-

Judge tells Australian mushroom murder jury to put emotion aside

Judge tells Australian mushroom murder jury to put emotion aside

-

Israel says 3 killed in Iran strike after Trump's ceasefire announcement

-

Messi's Miami and PSG progress to set up Club World Cup reunion

Messi's Miami and PSG progress to set up Club World Cup reunion

-

Rock on: how crushed stone could help fight climate change

-

Porto, Al Ahly out after sharing eight goals in thriller

Porto, Al Ahly out after sharing eight goals in thriller

-

Glamour, gripes as celebs head to Venice for exclusive Bezos wedding

-

Messi to face PSG after Miami and Palmeiras draw to go through

Messi to face PSG after Miami and Palmeiras draw to go through

-

Schmidt warned he must release Wallabies for Lions warm-ups

-

Palmeiras fight back against Inter Miami - both teams through

Palmeiras fight back against Inter Miami - both teams through

-

With missiles overhead, Tel Aviv residents huddle underground

-

Virgin Australia surges in market comeback

Virgin Australia surges in market comeback

-

Asian stocks up as Trump announces Iran-Israel ceasefire

-

Flatterer-in-chief: How NATO's Rutte worked to win over Trump

Flatterer-in-chief: How NATO's Rutte worked to win over Trump

-

Iran signals halt to strikes if Israel stops

-

NATO summit seeks to keep Trump happy -- and alliance united

NATO summit seeks to keep Trump happy -- and alliance united

-

Russian drone attacks kill three in northeast Ukraine

-

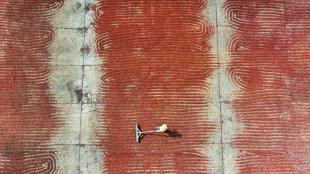

Better than gold: how Ecuador cashed in on surging cocoa prices

Better than gold: how Ecuador cashed in on surging cocoa prices

-

Millions in US sweat out first extreme heat wave of year

-

Pro-Palestinian protest leader details 104 days spent in US custody

Pro-Palestinian protest leader details 104 days spent in US custody

-

Gender not main factor in attacks on Egyptian woman pharaoh: study

-

'Throwing the book away' with no preparation for next season: Bayern's Kompany

'Throwing the book away' with no preparation for next season: Bayern's Kompany

-

Trump announces ceasefire between Iran and Israel

-

US Supreme Court allows third country deportations to resume

US Supreme Court allows third country deportations to resume

-

Oil prices tumble as markets shrug off Iranian rebuttal to US

-

Rishabh Pant: India's unorthodox hero with 'method to his madness'

Rishabh Pant: India's unorthodox hero with 'method to his madness'

