-

Thunder's Gilgeous-Alexander named NBA Finals MVP

Thunder's Gilgeous-Alexander named NBA Finals MVP

-

Thunder beat injury-hit Pacers in game seven to win NBA title

-

Oil prices spike after US strikes on Iran

Oil prices spike after US strikes on Iran

-

Man City demolish Al Ain to reach Club World Cup last 16

-

Thunder beat Pacers to clinch first NBA Finals crown

Thunder beat Pacers to clinch first NBA Finals crown

-

Bone collectors: searching for WWII remains in Okinawa

-

Madrid coach Alonso says Rudiger complained of racist insult in Club World Cup win

Madrid coach Alonso says Rudiger complained of racist insult in Club World Cup win

-

Girls shouldn't shout?: Women break the mould at French metal festival

-

Indian activists seek to save child brides

Indian activists seek to save child brides

-

Jonathan Anderson set for Dior debut at Paris Fashion Week

-

Ukraine says 'massive' Russian drone attack on Kyiv

Ukraine says 'massive' Russian drone attack on Kyiv

-

Oasis: from clash to cash

-

Toxic threat from 'forever chemicals' sparks resistance in Georgia towns

Toxic threat from 'forever chemicals' sparks resistance in Georgia towns

-

All Blacks name five debutants in squad for France Tests

-

Pacers' Haliburton hurt early in game seven against Thunder

Pacers' Haliburton hurt early in game seven against Thunder

-

Suicide attack on Damascus church kills at least 22

-

French police probe fake Disneyland 'marriage' with nine-year-old

French police probe fake Disneyland 'marriage' with nine-year-old

-

Ohtani bags strikeouts, home run as Dodgers rout Nats

-

Hall of Fame trainer Lukas ill, won't return to racing: Churchill Downs

Hall of Fame trainer Lukas ill, won't return to racing: Churchill Downs

-

US Ryder Cup captain Bradley edges Fleetwood to win PGA Travelers

-

Alonso says Rudiger complained of racist insult

Alonso says Rudiger complained of racist insult

-

Minjee Lee wins Women's PGA Championship for third major title

-

US bases in the Middle East

US bases in the Middle East

-

More than 20 killed in suicide attack on Damascus church

-

Ten-man Real Madrid show class in Pachuca win

Ten-man Real Madrid show class in Pachuca win

-

Blood, destruction at Damascus church after suicide attack

-

Tesla launches long-discussed robotaxi service

Tesla launches long-discussed robotaxi service

-

Palou wins at Road America to boost IndyCar season lead

-

Bumrah says 'fate' behind Brook's exit for 99 against India

Bumrah says 'fate' behind Brook's exit for 99 against India

-

Gout Gout says 100m 'too short' for him

-

Democrats assail 'erratic' Trump over Iran strikes

Democrats assail 'erratic' Trump over Iran strikes

-

Iran threatens US bases in response to strikes on nuclear sites

-

NBA Suns trade star forward Kevin Durant to Rockets

NBA Suns trade star forward Kevin Durant to Rockets

-

At least 20 killed in suicide attack on Damascus church

-

NATO strikes spending deal, but Spain exemption claim risks Trump ire

NATO strikes spending deal, but Spain exemption claim risks Trump ire

-

Queen's champion Alcaraz in the groove ahead of Wimbledon

-

Yildiz stars as Juventus beat Wydad at Club World Cup

Yildiz stars as Juventus beat Wydad at Club World Cup

-

Bumrah and Brook shine to leave England-India opener in the balance

-

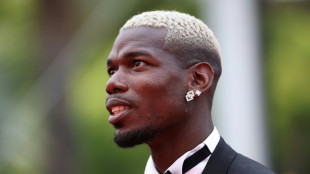

Pogba says he is talking to a club about comeback after ban

Pogba says he is talking to a club about comeback after ban

-

NBA Suns trade star forward Kevin Durant to Rockets: ESPN

-

Muslim countries urge end to Israel's 'aggression' against Iran

Muslim countries urge end to Israel's 'aggression' against Iran

-

'How to Train Your Dragon' holds top spot in N.America box office

-

Almeida wins time-trial to take Tour of Switzerland

Almeida wins time-trial to take Tour of Switzerland

-

Bublik sees off Medvedev to claim second title on grass in Halle

-

Feyi-Waboso banned for England tour to Argentina

Feyi-Waboso banned for England tour to Argentina

-

US strikes on Iran: what we know

-

Alcaraz crowned king of Queen's for second time

Alcaraz crowned king of Queen's for second time

-

US says strikes 'devastated' Iran's nuclear program

-

Bublik sees off Medvedev to claim fifth AFP title in Halle

Bublik sees off Medvedev to claim fifth AFP title in Halle

-

Freed Belarus opposition figure urges Trump to help release all prisoners

'Got cash?' Tunisians grapple with new restrictions on cheques

