-

In-form Bencic back in top 10 for first time since having baby

In-form Bencic back in top 10 for first time since having baby

-

Swiatek insists 'everything is fine' after back-to-back defeats

-

Wildfires spread to 15,000 hectares in Argentine Patagonia

Wildfires spread to 15,000 hectares in Argentine Patagonia

-

Napoli stay in touch with leaders Inter thanks to talisman McTominay

-

Meta urges Australia to change teen social media ban

Meta urges Australia to change teen social media ban

-

Venezuelans await political prisoners' release after government vow

-

Lens continue winning streak, Endrick opens Lyon account in French Cup

Lens continue winning streak, Endrick opens Lyon account in French Cup

-

McTominay double gives Napoli precious point at Serie A leaders Inter

-

Trump admin sends more agents to Minneapolis despite furor over woman's killing

Trump admin sends more agents to Minneapolis despite furor over woman's killing

-

Allen magic leads Bills past Jaguars in playoff thriller

-

Barca edge Real Madrid in thrilling Spanish Super Cup final

Barca edge Real Madrid in thrilling Spanish Super Cup final

-

Malinin spearheads US Olympic figure skating challenge

-

Malinin spearheads US figure Olympic figure skating challenge

Malinin spearheads US figure Olympic figure skating challenge

-

Iran rights group warns of 'mass killing', govt calls counter-protests

-

'Fragile' Man Utd hit new low with FA Cup exit

'Fragile' Man Utd hit new low with FA Cup exit

-

Iran rights group warns of 'mass killing' of protesters

-

Demonstrators in London, Paris, Istanbul back Iran protests

Demonstrators in London, Paris, Istanbul back Iran protests

-

Olise sparkles as Bayern fire eight past Wolfsburg

-

Man Utd knocked out of FA Cup by Brighton, Martinelli hits hat-trick for Arsenal

Man Utd knocked out of FA Cup by Brighton, Martinelli hits hat-trick for Arsenal

-

Troubled Man Utd crash out of FA Cup against Brighton

-

Danish PM says Greenland showdown at 'decisive moment' after new Trump threats

Danish PM says Greenland showdown at 'decisive moment' after new Trump threats

-

AC Milan snatch late draw at Fiorentina as title rivals Inter face Napoli

-

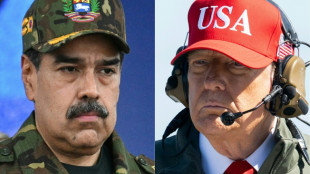

Venezuelans demand political prisoners' release, Maduro 'doing well'

Venezuelans demand political prisoners' release, Maduro 'doing well'

-

'Avatar: Fire and Ashe' leads in N.America for fourth week

-

Bordeaux-Begles rout Northampton in Champions Cup final rematch

Bordeaux-Begles rout Northampton in Champions Cup final rematch

-

NHL players will compete at Olympics, says international ice hockey chief

-

Kohli surpasses Sangakkara as second-highest scorer in international cricket

Kohli surpasses Sangakkara as second-highest scorer in international cricket

-

Young mother seeks five relatives in Venezuela jail

-

Arsenal villain Martinelli turns FA Cup hat-trick hero

Arsenal villain Martinelli turns FA Cup hat-trick hero

-

Syrians in Kurdish area of Aleppo pick up pieces after clashes

-

Kohli hits 93 as India edge New Zealand in ODI opener

Kohli hits 93 as India edge New Zealand in ODI opener

-

Trump tells Cuba to 'make a deal, before it is too late'

-

Toulon win Munster thriller as Quins progress in Champions Cup

Toulon win Munster thriller as Quins progress in Champions Cup

-

NHL players will complete at Olympics, says international ice hockey chief

-

Leeds rally to avoid FA Cup shock at Derby

Leeds rally to avoid FA Cup shock at Derby

-

Rassat sweeps to slalom victory to take World cup lead

-

Liverpool's Bradley out for the season with 'significant' knee injury

Liverpool's Bradley out for the season with 'significant' knee injury

-

Syria govt forces take control of Aleppo's Kurdish neighbourhoods

-

Comeback kid Hurkacz inspires Poland to first United Cup title

Comeback kid Hurkacz inspires Poland to first United Cup title

-

Kyiv shivers without heat, but battles on

-

Salah and fellow stars aim to deny Morocco as AFCON reaches semi-final stage

Salah and fellow stars aim to deny Morocco as AFCON reaches semi-final stage

-

Mitchell lifts New Zealand to 300-8 in ODI opener against India

-

Iran protest death toll rises as alarm grows over crackdown 'massacre'

