-

Canada's Carney to mend rift, boost trade as he meets India's Modi

Canada's Carney to mend rift, boost trade as he meets India's Modi

-

Crude soars, stocks drop after US strikes on Iran

-

Iran war spreads across region as US, Israel suffer losses

Iran war spreads across region as US, Israel suffer losses

-

Miriam Margolyes tackles aging in Oscar-nominated short

-

Recognition, not competition, for Oscar-nominated foreign filmmakers

Recognition, not competition, for Oscar-nominated foreign filmmakers

-

Israel, Hezbollah trade fire: latest developments in Iran war

-

Israel strikes Tehran: latest developments in Iran war

Israel strikes Tehran: latest developments in Iran war

-

Trump vows to avenge first US deaths as Iran war intensifies

-

Lowry collapses late again, Echavarria snatches victory in Cognizant Classic

Lowry collapses late again, Echavarria snatches victory in Cognizant Classic

-

Aubameyang strikes twice as Marseille edge Lyon in Ligue 1

-

Infantino says players who cover mouths when speaking could be sent off

Infantino says players who cover mouths when speaking could be sent off

-

Bolsonaro son rallies the right as thousands protest Brazil government

-

Juve stay in Champions League hunt with last-gasp Roma draw

Juve stay in Champions League hunt with last-gasp Roma draw

-

Maersk suspends vessel transit through Strait of Hormuz

-

France, Germany, UK ready to take 'defensive action' against Iran

France, Germany, UK ready to take 'defensive action' against Iran

-

Trump vows to avenge deaths of US troops: latest Iran developments

-

Knicks halt Spurs' 11-game NBA winning streak

Knicks halt Spurs' 11-game NBA winning streak

-

EU warns against long war, urges 'credible transition' in Iran

-

'Severe blow' dealt to Iran command centres: latest developments

'Severe blow' dealt to Iran command centres: latest developments

-

Bored of peace? Trump keeps choosing war

-

Arteta embraces Arsenal's 'Set-Piece FC' label after corners sink Chelsea

Arteta embraces Arsenal's 'Set-Piece FC' label after corners sink Chelsea

-

Sevilla rescue derby draw to deal Betis top four setback

-

India need 'special effort' to beat England in semi-final: Gambhir

India need 'special effort' to beat England in semi-final: Gambhir

-

'A terrible day,' says Israel community shaken by deadly Iranian strike

-

Arsenal corner Chelsea into submission, Man Utd climb to third

Arsenal corner Chelsea into submission, Man Utd climb to third

-

Arsenal win set-piece battle to sink Chelsea in title boost

-

What future for Iranian leadership after Khamenei's death?

What future for Iranian leadership after Khamenei's death?

-

'Scream 7' makes a killing at N. America box office

-

Thousands stranded as Iran conflict shuts Mideast hubs

Thousands stranded as Iran conflict shuts Mideast hubs

-

Samson's 97 puts India into T20 World Cup semi-final against England

-

Latest developments as Iran retaliates to US-Israel strikes that killed Khamenei

Latest developments as Iran retaliates to US-Israel strikes that killed Khamenei

-

Spurs have 'big problems' says Tudor as relegation risk persists

-

Dortmund captain Can out for season with ACL tear

Dortmund captain Can out for season with ACL tear

-

Leweling doubles up as Stuttgart sink sorry Wolfsburg

-

Man Utd climb to third, Fulham sink sorry Spurs

Man Utd climb to third, Fulham sink sorry Spurs

-

Iran strikes send VIP Dubai influencers 'back to reality'

