-

US consumer inflation holds steady but tariff risks persist

US consumer inflation holds steady but tariff risks persist

-

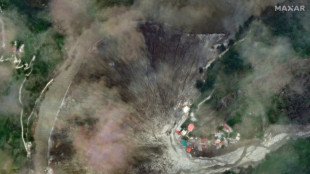

Two killed in European wildfires as heatwave intensifies

-

S.Africa to offer US new deal to avoid 30% tariff

S.Africa to offer US new deal to avoid 30% tariff

-

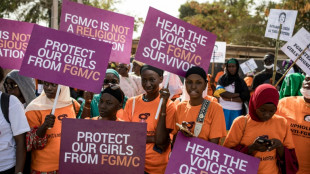

Gambia baby death heightens alarm over female genital mutilation

-

Soldier dies battling Montenegro wildfire

Soldier dies battling Montenegro wildfire

-

Last Liverpool goal had special meaning for Jota

-

Mixed crews introduced for 2027 America's Cup

Mixed crews introduced for 2027 America's Cup

-

Stocks rise on restrained US inflation

-

US consumer inflation holds steady but tariff worries persist

US consumer inflation holds steady but tariff worries persist

-

Brevis smashes record ton as South Africa level T20 series

-

EU ready to do plastic pollution deal 'but not at any cost'

EU ready to do plastic pollution deal 'but not at any cost'

-

China Evergrande Group says to delist from Hong Kong

-

In China's factory heartland, warehouses weather Trump tariffs

In China's factory heartland, warehouses weather Trump tariffs

-

Palace claim sporting merit 'meaningless' after Europa League demotion

-

Former Premier League referee Coote given eight-week ban over Klopp comments

Former Premier League referee Coote given eight-week ban over Klopp comments

-

Council of Europe cautions on weapon sales to Israel

-

The Elders group of global leaders warns of Gaza 'genocide'

The Elders group of global leaders warns of Gaza 'genocide'

-

Stocks gain on China-US truce, before key inflation data

-

Man killed in Spain wildfire as European heatwave intensifies

Man killed in Spain wildfire as European heatwave intensifies

-

US, China extend tariff truce for 90 days

-

Families mourn 40 years since deadly Japan Airlines crash

Families mourn 40 years since deadly Japan Airlines crash

-

Thai soldier wounded in Cambodia border landmine blast

-

PSG sign Ukrainian defender Illia Zabarnyi from Bournemouth

PSG sign Ukrainian defender Illia Zabarnyi from Bournemouth

-

PSG sign Ukrainian defender Illia Zabarnyi

-

Five Premier League talking points

Five Premier League talking points

-

Five talking points as Spain's La Liga begins

-

Markets boosted by China-US truce extension, inflation in focus

Markets boosted by China-US truce extension, inflation in focus

-

Japan boxing to adopt stricter safety rules after deaths of two fighters

-

France adopts law upholding ban on controversial insecticide

France adopts law upholding ban on controversial insecticide

-

Most markets rise as China-US truce extended, inflation in focus

-

Toll of India Himalayan flood likely to be at least 70

Toll of India Himalayan flood likely to be at least 70

-

Taylor Swift announces 12th album for 'pre pre-order'

