-

Fed chair Powell says targeted by federal probe

Fed chair Powell says targeted by federal probe

-

Trailblazing Milos Raonic retires from tennis

-

Australia recalls parliament early to pass hate speech, gun laws

Australia recalls parliament early to pass hate speech, gun laws

-

'One Battle After Another,' 'Hamnet' triumph at Golden Globes

-

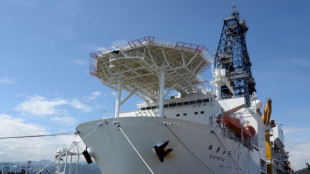

Japan aims to dig deep-sea rare earths to reduce China dependence

Japan aims to dig deep-sea rare earths to reduce China dependence

-

Top UN court to hear Rohingya genocide case against Myanmar

-

US sends more agents to Minneapolis despite furor over woman's killing

US sends more agents to Minneapolis despite furor over woman's killing

-

Trump says Iran 'want to negotiate' after reports of hundreds killed in protests

-

Bangladesh's powerful Islamists prepare for elections

Bangladesh's powerful Islamists prepare for elections

-

NBA-best Thunder beat the Heat as T-Wolves edge Spurs

-

Ukraine's Kostyuk defends 'conscious choice' to speak out about war

Ukraine's Kostyuk defends 'conscious choice' to speak out about war

-

Trump says working well with Venezuela's new leaders, open to meeting

-

Asian equities edge up, dollar slides as US Fed Reserve subpoenaed

Asian equities edge up, dollar slides as US Fed Reserve subpoenaed

-

Hong Kong court hears sentencing arguments for Jimmy Lai

-

Powell says Federal Reserve subpoenaed by US Justice Department

Powell says Federal Reserve subpoenaed by US Justice Department

-

Chalamet, 'One Battle' among winners at Golden Globes

-

Turning point? Canada's tumultuous relationship with China

Turning point? Canada's tumultuous relationship with China

-

Eagles stunned by depleted 49ers, Allen leads Bills fightback

-

Globes red carpet: chic black, naked dresses and a bit of politics

Globes red carpet: chic black, naked dresses and a bit of politics

-

Maduro's fall raises Venezuelans' hopes for economic bounty

-

Golden Globes kick off with 'One Battle' among favorites

Golden Globes kick off with 'One Battle' among favorites

-

Australian Open 'underdog' Medvedev says he will be hard to beat

-

In-form Bencic back in top 10 for first time since having baby

In-form Bencic back in top 10 for first time since having baby

-

Swiatek insists 'everything is fine' after back-to-back defeats

-

Wildfires spread to 15,000 hectares in Argentine Patagonia

Wildfires spread to 15,000 hectares in Argentine Patagonia

-

Napoli stay in touch with leaders Inter thanks to talisman McTominay

-

Meta urges Australia to change teen social media ban

Meta urges Australia to change teen social media ban

-

Venezuelans await political prisoners' release after government vow

-

Lens continue winning streak, Endrick opens Lyon account in French Cup

Lens continue winning streak, Endrick opens Lyon account in French Cup

-

McTominay double gives Napoli precious point at Serie A leaders Inter

-

Trump admin sends more agents to Minneapolis despite furor over woman's killing

Trump admin sends more agents to Minneapolis despite furor over woman's killing

-

Allen magic leads Bills past Jaguars in playoff thriller

-

Barca edge Real Madrid in thrilling Spanish Super Cup final

Barca edge Real Madrid in thrilling Spanish Super Cup final

-

Malinin spearheads US Olympic figure skating challenge

-

Malinin spearheads US figure Olympic figure skating challenge

Malinin spearheads US figure Olympic figure skating challenge

-

Iran rights group warns of 'mass killing', govt calls counter-protests

-

'Fragile' Man Utd hit new low with FA Cup exit

'Fragile' Man Utd hit new low with FA Cup exit

-

Iran rights group warns of 'mass killing' of protesters

-

Demonstrators in London, Paris, Istanbul back Iran protests

Demonstrators in London, Paris, Istanbul back Iran protests

-

Olise sparkles as Bayern fire eight past Wolfsburg

-

Man Utd knocked out of FA Cup by Brighton, Martinelli hits hat-trick for Arsenal

Man Utd knocked out of FA Cup by Brighton, Martinelli hits hat-trick for Arsenal

-

Troubled Man Utd crash out of FA Cup against Brighton

-

Danish PM says Greenland showdown at 'decisive moment' after new Trump threats

Danish PM says Greenland showdown at 'decisive moment' after new Trump threats

-

AC Milan snatch late draw at Fiorentina as title rivals Inter face Napoli

-

Venezuelans demand political prisoners' release, Maduro 'doing well'

