-

ICC unseals Libya war crimes warrant for militia officer

ICC unseals Libya war crimes warrant for militia officer

-

Montreal protagonists Mboko, Osaka out of Cincinnati Open

-

Trump says court halt of tariffs would cause 'Great Depression'

Trump says court halt of tariffs would cause 'Great Depression'

-

Glasner says demotion to Conference League would punish 'innocent' Palace

-

New Zealand build big total in 2nd Test against Zimbabwe

New Zealand build big total in 2nd Test against Zimbabwe

-

Trump hosts foes Armenia, Azerbaijan in his latest peace initiative

-

Nigerian scientists await return of Egusi seeds sent to space

Nigerian scientists await return of Egusi seeds sent to space

-

Pioneer spirit drives Swiss solar-powered plane altitude attempt

-

Thyssenkrupp to spin off marine division amid defence boom

Thyssenkrupp to spin off marine division amid defence boom

-

Vance and Lammy talk Gaza, fish as US VP starts UK holiday

-

Israel plans to 'take control' of Gaza City, sparking wave of criticism

Israel plans to 'take control' of Gaza City, sparking wave of criticism

-

Putin taps key allies ahead of Trump summit, sanctions deadline

-

Two tourists die, fires erupt in Greece amid gale-force winds

Two tourists die, fires erupt in Greece amid gale-force winds

-

Lens sign France international Thauvin from Udinese

-

Gold futures hit record on US tariff shock, stocks wobble

Gold futures hit record on US tariff shock, stocks wobble

-

Man Utd training ground upgrade will foster 'winning culture': Ratcliffe

-

Two tourists die at sea in Greece amid gale-force winds

Two tourists die at sea in Greece amid gale-force winds

-

'Optimistic': Champagne growers hope for US tariff shift

-

French firefighters optimistic after controlling vast wildfire

French firefighters optimistic after controlling vast wildfire

-

Germany suspends arms exports to Israel for use in Gaza

-

Stocks waver, gold futures hit record on US tariff updates

Stocks waver, gold futures hit record on US tariff updates

-

Guessand says he jumped at chance to join Aston Villa after sealing move

-

Israel to 'take control' of Gaza City, sparking wave of criticism

Israel to 'take control' of Gaza City, sparking wave of criticism

-

Accumulating bitcoin a risky digital rush by companies?

-

Liverpool's Slot hints at fresh Isak bid despite 'attacking power'

Liverpool's Slot hints at fresh Isak bid despite 'attacking power'

-

PSG to sign Lille goalkeeper Lucas Chevalier: source

-

Oil industry presence surges at UN plastic talks: NGOs

Oil industry presence surges at UN plastic talks: NGOs

-

Kipyegon says a woman will run a sub-four minute mile

-

Tokyo soars on trade deal relief as most Asian markets limp into weekend

Tokyo soars on trade deal relief as most Asian markets limp into weekend

-

Israel to 'take control' of Gaza City after approving new war plan

-

Australian A-League side Western United stripped of licence

Australian A-League side Western United stripped of licence

-

'Back home': family who fled front buried after Kyiv strike

-

Indonesia cracks down on pirate protest flag

Indonesia cracks down on pirate protest flag

-

Israeli army will 'take control' of Gaza City: PM's office

-

Australian mushroom murderer accused of poisoning husband

Australian mushroom murderer accused of poisoning husband

-

Coventry's mettle tested by Russian Olympic debate, say former IOC figures

-

Library user borrows rare Chinese artwork, returns fakes: US officials

Library user borrows rare Chinese artwork, returns fakes: US officials

-

Parisians hot under the collar over A/C in apartments

-

Crypto group reportedly says it planned sex toy tosses at WNBA games

Crypto group reportedly says it planned sex toy tosses at WNBA games

-

American Shelton tops Khachanov to win first ATP Masters title in Toronto

-

Tokyo soars on trade deal relief as Asian markets limp into weekend

Tokyo soars on trade deal relief as Asian markets limp into weekend

-

New species teem in Cambodia's threatened karst

-

Australian mushroom murderer accused of poisoning husband: police

Australian mushroom murderer accused of poisoning husband: police

-

Solid gold, royal missives and Nobel noms: how to win Trump over

-

Canadian teen Mboko outlasts Osaka to win WTA Montreal crown

Canadian teen Mboko outlasts Osaka to win WTA Montreal crown

-

Trump to host Armenia, Azerbaijan for historic 'Peace Signing'

