-

US consumer inflation holds steady but tariff risks persist

US consumer inflation holds steady but tariff risks persist

-

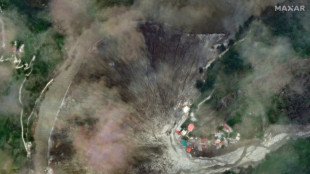

Two killed in European wildfires as heatwave intensifies

-

S.Africa to offer US new deal to avoid 30% tariff

S.Africa to offer US new deal to avoid 30% tariff

-

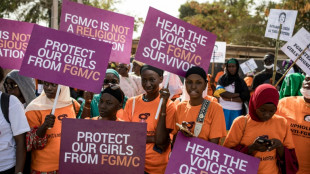

Gambia baby death heightens alarm over female genital mutilation

-

Soldier dies battling Montenegro wildfire

Soldier dies battling Montenegro wildfire

-

Last Liverpool goal had special meaning for Jota

-

Mixed crews introduced for 2027 America's Cup

Mixed crews introduced for 2027 America's Cup

-

Stocks rise on restrained US inflation

-

US consumer inflation holds steady but tariff worries persist

US consumer inflation holds steady but tariff worries persist

-

Brevis smashes record ton as South Africa level T20 series

-

EU ready to do plastic pollution deal 'but not at any cost'

EU ready to do plastic pollution deal 'but not at any cost'

-

China Evergrande Group says to delist from Hong Kong

-

In China's factory heartland, warehouses weather Trump tariffs

In China's factory heartland, warehouses weather Trump tariffs

-

Palace claim sporting merit 'meaningless' after Europa League demotion

-

Former Premier League referee Coote given eight-week ban over Klopp comments

Former Premier League referee Coote given eight-week ban over Klopp comments

-

Council of Europe cautions on weapon sales to Israel

-

The Elders group of global leaders warns of Gaza 'genocide'

The Elders group of global leaders warns of Gaza 'genocide'

-

Stocks gain on China-US truce, before key inflation data

-

Man killed in Spain wildfire as European heatwave intensifies

Man killed in Spain wildfire as European heatwave intensifies

-

US, China extend tariff truce for 90 days

-

Families mourn 40 years since deadly Japan Airlines crash

Families mourn 40 years since deadly Japan Airlines crash

-

Thai soldier wounded in Cambodia border landmine blast

-

PSG sign Ukrainian defender Illia Zabarnyi from Bournemouth

PSG sign Ukrainian defender Illia Zabarnyi from Bournemouth

-

PSG sign Ukrainian defender Illia Zabarnyi

-

Five Premier League talking points

Five Premier League talking points

-

Five talking points as Spain's La Liga begins

-

Markets boosted by China-US truce extension, inflation in focus

Markets boosted by China-US truce extension, inflation in focus

-

Japan boxing to adopt stricter safety rules after deaths of two fighters

-

France adopts law upholding ban on controversial insecticide

France adopts law upholding ban on controversial insecticide

-

Most markets rise as China-US truce extended, inflation in focus

-

Toll of India Himalayan flood likely to be at least 70

Toll of India Himalayan flood likely to be at least 70

-

Taylor Swift announces 12th album for 'pre pre-order'