Venezuelans demand political prisoners' release, Maduro 'doing well'

-

'Avatar: Fire and Ashe' leads in N.America for fourth week

-

Bordeaux-Begles rout Northampton in Champions Cup final rematch

Bordeaux-Begles rout Northampton in Champions Cup final rematch

-

NHL players will compete at Olympics, says international ice hockey chief

-

Kohli surpasses Sangakkara as second-highest scorer in international cricket

Kohli surpasses Sangakkara as second-highest scorer in international cricket

-

Young mother seeks five relatives in Venezuela jail

Markets mostly rise as rate cut hopes bring Christmas cheer

Most markets rose Tuesday, while gold and silver hit fresh records as optimism for more US interest rate cuts and an easing of AI fears helped investors prepare for the festive break on a positive note.

Data showing US unemployment rising and inflation slowing gave the Federal Reserve more room to lower borrowing costs and provided some much-needed pep to markets after a recent swoon.

That was compounded by a blockbuster earnings report from Micron Technologies that reinvigorated tech firms.

The sector has been the key driver of a surge in world markets to all-time highs this year owing to huge investments into all things artificial intelligence but that trade has been questioned in recent months, sparking fears of a bubble.

With few catalysts to drive gains on Wall Street, tech was again at the forefront of buying Monday, with chip titan Nvidia and Tesla leading the way.

"The amount of money being thrown towards AI has been eye-watering," wrote Michael Hewson of MCH Market Insights.

He said the vast sums pumped into the sector "has inevitably raised questions as to how all of this will be financed, when all the companies involved appear to be playing a game of pass the parcel when it comes to cash investment".

"These deals also raise all manner of questions about how this cash will generate a longer-term return on investment," he added.

"With questions now being posed... we may start to get a more realistic picture of who the winners and losers are likely to be, with the losers likely to be punished heavily."

Asian markets enjoyed a bright start though some stuttered as the day wore on.

Sydney, Seoul, Shanghai, Sydney, Singapore, Taipei, Wellington, Bangkok and Jakarta were all higher, while Tokyo and Mumbai were flat.

Hong Kong and Manila dipped.

Precious metals were also pushing ever higher on the back of expectations for more US rate cuts, which makes them more attractive to investors.

Bullion jumped to a high above $4,497 per ounce, while silver was just short of $70 an ounce, with the US blockade against Venezuela and the Ukraine conflict adding a geopolitical twist.

"The structural tailwinds that have driven both of these to record highs this year persist, be it central bank demand for gold or surging industrial demand for silver," said Neil Wilson at Saxo Markets.

"The latest surge comes after soft inflation and employment readings in the US last week, which reinforced expectations around the Fed's policy easing next year. Geopolitics remains a factor, too."

On currency markets, the yen extended gains after Japan's Finance Minister Satsuki Katayama flagged authorities' powers to step in to support the unit, citing speculative moves in markets.

The yen suffered heavy selling after Bank of Japan boss Kazuo Ueda held off signalling another rate hike anytime soon following last week's increase.

"The moves (on Friday) were clearly not in line with fundamentals but rather speculative," Katayama told Bloomberg on Monday.

"Against such movements, we have made clear that we will take bold action, as stated in the Japan–US finance ministers' joint statement," she added.

Oil prices dipped, having jumped more than two percent Monday on concerns about Washington's measures against Caracas.

The United States has taken control of two oil tankers and is chasing a third, after President Donald Trump last week ordered a blockade of "sanctioned" tankers heading to and leaving Venezuela.

- Key figures at around 0700 GMT -

Tokyo - Nikkei 225: FLAT at 50,412.87 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 25,764.84

Shanghai - Composite: UP 0.1 percent at 3,919.98 (close)

Dollar/yen: DOWN at 156.08 yen from 156.99 yen on Monday

Euro/dollar: UP at $1.1774 from $1.1756

Pound/dollar: UP at $1.3487 from $1.3458

Euro/pound: DOWN at 87.30 pence from 87.35 pence

West Texas Intermediate: DOWN 0.4 percent at $57.77 per barrel

Brent North Sea Crude: DOWN 0.4 percent at $61.83 per barrel

New York - Dow: UP 0.5 percent at 48,362.68 (close)

London - FTSE 100: DOWN 0.3 percent at 9,865.97 (close)

P.AbuBaker--SF-PST