-

NBA approves $6.1bn sale of Boston Celtics

NBA approves $6.1bn sale of Boston Celtics

-

PSG beat Tottenham on penalties to win UEFA Super Cup after late comeback

-

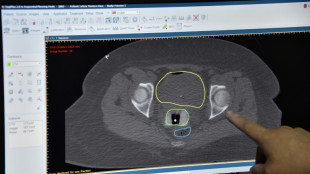

Cowboys owner Jones says experimental drug saved him after cancer diagnosis

Cowboys owner Jones says experimental drug saved him after cancer diagnosis

-

Striking Boeing defense workers turn to US Congress

-

PSG beat Tottenham on penalties to win UEFA Super Cup

PSG beat Tottenham on penalties to win UEFA Super Cup

-

Hong Kong court to hear closing arguments in mogul Jimmy Lai's trial

-

US singer Billy Joel to sell off motorcycles due to health condition

US singer Billy Joel to sell off motorcycles due to health condition

-

Barcelona's Ter Stegen validated as long-term injury by La Liga

-

Storm makes landfall in China after raking Taiwan as typhoon

Storm makes landfall in China after raking Taiwan as typhoon

-

Colombia buries assassinated presidential candidate

-

Zverev finishes overnight job at Cincinnati Open

Zverev finishes overnight job at Cincinnati Open

-

Bukele critics face long exile from El Salvador homeland

-

McIlroy 'shot down' suggestion of Ryder Cup playing captain role

McIlroy 'shot down' suggestion of Ryder Cup playing captain role

-

'Water lettuce' chokes tourism, fishing at El Salvador lake

-

Peru's president signs military crimes amnesty bill into law

Peru's president signs military crimes amnesty bill into law

-

At least 26 migrants dead in two shipwrecks off Italy

-

Root says Warner jibe 'all part of the fun' heading into Ashes

Root says Warner jibe 'all part of the fun' heading into Ashes

-

Plastic pollution treaty talks in disarray

-

Trump eyes three-way meeting with Putin, Zelensky

Trump eyes three-way meeting with Putin, Zelensky

-

'Viable' chance for Ukraine ceasefire thanks to Trump: UK PM

-

Vance visits US troops during UK trip

Vance visits US troops during UK trip

-

Premier League has no say on delay over Man City charges, says chief exec

-

Trump names Stallone, Strait among Kennedy Center honorees

Trump names Stallone, Strait among Kennedy Center honorees

-

Israeli military says approved plan for new Gaza offensive

-

Europeans urge Trump to push for Ukraine ceasefire in Putin summit

Europeans urge Trump to push for Ukraine ceasefire in Putin summit

-

Stocks extend gains on US rate-cut bets

-

Venus Williams receives wild card for US Open singles

Venus Williams receives wild card for US Open singles

-

Massive fire burns on mountain near western Canada city

-

Plastic pollution plague blights Asia

Plastic pollution plague blights Asia

-

Typhoon Podul pummels Taiwan, heads towards China

-

Russia in major Ukraine advance as Europe braces for Trump-Putin meet

Russia in major Ukraine advance as Europe braces for Trump-Putin meet

-

Stock markets extend gains on growing US rate cut hopes

-

Typhoon Podul pummels Taiwan, heads towards mainland

Typhoon Podul pummels Taiwan, heads towards mainland

-

In heatwave, Romans turn to vintage snow cones to stay cool

-

Russia in major Ukraine advance ahead of Trump-Putin meet in Alaska

Russia in major Ukraine advance ahead of Trump-Putin meet in Alaska

-

Ankara, Damascus top diplomats warn Israel over Syria action

-

Deadlocked plastics treaty talks 'at cliff's edge'

Deadlocked plastics treaty talks 'at cliff's edge'