Olfa Meriah stands, frustrated, before a smartphone shop near the capital Tunis. How can she buy a phone in instalments, she wonders, when a new banking reform has made split payments nearly impossible?

In Tunisia, where the average monthly salary hovers just around 1,000 dinars ($320), people have long relied on post-dated cheques to make purchases by paying in increments over months.

Unlike many other countries where cheques are now rarely seen in the era of instant online payments, the culture of paying by cheque persists in Tunisia.

But as part of banking reforms introduced in February the government seeks to reinforce the original role of cheques as a means of immediate payment. Cheques had effectively become a form of credit often tolerated by merchants.

Unlike debit cards, credit cards are not widely available in the north African country.

The new law officially aims at "curbing consumer debt" and "improving the business climate" in an economy whose real GDP growth, according to the International Monetary Fund, is projected at just 1.6 percent for 2025.

But many feel it has also begun disrupting household budgets and small businesses.

Ridha Chkoundali, a university professor and economist, said the new law "could be the last straw" for consumption and economic growth.

He said the measure upsets Tunisians' customary consumer behaviour, with mainly the middle class bearing its brunt.

"Since it came out, I've been searching for ways to pay for a smartphone over several months without it eating away my salary," said Meriah, 43. "But the new cheques don't allow that."

Once a crucial pillar of Tunisia's economic and social stability, the middle class made up around 60 percent of the population before the country's 2011 revolution.

Experts now estimate it has fallen by more than half to 25 percent.

- 'Got cash? Welcome' -

Leila, the owner of the smartphone shop in the Tunis-area district of Ariana, told AFP her sales have fallen by more than half, after she started taking cash only.

"No one buys anything anymore," said Leila, who didn't give her last name. "We didn't understand the law because it's complicated and we don't trust it. We decided not to accept cheques anymore."

"Got cash? Welcome. If not, I'm sorry," she summed up.

Consumers are under even more pressure during the current Muslim holy fasting month of Ramadan.

Tunisians tend to buy more during Ramadan, stocking up on food and sweets as families gather for collective meals before and after their daytime fasting.

And as Eid al-Fitr -- the holiday marking the end of Ramadan -- approaches at the end of March, shopping for clothes and gifts rises.

Many merchants had already grown reluctant to deal with cheques when the previous finance law ordered harsh prison sentences for cheque kiting -- the fraudulent practice of issuing cheques with non-existent funds.

Last April, judicial authorities said they were investigating more than 11,000 bad-cheque cases.

This year's reform is meant to reduce those cases. Based on the buyer's income and assets, it has introduced a cap on the amount that cheques can be written for.

It also allows the merchant to check if the payer has enough funds upon each transaction by scanning a QR code on their cheque.

- 'Another recession' -

Many feel the measure is intrusive, and the technological shift already adds a level of complexity.

Badreddine Daboussi, who owns one of Tunis's oldest bookstores told AFP the change has crippled his sales, adding to an already waning demand for books.

"Before, customers paid with post-dated cheques, but now they can't, and the new online tool is complicated and unreliable."

"They just can't buy books anymore," he added, noting he had even considered closing up shop.

Tunisia, a country of more than 12 million people, has long suffered sporadic shortages of basic items such as milk, sugar and flour.

Its national debt has risen to around 80 percent of GDP and inflation is at six percent, according to official figures.

Hamza Meddeb, a research fellow at the Malcolm H Kerr Carnegie Middle East Center in Beirut, wrote in October that President Kais Saied -- who rejected IMF reforms -- has engaged in "economic improvisation" with "heavy reliance on domestic debt".

Chkoundali, the other analyst, warned of "another recession".

"As consumption shrinks, the already little economic growth we have will also decline," he said.

Unemployment is already at 16 percent nationwide, according to official figures.

Feeble consumption would help push that figure even higher, Chkoundali explained, with workers risking significant layoffs as profits dwindle.

O.Mousa--SF-PST