-

Oil dips, dollar firms after US strikes in Iran

Oil dips, dollar firms after US strikes in Iran

-

Paris Olympics and Paralympics cost taxpayer nearly 6 bn euros: state body

-

Eurozone business activity almost flat again in June

Eurozone business activity almost flat again in June

-

In Norway's Arctic, meteorologists have a first-row seat to climate change

-

Iran vows retaliation for US strikes as Israel keeps up attacks

Iran vows retaliation for US strikes as Israel keeps up attacks

-

Russian drone and missile barrage on Kyiv kills seven

-

Oil rises, dollar firms after US strikes in Iran

Oil rises, dollar firms after US strikes in Iran

-

'Noble to attend': Budapest prepares for 'banned' Pride march

-

Art market banking on new generation of collectors

Art market banking on new generation of collectors

-

Turning 80, UN faces fresh storm of doubts

-

'A great start': NBA crown just the beginning for Shai

'A great start': NBA crown just the beginning for Shai

-

Man City hit six to reach Club World Cup last 16, Real Madrid win with 10 men

-

Iran vows retaliation after US strikes on nuclear sites

Iran vows retaliation after US strikes on nuclear sites

-

'Massive' Russian attack on Kyiv kills at least five: Ukraine

-

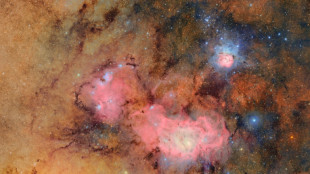

Groundbreaking Vera Rubin Observatory reveals first images

Groundbreaking Vera Rubin Observatory reveals first images

-

Thunder beat Pacers in game seven, cap stunning season with NBA crown

-

Pacers 'hearts dropped' after Haliburton injury: Carlisle

Pacers 'hearts dropped' after Haliburton injury: Carlisle

-

Ukraine says 'massive' Russian attack on Kyiv

-

Thunder's Gilgeous-Alexander named NBA Finals MVP

Thunder's Gilgeous-Alexander named NBA Finals MVP

-

Thunder beat injury-hit Pacers in game seven to win NBA title

-

Oil prices spike after US strikes on Iran

Oil prices spike after US strikes on Iran

-

Man City demolish Al Ain to reach Club World Cup last 16

-

Thunder beat Pacers to clinch first NBA Finals crown

Thunder beat Pacers to clinch first NBA Finals crown

-

Bone collectors: searching for WWII remains in Okinawa

-

Madrid coach Alonso says Rudiger complained of racist insult in Club World Cup win

Madrid coach Alonso says Rudiger complained of racist insult in Club World Cup win

