-

Hundred-plus detained after fans 'lynched' during South America cup tie

Hundred-plus detained after fans 'lynched' during South America cup tie

-

Trump hails 'total victory' as US court quashes $464 mn civil penalty

-

Stocks waver ahead of Fed speech but EU tariff deal lifts Europe

Stocks waver ahead of Fed speech but EU tariff deal lifts Europe

-

Slot says Liverpool will only sign right player at right price amid Isak row

-

Walmart expects better sales, earnings as shoppers squeezed by tariffs

Walmart expects better sales, earnings as shoppers squeezed by tariffs

-

Malnourished Gaza children facing death without aid, says UN

-

Autopsy rules out 'trauma' in Frenchman livestream death

Autopsy rules out 'trauma' in Frenchman livestream death

-

Liverpool's Frimpong out for several weeks with hamstring injury

-

EU gets 15% US tariff for cars, but fails to get wine reprieve

EU gets 15% US tariff for cars, but fails to get wine reprieve

-

Leverkusen rebuild continues with Bade and Echeverri signings

-

Ghana singer Shatta Wale held in US fraud probe over Lamborghini purchase

Ghana singer Shatta Wale held in US fraud probe over Lamborghini purchase

-

Wales skipper Callender passed fit for Women's Rugby World Cup opener against Scotland

-

Only goal is to win, says ever-competitive veteran Fraser-Pryce

Only goal is to win, says ever-competitive veteran Fraser-Pryce

-

Maresca adamant Fofana 'very happy' at Chelsea

-

Record EU wildfires burnt more than 1 mn hectares in 2025: AFP analysis

Record EU wildfires burnt more than 1 mn hectares in 2025: AFP analysis

-

Hurricane Erin brings coastal flooding to N. Carolina, Virginia

-

Stocks slide as investors await key Fed speech

Stocks slide as investors await key Fed speech

-

EU gets 15% US tariff for cars, fails to secure wine reprieve

-

Russian fuel prices surge after Ukraine hits refineries

Russian fuel prices surge after Ukraine hits refineries

-

Maguire feels it will be 'silly' to leave Man Utd now

-

Ukrainian suspect arrested in Italy over Nord Stream blasts

Ukrainian suspect arrested in Italy over Nord Stream blasts

-

England include ex-skipper Knight in Women's World Cup squad as Cross misses out

-

Walmart lifts outlook for sales, earnings despite tariffs

Walmart lifts outlook for sales, earnings despite tariffs

-

UK sees record asylum claims as row brews over housing

-

Swiss international Okafor move to Leeds heralds new EPL record

Swiss international Okafor move to Leeds heralds new EPL record

-

Microsoft re-joins handheld gaming fight against Nintendo's Switch

-

McReight to captain Wallabies against Springboks

McReight to captain Wallabies against Springboks

-

Taiwanese boxer Lin agrees to gender test for world championships

-

Stocks slip as investors await key Fed speech

Stocks slip as investors await key Fed speech

-

Hong Kong mogul Jimmy Lai's 'punditry' not criminal: lawyer

-

Bournemouth sign 'proven winner' Adli from Leverkusen

Bournemouth sign 'proven winner' Adli from Leverkusen

-

Israel pounds Gaza City as military takes first steps in offensive

-

First security guarantees, then Putin summit, Zelensky says

First security guarantees, then Putin summit, Zelensky says

-

Suspended Thai PM testifies in court case seeking her ouster

-

Shilton congratulates Brazilian goalkeeper Fabio on breaking record

Shilton congratulates Brazilian goalkeeper Fabio on breaking record

-

Markets mixed as investors await key Fed speech

-

Israel pounds Gaza City after offensive gets green light

Israel pounds Gaza City after offensive gets green light

-

Fraser-Pryce seeks Brussels boost ahead of Tokyo worlds

-

Asian markets mixed as investors await key speech

Asian markets mixed as investors await key speech

-

Ten hurt, 90 arrested as match abandoned following fan violence in Argentina

-

Indian heritage restorers piece together capital's past

Indian heritage restorers piece together capital's past

-

Australian Rules player suspended for homophobic slur

-

Online behaviour under scrutiny as Russia hunts 'extremists'

Online behaviour under scrutiny as Russia hunts 'extremists'

