-

Oil dips, dollar firms after US strikes in Iran

Oil dips, dollar firms after US strikes in Iran

-

Paris Olympics and Paralympics cost taxpayer nearly 6 bn euros: state body

-

Eurozone business activity almost flat again in June

Eurozone business activity almost flat again in June

-

In Norway's Arctic, meteorologists have a first-row seat to climate change

-

Iran vows retaliation for US strikes as Israel keeps up attacks

Iran vows retaliation for US strikes as Israel keeps up attacks

-

Russian drone and missile barrage on Kyiv kills seven

-

Oil rises, dollar firms after US strikes in Iran

Oil rises, dollar firms after US strikes in Iran

-

'Noble to attend': Budapest prepares for 'banned' Pride march

-

Art market banking on new generation of collectors

Art market banking on new generation of collectors

-

Turning 80, UN faces fresh storm of doubts

-

'A great start': NBA crown just the beginning for Shai

'A great start': NBA crown just the beginning for Shai

-

Man City hit six to reach Club World Cup last 16, Real Madrid win with 10 men

-

Iran vows retaliation after US strikes on nuclear sites

Iran vows retaliation after US strikes on nuclear sites

-

'Massive' Russian attack on Kyiv kills at least five: Ukraine

-

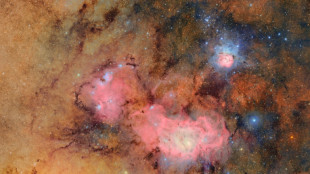

Groundbreaking Vera Rubin Observatory reveals first images

Groundbreaking Vera Rubin Observatory reveals first images

-

Thunder beat Pacers in game seven, cap stunning season with NBA crown

-

Pacers 'hearts dropped' after Haliburton injury: Carlisle

Pacers 'hearts dropped' after Haliburton injury: Carlisle

-

Ukraine says 'massive' Russian attack on Kyiv

-

Thunder's Gilgeous-Alexander named NBA Finals MVP

Thunder's Gilgeous-Alexander named NBA Finals MVP

-

Thunder beat injury-hit Pacers in game seven to win NBA title

-

Oil prices spike after US strikes on Iran

Oil prices spike after US strikes on Iran

-

Man City demolish Al Ain to reach Club World Cup last 16

-

Thunder beat Pacers to clinch first NBA Finals crown

Thunder beat Pacers to clinch first NBA Finals crown

-

Bone collectors: searching for WWII remains in Okinawa

-

Madrid coach Alonso says Rudiger complained of racist insult in Club World Cup win

Madrid coach Alonso says Rudiger complained of racist insult in Club World Cup win

