-

'One Battle After Another,' 'Hamnet' triumph at Golden Globes

'One Battle After Another,' 'Hamnet' triumph at Golden Globes

-

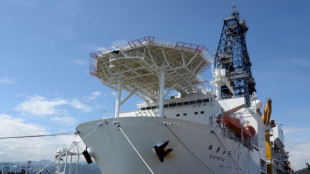

Japan aims to dig deep-sea rare earths to reduce China dependence

-

Top UN court to hear Rohingya genocide case against Myanmar

Top UN court to hear Rohingya genocide case against Myanmar

-

US sends more agents to Minneapolis despite furor over woman's killing

-

Trump says Iran 'want to negotiate' after reports of hundreds killed in protests

Trump says Iran 'want to negotiate' after reports of hundreds killed in protests

-

Bangladesh's powerful Islamists prepare for elections

-

NBA-best Thunder beat the Heat as T-Wolves edge Spurs

NBA-best Thunder beat the Heat as T-Wolves edge Spurs

-

Ukraine's Kostyuk defends 'conscious choice' to speak out about war

-

Trump says working well with Venezuela's new leaders, open to meeting

Trump says working well with Venezuela's new leaders, open to meeting

-

Asian equities edge up, dollar slides as US Fed Reserve subpoenaed

-

Hong Kong court hears sentencing arguments for Jimmy Lai

Hong Kong court hears sentencing arguments for Jimmy Lai

-

Powell says Federal Reserve subpoenaed by US Justice Department

-

Chalamet, 'One Battle' among winners at Golden Globes

Chalamet, 'One Battle' among winners at Golden Globes

-

Turning point? Canada's tumultuous relationship with China

-

Eagles stunned by depleted 49ers, Allen leads Bills fightback

Eagles stunned by depleted 49ers, Allen leads Bills fightback

-

Globes red carpet: chic black, naked dresses and a bit of politics

-

Maduro's fall raises Venezuelans' hopes for economic bounty

Maduro's fall raises Venezuelans' hopes for economic bounty

-

Golden Globes kick off with 'One Battle' among favorites

-

Australian Open 'underdog' Medvedev says he will be hard to beat

Australian Open 'underdog' Medvedev says he will be hard to beat

-

In-form Bencic back in top 10 for first time since having baby

-

Swiatek insists 'everything is fine' after back-to-back defeats

Swiatek insists 'everything is fine' after back-to-back defeats

-

Wildfires spread to 15,000 hectares in Argentine Patagonia

-

Napoli stay in touch with leaders Inter thanks to talisman McTominay

Napoli stay in touch with leaders Inter thanks to talisman McTominay

-

Meta urges Australia to change teen social media ban

-

Venezuelans await political prisoners' release after government vow

Venezuelans await political prisoners' release after government vow

-

Lens continue winning streak, Endrick opens Lyon account in French Cup

-

McTominay double gives Napoli precious point at Serie A leaders Inter

McTominay double gives Napoli precious point at Serie A leaders Inter

-

Trump admin sends more agents to Minneapolis despite furor over woman's killing

-

Allen magic leads Bills past Jaguars in playoff thriller

Allen magic leads Bills past Jaguars in playoff thriller

-

Barca edge Real Madrid in thrilling Spanish Super Cup final

-

Malinin spearheads US Olympic figure skating challenge

Malinin spearheads US Olympic figure skating challenge

-

Malinin spearheads US figure Olympic figure skating challenge

-

Iran rights group warns of 'mass killing', govt calls counter-protests

Iran rights group warns of 'mass killing', govt calls counter-protests

-

'Fragile' Man Utd hit new low with FA Cup exit

-

Iran rights group warns of 'mass killing' of protesters

Iran rights group warns of 'mass killing' of protesters

-

Demonstrators in London, Paris, Istanbul back Iran protests

-

Olise sparkles as Bayern fire eight past Wolfsburg

Olise sparkles as Bayern fire eight past Wolfsburg

-

Man Utd knocked out of FA Cup by Brighton, Martinelli hits hat-trick for Arsenal

-

Troubled Man Utd crash out of FA Cup against Brighton

Troubled Man Utd crash out of FA Cup against Brighton

-

Danish PM says Greenland showdown at 'decisive moment' after new Trump threats

-

AC Milan snatch late draw at Fiorentina as title rivals Inter face Napoli

AC Milan snatch late draw at Fiorentina as title rivals Inter face Napoli

-

Venezuelans demand political prisoners' release, Maduro 'doing well'