-

Girls shouldn't shout?: Women break the mould at French metal festival

-

Indian activists seek to save child brides

Indian activists seek to save child brides

-

Jonathan Anderson set for Dior debut at Paris Fashion Week

-

Ukraine says 'massive' Russian drone attack on Kyiv

Ukraine says 'massive' Russian drone attack on Kyiv

-

Oasis: from clash to cash

-

Toxic threat from 'forever chemicals' sparks resistance in Georgia towns

Toxic threat from 'forever chemicals' sparks resistance in Georgia towns

-

All Blacks name five debutants in squad for France Tests

-

Pacers' Haliburton hurt early in game seven against Thunder

Pacers' Haliburton hurt early in game seven against Thunder

-

Suicide attack on Damascus church kills at least 22

-

French police probe fake Disneyland 'marriage' with nine-year-old

French police probe fake Disneyland 'marriage' with nine-year-old

-

Ohtani bags strikeouts, home run as Dodgers rout Nats

-

Hall of Fame trainer Lukas ill, won't return to racing: Churchill Downs

Hall of Fame trainer Lukas ill, won't return to racing: Churchill Downs

-

US Ryder Cup captain Bradley edges Fleetwood to win PGA Travelers

-

Alonso says Rudiger complained of racist insult

Alonso says Rudiger complained of racist insult

-

Minjee Lee wins Women's PGA Championship for third major title

-

US bases in the Middle East

US bases in the Middle East

-

More than 20 killed in suicide attack on Damascus church

-

Ten-man Real Madrid show class in Pachuca win

Ten-man Real Madrid show class in Pachuca win

-

Blood, destruction at Damascus church after suicide attack

-

Tesla launches long-discussed robotaxi service

Tesla launches long-discussed robotaxi service

-

Palou wins at Road America to boost IndyCar season lead

-

Bumrah says 'fate' behind Brook's exit for 99 against India

Bumrah says 'fate' behind Brook's exit for 99 against India

-

Gout Gout says 100m 'too short' for him

-

Democrats assail 'erratic' Trump over Iran strikes

Democrats assail 'erratic' Trump over Iran strikes

-

Iran threatens US bases in response to strikes on nuclear sites

US and European stocks gyrate on tariffs and growth

Wall Street stocks resumed their downward slide on Thursday amid uncertainty over US President Donald Trump's shifting trade policy, while European bourses advanced following an ECB interest rate cut.

Major US indices spent the entire day in the red, shrugging off Trump's moves to soften tariff actions.

Trump on Thursday unveiled a temporary rollback to steep tariffs targeting Canada and Mexico, broadening a step announced Wednesday that gave relief to the auto sector.

Stocks had rallied after the auto reprieve, but this time all three major indices dropped one percent or more.

Art Hogan of B. Riley Wealth Management said the uncertainty around trade policy is "affecting the real economy," dragging down consumer sentiment and business investment.

"The longer that goes on, the more the economy slows," he said.

In Europe, Frankfurt's DAX index hit a new record as plans for a massive German defense and infrastructure investment program stoked optimism for pulling the eurozone's largest economy out of recession.

France and other eurozone markets ended the day higher as the European Central Bank followed through with an expected quarter-point cut in interest rates.

But ECB President Christine Lagarde said that rising trade tensions could knock eurozone economic growth.

"We have risks all over and uncertainty all over," Lagarde added.

The ECB cut its growth forecasts for this year and the next while raising its 2025 inflation estimate.

Meanwhile, bond yields continued to climb, and the rise extended to Asia, with Japanese 10-year yields hitting 1.5 percent for the first time in more than a decade.

The increase signals expectations of higher inflation and that governments, companies and consumers will need to pay more to borrow.

- Asia rises -

Wednesday's announcement of the tariff delay buoyed Asian stock markets, in particular lifting the auto sector.

The move "helped reinforce hopes there may be some flexibility in the new administration's trade policy," said AJ Bell investment director Russ Mould.

Chinese stocks responded well to Beijing announcing its 2025 growth target of around five percent, at the start of its annual meeting of the National People's Congress on Wednesday.

The meeting has heightened investors' expectations that a huge fiscal stimulus package could be coming.

China has vowed to make domestic demand its main economic driver despite facing persistent economic headwinds, and as an escalating trade war with the US hit exports.

- Key figures around 2150 GMT -

New York - Dow: DOWN 1.0 percent at 42,579.08 (close)

New York - S&P 500: DOWN 1.8 percent at 5,738.52 (close)

New York - Nasdaq Composite: DOWN 2.6 percent at 18,069.26 (close)

London - FTSE 100: DOWN 0.8 percent at 8,682.84 (close)

Paris - CAC 40: UP 0.3 percent at 8,197.67 (close)

Frankfurt - DAX: UP 1.5 percent at 23,419.48 (close)

Tokyo - Nikkei 225: UP 0.8 percent at 37,704.93 (close)

Hong Kong - Hang Seng Index: UP 3.3 percent at 24,369.71 (close)

Shanghai - Composite: UP 1.2 percent at 3,381.10 (close)

Euro/dollar: DOWN at 1.0787 from 1.0789 on Wednesday

Pound/dollar: UP at $1.2882 from $1.2895

Dollar/yen: DOWN 147.97 from 148.88 yen

Euro/pound: UP at 83.72 pence from 83.67 pence

Brent North Sea Crude: UP 0.2 percent at 69.46 per barrel

West Texas Intermediate: FLAT at $66.31 per barrel

burs-jmb/des

M.Qasim--SF-PST