Iran protest death toll rises as alarm grows over crackdown 'massacre'

-

Malaysia suspends access to Musk's Grok AI: regulator

-

Venezuelans await release of more political prisoners, Maduro 'doing well'

Venezuelans await release of more political prisoners, Maduro 'doing well'

-

Kunlavut seals Malaysia Open title after injured Shi retires

-

Medvedev warms up in style for Australian Open with Brisbane win

Medvedev warms up in style for Australian Open with Brisbane win

-

Bublik powers into top 10 ahead of Australian Open after Hong Kong win

-

Sabalenka fires Australian Open warning with Brisbane domination

Sabalenka fires Australian Open warning with Brisbane domination

-

In Gaza hospital, patients cling to MSF as Israel orders it out

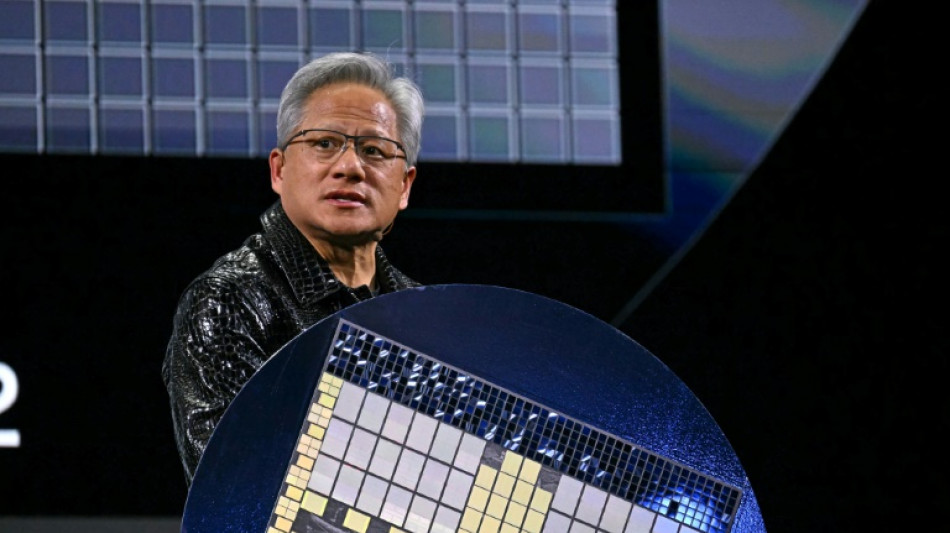

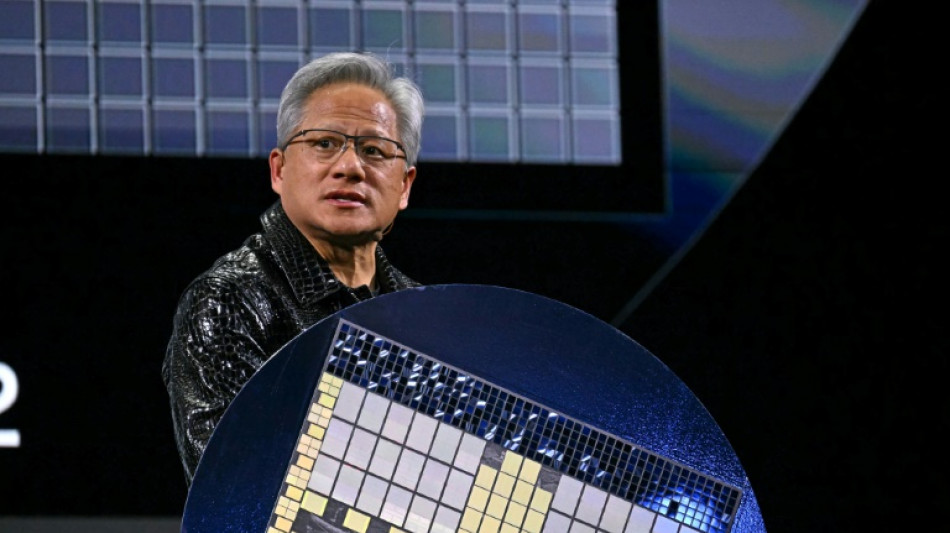

AI giant Nvidia becomes first company to reach $4 tn in value

Nvidia became the first company to touch $4 trillion in market value on Wednesday, a new milestone in Wall Street's bet that artificial intelligence will transform the economy.

Shortly after the stock market opened, Nvidia vaulted as high as $164.42, giving it a valuation above $4 trillion. The stock subsequently edged lower, ending just under the record threshold.

"The market has an incredible certainty that AI is the future," said Steve Sosnick of Interactive Brokers. "Nvidia is certainly the company most positioned to benefit from that gold rush."

Nvidia, led by electrical engineer Jensen Huang, now has a market value greater than the GDP of France, Britain or India, a testament to investor confidence that AI will spur a new era of robotics and automation.

The California chip company's latest surge is helping drive a recovery in the broader stock market, as Nvidia itself outperforms major indices.

Part of this is due to relief that President Donald Trump has walked back his most draconian tariffs, which pummeled global markets in early April.

Even as Trump announced new tariff actions in recent days, US stocks have stayed at lofty levels, with the tech-centered Nasdaq ending at a fresh record on Wednesday.

"You've seen the markets walk us back from a worst-case scenario in terms of tariffs," said Angelo Zino, technology analyst at CFRA Research.

While Nvidia still faces US export controls to China as well as broader tariff uncertainty, the company's deal to build AI infrastructure in Saudi Arabia during a Trump state visit in May showed a potential upside in the US president's trade policy.

"We've seen the administration using Nvidia chips as a bargaining chip," Zino said.