-

'Avatar: Fire and Ashe' leads in N.America for fourth week

'Avatar: Fire and Ashe' leads in N.America for fourth week

-

Bordeaux-Begles rout Northampton in Champions Cup final rematch

-

NHL players will compete at Olympics, says international ice hockey chief

NHL players will compete at Olympics, says international ice hockey chief

-

Kohli surpasses Sangakkara as second-highest scorer in international cricket

-

Young mother seeks five relatives in Venezuela jail

Young mother seeks five relatives in Venezuela jail

-

Arsenal villain Martinelli turns FA Cup hat-trick hero

-

Syrians in Kurdish area of Aleppo pick up pieces after clashes

Syrians in Kurdish area of Aleppo pick up pieces after clashes

-

Kohli hits 93 as India edge New Zealand in ODI opener

Rare earth production outside China 'major milestone'

An Australian firm's production of a heavy rare earth, a first outside of China, is a "major milestone" in diversifying a critical supply chain dominated by Beijing, experts say.

But the announcement by Lynas Rare Earths also illustrates how much more needs to be done to broaden the supply of elements critical for electric vehicles and renewable technology.

What are rare earths?

Rare earth elements (REE) are 17 metals that are used in a wide variety of everyday and high-tech products, from light bulbs to guided missiles.

Among the most sought-after are neodymium and dysprosium, used to make super-strong magnets that power electric car batteries and ocean wind turbines.

Despite their name, rare earths are relatively abundant in the Earth's crust. Their moniker is a nod to how unusual it is to find them in a pure form.

Heavy rare earths, a subset of overall REE, have higher atomic weights, are generally less abundant and often more valuable.

China dominates all elements of the rare earths supply chain, accounting for more than 60 percent of mining production and 92 percent of global refined output, according to the International Energy Agency.

What did Lynas achieve?

Lynas said it produced dysprosium oxide at its Malaysia facility, making it the only commercial producer of separated heavy rare earths outside of China.

It hopes to refine a second heavy rare earth -- terbium -- at the same facility next month. It too can be used in permanent magnets, as well as some light bulbs.

It "is a major milestone," said Neha Mukherjee, senior analyst on raw materials at Benchmark Mineral Intelligence.

The announcement comes with China's REE supply caught up in its trade war with Washington.

It is unclear whether a 90-day truce means Chinese export controls on some rare earths will be lifted, and experts say a backlog in permit approvals will snarl trade regardless.

"Given this context, the Lynas development marks a real and timely shift, though it doesn't eliminate the need for broader, global diversification efforts," said Mukherjee.

How significant is it?

Lynas did not say how much dysprosium it refined, and rare earths expert Jon Hykawy warned the firm faces constraints.

"The ore mined by Lynas contains relatively little of the heavy rare earths, so their produced tonnages can't be that large," said Hykawy, president of Stormcrow Capital.

"Lynas can make terbium and dysprosium, but not enough, and more is needed."

The mines most suited for extracting dysprosium are in south China, but deposits are known in Africa, South America and elsewhere.

"Even with Lynas' production, China will still be in a position of dominance," added Gavin Wendt, founding director and senior resource analyst at MineLife.

"However, it is a start, and it is crucial that other possible projects in the USA, Canada, Brazil, Europe and Asia, also prove technically viable and can be approved, so that the supply balance can really begin to shift."

What are the challenges to diversifying?

China's domination of the sector is partly the result of long-standing industrial policy. Just a handful of facilities refining light rare earths operate elsewhere, including in Estonia.

It also reflects a tolerance for "in-situ mining", an extraction technique that is cheap but polluting, and difficult to replicate in countries with higher environmental standards.

For them, "production is more expensive, so they need prices to increase to make any seriously interesting profits," said Hykawy.

That is a major obstacle for now.

"Prices have not supported new project development for over a year," said Mukherjee.

"Most non-Chinese projects would struggle to break even at current price levels."

There are also technical challenges, as processing rare earths requires highly specialised and efficient techniques, and can produce difficult-to-manage waste.

What more capacity is near?

Lynas has commissioned more processing capacity at its Malaysia plant, designed to produce up to 1,500 tonnes of heavy rare earths.

If that focused on dysprosium and terbium, it could capture a third of global production, said Mukherjee.

The firm is building a processing facility in Texas, though cost increases have cast doubt on the project, and Lynas wants the US government to pitch in more funds.

US firm MP Materials has also completed pilot testing for heavy rare earth separation and plans to boost production this year.

Canada's Aclara Resources is also developing a rare earths separation plant in the United States.

And Chinese export uncertainty could mean prices start to rise, boosting balance sheets and the capacity of small players to expand.

"The Lynas announcement shows progress is possible," said Mukherjee.

"It sends a strong signal that with the right mix of technical readiness, strategic demand, and geopolitical urgency, breakthroughs can happen."

M.AlAhmad--SF-PST