-

'Nowhere to sleep': Melissa upends life for Jamaicans

'Nowhere to sleep': Melissa upends life for Jamaicans

-

Irish octogenarian enjoys new lease on life making harps

-

Tanzania blackout after election chaos, deaths feared

Tanzania blackout after election chaos, deaths feared

-

G7 meets on countering China's critical mineral dominance

-

Trump hails tariff, rare earth deal with Xi

Trump hails tariff, rare earth deal with Xi

-

Court rules against K-pop group NewJeans in label dispute

-

India's Iyer says 'getting better by the day' after lacerated spleen

India's Iyer says 'getting better by the day' after lacerated spleen

-

Yesavage fairytale carries Blue Jays to World Series brink

-

Bank of Japan keeps interest rates unchanged

Bank of Japan keeps interest rates unchanged

-

Impoverished Filipinos forge a life among the tombstones

-

Jokic posts fourth straight triple-double as Nuggets rout Pelicans

Jokic posts fourth straight triple-double as Nuggets rout Pelicans

-

UN calls for end to Sudan siege after mass hospital killings

-

Teenage Australian cricketer dies after being hit by ball

Teenage Australian cricketer dies after being hit by ball

-

As Russia advances on Kupiansk, Ukrainians fear second occupation

-

Trade truce in balance as Trump meets 'tough negotiator' Xi

Trade truce in balance as Trump meets 'tough negotiator' Xi

-

China to send youngest astronaut, mice on space mission this week

-

Yesavage gem carries Blue Jays to brink of World Series as Dodgers downed

Yesavage gem carries Blue Jays to brink of World Series as Dodgers downed

-

With inflation under control, ECB to hold rates steady again

-

Asia stocks muted with all eyes on Trump-Xi meeting

Asia stocks muted with all eyes on Trump-Xi meeting

-

Personal tipping points: Four people share their climate journeys

-

Moto3 rider Dettwiler 'no longer critical' after crash: family

Moto3 rider Dettwiler 'no longer critical' after crash: family

-

US economy in the dark as government shutdown cuts off crucial data

-

Trump orders nuclear testing resumption ahead of Xi talks

Trump orders nuclear testing resumption ahead of Xi talks

-

'Utter madness': NZ farmers agree dairy sale to French group

-

Samsung posts 32% profit rise on-year in third quarter

Samsung posts 32% profit rise on-year in third quarter

-

30 years after cliffhanger vote, Quebec separatists voice hope for independence

-

Taxes, labor laws, pensions: what Milei wants to do next

Taxes, labor laws, pensions: what Milei wants to do next

-

South Sudan's blind football team dreams of Paralympic glory

-

US says 4 killed in new strike on alleged Pacific drug boat

US says 4 killed in new strike on alleged Pacific drug boat

-

What we do and don't know about Rio's deadly police raid

-

'They slit my son's throat' says mother of teen killed in Rio police raid

'They slit my son's throat' says mother of teen killed in Rio police raid

-

Arteta hails 'special' Dowman after 15-year-old makes historic Arsenal start

-

Google parent Alphabet posts first $100 bn quarter as AI fuels growth

Google parent Alphabet posts first $100 bn quarter as AI fuels growth

-

Underwater 'human habitat' aims to allow researchers to make weeklong dives

-

Maresca slams Delap for 'stupid' red card in Chelsea win at Wolves

Maresca slams Delap for 'stupid' red card in Chelsea win at Wolves

-

'Non-interventionist' Trump flexes muscles in Latin America

-

Slot defends League Cup selection despite not meeting 'Liverpool standards'

Slot defends League Cup selection despite not meeting 'Liverpool standards'

-

'Poor' PSG retain Ligue 1 lead despite stalemate and Doue injury

-

Kane nets twice in German Cup as Bayern set European wins record

Kane nets twice in German Cup as Bayern set European wins record

-

Liverpool crisis mounts after League Cup exit against Palace

-

Juve bounce back after Tudor sacking as Roma, Inter keep pace with leaders Napoli

