-

French Open sensation Boisson falls in Wimbledon qualifying

French Open sensation Boisson falls in Wimbledon qualifying

-

US Fed chair to signal no rush for rate cuts despite Trump pressure

-

England lay foundation for victory charge against India

England lay foundation for victory charge against India

-

EU lawmakers vote to bar carry-on luggage fees on planes

-

Wimbledon plan to honour Murray with statue

Wimbledon plan to honour Murray with statue

-

Russian strikes kill 7, wound dozens in Dnipro

-

Trump says Iran-Israel truce holds after berating both countries

Trump says Iran-Israel truce holds after berating both countries

-

Oil slides, stocks jump amid Iran-Israel ceasefire uncertainty

-

Ceasefire in Iran-Israel war takes hold

Ceasefire in Iran-Israel war takes hold

-

Former India spinner Dilip Doshi dies aged 77

-

Edwards appointed Middlesbrough manager

Edwards appointed Middlesbrough manager

-

German budget plans outline vast spending - and record debt

-

Deadly dengue fever impacts climate-hit Bangladesh coast

Deadly dengue fever impacts climate-hit Bangladesh coast

-

France orders Tesla to end 'deceptive commercial practices'

-

France charges Briton over staged Disneyland 'marriage' with child

France charges Briton over staged Disneyland 'marriage' with child

-

Israel says agreed to Trump plan for ceasefire with Iran

-

Brazil records 62% jump in area burned by forest fires: monitor

Brazil records 62% jump in area burned by forest fires: monitor

-

It will be 'big and punchy': Athletics chief Coe looks to future

-

India's Pant reprimanded for dissent in first Test

India's Pant reprimanded for dissent in first Test

-

Oil prices drop as Israel agrees to ceasefire proposal

-

UK aims to tackle Google dominance of online search

UK aims to tackle Google dominance of online search

-

'Not at the level': Atletico left to ruminate after Club World Cup KO

-

Border confusion as Thailand shuts land crossings with Cambodia

Border confusion as Thailand shuts land crossings with Cambodia

-

Vietnam puts 41 on trial in $45 mn corruption case

-

World facing 'most complex' situation in decades: WEF

World facing 'most complex' situation in decades: WEF

-

Trial of Sean Combs approaches final stretch

-

Panama says has regained 'control' of restive province after months of protests

Panama says has regained 'control' of restive province after months of protests

-

Trump says Iran-Israel ceasefire in force

-

Pharrell bigs up brown denim as Paris fashion week starts

Pharrell bigs up brown denim as Paris fashion week starts

-

'Companions' ease pain of China's bustling, bamboozling hospitals

-

Japan PM to face tough upper house election on July 20

Japan PM to face tough upper house election on July 20

-

Judge tells Australian mushroom murder jury to put emotion aside

-

Israel says 3 killed in Iran strike after Trump's ceasefire announcement

Israel says 3 killed in Iran strike after Trump's ceasefire announcement

-

Messi's Miami and PSG progress to set up Club World Cup reunion

-

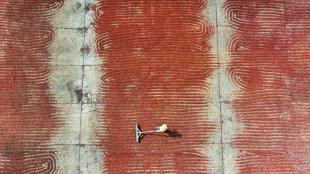

Rock on: how crushed stone could help fight climate change

Rock on: how crushed stone could help fight climate change

-

Porto, Al Ahly out after sharing eight goals in thriller

-

Glamour, gripes as celebs head to Venice for exclusive Bezos wedding

Glamour, gripes as celebs head to Venice for exclusive Bezos wedding

-

Messi to face PSG after Miami and Palmeiras draw to go through

-

Schmidt warned he must release Wallabies for Lions warm-ups

Schmidt warned he must release Wallabies for Lions warm-ups

-

Palmeiras fight back against Inter Miami - both teams through

-

With missiles overhead, Tel Aviv residents huddle underground

With missiles overhead, Tel Aviv residents huddle underground

-

Virgin Australia surges in market comeback

-

Asian stocks up as Trump announces Iran-Israel ceasefire

Asian stocks up as Trump announces Iran-Israel ceasefire

