-

US consumer inflation holds steady but tariff risks persist

US consumer inflation holds steady but tariff risks persist

-

Two killed in European wildfires as heatwave intensifies

-

S.Africa to offer US new deal to avoid 30% tariff

S.Africa to offer US new deal to avoid 30% tariff

-

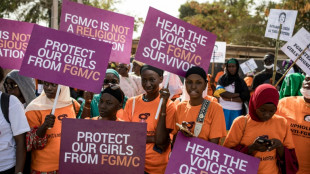

Gambia baby death heightens alarm over female genital mutilation

-

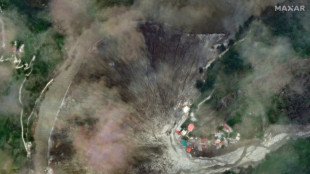

Soldier dies battling Montenegro wildfire

Soldier dies battling Montenegro wildfire

-

Last Liverpool goal had special meaning for Jota

-

Mixed crews introduced for 2027 America's Cup

Mixed crews introduced for 2027 America's Cup

-

Stocks rise on restrained US inflation

-

US consumer inflation holds steady but tariff worries persist

US consumer inflation holds steady but tariff worries persist

-

Brevis smashes record ton as South Africa level T20 series

-

EU ready to do plastic pollution deal 'but not at any cost'

EU ready to do plastic pollution deal 'but not at any cost'

-

China Evergrande Group says to delist from Hong Kong

-

In China's factory heartland, warehouses weather Trump tariffs

In China's factory heartland, warehouses weather Trump tariffs

-

Palace claim sporting merit 'meaningless' after Europa League demotion

-

Former Premier League referee Coote given eight-week ban over Klopp comments

Former Premier League referee Coote given eight-week ban over Klopp comments

-

Council of Europe cautions on weapon sales to Israel

-

The Elders group of global leaders warns of Gaza 'genocide'

The Elders group of global leaders warns of Gaza 'genocide'

-

Stocks gain on China-US truce, before key inflation data

-

Man killed in Spain wildfire as European heatwave intensifies

Man killed in Spain wildfire as European heatwave intensifies

-

US, China extend tariff truce for 90 days

-

Families mourn 40 years since deadly Japan Airlines crash

Families mourn 40 years since deadly Japan Airlines crash

-

Thai soldier wounded in Cambodia border landmine blast

-

PSG sign Ukrainian defender Illia Zabarnyi from Bournemouth

PSG sign Ukrainian defender Illia Zabarnyi from Bournemouth

-

PSG sign Ukrainian defender Illia Zabarnyi

-

Five Premier League talking points

Five Premier League talking points

-

Five talking points as Spain's La Liga begins

-

Markets boosted by China-US truce extension, inflation in focus

Markets boosted by China-US truce extension, inflation in focus

-

Japan boxing to adopt stricter safety rules after deaths of two fighters

-

France adopts law upholding ban on controversial insecticide

France adopts law upholding ban on controversial insecticide

-

Most markets rise as China-US truce extended, inflation in focus

-

Toll of India Himalayan flood likely to be at least 70

Toll of India Himalayan flood likely to be at least 70

-

Taylor Swift announces 12th album for 'pre pre-order'