Juve bounce back after Tudor sacking as Roma, Inter keep pace with leaders Napoli

-

Kane scores twice as Bayern set European wins record

-

Radio Free Asia suspends operations after Trump cuts and shutdown

Radio Free Asia suspends operations after Trump cuts and shutdown

-

Meta shares sink as $16 bn US tax charge tanks profit

-

Dollar rises after Fed chair says December rate cut not a given

Dollar rises after Fed chair says December rate cut not a given

-

Google parent Alphabet posts first $100 bn quarter as AI drives growth

-

Rob Jetten: ex-athlete setting the pace in Dutch politics

Rob Jetten: ex-athlete setting the pace in Dutch politics

-

Juve bounce back after Tudor sacking as Roma keep pace with leaders Napoli

-

Favorite Sovereignty scratched from Breeders' Cup Classic after fever

Favorite Sovereignty scratched from Breeders' Cup Classic after fever

-

Doue injured as PSG held at Lorient in Ligue 1

Asian markets enjoy much-needed rally as Fed's big day arrives

Asian markets enjoyed some respite Wednesday from the hefty selling at the start of the week, with focus on the end of the Federal Reserve's policy meeting later in the day, when traders hope it will provide much-needed guidance on its plans for hiking interest rates.

After weeks of uncertainty, the US central bank will finally deliver its views on the state of the world's top economy and how officials plan to tackle inflation that is now at a four-decade high without knocking its recovery off course.

Minutes from its December gathering pointed to a more hawkish tilt, with plans to speed up the taper of its vast bond-buying programme, the selling of the assets it already has and three or four rate increases before the end of the year.

While boss Jerome Powell pledged any tightening would be carefully calibrated, the prospect of higher borrowing costs has rattled markets across the world with most key indexes deep in the red from the start of the year, with Wall Street particularly hard hit.

His comments after the meeting will be pored over for signs of the Fed's plans, which most commentators believe include a first hike in March.

Analysts were leaning positive ahead of the meeting.

Frances Stacy, at Optimal Capital, told Bloomberg Television that Powell would try to take a less hawkish tone, saying policy would be guided by data while supply chains were improving and inflation showed signs of peaking.

"I think what that's going to do is potentially reassure markets that the Fed put is ready, willing and able," she said, referring to the bank's past in backstopping markets. "That could cause some serious enthusiasm and a short squeeze."

And Standard Chartered Bank's Steven Englander concurred, adding that "a moderately hawkish Powell would be dovish in market terms".

Meanwhile, markets strategist Louis Navellier saw three rate hikes this year and that after the recent bout of selling across markets, buying opportunities were emerging.

"I'm very comfortable that we are going to have a bottom here soon. Remember, the market is a manic crowd," he said in a note.

After a second day of high volatility in New York, Asia enjoyed a little more calm in the morning.

Hong Kong, Shanghai, Singapore, Seoul, Wellington, Taipei and Jakarta all rose, though Tokyo and Manila edged down.

However, while there remains some optimism among analysts about the outlook, the International Monetary Fund on Tuesday lowered its growth outlook for the global economy saying it has started the year "in a weaker position than previously expected".

It said Omicron threatened to set back the recovery as countries impose containment measures, while other issues remained, including inflation and geopolitical tensions.

