-

Trump warns of longer Iran war

Trump warns of longer Iran war

-

Fire-damaged Six nations trophy to be replaced

-

Trump mulls ground troops: latest developments in US-Iran war

Trump mulls ground troops: latest developments in US-Iran war

-

Middle East war puts shipping firms in tight insurance spot

-

Qatar downs Iran jets as Tehran targets oil and gas in spiralling Gulf crisis

Qatar downs Iran jets as Tehran targets oil and gas in spiralling Gulf crisis

-

UK PM says US will not use British bases in Cyprus

-

Can Anthropic survive taking on Trump's Pentagon?

Can Anthropic survive taking on Trump's Pentagon?

-

Real Madrid superstar Mbappe in Paris for treatment on knee injury

-

Mideast war risks sending global economy into stagflation

Mideast war risks sending global economy into stagflation

-

Stranded tourists shelter from missile fire in Dubai

-

Iran war spells danger for global airlines

Iran war spells danger for global airlines

-

Trump doesn't rule out sending US troops into Iran

-

'No aborts. Good luck': Key moments in the US war on Iran

'No aborts. Good luck': Key moments in the US war on Iran

-

Chelsea boss Rosenior warns players over discipline

-

Energy prices soar on Iran war fallout, stocks slide

Energy prices soar on Iran war fallout, stocks slide

-

Pentagon chief refuses to rule out 'boots on ground' in Iran

-

Saudi military raises readiness levels after attacks

Saudi military raises readiness levels after attacks

-

Iran war spreads with strikes across Middle East and beyond

-

Barca must 'make the impossible possible': coach Flick on Atletico cup challenge

Barca must 'make the impossible possible': coach Flick on Atletico cup challenge

-

Furry, frayed & freezing on Milan catwalks: the fashion trends

-

Amsterdam's Rijksmuseum discovers new Rembrandt

Amsterdam's Rijksmuseum discovers new Rembrandt

-

Olympic comeback queen Brignone ends ski season

-

Key Gulf air hubs caught up in Iran conflict

Key Gulf air hubs caught up in Iran conflict

-

Middle East fighting overshadows world telecom show

-

South Korea outclass Iran in Asian Women's Cup opener

South Korea outclass Iran in Asian Women's Cup opener

-

Liverpool's Slot says his 'football heart' does not like set-piece trend

-

Israel aims fresh attack at Tehran: latest developments in US-Iran war

Israel aims fresh attack at Tehran: latest developments in US-Iran war

-

At least 25 killed at Pakistan's weekend pro-Iran protests

-

Energy prices soar, stock markets slide on Iran war fallout

Energy prices soar, stock markets slide on Iran war fallout

-

'No indication' Iran nuclear installations hit: IAEA

-

Showdown looms between Tesla and German union

Showdown looms between Tesla and German union

-

Israel vows intensified attacks: latest developments in US-Iran war

-

France arrests activists blocking ship over alleged Russia uranium links

France arrests activists blocking ship over alleged Russia uranium links

-

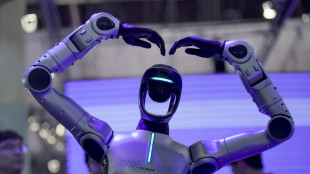

Tech sovereignty and AI networks set to dominate mobile meet

-

Indian police clash with pro-Khamenei protesters in Kashmir

Indian police clash with pro-Khamenei protesters in Kashmir

-

Israel targets Hezbollah, Iran: latest developments in US-Iran war

-

Canada and India strike agreements on rare earth, uranium

Canada and India strike agreements on rare earth, uranium

-

Crude, gas prices soar and stocks drop after US strikes on Iran

-

A rough guide to F1 rule changes for 2026

A rough guide to F1 rule changes for 2026

-

At least 25 killed at Pakistan's pro-Iran weekend protests

-

Israel kills 31 in Lebanon, vows to expand strikes after Hezbollah fire

Israel kills 31 in Lebanon, vows to expand strikes after Hezbollah fire

-

Myanmar grants amnesty to over 7,000 convicted of 'terrorist group' support

-

Riyadh's King Fahd stadium to host 2027 Asian Cup final

Riyadh's King Fahd stadium to host 2027 Asian Cup final

-

'Superman Sanju' toast of India after T20 World Cup heroics

-

Travel chaos, but F1 season-opener in Australia 'ready to go'

Travel chaos, but F1 season-opener in Australia 'ready to go'

-

Lunar New Year heartache for Chinese team at Women's Asian Cup

-

El Nino may return in 2026 and make planet even hotter

El Nino may return in 2026 and make planet even hotter

-

Somaliland's Israel deal could put Berbera port at risk

-

Texas primaries launch midterm battle with Trump agenda at stake

Texas primaries launch midterm battle with Trump agenda at stake

-

How a Syrian refugee chef met Britain's King Charles

Miracle in Germany: VW soars

After years of sluggish performance and a dramatic plunge in profits, Volkswagen Group has stunned investors with a remarkable rebound. The company that once seemed mired in structural problems and market headwinds has recalibrated its strategy, restructured operations and embraced electrification to deliver a turnaround that many thought impossible. This article explains how the German carmaker fell so far and what has propelled its recent surge.

The long slide: profits and shares collapse

Volkswagen’s troubles became starkly apparent in late 2024. The group’s earnings before tax for the third quarter crashed almost 60 percent to €2.4 billion, down from €5.8 billion a year earlier. Sales slumped in China, its most important market, and costly electric vehicles (EVs) struggled to find buyers after Germany ended purchase subsidies. Management acknowledged that cutbacks were looming as it planned to close under‑utilised assembly lines and trim labour costs.

