-

Trial of Sean 'Diddy' Combs heads into closing arguments

Trial of Sean 'Diddy' Combs heads into closing arguments

-

Wallabies release Reds pair Faessler and Paisami for Lions clash

-

UN Charter: a founding document violated and ignored

UN Charter: a founding document violated and ignored

-

Vinicius, Mbappe have to defend: Real Madrid's Alonso

-

US teen Cooper Flagg chosen by Mavericks with top pick in NBA draft

US teen Cooper Flagg chosen by Mavericks with top pick in NBA draft

-

Guardiola says City must be ready to 'suffer' in Orlando heat

-

NBA studying uptick of Achilles injuries - Silver

NBA studying uptick of Achilles injuries - Silver

-

Pacquiao 'hungry' for comeback after four-year layoff

-

'Job done': Sundowns coach proud despite Club World Cup exit

'Job done': Sundowns coach proud despite Club World Cup exit

-

RFK Jr vaccine panel targets childhood vaccinations in first meeting

-

Tech giants' net zero goals verging on fantasy: researchers

Tech giants' net zero goals verging on fantasy: researchers

-

Australia quicks hit back after strong West Indies bowling effort

-

Dortmund through to Club World Cup last 16, Fluminense deny Sundowns

Dortmund through to Club World Cup last 16, Fluminense deny Sundowns

-

Judge orders Trump admin to release billions in EV charging funds

-

Sale of NBA's $10 bn Lakers expected to close this year

Sale of NBA's $10 bn Lakers expected to close this year

-

US Fed proposes easing key banking rule

-

Nvidia hits fresh record while global stocks are mixed

Nvidia hits fresh record while global stocks are mixed

-

Elliott-inspired England to play Germany in Under-21 Euros final

-

Gunmen kill 11 in crime-hit Mexican city

Gunmen kill 11 in crime-hit Mexican city

-

Mbappe absent from Real Madrid squad for Salzburg Club World Cup clash

-

Sainz opts out of race for FIA presidency

Sainz opts out of race for FIA presidency

-

Shamar Joseph rips through Australia top order in first Test

-

Court rejects EDF complaint over Czech nuclear tender

Court rejects EDF complaint over Czech nuclear tender

-

Mbappe returns to Real Madrid training at Club World Cup

-

Kenya anniversary protests turn violent, 8 dead

Kenya anniversary protests turn violent, 8 dead

-

Elliott double fires England into Under-21 Euros final

-

Trans campaigners descend on UK parliament to protest 'bathroom ban'

Trans campaigners descend on UK parliament to protest 'bathroom ban'

-

New York mayoral vote floors Democratic establishment

-

Trump claims 'win' as NATO agrees massive spending hike

Trump claims 'win' as NATO agrees massive spending hike

-

EU probes Mars takeover of Pringles maker Kellanova

-

Sidelined Zelensky still gets Trump face time at NATO summit

Sidelined Zelensky still gets Trump face time at NATO summit

-

Mexico president threatens to sue over SpaceX rocket debris

-

Amazon tycoon Bezos arrives in Venice for lavish wedding

Amazon tycoon Bezos arrives in Venice for lavish wedding

-

Shamar Joseph gives West Indies strong start against Australia

-

Raducanu's Wimbledon build-up hit by Eastbourne exit

Raducanu's Wimbledon build-up hit by Eastbourne exit

-

RFK Jr.'s vaccine panel opens amid backlash over fabricated study

-

'You try not to bump into things:' blind sailing in Rio

'You try not to bump into things:' blind sailing in Rio

-

Trump says 'three or four' candidates in mind for Fed chief

-

Trump teases Iran talks next week, says nuclear programme set back 'decades'

Trump teases Iran talks next week, says nuclear programme set back 'decades'

-

Turkey tussles with Australia to host 2026 UN climate talks

-

Bielle-Biarrey 'fit' for Top 14 final after suffering concussion

Bielle-Biarrey 'fit' for Top 14 final after suffering concussion

-

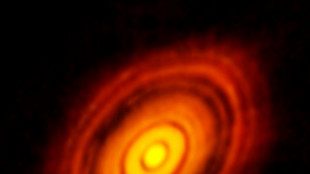

James Webb telescope discovers its first exoplanet

-

Kenya's Kipyegon seeks history with four minute mile attempt

Kenya's Kipyegon seeks history with four minute mile attempt

-

Gunmen kill 10 in crime-hit Mexican city

-

Olympic surfing venue battling erosion threat

Olympic surfing venue battling erosion threat

-

Relief, joy as Israel reopens after Iran war ceasefire

-

Spain upholds fine against Rubiales for Hermoso forced kiss

Spain upholds fine against Rubiales for Hermoso forced kiss

-

Iran hangs three more accused of spying as fears grow for Swede

-

Australia choose to bat first in first Test against West Indies

Australia choose to bat first in first Test against West Indies

-

Gambhir backs India bowlers to 'deliver' despite first Test misery

BP pledges strategic 'reset' as profit tumbles

Britain's BP on Tuesday said its annual net profit slumped 97 percent last year, as the struggling oil and gas giant pledged to "fundamentally reset" its strategy.

Profit after tax tumbled to $381 million in 2024 from $15.2 billion in 2023, owing to weaker refining margins, asset write-downs and unfavourable accounting effects linked to gas prices, BP said in a results statement.

Total revenues dropped nine percent to $195 billion.

"We now plan to fundamentally reset our strategy and drive further improvements in performance," said chief executive Murray Auchincloss.

He said it would be a "new direction for BP", which is set to be revealed at an eagerly anticipated investor day on February 26.

Auchincloss has put the emphasis on oil and gas to boost profits, scaling back on the group's key climate targets since taking the helm just over a year ago.

Last year BP announced it would "significantly reduce" investment in renewable energy through the end of the decade.

- Activist investor -

This week it was widely reported that US activist investor Elliott Investment Management had built a significant stake in BP, sending its share price soaring on Monday.

The fund is known for forcing through corporate changes within groups it invests in, signalling further upheaval ahead for BP, analysts said.

"Expectations were low going into the final quarter and full-year numbers and, unfortunately, BP has duly delivered," said Richard Hunter, head of markets at investment platform Interactive Investor.

The company's share price dipped slightly on London's FTSE 100 index in reaction to the results.

The investor day is considered a crucial test for the future of the company that has lagged behind other oil majors including rivals Shell, ExxonMobil and Chevron.

BP has already embarked on a plan to find $2 billion in cost savings and last month axed 4,700 staff jobs, or around five percent of its workforce.

BP has also scaled back its climate plans with a target of reducing carbon emissions by 20-30 percent by the end of this decade compared to 2019 levels.

This is down from a previous target of 35-40 percent.

British rival Shell and other oil majors, including France's TotalEnergies and Norwegian firm Equinor, have also cut back on clean energy objectives.

Investors have speculated that BP could abandon its pledge to reduce oil production by 25 percent by 2030 compared to its 2019 levels.

Faced with lower oil and gas prices, Shell also reported a drop to its annual net profits for 2024 last month.

K.AbuDahab--SF-PST