-

In-form Bencic back in top 10 for first time since having baby

In-form Bencic back in top 10 for first time since having baby

-

Swiatek insists 'everything is fine' after back-to-back defeats

-

Wildfires spread to 15,000 hectares in Argentine Patagonia

Wildfires spread to 15,000 hectares in Argentine Patagonia

-

Napoli stay in touch with leaders Inter thanks to talisman McTominay

-

Meta urges Australia to change teen social media ban

Meta urges Australia to change teen social media ban

-

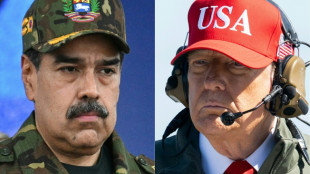

Venezuelans await political prisoners' release after government vow

-

Lens continue winning streak, Endrick opens Lyon account in French Cup

Lens continue winning streak, Endrick opens Lyon account in French Cup

-

McTominay double gives Napoli precious point at Serie A leaders Inter

-

Trump admin sends more agents to Minneapolis despite furor over woman's killing

Trump admin sends more agents to Minneapolis despite furor over woman's killing

-

Allen magic leads Bills past Jaguars in playoff thriller

-

Barca edge Real Madrid in thrilling Spanish Super Cup final

Barca edge Real Madrid in thrilling Spanish Super Cup final

-

Malinin spearheads US Olympic figure skating challenge

-

Malinin spearheads US figure Olympic figure skating challenge

Malinin spearheads US figure Olympic figure skating challenge

-

Iran rights group warns of 'mass killing', govt calls counter-protests

-

'Fragile' Man Utd hit new low with FA Cup exit

'Fragile' Man Utd hit new low with FA Cup exit

-

Iran rights group warns of 'mass killing' of protesters

-

Demonstrators in London, Paris, Istanbul back Iran protests

Demonstrators in London, Paris, Istanbul back Iran protests

-

Olise sparkles as Bayern fire eight past Wolfsburg

-

Man Utd knocked out of FA Cup by Brighton, Martinelli hits hat-trick for Arsenal

Man Utd knocked out of FA Cup by Brighton, Martinelli hits hat-trick for Arsenal

-

Troubled Man Utd crash out of FA Cup against Brighton

-

Danish PM says Greenland showdown at 'decisive moment' after new Trump threats

Danish PM says Greenland showdown at 'decisive moment' after new Trump threats

-

AC Milan snatch late draw at Fiorentina as title rivals Inter face Napoli

-

Venezuelans demand political prisoners' release, Maduro 'doing well'

Venezuelans demand political prisoners' release, Maduro 'doing well'

-

'Avatar: Fire and Ashe' leads in N.America for fourth week

-

Bordeaux-Begles rout Northampton in Champions Cup final rematch

Bordeaux-Begles rout Northampton in Champions Cup final rematch

-

NHL players will compete at Olympics, says international ice hockey chief

-

Kohli surpasses Sangakkara as second-highest scorer in international cricket

Kohli surpasses Sangakkara as second-highest scorer in international cricket

-

Young mother seeks five relatives in Venezuela jail

-

Arsenal villain Martinelli turns FA Cup hat-trick hero

Arsenal villain Martinelli turns FA Cup hat-trick hero

-

Syrians in Kurdish area of Aleppo pick up pieces after clashes

-

Kohli hits 93 as India edge New Zealand in ODI opener

Kohli hits 93 as India edge New Zealand in ODI opener

-

Trump tells Cuba to 'make a deal, before it is too late'

-

Toulon win Munster thriller as Quins progress in Champions Cup

Toulon win Munster thriller as Quins progress in Champions Cup

-

NHL players will complete at Olympics, says international ice hockey chief

-

Leeds rally to avoid FA Cup shock at Derby

Leeds rally to avoid FA Cup shock at Derby

-

Rassat sweeps to slalom victory to take World cup lead

-

Liverpool's Bradley out for the season with 'significant' knee injury

Liverpool's Bradley out for the season with 'significant' knee injury

-

Syria govt forces take control of Aleppo's Kurdish neighbourhoods

-

Comeback kid Hurkacz inspires Poland to first United Cup title

Comeback kid Hurkacz inspires Poland to first United Cup title

-

Kyiv shivers without heat, but battles on

-

Salah and fellow stars aim to deny Morocco as AFCON reaches semi-final stage

Salah and fellow stars aim to deny Morocco as AFCON reaches semi-final stage

-

Mitchell lifts New Zealand to 300-8 in ODI opener against India

-

Iran protest death toll rises as alarm grows over crackdown 'massacre'

