposed steep levies on China, and lower "baseline" levies of 10 percent on goods from most other countries, along with 25 percent duties on specific items like steel, automobiles and aluminum.

The president has also paused higher duties on dozens of other trading partners until July to give them time to renegotiate existing arrangements with the United States.

Most economists expect the tariffs introduced since January to push up prices and cool economic growth -- at least in the short run -- potentially keeping the Fed on hold for longer.

"The Fed has to be very focused on maintaining inflation so that it doesn't start moving back up in a more persistent way," said Loretta Mester, who recently stepped down after a decade as president of the Cleveland Fed.

"That would undermine all the work that was done over the last three years of getting inflation down," she told AFP.

- 'Good place to be' -

Trump reiterated his call for Fed chair Jerome Powell to lower rates in an NBC interview published in full on Sunday, claiming the decision not to do so was largely personal.

"Well, he should lower them. And at some point, he will. He'd rather not because he's not a fan of mine," Trump said.

The Fed has held its key interest rate at between 4.25 percent and 4.50 percent since December, as it continues its plan to bring inflation to the bank's long-term target of two percent, with another eye firmly fixed on keeping unemployment under control.

Recent data points to the Fed's inflation remaining broadly on track ahead of the introduction of Trump's "Liberation Day" tariffs, while unemployment has remained relatively stable, hugging close to historic lows.

At the same time, various "softer" data points such as consumer confidence surveys have reflected a sharp decline in optimism about the health of the US economy -- and growing concerns about inflation.

"Whether the economy enters a recession or not, it's hard to say at this point," said Mester, now an adjunct professor of finance at the Wharton School of the University of Pennsylvania.

"I think the committee remains in good condition here, and most likely they'll remain on hold at this meeting," said Jim Bullard, the long-serving former president of the St. Louis Fed.

"I think it's a good place for them to be while there's a lot of turbulence in the trade war," added Bullard, now dean of the Daniels School of Business at Purdue University.

Financial markets overwhelmingly expect the Fed to announce another rate-cut pause on Wednesday, according to data from CME Group.

- Pushing back rate cuts -

US hiring data for April published last week came in better than expected, lowering anxiety about the health of the labor market -- and reducing pressure on the Fed's rate-setting committee to reach for rate cuts.

Economists at several large banks including Goldman Sachs and Barclays subsequently delayed their expected date for rate cuts from June to July.

"Cutting in late July allows the committee to see more data on the evolution of the labor market, and should benefit from resolving uncertainty about tariffs and fiscal policy," economists at Barclays wrote in a note to clients published Friday.

Other analysts see rate cuts happening even later, depending on the effects of the tariffs.

"A slower reaction to economic weakness" could happen "if backward-looking data gives the impression of resilient demand while inflation gauges heat up," wrote EY Chief Economist Gregory Daco.

The rise in longer-run inflation expectations in the survey data points to growing concerns that tariff-related price pressures could become embedded in the US economy -- even as the market-based measures have remained close to the Fed's two percent target.

"I would be sort of in the camp (saying) prove to me that they're not going to be inflationary," Mester said of tariffs, adding that it would be "unwise" to assume that inflation expectations were stable, given the recent survey data.

But Bullard from Purdue took a different view, stressing the stability of the market-based measures.

"I haven't liked the survey-based measures of inflation expectations, because they seem to be partly about inflation but partly about many other issues, maybe, including politics," he said.

"This is a moment where you might want to look through the survey-based measures that are talking about very extreme levels of inflation that don't seem likely to develop near-term," he added.

O.Farraj--SF-PST