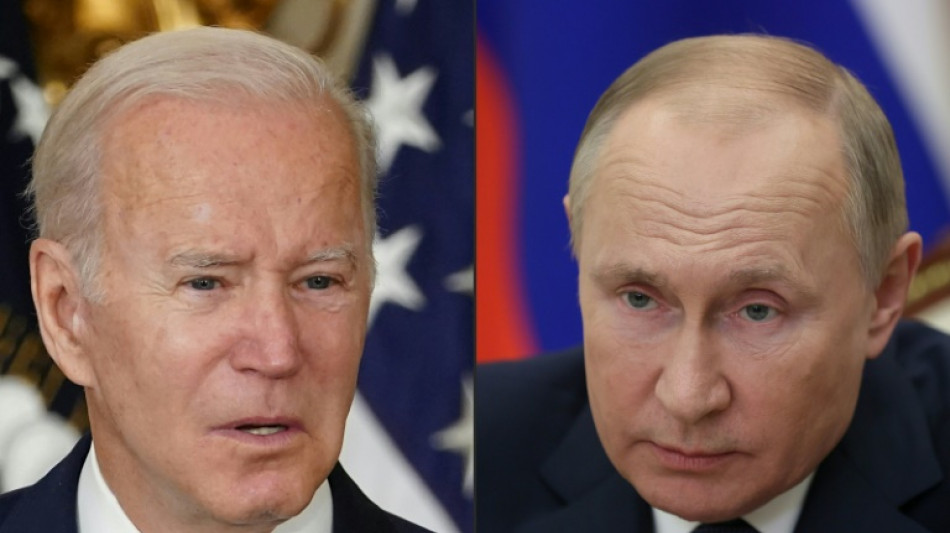

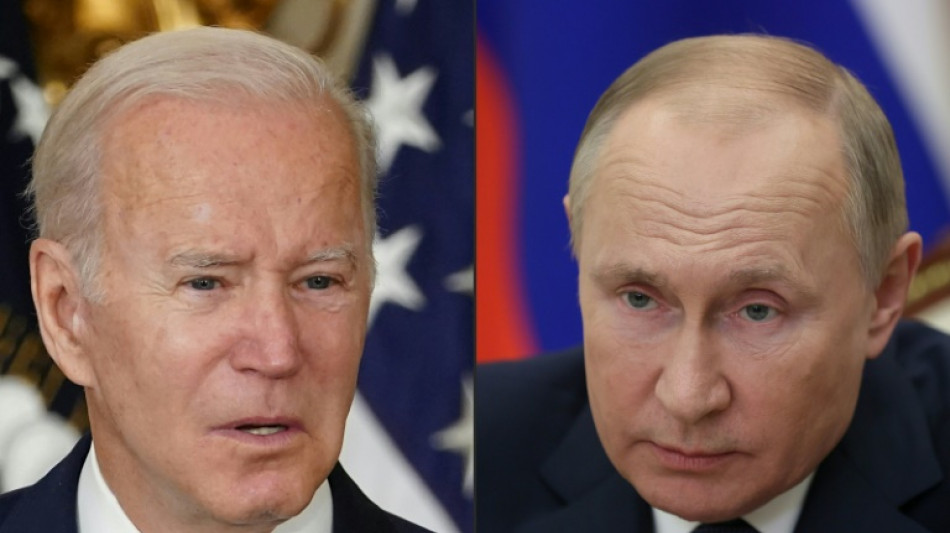

Included in those tensions is the standoff on the Ukraine-Russia border, with Moscow building up troop numbers and the West led by the United States warning the risk of an invasion "remains imminent".

US President Joe Biden said such a move would prompt "enormous consequences" and even "change the world", adding that he would consider imposing direct sanctions on Russian counterpart Vladimir Putin on top of a raft of measures being drawn up.

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: DOWN 0.4 percent at 27,024.08 (break)

Hong Kong - Hang Seng Index: UP 0.8 percent at 24,439.17

Shanghai - Composite: UP 0.5 percent at 3,449.11

Euro/dollar: UP at $1.1309 from $1.1305 late Tuesday

Pound/dollar: UP at $1.3517 from $1.3507

Euro/pound: DOWN at 83.64 pence from 83.66 pence

Dollar/yen: DOWN at 113.84 yen from 113.87 yen

West Texas Intermediate: DOWN 0.3 percent at $85.36 per barrel

Brent North Sea crude: DOWN 0.1 percent at $88.16 per barrel

New York - Dow: DOWN 0.2 percent at 34,297.73 (close)

London - FTSE 100: UP 1.0 percent at 7,371.46 (close)

E.Qaddoumi--SF-PST