Iran protest death toll rises as alarm grows over crackdown 'massacre'

-

Malaysia suspends access to Musk's Grok AI: regulator

-

Venezuelans await release of more political prisoners, Maduro 'doing well'

Venezuelans await release of more political prisoners, Maduro 'doing well'

-

Kunlavut seals Malaysia Open title after injured Shi retires

-

Medvedev warms up in style for Australian Open with Brisbane win

Medvedev warms up in style for Australian Open with Brisbane win

-

Bublik powers into top 10 ahead of Australian Open after Hong Kong win

-

Sabalenka fires Australian Open warning with Brisbane domination

Sabalenka fires Australian Open warning with Brisbane domination

-

In Gaza hospital, patients cling to MSF as Israel orders it out

Stocks mixed, precious metals slip in quiet Asian trade

Asian equities were mixed Monday in quiet post-Christmas trading as investors look ahead to the release of minutes from the Federal Reserve's policy meeting this month, while precious metals retreated from record highs.

Markets looked set to end the last few days of the year on a positive note, helped by hopes for more US interest rate cuts and optimism that the tech-led rally still has more legs.

While the US central bank lowered borrowing costs earlier in December as expected, it also indicated it could stand pat when decision-makers gather again at the end of next month, with two voting against any move and one calling for a bigger reduction.

The minutes from the meeting are due to be released on Tuesday and traders will be poring over their contents for any indication about its plans for 2026.

The prospect of cuts has helped push world markets ever higher this year, offsetting niggling worries about stretched valuations in the tech sector.

On Monday, shares in Hong Kong, Tokyo, Sydney, Wellington, Mumbai and Bangkok slipped while those in Singapore, Seoul, Taipei and Manila edged up. Shanghai was marginally higher.

On commodities markets, gold and silver slipped after hitting new records in recent days.

The precious metals have also enjoyed strong buying, with gold and silver both hitting record highs on expectations for more rate cuts, which makes them more desirable to investors.

Their status as a safe haven asset in times of turmoil has also added to their allure amid geopolitical upheaval with US strikes in Nigeria and a blockade of Venezuelan oil tankers.

On Monday gold was sitting around $4,450, having peaked a whisker shy of $4,550 on Friday, while silver slipped to $77.50 after touching a record above $80.

The white metal has also seen a sharp run-up in recent weeks owing to surging demand and tight supply.

"We are witnessing a generational bubble playing out in silver," wrote Tony Sycamore at IG.

"Relentless industrial demand from solar panels, EVs, AI data centres and electronics, pushing against depleting inventories, has driven physical premiums to extremes."

Oil prices rose, having sunk more than two percent Friday as investors eyed the weekend meeting between US President Donald Trump and Ukrainian counterpart Volodymyr Zelensky on peace proposals.

Trump said Sunday a deal was closer than ever to end Russia's invasion of Ukraine but reported no apparent breakthrough on the issue of territory.

The US president said it would become clear within weeks whether it was possible to end the nearly four-year-long war that has killed tens of thousands.

- Key figures at around 0700 GMT -

Tokyo - Nikkei 225: DOWN 0.4 percent at 50,526.92 (close)

Hong Kong - Hang Seng Index: DOWN 0.5 percent at 25,688.89

Shanghai - Composite: FLAT at 3,965.28 (close)

Dollar/yen: DOWN at 156.29 yen from 156.50 yen on Friday

Euro/dollar: DOWN at $1.1762 from $1.1776

Pound/dollar: DOWN at $1.3494 from $1.3501

Euro/pound: DOWN at 87.18 pence from 87.21 pence

West Texas Intermediate: UP 1.1 percent at $57.38 per barrel

Brent North Sea Crude: UP 1.1 percent at $61.30 per barrel

New York - Dow: FLAT at 48,710.97 (close)

J.Saleh--SF-PST