-

Malaysia rules out return of F1 over costs

-

German firm gives 'second life' to used EV batteries

German firm gives 'second life' to used EV batteries

-

Wallabies great Will Genia announces retirement at 37

-

South Africa spinner Subrayen cited for suspect bowling action

South Africa spinner Subrayen cited for suspect bowling action

-

Menendez brothers face parole board seeking freedom after parents murders

-

Weaponising the feed: Inside Kenya's online war against activists

Weaponising the feed: Inside Kenya's online war against activists

-

Africa could become 'renewable superpower', says Guterres

| RBGPF | 0% | 73.27 | $ | |

| CMSC | 0.21% | 23.49 | $ | |

| RELX | -1.05% | 48.185 | $ | |

| SCS | -0.37% | 16.12 | $ | |

| BP | -0.09% | 33.85 | $ | |

| NGG | -0.97% | 71.39 | $ | |

| BTI | 0.26% | 59.165 | $ | |

| GSK | 0.52% | 40.28 | $ | |

| RIO | 0.64% | 61.01 | $ | |

| RYCEF | 1.36% | 13.94 | $ | |

| CMSD | -0.06% | 23.675 | $ | |

| AZN | 0.18% | 80.665 | $ | |

| BCC | -0.51% | 84.07 | $ | |

| BCE | -0.78% | 25.54 | $ | |

| JRI | -0.04% | 13.325 | $ | |

| VOD | -0.76% | 11.81 | $ |

Oil prices drop following Trump's Iran comments, US stocks rise

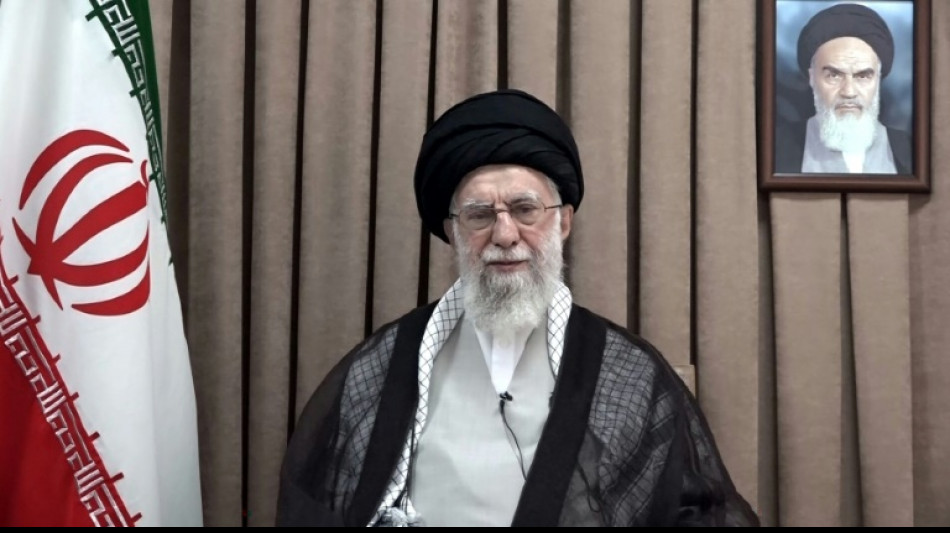

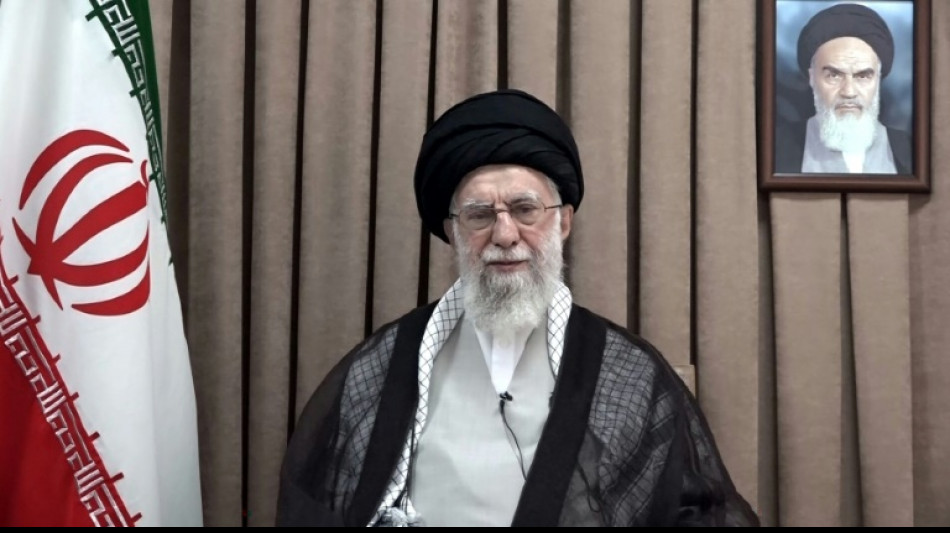

Oil prices dropped Wednesday as comments by President Donald Trump trimmed concerns about an imminent US intervention in the Israel-Iran conflict.