-

Briton Brennan bursts to Kuurne-Bruxelles-Kuurne triumph

Briton Brennan bursts to Kuurne-Bruxelles-Kuurne triumph

-

Activists pressure Milan Fashion Week to go fully fur-free

-

First US service members killed in operation against Iran

First US service members killed in operation against Iran

-

Blasts in Kabul as Afghan govt says responding to Pakistan attacks

-

Iranians grieve, celebrate, worry after Khamenei's killing

Iranians grieve, celebrate, worry after Khamenei's killing

-

Latest developments as Iran lashes out after US-Israel strikes kill Khamenei

-

First US soldiers killed in operation against Iran

First US soldiers killed in operation against Iran

-

West Indies post 195-4 against India in T20 World Cup do-or-die clash

-

South Africa 'embrace pressure' and favourites tag, says coach

South Africa 'embrace pressure' and favourites tag, says coach

-

Tel Aviv residents say ready to withstand more Iranian attacks

-

Russia loses key ally leader as Putin slams Khamenei 'cynical' killing

Russia loses key ally leader as Putin slams Khamenei 'cynical' killing

-

AC Milan consolidate top-four credentials with win at Cremonese

-

Flights of fancy at Bottega Veneta, atmospheric mood at Armani in Milan

Flights of fancy at Bottega Veneta, atmospheric mood at Armani in Milan

-

South Africa beat plucky Zimbabwe ahead of New Zealand semi-final

Embraer’s 950% surge

Embraer has rewritten the aerospace playbook. From a once-overlooked regional specialist, the Brazilian manufacturer has emerged as the industry’s quiet juggernaut—outpacing its far larger rivals in shareholder returns and converting a focused product strategy into record commercial momentum. Since the pandemic trough, Embraer’s New York–listed shares have risen by well over ninefold, vaulting from single digits to new highs and putting a spotlight on how a disciplined “middle-of-the-market” bet can beat scale.

At the heart of the surge is a portfolio calibrated for today’s constraints. Where Boeing fights through quality and compliance crises and Airbus wrestles with capacity limits and engine supply headaches, Embraer has leaned into the 70–150 seat segment with its second-generation E-Jets, expanded a resilient business-jet franchise, and steadily racked up wins for its C-390 Millennium airlifter. The result: an all-time-high firm order backlog nearing $30 billion this summer, alongside quarter-record revenues and deliveries. In a supply-choked world, dependable execution is a strategy—and it shows.

Commercial aviation is the spear tip. Flagship orders in 2025—from Japan’s ANA for E190-E2s to a landmark SAS deal for up to 55 E195-E2s—signaled that network planners across developed markets want lower trip costs without sacrificing comfort or range. E2 economics have given carriers a credible alternative to deploying larger narrowbodies on thin or regional routes, and Embraer’s cabin design (no middle seat, fast turns) aligns neatly with post-pandemic route rebuilding. New-market beachheads in Mexico and continued growth with operators in Europe and the Americas are translating into delivery growth that’s outpacing last year.

Defense has become the dark horse. The C-390 Millennium, once a niche challenger, has turned into Europe’s go-to Hercules alternative, notching selections and orders across NATO and beyond. Beyond mission flexibility and speed, Embraer’s willingness to localize industrial footprints in Europe has strengthened its political and logistical case. As defense budgets rose, that combination—performance plus partnership—pulled the program into the mainstream and diversified group earnings just as commercial demand returned.

Then there is executive aviation, an underestimated earnings engine. Phenom and Praetor jets continue to compound on the back of strong utilization, fleet replacements, and aftermarket growth. Together with services and support, these businesses have added ballast to Embraer’s cash generation and helped smooth cyclicality—another reason the equity rerated higher rather than snapping back to pre-crisis multiples.

The competitive contrast is stark. Airbus remains the global delivery leader with a gargantuan backlog—but constrained slots mean years-long waits, particularly in single-aisles. Boeing, meanwhile, is still working through a prolonged manufacturing and oversight reset that has capped output and sapped buyer confidence. Embraer isn’t “bigger” than either; it’s simply been better positioned to deliver reliable capacity now, in exactly the seat ranges airlines can actually crew, fuel, and fill profitably. In public markets, timing and credibility compound.

