-

Trump to attend White House Correspondents' dinner

Trump to attend White House Correspondents' dinner

-

Will Iran's missiles drain US interceptor stocks?

-

Trump warns of longer Iran war as violence spreads

Trump warns of longer Iran war as violence spreads

-

Energy infrastructure emerges as war target, lifting prices

-

Trump warns of longer Iran war, Rubio points at Israel

Trump warns of longer Iran war, Rubio points at Israel

-

US urges to 'depart now' from Middle East: Latest developments in Iran war

-

Ecuador launches joint anti-drug operations with US

Ecuador launches joint anti-drug operations with US

-

Getafe deal flat Real Madrid La Liga title race blow

-

Rubio, Hezbollah and Qatar: Latest developments in Iran war

Rubio, Hezbollah and Qatar: Latest developments in Iran war

-

Rubio says Israel's strike plan triggered US attack on Iran

-

'Thank you, madam president': Melania Trump leads UN Security Council as Iran war rages

'Thank you, madam president': Melania Trump leads UN Security Council as Iran war rages

-

Bombing Iran, Trump has 'epic fury' but endgame undefined

-

US slaps sanctions on Rwanda military over DR Congo 'violation'

US slaps sanctions on Rwanda military over DR Congo 'violation'

-

US Congress to debate Trump's war powers

-

US appeals court denies Trump bid to delay tariff refund lawsuits

US appeals court denies Trump bid to delay tariff refund lawsuits

-

Trump warns of longer Iran war

-

Fire-damaged Six nations trophy to be replaced

Fire-damaged Six nations trophy to be replaced

-

Trump mulls ground troops: latest developments in US-Iran war

-

Middle East war puts shipping firms in tight insurance spot

Middle East war puts shipping firms in tight insurance spot

-

Qatar downs Iran jets as Tehran targets oil and gas in spiralling Gulf crisis

-

UK PM says US will not use British bases in Cyprus

UK PM says US will not use British bases in Cyprus

-

Can Anthropic survive taking on Trump's Pentagon?