Meanwhile, Wall Street's main indices advanced in late morning trading as investors also awaited the Federal Reserve rate decision, although they were mixed elsewhere.

Oil prices initially rose after Iran's supreme leader Ali Khamenei rejected US President Donald Trump's demand for an "unconditional surrender", adding to sharp gains made the previous day.

Six days into the conflict, Khamenei warned the United States would face "irreparable damage" if it intervenes in support of Israel.

But oil prices then fell after Trump spoke later and indicated he was still considering whether the United States would join Israeli strikes and indicated that Iran had reached out to seek negotiations.

"For now at least, the US is not getting involved, if one can believe Trump," said City Index and FOREX.com analyst Fawad Razaqzada.

Despite heightened tensions, "there has been no sense of panic from investors", said David Morrison, market analyst at financial services firm Trade Nation.

"As far as the US is concerned, events are taking place a long way from home," he said.

"But there's also a feeling that investors are betting on a short and sharp engagement, resulting in a more stable position across the Middle East than the one that currently exists."

Of particular concern, however, is the possibility of Iran shutting off the Strait of Hormuz, through which around one fifth of global oil supply is transported.

In Europe, the London stock market rose but Paris and Frankfurt ended the day down. Asian equities closed mixed as well.

- Fed watch -

The Federal Reserve is widely expected to hold interest rates steady on Wednesday, as officials gauge the impact of US tariffs on inflation.

The central bank has ignored calls from Trump to cut borrowing costs as the world's biggest economy faces pressure.

Trump again publicly berated Fed chief Jerome Powell on Wednesday, calling him a "stupid person" for not cutting interest rates.

The Federal Reserve will also release on Wednesday its rate and economic growth outlook for the rest of the year, which are expected to take account of Trump's tariff war.

Weak US retail sales and factory output data on Tuesday rekindled worries about the impact of tariffs on the economy but also provided hope that the Fed would still cut rates this year.

"The Fed would no doubt be cutting again by now if not for the uncertainty regarding tariffs and a recent escalation of tensions in the Middle East," said KPMG senior economist Benjamin Shoesmith.

In a busy week for monetary policy, Sweden's central bank cut its key interest rate on Wednesday to try and boost the country's economy, as it cited risks linked to trade tensions and the escalating conflict in the Middle East.

The Bank of England is expected to keep its key rate steady Thursday, especially after official data Wednesday showed UK annual inflation fell less than expected in May.

The Bank of Japan on Tuesday kept interest rates unchanged and said it would taper its purchase of government bonds at a slower pace, as trade uncertainty threatens to weigh on the world's number four economy.

- Key figures at around 1530 GMT -

Brent North Sea Crude: DOWN 2.0 percent at $74.93 per barrel

West Texas Intermediate: DOWN 2.0 percent at $71.82 per barrel

New York - Dow: UP 0.5 percent at 42,411.50 points

New York - S&P 500: UP 0.4 percent at 6,007.85

New York - Nasdaq Composite: UP 0.5 percent at 19,624.09

London - FTSE 100: UP 0.1 at 8,843.47 (close)

Paris - CAC 40: DOWN 0.4 percent at 7,656.12 (close)

Frankfurt - DAX: DOWN 0.5 percent at 23,317.81 (close)

Tokyo - Nikkei 225: UP 0.9 percent at 38,885.15 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 23,710.69 (close)

Shanghai - Composite: FLAT at 3,388.81 (close)

Euro/dollar: UP at $1.1530 from $1.1488 on Tuesday

Pound/dollar: UP at $1.3471 from $1.3425

Dollar/yen: DOWN at 144.59 yen from 145.27 yen

Euro/pound: UP at 85.59 pence from 85.54 pence

burs-rl/rmb

Z.AbuSaud--SF-PST