-

Canada's Carney to mend rift, boost trade as he meets India's Modi

Canada's Carney to mend rift, boost trade as he meets India's Modi

-

Crude soars, stocks drop after US strikes on Iran

-

Iran war spreads across region as US, Israel suffer losses

Iran war spreads across region as US, Israel suffer losses

-

Miriam Margolyes tackles aging in Oscar-nominated short

-

Recognition, not competition, for Oscar-nominated foreign filmmakers

Recognition, not competition, for Oscar-nominated foreign filmmakers

-

Israel, Hezbollah trade fire: latest developments in Iran war

-

Israel strikes Tehran: latest developments in Iran war

Israel strikes Tehran: latest developments in Iran war

-

Trump vows to avenge first US deaths as Iran war intensifies

-

Lowry collapses late again, Echavarria snatches victory in Cognizant Classic

Lowry collapses late again, Echavarria snatches victory in Cognizant Classic

-

Aubameyang strikes twice as Marseille edge Lyon in Ligue 1

-

Infantino says players who cover mouths when speaking could be sent off

Infantino says players who cover mouths when speaking could be sent off

-

Bolsonaro son rallies the right as thousands protest Brazil government

-

Juve stay in Champions League hunt with last-gasp Roma draw

Juve stay in Champions League hunt with last-gasp Roma draw

-

Maersk suspends vessel transit through Strait of Hormuz

-

France, Germany, UK ready to take 'defensive action' against Iran

France, Germany, UK ready to take 'defensive action' against Iran

-

Trump vows to avenge deaths of US troops: latest Iran developments

-

Knicks halt Spurs' 11-game NBA winning streak

Knicks halt Spurs' 11-game NBA winning streak

-

EU warns against long war, urges 'credible transition' in Iran

-

'Severe blow' dealt to Iran command centres: latest developments

'Severe blow' dealt to Iran command centres: latest developments

-

Bored of peace? Trump keeps choosing war

-

Arteta embraces Arsenal's 'Set-Piece FC' label after corners sink Chelsea

Arteta embraces Arsenal's 'Set-Piece FC' label after corners sink Chelsea

-

Sevilla rescue derby draw to deal Betis top four setback

-

India need 'special effort' to beat England in semi-final: Gambhir

India need 'special effort' to beat England in semi-final: Gambhir

-

'A terrible day,' says Israel community shaken by deadly Iranian strike

-

Arsenal corner Chelsea into submission, Man Utd climb to third

Arsenal corner Chelsea into submission, Man Utd climb to third

-

Arsenal win set-piece battle to sink Chelsea in title boost

-

What future for Iranian leadership after Khamenei's death?

What future for Iranian leadership after Khamenei's death?

-

'Scream 7' makes a killing at N. America box office

-

Thousands stranded as Iran conflict shuts Mideast hubs

Thousands stranded as Iran conflict shuts Mideast hubs

-

Samson's 97 puts India into T20 World Cup semi-final against England

-

Latest developments as Iran retaliates to US-Israel strikes that killed Khamenei

Latest developments as Iran retaliates to US-Israel strikes that killed Khamenei

-

Spurs have 'big problems' says Tudor as relegation risk persists

-

Dortmund captain Can out for season with ACL tear

Dortmund captain Can out for season with ACL tear

-

Leweling doubles up as Stuttgart sink sorry Wolfsburg

-

Man Utd climb to third, Fulham sink sorry Spurs

Man Utd climb to third, Fulham sink sorry Spurs

-

Iran strikes send VIP Dubai influencers 'back to reality'

-

Briton Brennan bursts to Kuurne-Bruxelles-Kuurne triumph

Briton Brennan bursts to Kuurne-Bruxelles-Kuurne triumph

-

Activists pressure Milan Fashion Week to go fully fur-free

-

First US service members killed in operation against Iran

First US service members killed in operation against Iran

-

Blasts in Kabul as Afghan govt says responding to Pakistan attacks

-

Iranians grieve, celebrate, worry after Khamenei's killing

Iranians grieve, celebrate, worry after Khamenei's killing

-

Latest developments as Iran lashes out after US-Israel strikes kill Khamenei

-

First US soldiers killed in operation against Iran

First US soldiers killed in operation against Iran

-

West Indies post 195-4 against India in T20 World Cup do-or-die clash

-

South Africa 'embrace pressure' and favourites tag, says coach

South Africa 'embrace pressure' and favourites tag, says coach

-

Tel Aviv residents say ready to withstand more Iranian attacks

-

Russia loses key ally leader as Putin slams Khamenei 'cynical' killing

Russia loses key ally leader as Putin slams Khamenei 'cynical' killing

-

AC Milan consolidate top-four credentials with win at Cremonese

-

Flights of fancy at Bottega Veneta, atmospheric mood at Armani in Milan

Flights of fancy at Bottega Veneta, atmospheric mood at Armani in Milan

-

South Africa beat plucky Zimbabwe ahead of New Zealand semi-final

Alert in Trump’s America

In recent weeks, JPMorgan Chase CEO Jamie Dimon has issued a series of sobering warnings about the fragile state of the U.S. economy—warnings that ring particularly alarmingly in light of the aggressive economic policies advanced under Donald Trump. Dimon cautioned that the nation's bond market is on the brink of a serious "crack," fueled by ballooning budget deficits and deepening investor skepticism. With the national debt already exceeding $36 trillion and credit ratings under pressure, he warned that without decisive reforms, a reckoning is all but inevitable.