None of this is risk-free. The E2 family’s reliance on geared-turbofan technology ties Embraer to an engine ecosystem still normalizing after widespread inspection programs. Trade policy is a new wild card, with tariff chatter periodically jolting shares. And the urban-air-mobility bet via Eve remains a long-dated option, not a 2025 cash cow. But the core machine—commercial E-Jets, executive jets, C-390, and services—is running at record velocity with improving mix and scale.

“Destroyed” may be the language of headlines; what’s indisputable is the scoreboard: since its pandemic low, Embraer has delivered a stock performance that has eclipsed both transatlantic giants, while building a backlog and delivery cadence that validate its strategic lane. In today’s aerospace cycle, the middle seat wins.

Cuba's golden Goose dies

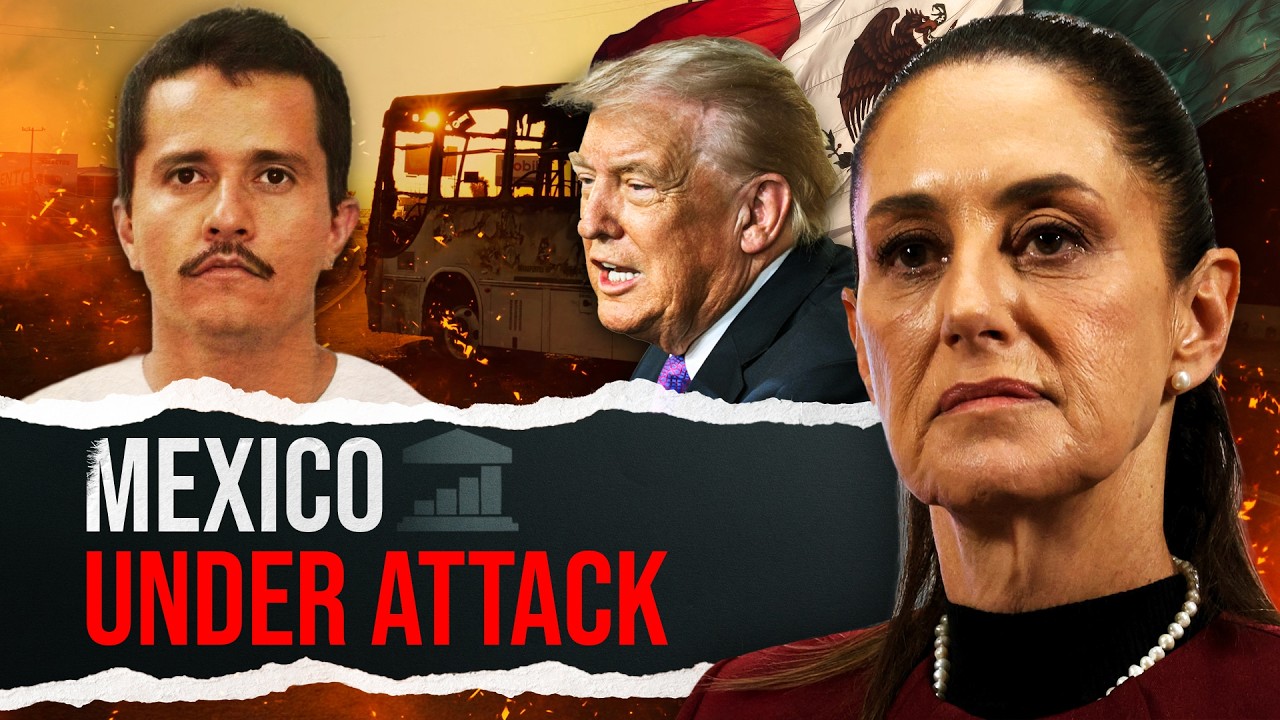

Mexico after El Mencho falls

Nicaragua on the brink?

Cuba: The Regime's last Card

Strike fears rise over Iran

U.S. Jobs stall, gdp slows

Japan’s right‑turn triumph

EU India deal gains unveiled

AI sparks Wall Street panic

India defies U.S. tariffs

EU misstep on mercosur Deal