-

Italian athlete dies at World Games in China

Italian athlete dies at World Games in China

-

AI porn victims see Hong Kong unprepared for threat

-

Two dead, 10 hospitalized in Pennsylvania steel plant explosions

Two dead, 10 hospitalized in Pennsylvania steel plant explosions

-

Steely Sinner advances amid Cincinnati power-failure chaos

-

Families forever scarred 4 years on from Kabul plane deaths

Families forever scarred 4 years on from Kabul plane deaths

-

Scientists find 74-million-year-old mammal fossil in Chile

-

Trump signs order to extend China tariff truce by 90 days

Trump signs order to extend China tariff truce by 90 days

-

Spanish police bust 'spiritual retreat' offering hallucinogenic drugs

-

Jellyfish force French nuclear plant shutdown

Jellyfish force French nuclear plant shutdown

-

Formerra Becomes North American Distributor for Syensqo PVDF

-

One dead, 10 hospitalized in Pennsylvania steel plant explosions

One dead, 10 hospitalized in Pennsylvania steel plant explosions

-

Trump meets with Intel CEO after demanding he resign

-

Stocks cautious before US inflation report

Stocks cautious before US inflation report

-

Sabalenka survives massive Cincinnati struggle with Raducanu

-

Trump says plans to test out Putin as Europe engages Ukraine

Trump says plans to test out Putin as Europe engages Ukraine

-

Straka skips BMW but will play PGA Tour Championship

-

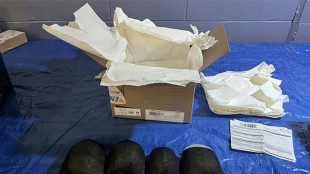

Chinese man pleads guilty in US to smuggling protected turtles

Chinese man pleads guilty in US to smuggling protected turtles

-

Trump sends troops to US capital, mulls wider crackdown

| RYCEF | 1.04% | 14.49 | $ | |

| RBGPF | 0% | 73.08 | $ | |

| AZN | 1.13% | 74.915 | $ | |

| GSK | 1.01% | 38.095 | $ | |

| VOD | 0.39% | 11.555 | $ | |

| RELX | -0.67% | 47.72 | $ | |

| RIO | 1.61% | 63.16 | $ | |

| BTI | -0.47% | 58.055 | $ | |

| CMSC | 0.13% | 23.09 | $ | |

| SCU | 0% | 12.72 | $ | |

| BP | 1.11% | 34.33 | $ | |

| NGG | -1.53% | 70.16 | $ | |

| SCS | 1.72% | 16.24 | $ | |

| BCC | 4.09% | 84.18 | $ | |

| CMSD | -0.05% | 23.56 | $ | |

| BCE | 2.05% | 24.86 | $ | |

| JRI | -0.27% | 13.354 | $ |

Trump's tariff storm a threat to dollar's dominance?

As President Donald Trump's tariffs threaten the US economy, questions are being asked about how long the dollar can maintain its status as the world's key trading and reserve currency.

AFP examines the greenback's current situation and outook:

- Is the dollar still all-powerful? -

The dollar, whose strength is based on the economic and political power of the United States, is traditionally considered a preferred safe haven in times of crisis or conflict.

Almost 58 percent of foreign exchange reserves together held by the world's central banks were denominated in dollars as of the final quarter last year, according to the International Monetary Fund.

That compares with 71 percent in 1999, with the drop attributed to rising competition from smaller currencies.

Roughly half of all global transactions by value are currently in dollars, compared with around 22 percent for the euro, seven percent for the pound sterling, and four percent for the Chinese yuan, according February data from international payments facilitator Swift.

Many strategic commodities, such as oil, are quoted in the greenback, reinforcing its central role across global trade.

However, the recent decline in the dollar's value suggests its safe haven status "has at least temporarily disappeared" in favour of the Swiss franc, yen and gold, Ryan Chahrour, a professor of economics at Cornell University, told AFP.

- 'Exorbitant privilege'? -

Before the dollar took charge, sterling dominated international trade, driven by the UK's status as an industrial powerhouse beginning in the 19th century.

However, following the Second World War, a ruined Europe desperately needed liquidity, while the United States found itself in a position of strength.

The dollar emerged as the new reference currency under the Bretton Woods accords of 1944, which laid the foundations for the current international monetary system.

Many countries have since chosen to peg their currency to the US unit, while demand for dollars has allowed the world's biggest economy to borrow freely, theoretically without limits, with its debt largely owed to foreign investors.

Former French finance minister Valery Giscard d'Estaing described this economic advantage enjoyed by the United States as an "exorbitant privilege", ahead of becoming French president in the 1970s.

On the other hand, the relative strength of the greenback despite recent turmoil makes American exports more expensive.

To counter this, Trump advisor Stephen Miran is considering major global reform aimed at devaluing the US currency.

At the same time, several central banks have begun a process of "de-dollarising" their reserves.

By using the dollar extensively, countries and companies expose themselves to US sanctions -- as illustrated by the freezing of Russia's foreign exchange reserves abroad following its invasion of Ukraine in early 2022.

- Why is Trump shaking the dollar? -

The dollar initially gained on news of Trump's tariffs owing to concerns the levies will push up inflation.

However, that has given way to rising fears that global growth will be impacted, causing recent heavy falls for oil prices that in turn have reduced inflationary pressures.

Expectations that the US Federal Reserve could cut interest rates to prop up the economy are also weighing on the dollar.

Another fear is that the Fed is no longer fulfilling its role as lender of last resort, as it limits the availability of dollars to other central banks.

Trump is contributing to "undermining the foundations of dollar dominance", tarnishing the reputation of the United States, believes Mark Sobel, a former senior US Treasury official.

He argues that in addition to weakening the country's economic strength through his trade policy, Trump is challenging the rule of law.

"The United States is not acting like a reliable partner or trusted ally," he told AFP.

- What alternatives? -

Sobel said it is "premature to say dollar dominance is going away or the dollar has lost its kind of global status because there aren't alternatives".

Stefan Lewellen, assistant professor of finance at Pennsylvania State University, said it is not yet time to write the currency's "obituary".

Looking at why the euro is not ready to take the helm, he added that the European single currency is "fundamentally still governed by individual nations that have mixed incentives to cooperate".

Among other units, he said the Canadian and Australian dollars, as well as the Swiss franc, are limited by the modest size of their markets.

As for the yuan, it remains under Beijing's strict control, owing to the lack of free convertibility and restrictions on capital movements.

G.AbuHamad--SF-PST