-

Real Madrid superstar Mbappe in Paris for treatment on knee injury

Real Madrid superstar Mbappe in Paris for treatment on knee injury

-

Mideast war risks sending global economy into stagflation

-

Stranded tourists shelter from missile fire in Dubai

Stranded tourists shelter from missile fire in Dubai

-

Iran war spells danger for global airlines

-

Trump doesn't rule out sending US troops into Iran

Trump doesn't rule out sending US troops into Iran

-

'No aborts. Good luck': Key moments in the US war on Iran

-

Chelsea boss Rosenior warns players over discipline

Chelsea boss Rosenior warns players over discipline

-

Energy prices soar on Iran war fallout, stocks slide

-

Pentagon chief refuses to rule out 'boots on ground' in Iran

Pentagon chief refuses to rule out 'boots on ground' in Iran

-

Saudi military raises readiness levels after attacks

-

Iran war spreads with strikes across Middle East and beyond

Iran war spreads with strikes across Middle East and beyond

-

Barca must 'make the impossible possible': coach Flick on Atletico cup challenge

-

Furry, frayed & freezing on Milan catwalks: the fashion trends

Furry, frayed & freezing on Milan catwalks: the fashion trends

-

Amsterdam's Rijksmuseum discovers new Rembrandt

-

Olympic comeback queen Brignone ends ski season

Olympic comeback queen Brignone ends ski season

-

Key Gulf air hubs caught up in Iran conflict

-

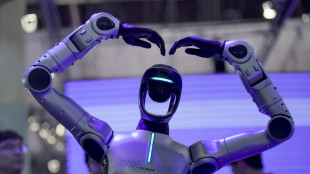

Middle East fighting overshadows world telecom show

Middle East fighting overshadows world telecom show

-

South Korea outclass Iran in Asian Women's Cup opener

-

Liverpool's Slot says his 'football heart' does not like set-piece trend

Liverpool's Slot says his 'football heart' does not like set-piece trend

-

Israel aims fresh attack at Tehran: latest developments in US-Iran war

-

At least 25 killed at Pakistan's weekend pro-Iran protests

At least 25 killed at Pakistan's weekend pro-Iran protests

-

Energy prices soar, stock markets slide on Iran war fallout

-

'No indication' Iran nuclear installations hit: IAEA

'No indication' Iran nuclear installations hit: IAEA

-

Showdown looms between Tesla and German union

-

Israel vows intensified attacks: latest developments in US-Iran war

Israel vows intensified attacks: latest developments in US-Iran war

-

France arrests activists blocking ship over alleged Russia uranium links

-

Tech sovereignty and AI networks set to dominate mobile meet

Tech sovereignty and AI networks set to dominate mobile meet

-

Indian police clash with pro-Khamenei protesters in Kashmir

Australian economy Crisis

Australia is facing a suite of troubling economic trends. Growth is slowing, prices are rising and people’s living standards are slipping. Despite a headline unemployment rate that remains around 4.3 %, officials warn that the economy may be trapped in a slow‑growth, high‑inflation environment unless investment and productivity improve. Households are feeling the strain as wages fail to keep pace with costs and the housing market becomes increasingly inaccessible.

Official national accounts show that the economy grew by only 0.6 % in the June 2025 quarter and by 1.3 % over the year; the terms of trade fell and the household saving ratio slid to 4.2 %. Living cost indexes rose between 0.6 % and 1.5 % in the September quarter, with housing and recreation costs making the biggest contribution. Consumer prices increased 1.3 % in the September quarter and 3.2 % over the year, while wages grew only 0.8 % in the June quarter and 3.4 % annually. The resulting squeeze on household budgets is causing real incomes to stagnate.

Underlying inflation has accelerated to around 3 %, reflecting higher electricity, fuel and services prices. The September inflation pulse overshot forecasts and dashed hopes of a quick rate cut; electricity prices jumped 9 % in the quarter, holiday travel costs rose 2.5 % and local government charges climbed 6.3 %. Analysts note that real wages are unlikely to regain their 2011 purchasing power until the latter part of this decade.

Housing is the most visible symptom of the malaise. About one‑third of households rent, and median advertised rents have increased by roughly 48 % over the past decade; they rose 5.5 % between the first quarter of 2024 and the first quarter of 2025. More than 1.26 million low‑income households spend over 30 % of their disposable income on housing, including 44.5 % of mortgage holders and 20.5 % of renters. Median house prices have risen by 8.6 % in the past year, far outpacing incomes, and home values rose 1.1 % in October alone. Investor lending now accounts for two in every five new home loans, with the value of these loans rising 17.6 % and calls emerging for regulators to curb landlord credit growth. A government scheme allowing first‑home buyers to borrow with a 5 % deposit effectively grants buyers the equivalent of a $120 000 deposit on an $800 000 home; critics warn that this incentive fuels investor speculation and pushes up prices.

Mortgage stress is spreading. Research shows that 27.9 % of mortgage holders were at risk of stress in the three months to August 2025, with 17.9 % extremely at risk. Nearly one million Australians now work two or more jobs – 6.6 % of the employed population – because rising living costs and inflation are outpacing wage growth. Taking on additional employment has become a coping strategy for households trying to meet mortgage repayments and other bills.

Young Australians are particularly pessimistic. A national survey found that 85 % of young people experienced financial difficulty in the past year and almost four‑fifths believe they will be worse off than their parents. Fewer than half expect to own a home, and about 44 % have experienced unemployment while 60 % have endured underemployment. Poverty is widespread: more than one in seven people (14.2 %) and one in six children live below the poverty line, defined at 50 % of median after‑tax household income, and more than 57 % of low‑income renters are in housing stress. Rents in major cities have risen between 34 % and 41 % since 2021, deepening financial hardship.

Beneath the veneer of a modestly strong labour market lie deepening structural problems. Per‑capita economic output has contracted at various points over the past two years, and productivity growth has slowed. Officials acknowledge that without a revival of investment and productivity, the country risks a prolonged period of sluggish growth and persistent inflation. Rising housing costs, real wage stagnation, mortgage stress and youth pessimism all point to an economy that is leaving many behind. Unless these issues are addressed with urgency, something terrible will indeed continue to happen in the Australian economy.

Digital Ocean Twin: Protecting the Oceans

What is the outlook for France’s economy?

How melting Alpine glaciers affect valleys

How melting Alpine glaciers affect valleys

The EU Commission and its climate targets?

Irish government to subsidise school books

European democracy is weakening, report warns

Low demand: electric vehicles clog Belgian port

EU calls for tougher measures for a ‘tobacco-free generation’

This Summer experiences Romania first heatwave

Mike Pence: U.S. will continue to support Ukraine