-

Stock markets rise on growing US rate cut hopes

-

New cancer plan urged as survival improvements in England slow

New cancer plan urged as survival improvements in England slow

-

Japanese star convicted of indecent assault in Hong Kong

-

Thousands battle Greece fires as heatwave bakes Europe

Thousands battle Greece fires as heatwave bakes Europe

-

Woodman-Wickliffe lines up 'one last ride' for Black Ferns at World Cup

-

Bournemouth splash out on Diakite as Zabarnyi replacement

Bournemouth splash out on Diakite as Zabarnyi replacement

-

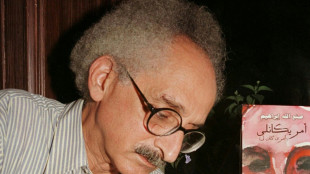

Renowned Egyptian novelist Sonallah Ibrahim dies at 88

-

Israel military says approved plan for new Gaza offensive

Israel military says approved plan for new Gaza offensive

-

Romero replaces Son as Spurs captain

-

150 species saved in England, but 'time running out' to halt decline

150 species saved in England, but 'time running out' to halt decline

-

Man Utd in 'no man's land' due to lack of plan, says Rashford

-

Musk clashes with Altman after accusing App Store of favoring OpenAI

Musk clashes with Altman after accusing App Store of favoring OpenAI

-

Zelensky, European leaders hope to sway Trump before Putin summit

Stocks retreat as US hits Nvidia chip export to China

European and Asian stock markets mostly retreated Wednesday after the US government imposed restrictions on exports of a key Nvidia chip to China, the latest trade war salvo between the world's biggest economies.

Nvidia late Tuesday notified regulators that it expects a $5.5 billion hit this quarter owing to a new US licensing requirement on the chip it can legally sell in the Asian country.

The company at the heart of helping to power artificial intelligence said it must obtain licenses to export its H20 chips to China because of concerns they may be used in supercomputers there.

President Donald Trump's decision over Nvidia is "signalling a tech-led decline for US equities" when Wall Street opens, noted Joshua Mahony, analyst at trading group Scope Markets.

After a relatively peaceful couple of days on markets following last week's tariff-fuelled ructions, investors were once again on the defensive, sending safe haven gold above $3,300 an ounce for the first time.

Nvidia shares tumbled around six percent in after-market trade, and its Asian suppliers were also hit.

Trump has also kicked off an investigation that could see tariffs imposed on critical minerals such as rare earths, which are used in a wide range of products including smartphones, wind turbines and electric vehicle motors.

"Nvidia dropped the mic, revealing fresh export curbs on AI gear headed to China," said Stephen Innes at SPI Asset Management.

"Then came the other shoe: Trump ordering a new probe into tariffs on critical minerals. Boom -- just like that, we're back in whiplash mode.

"Welcome to the new normal: one step forward, two tariff probes back," added Innes.

In Europe, London's benchmark FTSE 100 stocks index was down about 0.5 percent around midday, even as official data showed UK inflation slowed more than expected in March.

Paris and Frankfurt shed a similar amount.

The dollar slid once more against main rivals, helping gold to reach yet another fresh record high, this time at $3,317.75.

Oil prices rose nearly one percent after recent sharp falls on fears that the tariffs will dampen global economic growth.

However, cheaper oil could help put on lid on inflation, analysts said.

Trump's most recent moves mark the latest salvo in an increasingly nasty row that has seen Washington and Beijing hit each other with eye-watering tariffs.

China did little to soothe worries Wednesday by saying US levies were putting pressure on its economy, even if official data showed it expanded more than expected in the first quarter.

Beijing told Washington to "stop threatening and blackmailing".

A decision by Hong Kong's postal service to stop shipping US-bound goods in response to "bullying" levies added to the unease.

- Key figures around 1035 GMT -

London - FTSE 100: DOWN 0.4 percent at 8,220.27 points

Paris - CAC 40: DOWN 0.5 percent at 7,295.34

Frankfurt - DAX: DOWN 0.5 percent at 21,150.31

Tokyo - Nikkei 225: DOWN 1.0 percent at 33,920.40 (close)

Hong Kong - Hang Seng Index: DOWN 1.9 percent at 21,056.98 (close)

Shanghai - Composite: UP 0.3 percent at 3,276.00 (close)

New York - Dow: UP 0.4 percent at 40,368.96 (close)

Euro/dollar: UP at $1.1369 from $1.1291 on Tuesday

Pound/dollar: UP at $1.3272 from $1.3232

Dollar/yen: DOWN at 142.66 yen from 143.18 yen

Euro/pound: UP at 85.69 pence from 85.30 pence

Brent North Sea Crude: UP 0.9 percent at $65.23 per barrel

West Texas Intermediate: UP 0.9 percent at $61.87 per barrel

burs-bcp/lth

J.Saleh--SF-PST