-

Italian athlete dies at World Games in China

Italian athlete dies at World Games in China

-

AI porn victims see Hong Kong unprepared for threat

-

Two dead, 10 hospitalized in Pennsylvania steel plant explosions

Two dead, 10 hospitalized in Pennsylvania steel plant explosions

-

Steely Sinner advances amid Cincinnati power-failure chaos

-

Families forever scarred 4 years on from Kabul plane deaths

Families forever scarred 4 years on from Kabul plane deaths

-

Scientists find 74-million-year-old mammal fossil in Chile

-

Trump signs order to extend China tariff truce by 90 days

Trump signs order to extend China tariff truce by 90 days

-

Spanish police bust 'spiritual retreat' offering hallucinogenic drugs

-

Jellyfish force French nuclear plant shutdown

Jellyfish force French nuclear plant shutdown

-

Formerra Becomes North American Distributor for Syensqo PVDF

-

One dead, 10 hospitalized in Pennsylvania steel plant explosions

One dead, 10 hospitalized in Pennsylvania steel plant explosions

-

Trump meets with Intel CEO after demanding he resign

-

Stocks cautious before US inflation report

Stocks cautious before US inflation report

-

Sabalenka survives massive Cincinnati struggle with Raducanu

-

Trump says plans to test out Putin as Europe engages Ukraine

Trump says plans to test out Putin as Europe engages Ukraine

-

Straka skips BMW but will play PGA Tour Championship

-

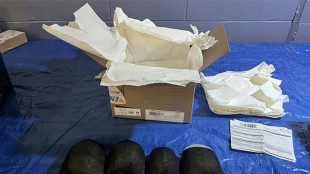

Chinese man pleads guilty in US to smuggling protected turtles

Chinese man pleads guilty in US to smuggling protected turtles

-

Trump sends troops to US capital, mulls wider crackdown

| RYCEF | 1.04% | 14.49 | $ | |

| RBGPF | 0% | 73.08 | $ | |

| AZN | 1.13% | 74.915 | $ | |

| GSK | 1.01% | 38.095 | $ | |

| VOD | 0.39% | 11.555 | $ | |

| RELX | -0.67% | 47.72 | $ | |

| RIO | 1.61% | 63.16 | $ | |

| BTI | -0.47% | 58.055 | $ | |

| CMSC | 0.13% | 23.09 | $ | |

| SCU | 0% | 12.72 | $ | |

| BP | 1.11% | 34.33 | $ | |

| NGG | -1.53% | 70.16 | $ | |

| SCS | 1.72% | 16.24 | $ | |

| BCC | 4.09% | 84.18 | $ | |

| CMSD | -0.05% | 23.56 | $ | |

| BCE | 2.05% | 24.86 | $ | |

| JRI | -0.27% | 13.354 | $ |

Turkish central bank raises interest rate to 46 percent

Turkey's central bank hiked its key interest rate to 46 percent on Thursday after a month of protests over the arrest of Istanbul's opposition mayor and economic uncertainty provoked by US President Donald Trump's sweeping tariffs.

That represents the first hike since March 2024, in what economists hail as a "strong signal of commitment" to a tight monetary policy stance.

The rate hike came as Turkey was roiled by street protests against the arrest and jailing last month of Istanbul's popular mayor, Ekrem Imamoglu, on graft charges he denies, which sent the Turkish lira to record lows against the dollar.

It also follows US President Donald Trump's global tariffs that sparked growing economic uncertainty despite the relatively low 10 percent baseline tariff that Washington has applied to Turkey.

The monetary policy committee "has decided to raise the policy rate from 42.5 percent to 46 percent," the central bank said in a statement.

- Risks to inflation -

Nicholas Farr, emerging Europe economist at London-based Capital Economics, said the decision "is a strong signal of commitment to a tight policy stance", in a policy note.

It also "suggests that policymakers have become more concerned about upside risks to inflation," he said.

Turkey's annual inflation that soared to 75 percent in May last year fell to 38.1 percent in March, its lowest level since December 2021, according to official figures released early this month.

But in April, "monthly core goods inflation is expected to rise slightly due to recent developments in financial markets," the bank warned, saying that policymakers would closely monitor capital flows amid the current uncertainty around US trade protectionism.

Turkish authorities are officially targeting 24 percent inflation by the end of 2025.

In addition to calls for boycotts against companies close to the government, the wave of protests has led to a significant decline in the Istanbul Stock Exchange, which has lost more than 13 percent since its close on March 18.

On the day of Imamoglu's arrest, the Turkish lira had plummeted by around 12 percent, reaching its lowest level ever.

This drastic drop was brief, but the lira has still lost more than four percent against the dollar since March 19, despite the $50 billion injection by the central bank to limit the damage.

The bank said Thursday the tight monetary stance would be maintained "until price stability is achieved via a sustained decline in inflation.

"The Committee will adjust the policy rate prudently on a meeting-by-meeting basis with a focus on the inflation outlook," the bank said.

"Monetary policy stance will be tightened in case a significant and persistent deterioration in inflation is foreseen."

H.Nasr--SF-PST