- New advances -

Nvidia's surge to $4 trillion marks a new benchmark in a fairly consistent rise over the last two years as AI enthusiasm has built.

In 2025 so far, the company's shares have risen more than 21 percent, whereas the Nasdaq has gained 6.7 percent.

Taiwan-born Huang has wowed investors with a series of advances, including its core product: graphics processing units (GPUs), key to many of the generative AI programs behind autonomous driving, robotics and other cutting-edge domains.

The company has also unveiled its Blackwell next-generation technology allowing more super processing capacity. One of its advances is "real-time digital twins," significantly speeding production development time in manufacturing, aerospace and myriad other sectors.

However, Nvidia's winning streak was challenged early in 2025 when China-based DeepSeek shook up the world of generative AI with a low-cost, high-performance model that challenged the hegemony of OpenAI and other big-spending behemoths.

Nvidia's lost some $600 billion in market valuation in a single session during this period.

Huang has welcomed DeepSeek's presence, while arguing against US export constraints.

- AI race -

In the most recent quarter, Nvidia reported earnings of nearly $19 billion despite a $4.5 billion hit from US export controls limiting sales of cutting-edge technology to China.

The first-quarter earnings period also revealed that momentum for AI remained strong. Many of the biggest tech companies -- Microsoft, Google, Amazon and Meta -- are jostling to come out on top in the multi-billion-dollar AI race.

A recent UBS survey of technology executives showed Nvidia widening its lead over rivals.

Zino said Nvidia's latest surge reflected a fuller understanding of DeepSeek, which has ultimately stimulated investment in complex reasoning models but not threatened Nvidia's business.

Nvidia is at the forefront of "AI agents," the current focus in generative AI in which machines are able to reason and infer more than in the past, he said.

"Overall the demand landscape has improved for 2026 for these more complex reasoning models," Zino said.

But the speedy growth of AI will also be a source of disruption.

Executives at Ford, JPMorgan Chase and Amazon are among those who have begun to say the "quiet part out loud," according to a Wall Street Journal report recounting recent public acknowledgment of white-collar job loss due to AI.

Shares of Nvidia closed the day at $162.88, up 1.8 percent, finishing at just under $4 trillion in market value.

J.AbuHassan--SF-PST