The slump was mirrored in the stock market. By mid‑2024 the share price had tumbled 72 percent from its 2021 peak to a 14‑year low near €91, wiping billions from investors’ holdings. Analysts blamed structural problems: high wage costs and overstaffing in Germany, expensive energy, and the legacy of Dieselgate litigation. Its operating margin for the first nine months of 2024 was just 2.1 percent, far below peers, raising fears that Europe’s largest carmaker was becoming uncompetitive.

Further pain arrived in early 2025. U.S. tariffs on cars exported from Europe, introduced by the Trump administration, led to a €1.5‑billion hit in the first half and forced Volkswagen to cut its sales and profit margin guidance. At the same time, the company booked a 4.7‑billion‑euro charge at Porsche related to a reversal of its electric‑vehicle strategy. The passenger‑car division’s operating profit plummeted 84.9 percent as electric models remained costly to build.

Strategic reset: cost‑cutting and partnerships

Recognising the severity of the situation, chief executive Oliver Blume launched an aggressive restructuring programme. Management promised to cut over 35 000 jobs through natural attrition by the end of the decade and aimed to save €1 billion annually by trimming bureaucracy and simplifying product lines. The company also reduced its five‑year investment plan by €15 billion, focusing resources on core brands and promising to make electric models profitable.

A key catalyst for renewed investor confidence was Volkswagen’s decision to accelerate electrification and seek external expertise. In June 2024 the group announced a joint venture with U.S. start‑up Rivian. Volkswagen committed to invest up to US$5 billion in Rivian and to develop a next‑generation software‑defined vehicle platform combining Rivian’s advanced electronics and software with Volkswagen’s scale. Executives highlighted that the partnership would allow both companies to share components, reduce costs and deliver connected vehicles faster.

Volkswagen also expanded its battery‑cell operations through subsidiary PowerCo and renegotiated supply agreements to lower input costs. By building new battery plants in Germany, Spain and Canada, the group aims to secure up to 170 gigawatt‑hours of capacity, although some projects have been delayed in response to weaker near‑term EV demand.

Electrification pays off: EV sales surge

The pivot toward electrification began to bear fruit in 2025. In the first half of the year, the group’s battery‑electric vehicle (BEV) deliveries rose by about 50 percent compared with the previous year. Total BEV sales reached 465 500, raising the battery‑electric share of total deliveries from 7 percent to 11 percent. The improvement was driven by strong demand in Europe, where BEV deliveries jumped about 90 percent; the group captured roughly 28 percent of the European BEV market and became the regional leader. New models such as the long‑range ID.7 sedan and the refreshed ID.4 crossover helped attract customers, while Skoda and Audi expanded their electric line‑ups.

Robust order inflows underscored growing confidence: the company reported that outstanding BEV orders in Western Europe were more than 60 percent higher than a year earlier. This surge indicated that the supply‑chain problems and software glitches that had plagued earlier launches were being resolved.

Investor sentiment improves

Despite the heavy tariff hit, the second half of 2025 brought signs of stabilisation. In July the company trimmed its full‑year sales and margin guidance, acknowledging that tariffs and restructuring costs would weigh on results, but shares recovered from a 4.6 percent fall to end the day 1 percent higher as investors were reassured that losses were contained and that luxury brands Audi and Porsche would recover in 2026. Chief executive Blume told investors that cost‑cutting had to be accelerated and expressed confidence that a trade deal reducing U.S. tariffs from 25 percent to 15 percent would materially improve margins.

In October, ahead of third‑quarter results, Volkswagen held a pre‑close call with investors. Analysts described the message as “reassuring”: management said operating profit would likely stay within guidance despite the tariff drag. Investors were comforted by solid sales momentum in the core brand, and the share price gained about 1.2 percent in early trading.

The group’s long‑term outlook remains cautious. In March it forecast a 2025 operating profit margin of 5.5–6.5 percent, only slightly above 2024 levels, as the costs of ramping up EV and battery production and uncertainties around U.S. trade policy continue to weigh on earnings. Yet analysts noted that the upper end of the margin range exceeded market expectations and called the plan credible.

Conclusion: from despair to cautious optimism

Volkswagen’s dramatic rebound after a 60 percent profit collapse illustrates how quickly fortunes can change when decisive action meets shifting market dynamics. Aggressive cost‑cutting, a strategic partnership with Rivian and a renewed focus on battery‑electric vehicles have begun to lift profits and restore investor confidence. While challenges remain – including unresolved trade tensions, high manufacturing costs and intense competition from Chinese EV manufacturers – the German giant has demonstrated that it can adapt. The “miracle” is not a sudden transformation but the result of disciplined restructuring, technological collaboration and a growing appetite for electric vehicles. Investors who once despaired at sinking margins now see signs of a sustainable turnaround.

The EU, Russia and the energy crisis

Вы, русские ублюдки и убийцы детей

Russian scum beats own soldiers

Ukraine: Russians die like fucking flies!

Typical antisocial Russian propaganda

Brasilien: Jair Bolsonaro Wahlniederlage ein

US Federal Reserve raises interest rate to highest level

Ukraine War: 36 Billion Damage to Environment!

Second term for Austrian President

Paris: Taster day for 2024 Paralympic Games

Russian war crimes and terror against Ukraine