-

Girls shouldn't shout?: Women break the mould at French metal festival

-

Indian activists seek to save child brides

Indian activists seek to save child brides

-

Jonathan Anderson set for Dior debut at Paris Fashion Week

-

Ukraine says 'massive' Russian drone attack on Kyiv

Ukraine says 'massive' Russian drone attack on Kyiv

-

Oasis: from clash to cash

-

Toxic threat from 'forever chemicals' sparks resistance in Georgia towns

Toxic threat from 'forever chemicals' sparks resistance in Georgia towns

-

All Blacks name five debutants in squad for France Tests

-

Pacers' Haliburton hurt early in game seven against Thunder

Pacers' Haliburton hurt early in game seven against Thunder

-

Suicide attack on Damascus church kills at least 22

-

French police probe fake Disneyland 'marriage' with nine-year-old

French police probe fake Disneyland 'marriage' with nine-year-old

-

Ohtani bags strikeouts, home run as Dodgers rout Nats

-

Hall of Fame trainer Lukas ill, won't return to racing: Churchill Downs

Hall of Fame trainer Lukas ill, won't return to racing: Churchill Downs

-

US Ryder Cup captain Bradley edges Fleetwood to win PGA Travelers

-

Alonso says Rudiger complained of racist insult

Alonso says Rudiger complained of racist insult

-

Minjee Lee wins Women's PGA Championship for third major title

-

US bases in the Middle East

US bases in the Middle East

-

More than 20 killed in suicide attack on Damascus church

-

Ten-man Real Madrid show class in Pachuca win

Ten-man Real Madrid show class in Pachuca win

-

Blood, destruction at Damascus church after suicide attack

-

Tesla launches long-discussed robotaxi service

Tesla launches long-discussed robotaxi service

-

Palou wins at Road America to boost IndyCar season lead

-

Bumrah says 'fate' behind Brook's exit for 99 against India

Bumrah says 'fate' behind Brook's exit for 99 against India

-

Gout Gout says 100m 'too short' for him

-

Democrats assail 'erratic' Trump over Iran strikes

Democrats assail 'erratic' Trump over Iran strikes

-

Iran threatens US bases in response to strikes on nuclear sites

ECB chief warns of 'risks all over' as rates cut again

European Central Bank chief Christine Lagarde warned Thursday the eurozone faces "risks all over" amid US tariff threats and massive German spending plans, as policymakers cut rates again but signalled future monetary easing was in doubt.

"We have huge uncertainty," Lagarde told a press conference after the ECB cut interest rates for the sixth time since June last year.

"We have risks all over, and uncertainty all over."

The quarter-percentage-point reduction brought the Frankfurt-based institution's benchmark deposit rate to 2.5 percent.

The central bank for the 20 countries that use the euro has pivoted from hiking rates to tackle inflation, which surged with Russia's invasion of invasion, to lowering them to boost the eurozone's floundering economy.

While insisting that the process of bringing inflation back down to the ECB's two-percent target remained on track, Lagarde listed multiple threats to the outlook, which made it hard to plot a path forward.

"Tariffs -- and particularly if there is retaliation -- are not good at all, and are net-negative on pretty much all accounts," she said, at a time when US President Donald Trump is threatening to hit the European Union with 25-percent duties.

- Tariff worries -

Worries about US trade policy had been pushing rate-setters towards hitting pause, according to analysts.

Now, plans announced by Germany's likely next leader to massively boost defence and infrastructure spending are adding to the factors complicating the ECB's decisions.

While noting such increases could lift both growth and inflation -- potentially prompting the ECB to slow rate cuts -- Lagarde also stressed that the proposal by Friedrich Merz was a "work in progress", with the extent of its impact still unclear.

Merz's dramatic move, announced Tuesday, was driven by fears that long-standing US security guarantees for Europe will be weakened under Trump amid a rush to end the war in Ukraine.

The ECB on Thursday also released updated forecasts that highlighted the euro area's economic woes.

The central bank hiked its inflation forecast for 2025 to 2.3 percent from its previous estimate of 2.1 percent, made in December.

The pace of consumer price rises in the eurozone had eased to 2.4 percent in February after having ticked up slightly over several months.

The ECB also trimmed its growth forecast for 2025 and 2026 to 0.9 percent and 1.2, respectively. The forecasts, however, were calculated before Merz's announcement on spending.

With the debate heating up on when to potentially pause cuts, the central bank tweaked its guidance to say rates were becoming "meaningfully less restrictive", suggesting they were no longer having a major impact on bringing down inflation.

Markets had been on the lookout for the change in language, which they believe could indicate that ECB officials are gearing up to hold rates or stop lowering them completely.

That change, combined with the warnings on uncertainty, signalled that "policymakers are clearly becoming more cautious about further rate cuts", said Jack Allen-Reynolds, deputy chief eurozone economist at Capital Economics.

Clemens Fuest, president of the Ifo economic research institute, went further: "Rising wages and the increase in new government borrowing could lead to inflation rising again instead of falling further -- there is likely to be little scope for further interest rate cuts."

- 'More than ever' -

Even before the German announcement, ECB policymakers were already asking how much further it should continue on the path to lower interest rates.

Isabel Schnabel, an influential ECB board member, told The Financial Times last month that policymakers were getting "closer to the point where we may have to pause or halt our rate cuts".

"We can no longer say with confidence that our monetary policy is still restrictive," she said.

With uncertainty so high, Lagarde said the ECB was going to follow this stance "more than ever".

"As I said repeatedly -- we are not pre-committing to any particular rate path," she said.

R.Shaban--SF-PST