-

Palou wins at Road America to boost IndyCar season lead

Palou wins at Road America to boost IndyCar season lead

-

Bumrah says 'fate' behind Brook's exit for 99 against India

-

Gout Gout says 100m 'too short' for him

Gout Gout says 100m 'too short' for him

-

Democrats assail 'erratic' Trump over Iran strikes

-

Iran threatens US bases in response to strikes on nuclear sites

Iran threatens US bases in response to strikes on nuclear sites

-

NBA Suns trade star forward Kevin Durant to Rockets

-

At least 20 killed in suicide attack on Damascus church

At least 20 killed in suicide attack on Damascus church

-

NATO strikes spending deal, but Spain exemption claim risks Trump ire

-

Queen's champion Alcaraz in the groove ahead of Wimbledon

Queen's champion Alcaraz in the groove ahead of Wimbledon

-

Yildiz stars as Juventus beat Wydad at Club World Cup

-

Bumrah and Brook shine to leave England-India opener in the balance

Bumrah and Brook shine to leave England-India opener in the balance

-

Pogba says he is talking to a club about comeback after ban

-

NBA Suns trade star forward Kevin Durant to Rockets: ESPN

NBA Suns trade star forward Kevin Durant to Rockets: ESPN

-

Muslim countries urge end to Israel's 'aggression' against Iran

-

'How to Train Your Dragon' holds top spot in N.America box office

'How to Train Your Dragon' holds top spot in N.America box office

-

Almeida wins time-trial to take Tour of Switzerland

-

Bublik sees off Medvedev to claim second title on grass in Halle

Bublik sees off Medvedev to claim second title on grass in Halle

-

Feyi-Waboso banned for England tour to Argentina

-

US strikes on Iran: what we know

US strikes on Iran: what we know

-

Alcaraz crowned king of Queen's for second time

-

US says strikes 'devastated' Iran's nuclear program

US says strikes 'devastated' Iran's nuclear program

-

Bublik sees off Medvedev to claim fifth AFP title in Halle

-

Freed Belarus opposition figure urges Trump to help release all prisoners

Freed Belarus opposition figure urges Trump to help release all prisoners

-

Wave of syringe attacks mar France's street music festival

-

US intervention 'devastated' Iran's nuclear programme says Pentagon

US intervention 'devastated' Iran's nuclear programme says Pentagon

-

Marc Marquez completes perfect Mugello weekend with Italian MotoGP triumph

-

Vondrousova warms up for Wimbledon with Berlin title

Vondrousova warms up for Wimbledon with Berlin title

-

India still on top in first Test despite Brook fifty for England

-

Ukraine army chief vows to expand strikes on Russia

Ukraine army chief vows to expand strikes on Russia

-

United behind Iran war effort, Israelis express relief at US bombing

-

Former England fast bowler David Lawrence dead at 61

Former England fast bowler David Lawrence dead at 61

-

At least three impacts in Israel during Iran missile attacks, 23 hurt

-

Trump says US strikes 'obliterated' Iran nuclear sites

Trump says US strikes 'obliterated' Iran nuclear sites

-

Japan's high-tech sunscreens tap into skincare craze

-

Tesla expected to launch long-discussed robotaxi service

Tesla expected to launch long-discussed robotaxi service

-

South Korea counts on shipbuilding to ease US tariff woes

-

Bombing Iran, Trump gambles on force over diplomacy

Bombing Iran, Trump gambles on force over diplomacy

-

Trump says US attack 'obliterated' Iran nuclear sites

-

Itoje to Valetini: five to watch when the Lions face Australia

Itoje to Valetini: five to watch when the Lions face Australia

-

Wallabies confident but wary of wounded British and irish Lions

-

Utopia and fragile democracy at Art Basel fair

Utopia and fragile democracy at Art Basel fair

-

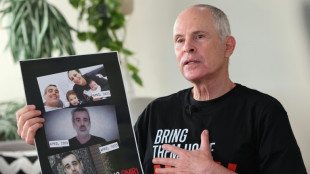

Freed Israeli hostage recounts 484-day nightmare in Gaza

-

River Plate frustrated by Monterrey in 0-0 stalemate

River Plate frustrated by Monterrey in 0-0 stalemate

-

Panama cuts internet, cell phones in restive province

-

Tens of thousands join pro-Palestinian marches across Europe

Tens of thousands join pro-Palestinian marches across Europe

-

Coach Penney unsure of return to Super Rugby champions Crusaders

-

Trump says US 'obliterated' Iran nuclear sites, threatens more

Trump says US 'obliterated' Iran nuclear sites, threatens more

-

Olympic chief Kirsty Coventry's steeliness honed by hard knocks

-

Outgoing IOC president Thomas Bach faced mammoth challenges

Outgoing IOC president Thomas Bach faced mammoth challenges

-

Maro Itoje comes of age with Lions captaincy

UniCredit gets ECB nod for Commerzbank stake

Italian banking giant UniCredit said Friday it had secured approval from the European Central Bank to buy up to 29.9 percent of Commerzbank, opening the door to a possible takeover of its German rival.

Commerzbank has vowed to fight any takeover and UniCredit's approach has angered German politicians, including outgoing Chancellor Olaf Scholz and his likely successor, Friedrich Merz, whose conservatives won elections last month.

UniCredit, Italy's second largest bank, said Friday it was "awaiting the opportunity to initiate a constructive dialogue with the new German government once formed".

It added that this and other factors meant that it would take longer than expected to make a decision on a takeover, with the timeline "now likely to extend well beyond the end of 2025".

The UniCredit-Commerzbank saga began in September when the Italian lender revealed it had built up a stake in its rival, triggering talk that chief executive Andrea Orcel wanted to push for an ambitious pan-European banking merger.

UniCredit has since boosted its holding in Germany's second-biggest bank to around 28 percent.

Commerzbank said the ECB's green light Friday "does not change the fundamental situation: UniCredit continues to be a shareholder of Commerzbank".

"We are convinced of our strategy, which aims for profitable growth and value increase, and we are focusing on its successful implementation," it said.

- Still many factors -

Last month, Commerzbank announced it planned to cut about 3,900 jobs -- around 10 percent of its workforce -- and hiked its financial targets, in a bid to boost attractiveness for shareholders and bolster defences against its Italian suitor.

The job cuts, to be implemented by 2028, come after the lender booked a record profit in 2024.

UniCredit on Friday welcomed "some positive change at Commerzbank, which, together with the recent more optimistic view on German macro (economy), has driven a substantial increase in the bank share price".

"However, only significant time will reveal if the plan is executable and hence determine whether such price appreciation is justified and sustainable," it said.

UniCredit said the ECB authorisation underscored its own "financial strength and regulatory compliance" but said there were "still many factors" that will determine its plans on Commerzbank.

"Several further approvals are still required before the around 18.5 percent shares held through derivatives can be converted into physical shares, including from the Germany Federal Cartel Office," it said.

Orcel said in January he would not rush a takeover, and was willing to walk away, but would wait until the outcome of Germany's elections.

Berlin still holds a 12-percent stake in the lender, the legacy of a government bailout during the 2008 global financial crisis.

Merz, who is in talks to form a coalition government after the February vote, described a possible bid for Commerzbank as "hostile" in an interview with The Economist magazine last month.

However, some EU policymakers have backed the idea of a tie-up, saying it would create a heavyweight better able to compete internationally.

M.Qasim--SF-PST