-

Israeli airline's Paris offices daubed with red paint, slogans

Israeli airline's Paris offices daubed with red paint, slogans

-

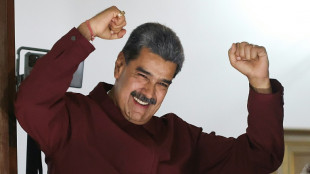

US raises bounty on Venezuela's Maduro to $50 mn

-

Lebanon cabinet meets again on Hezbollah disarmament

Lebanon cabinet meets again on Hezbollah disarmament

-

France's huge wildfire will burn for days: authorities

| CMSC | 0.43% | 23.06 | $ | |

| RBGPF | -5.79% | 71.84 | $ | |

| BCC | -0.55% | 82.735 | $ | |

| RYCEF | -0.7% | 14.35 | $ | |

| NGG | -1.28% | 71.17 | $ | |

| RIO | 2.02% | 62.021 | $ | |

| RELX | -1.89% | 48.145 | $ | |

| SCS | -0.19% | 15.97 | $ | |

| CMSD | 0.25% | 23.58 | $ | |

| SCU | 0% | 12.72 | $ | |

| BCE | 2.48% | 24.385 | $ | |

| JRI | 0.22% | 13.439 | $ | |

| VOD | 1.03% | 11.377 | $ | |

| AZN | -0.54% | 73.66 | $ | |

| GSK | 0.9% | 37.92 | $ | |

| BTI | 0.85% | 57.175 | $ | |

| BP | 0.22% | 34.265 | $ |

Warren Buffett to retire from Berkshire Hathaway by year's end

Influential billionaire investor Warren Buffett said Saturday he would retire from leading his Berkshire Hathaway business group by the end of the year and that he would recommend his chosen successor Greg Abel take over.

Buffett's success, coupled with his ability to explain his thinking in clear soundbites, has made him highly influential in the business and financial communities, earning him the nickname "The Oracle of Omaha."

Buffett indicated several years ago 62-year-old Abel would be his pick for successor.

"The time has arrived where Greg should become the chief executive officer of the company at year end," Buffett, 94, told an annual shareholder meeting in Omaha, the Midwestern city where Berkshire is based.

Buffett said he believed the board of directors would be "unanimously in favor of" his recommendation.

"I would still hang around and could conceivably be useful in a few cases, but the final word would be what Greg said in operations, in capital deployment, whatever it might be," he added.

Buffett transformed Berkshire Hathaway from a medium-sized textile company when he bought it in the 1960s into a giant conglomerate, now valued at more than $1 trillion and with liquid assets of $300 billion.

- 'Wizard of Wall Street' -

Peter Cardillo of Spartan Capital Securities described Buffett as the "Wizard of Wall Street" and said his announcement could come as a relief to those worried about succession.

"This helps alleviate concerns about who will replace him and may very well be well received by his followers," Cardillo told AFP.

The company on Saturday reported first-quarter profits of $9.6 billion, down 14 percent. That works out to $4.47 per share, also down sharply.

And Buffett's net worth as of Saturday was $168.2 billion, according to Forbes magazine's real-time rich list.

"I have no intention -- zero -- of selling one share of Berkshire Hathaway. I will give it away eventually," Buffett told shareholders, who responded with a standing ovation.

"The decision to keep every share is an economic decision because I think the prospects of Berkshire will be better under Greg's management than mine."

"So that's the news hook for the day," Buffett quipped.

Abel, a long-time core figure of Berkshire, joined the group in the energy division in 1992 and has been on the board of directors since 2018.

"Greg Abel and the rest of the team has huge shoes to fill, and they have immense amounts of cash to put to work if they so desire," said Steve Sosnick of Interactive Brokers.

"This is truly the end of an era," he added.

- Trade 'should not be a weapon' -

Buffett earlier used the stage to declare that "trade should not be a weapon," in remarks clearly targeting US President Donald Trump's aggressive use of tariffs against countries around the world.

"There is no question that trade can be an act of war," he said, without mentioning Trump by name.

Those comments came as analysts in the United States and abroad have expressed growing concern that tariffs could seriously slow global growth.

Two months ago, Buffett told a CBS interviewer that tariffs "are a tax on goods" -- and not a relatively painless revenue-raiser, as Trump has suggested -- adding, "I mean, the Tooth Fairy doesn't pay 'em!"

On Saturday Buffett urged Washington to continue trading with the rest of the world, saying, "We should do what we do best and they should do what they do best."

Achieving prosperity is not a zero-sum game, with one country's successes meaning another's losses, he said. Both can prosper.

"I do think that the more prosperous the rest of the world becomes, it won't be at our expense. The more prosperous we'll become, and the safer we'll feel," Buffett said.

He added that it can be dangerous for one country to offend the rest of the world while claiming superiority.

"It's a big mistake, in my view, when you have seven and a half billion people that don't like you very well, and you got 300 million that are crowing in some way about how well they've done," Buffett told shareholders.

Compared to that dynamic, he said, the financial markets' recent gyrations are "really nothing."

H.Darwish--SF-PST