-

Italian athlete dies at World Games in China

Italian athlete dies at World Games in China

-

AI porn victims see Hong Kong unprepared for threat

-

Two dead, 10 hospitalized in Pennsylvania steel plant explosions

Two dead, 10 hospitalized in Pennsylvania steel plant explosions

-

Steely Sinner advances amid Cincinnati power-failure chaos

-

Families forever scarred 4 years on from Kabul plane deaths

Families forever scarred 4 years on from Kabul plane deaths

-

Scientists find 74-million-year-old mammal fossil in Chile

-

Trump signs order to extend China tariff truce by 90 days

Trump signs order to extend China tariff truce by 90 days

-

Spanish police bust 'spiritual retreat' offering hallucinogenic drugs

-

Jellyfish force French nuclear plant shutdown

Jellyfish force French nuclear plant shutdown

-

Formerra Becomes North American Distributor for Syensqo PVDF

-

One dead, 10 hospitalized in Pennsylvania steel plant explosions

One dead, 10 hospitalized in Pennsylvania steel plant explosions

-

Trump meets with Intel CEO after demanding he resign

-

Stocks cautious before US inflation report

Stocks cautious before US inflation report

-

Sabalenka survives massive Cincinnati struggle with Raducanu

-

Trump says plans to test out Putin as Europe engages Ukraine

Trump says plans to test out Putin as Europe engages Ukraine

-

Straka skips BMW but will play PGA Tour Championship

-

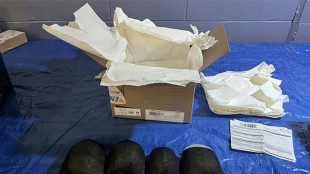

Chinese man pleads guilty in US to smuggling protected turtles

Chinese man pleads guilty in US to smuggling protected turtles

-

Trump sends troops to US capital, mulls wider crackdown

| RYCEF | 1.04% | 14.49 | $ | |

| RBGPF | 0% | 73.08 | $ | |

| AZN | 1.13% | 74.915 | $ | |

| GSK | 1.01% | 38.095 | $ | |

| VOD | 0.39% | 11.555 | $ | |

| RELX | -0.67% | 47.72 | $ | |

| RIO | 1.61% | 63.16 | $ | |

| BTI | -0.47% | 58.055 | $ | |

| CMSC | 0.13% | 23.09 | $ | |

| SCU | 0% | 12.72 | $ | |

| BP | 1.11% | 34.33 | $ | |

| NGG | -1.53% | 70.16 | $ | |

| SCS | 1.72% | 16.24 | $ | |

| BCC | 4.09% | 84.18 | $ | |

| CMSD | -0.05% | 23.56 | $ | |

| BCE | 2.05% | 24.86 | $ | |

| JRI | -0.27% | 13.354 | $ |

Stocks diverge as ECB rate cut looms, Trump tussles with Fed

European stock markets dropped Thursday following Asian gains as investors awaited an expected interest rate cut by the European Central Bank while US President Donald Trump blasted the head of the Federal Reserve.

Safe-haven investment gold hit a fresh record above $3,357.78 an ounce, while the dollar and oil prices firmed.

Fed chairman Jerome Powell warned on Wednesday that Trump's sweeping tariffs on virtually every trade partner could put the US central bank in the unenviable position of having to choose between tackling inflation and unemployment.

His comments led to sharp losses Wednesday on Wall Street, as did chip giant Nvidia flagging hefty costs it faced owing to the US-China trade war.

"All-in-all, the trade news and Powell's comments provided a tough backdrop for market," said a Deutsche Bank analyst note.

Trump hit back Thursday, slamming Powell for not lowering interest rates like the ECB has done and saying his "termination cannot come fast enough".

Eyes were on the ECB which is expected to cut interest rates again, with Trump's stop-start tariff announcements sowing concern in the eurozone.

Tokyo led Asian stocks higher as optimism over Japan-US trade talks offset Federal Reserve boss Jerome Powell's warning that Trump's tariffs could force officials to choose between fighting inflation or unemployment.

Investors are keeping a nervous eye on Washington as governments scramble to cut deals to avert crippling tariffs the US president unveiled on his April 2 "Liberation Day" but then delayed for 90 days.

"Tariffs continue to make the headlines, with Donald Trump claiming that 'big progress' had been made in talks with Japanese negotiators, aimed at lowering the hefty tariffs that the US will otherwise impose in under three months," noted Steve Clayton, head of equity funds at Hargreaves Lansdown.

With Japanese companies the biggest investors into the United States, Tokyo's negotiations are of particular interest to markets -- with some describing it as the canary in the coal mine -- and traders took heart from early signs.

Trump posted on social media that there had been "Big Progress!"

Tokyo's envoy Ryosei Akazawa said: "I understand that the US wants to make a deal within the 90 days. For our part, we want to do it as soon as possible."

While Japan's Prime Minister Shigeru Ishiba warned that the talks "won't be easy", he said the president had "expressed his desire to give the negotiations... the highest priority".

Hopes that Trump's blistering tariffs can be pared back have helped temper some of the disquiet on markets after a rout at the start of the month fuelled by talk of a global recession and an upending of historic trading norms.

- Key figures at 1130 GMT -

London - FTSE 100: DOWN 0.7 percent at 8,218.19 points

Paris - CAC 40: DOWN 0.8 percent at 7,268.90

Frankfurt - DAX: DOWN 0.6 percent at 21,178.14

Tokyo - Nikkei 225: UP 1.4 percent at 34,377.60 (close)

Hong Kong - Hang Seng Index: UP 1.6 percent at 21,395.14 (close)

Shanghai - Composite: UP 0.1 percent at 3,280.34 (close)

New York - Dow: DOWN 1.7 percent at 39,669.39 (close)

Euro/dollar: DOWN at $1.1368 from $1.1395 on Wednesday

Pound/dollar: DOWN $1.3234 at $1.3235

Dollar/yen: UP at 142.50 yen from 142.12 yen

Euro/pound: DOWN at 85.91 pence from 86.06 pence

Brent North Sea Crude: UP 1.0 percent at $66.51 per barrel

West Texas Intermediate: UP 1.2 percent at $62.55 per barrel

L.AbuAli--SF-PST