-

PSG ease past Seattle Sounders and into Club World Cup last 16

-

Atletico win in vain as Botafogo advance at Club World Cup

Atletico win in vain as Botafogo advance at Club World Cup

-

Osaka, Azarenka advance on grass at Bad Homburg

-

Haliburton latest NBA star with severe injury in playoffs

Haliburton latest NBA star with severe injury in playoffs

-

Trump wants quick win in Iran, but goal remains elusive

-

Iran attacks US base in Qatar, Trump says time to make peace

Iran attacks US base in Qatar, Trump says time to make peace

-

Kasatkina falls, Fonseca secures first win on grass at Eastbourne

-

Iran attacks US base in Qatar in retaliation for strikes on nuclear sites

Iran attacks US base in Qatar in retaliation for strikes on nuclear sites

-

Club World Cup prize money does not mean more pressure: Chelsea boss Maresca

-

Leeds sign Slovenia defender Bijol from Udinese

Leeds sign Slovenia defender Bijol from Udinese

-

E.coli can turn plastic into painkillers, chemists discover

-

Bluff and last-minute orders: Trump's path to Iran decision

Bluff and last-minute orders: Trump's path to Iran decision

-

US strikes on Iran open rift in Trump's support base

-

Indiana's Haliburton has torn right Achilles tendon: reports

Indiana's Haliburton has torn right Achilles tendon: reports

-

England rally after Pant heroics to set up thrilling finish to India opener

-

US hit by first extreme heat wave of the year

US hit by first extreme heat wave of the year

-

Holders Thailand among seven set for LPGA International Crown

-

England set 371 to win India series opener after Pant heroics

England set 371 to win India series opener after Pant heroics

-

UK and Ukraine agree to deepen ties as Zelensky meets Starmer

-

New York state to build nuclear power plant

New York state to build nuclear power plant

-

Syria announces arrests over Damascus church attack

-

Bradley eyes playing captain role at Ryder Cup after win

Bradley eyes playing captain role at Ryder Cup after win

-

US existing home sales little-changed on sluggish market

-

Top US court takes case of Rastafarian whose hair was cut in prison

Top US court takes case of Rastafarian whose hair was cut in prison

-

Greece declares emergency on Chios over wildfires

BP ditches climate targets in pivot back to oil and gas

British energy giant BP launched a major pivot back to its more profitable oil and gas business Wednesday, shelving its once industry-leading targets on reducing carbon emissions and slashing clean energy investment.

The strategy overhaul comes after a difficult trading year for BP, which is under pressure from investors to boost its share price as countries look to slash emissions.

"We are reducing and reallocating capital expenditure to our highest-returning businesses to drive growth," chief executive Murray Auchincloss said in a statement ahead of a presentation to investors in London.

"This is a reset BP, with an unwavering focus on growing long-term shareholder value," he added.

To the dismay of environmentalists, the group will cut cleaner energy investment by more than $5 billion annually, while retiring targets on cutting emissions.

BP on Wednesday claimed it had reduced emissions by more than expected. Its carbon-cutting targets, announced in 2020, had stood out at the time as one of the most ambitious in the industry.

- Clean energy reset -

BP will increase oil and gas investment to around $10 billion per year, making up two-thirds of capital expenditure, it added Wednesday.

The group will grow oil and gas production up to 2.5 million barrels a day in 2030, in a major pivot away from previous plans to cut output of fossil fuels.

"This is positive proof that fossil fuel companies can't or won't be part of climate crisis solutions," senior climate adviser for Greenpeace UK, Charlie Kronick, said in reaction.

"This conversation is over."

BP plans to also offload assets worth a total of $20 billion by 2027, including from the potential sale of its Castrol lubricants division.

The much-anticipated update comes after BP suffered a 97-percent slump in net profit last year.

Its profit after tax tumbled to $381 million from $15.2 billion in 2023 in the face of higher costs as well as weaker oil and gas prices.

Total revenue dropped nine percent to $195 billion.

Auchincloss had already put emphasis on oil and gas to boost profits, scaling back on the group's key climate targets since taking the helm at the start of 2024.

The energy group has embarked on a plan to find $2 billion in cost savings and recently axed 4,700 staff jobs, or around five percent of its workforce.

Ahead of the investor day, it has widely been reported that US activist investor Elliott Investment Management has built a significant stake in BP.

The fund is known for forcing through corporate changes within groups it invests in, signalling further upheaval ahead for BP, analysts said.

British rival Shell and other oil majors have also cut back on clean energy objectives.

On the eve of BP's update, TotalEnergies chief executive Patrick Pouyanne said that while oil and gas would continue to be produced, "you need to produce it differently with much lower emissions".

The head of the French giant was speaking Tuesday at International Energy Week, an annual gathering in London of major players from across the sector.

Shell the same day forecast global demand for liquefied natural gas to rise by about 60 percent by 2040.

It forecast that this would be "largely driven by economic growth in Asia, emissions reductions in heavy industry and transport as well as the impact of artificial intelligence".

Gas is being touted by energy companies as cleaner than other fossil fuels as countries around the world strive to reduce their emissions and slow global warming.

O.Salim--SF-PST