-

Flatterer-in-chief: How NATO's Rutte worked to win over Trump

-

Iran signals halt to strikes if Israel stops

Iran signals halt to strikes if Israel stops

-

NATO summit seeks to keep Trump happy -- and alliance united

-

Russian drone attacks kill three in northeast Ukraine

Russian drone attacks kill three in northeast Ukraine

-

Better than gold: how Ecuador cashed in on surging cocoa prices

-

Millions in US sweat out first extreme heat wave of year

Millions in US sweat out first extreme heat wave of year

-

Pro-Palestinian protest leader details 104 days spent in US custody

Stock markets rise as Alibaba fuels Hong Kong tech rally

European and Asian markets rose on Friday, with Hong Kong leading the way thanks to a surge in tech stocks led by e-commerce titan Alibaba.

The gains followed a week marked by uncertainty as traders weighed the economic outlook in light of Donald Trump's tariffs drive and geopolitical machinations.

Asian equities led gains, with Shanghai rising and Hong Kong piling on more four percent to hit a three-year high fuelled by tech firms.

“The gains in Hong Kong and China came amid renewed excitement about the tech sector in the region as Alibaba announced big AI spending plans," said AJ Bell investment director Russ Mould.

China's Alibaba rocketed more than 14 percent following its forecast-busting earnings figures the previous day. The firm has bounced nearly 70 percent higher since the turn of the year.

Other household names pushed the Hang Seng Index higher, Tencent added more than six percent, JD.com and XD Inc gained more than five percent.

China's tech sector has been on a roll this year, and has been given an extra boost since startup DeepSeek unveiled a chatbot that upended the global AI sector.

In the eurozone, Paris and Frankfurt stock markets rose after a closely watch survey showed that business activity grew again albeit at a very small pace.

London's FTSE 100 also edged up, shrugging off the same survey that showed UK private sector activity was little changed from a month earlier.

The euro retreated against the dollar ahead of the German election on Sunday, with investors expecting a more expansionary fiscal policy from Berlin to revive Europe's largest economy.

"The election comes against a difficult backdrop for Germany right now, as their economy has just experienced two consecutive annual contractions over 2023 and 2024," said Deutsche Bank's Jim Reid.

Meanwhile, disappointing earnings from retail titan Walmart sparked worries about the impact of US consumer activity on the world's top economy, with all three main Wall Street indexes ending in negative territory.

In Tokyo, the yen retreated after Japanese Finance Minister Katsunobu Kato said Friday that rising government bond yields -- which are at their highest since 1999 -- could weigh on economic growth.

That dented expectations the Bank of Japan will announce a series of rate hikes this year, even as data showed Japanese core inflation hit a 19-month high.

Nissan shares jumped nearly 10 percent in Tokyo after a report that a Japanese group including a former prime minister plans to ask US electric vehicle giant Tesla to invest in the automaker.

- Key figures around 1100 GMT -

London - FTSE 100: UP 0.2 percent at 8,680.95 points

Paris - CAC 40: UP 0.7 percent at 8,175.77

Frankfurt - DAX: UP 0.3 percent at 22,375.42

Tokyo - Nikkei 225: UP 0.3 percent at 38,776.94 (close)

Hong Kong - Hang Seng Index: UP 4.0 percent at 23,477.92 (close)

Shanghai - Composite: UP 0.9 percent at 3,379.11 (close)

New York - Dow: DOWN 1.0 percent at 44,176.65 (close)

Euro/dollar: DOWN at $1.0466 from $1.0505 on Thursday

Pound/dollar: DOWN at $1.2646 from $1.2668

Dollar/yen: UP at 150.37 from 149.65 yen

Euro/pound: DOWN at 82.75 pence from 82.90 pence

West Texas Intermediate: DOWN 1.0 percent at $71.75 per barrel

Brent North Sea Crude: DOWN 0.9 percent at $75.75 per barrel

Z.AlNajjar--SF-PST