Dimon’s concerns extend beyond bonds. In his quarterly report, he described the U.S. stock market as "kind of inflated," noting that asset valuations currently rank among the top 10–15 percent of historical levels. He attributed this overheating to sustained deficit spending, inflationary pressures, and geopolitical tensions. Trade measures, particularly tariffs adopted by the Trump administration, have further intensified those pressures—raising the risk of slower growth, inflation, and market instability.

Emerging trends indicate volatility in Treasury yields, a jittery bond market, and mounting fears that markets may be underpricing systemic risks. Dimon voiced alarm that such mispriced optimism could lead to sudden market shocks, even as he sought to reassure stakeholders that the financial system remains fundamentally sound.

Taken together, these warnings paint a picture of a U.S. economy that appears robust on the surface—buoyed by high valuations and bullish sentiment—but is in fact navigating mounting macroeconomic vulnerabilities. Under the Trump-era policies of elevated deficits, protectionism and regulatory uncertainty, Dimon is urging policymakers to act swiftly: not to stoke the bubble, but to defuse it before it bursts.

Cuba's golden Goose dies

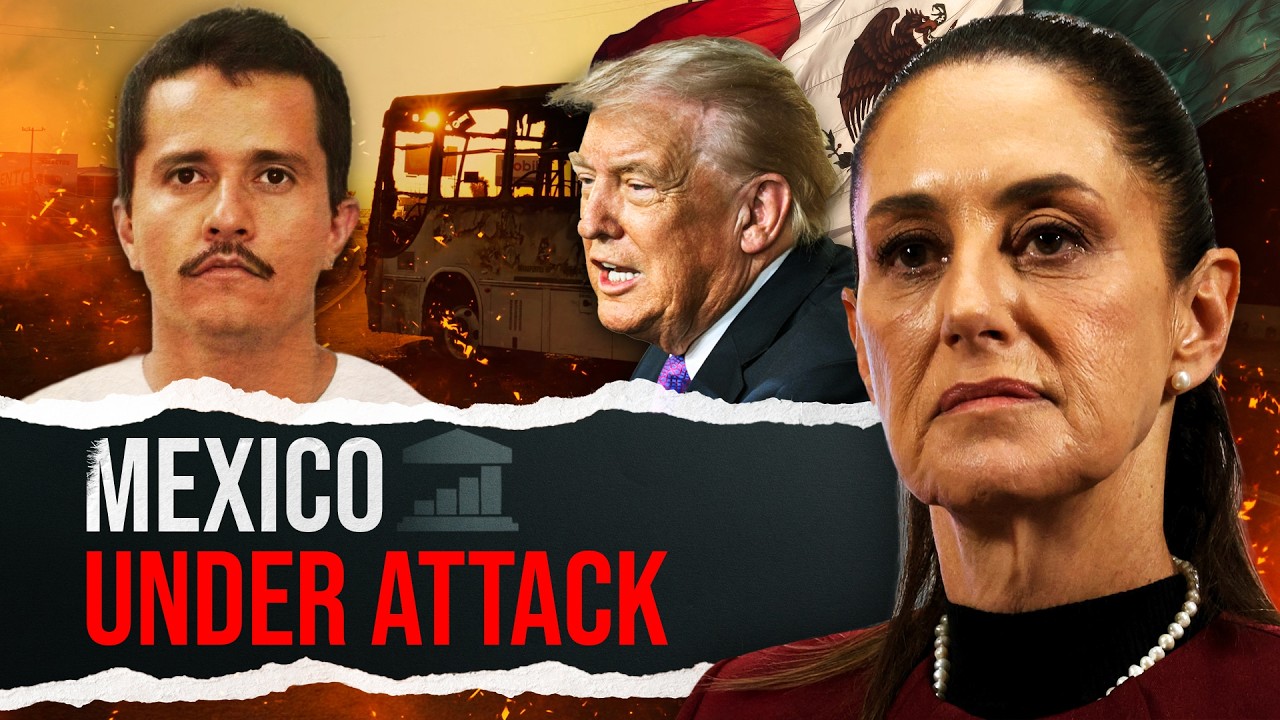

Mexico after El Mencho falls

Nicaragua on the brink?

Cuba: The Regime's last Card

Strike fears rise over Iran

U.S. Jobs stall, gdp slows

Japan’s right‑turn triumph

EU India deal gains unveiled

AI sparks Wall Street panic

India defies U.S. tariffs

EU misstep on mercosur Deal