-

US singer signs on for Russia's answer to Eurovision

US singer signs on for Russia's answer to Eurovision

-

Hundred-plus detained after fans 'lynched' during South America cup tie

-

Trump hails 'total victory' as US court quashes $464 mn civil penalty

Trump hails 'total victory' as US court quashes $464 mn civil penalty

-

Stocks waver ahead of Fed speech but EU tariff deal lifts Europe

-

Slot says Liverpool will only sign right player at right price amid Isak row

Slot says Liverpool will only sign right player at right price amid Isak row

-

Walmart expects better sales, earnings as shoppers squeezed by tariffs

-

Malnourished Gaza children facing death without aid, says UN

Malnourished Gaza children facing death without aid, says UN

-

Autopsy rules out 'trauma' in Frenchman livestream death

-

Liverpool's Frimpong out for several weeks with hamstring injury

Liverpool's Frimpong out for several weeks with hamstring injury

-

EU gets 15% US tariff for cars, but fails to get wine reprieve

-

Leverkusen rebuild continues with Bade and Echeverri signings

Leverkusen rebuild continues with Bade and Echeverri signings

-

Ghana singer Shatta Wale held in US fraud probe over Lamborghini purchase

-

Wales skipper Callender passed fit for Women's Rugby World Cup opener against Scotland

Wales skipper Callender passed fit for Women's Rugby World Cup opener against Scotland

-

Only goal is to win, says ever-competitive veteran Fraser-Pryce

-

Maresca adamant Fofana 'very happy' at Chelsea

Maresca adamant Fofana 'very happy' at Chelsea

-

Record EU wildfires burnt more than 1 mn hectares in 2025: AFP analysis

-

Hurricane Erin brings coastal flooding to N. Carolina, Virginia

Hurricane Erin brings coastal flooding to N. Carolina, Virginia

-

Stocks slide as investors await key Fed speech

-

EU gets 15% US tariff for cars, fails to secure wine reprieve

EU gets 15% US tariff for cars, fails to secure wine reprieve

-

Russian fuel prices surge after Ukraine hits refineries

-

Maguire feels it will be 'silly' to leave Man Utd now

Maguire feels it will be 'silly' to leave Man Utd now

-

Ukrainian suspect arrested in Italy over Nord Stream blasts

-

England include ex-skipper Knight in Women's World Cup squad as Cross misses out

England include ex-skipper Knight in Women's World Cup squad as Cross misses out

-

Walmart lifts outlook for sales, earnings despite tariffs

-

UK sees record asylum claims as row brews over housing

UK sees record asylum claims as row brews over housing

-

Swiss international Okafor move to Leeds heralds new EPL record

-

Microsoft re-joins handheld gaming fight against Nintendo's Switch

Microsoft re-joins handheld gaming fight against Nintendo's Switch

-

McReight to captain Wallabies against Springboks

-

Taiwanese boxer Lin agrees to gender test for world championships

Taiwanese boxer Lin agrees to gender test for world championships

-

Stocks slip as investors await key Fed speech

-

Hong Kong mogul Jimmy Lai's 'punditry' not criminal: lawyer

Hong Kong mogul Jimmy Lai's 'punditry' not criminal: lawyer

-

Bournemouth sign 'proven winner' Adli from Leverkusen

-

Israel pounds Gaza City as military takes first steps in offensive

Israel pounds Gaza City as military takes first steps in offensive

-

First security guarantees, then Putin summit, Zelensky says

-

Suspended Thai PM testifies in court case seeking her ouster

Suspended Thai PM testifies in court case seeking her ouster

-

Shilton congratulates Brazilian goalkeeper Fabio on breaking record

-

Markets mixed as investors await key Fed speech

Markets mixed as investors await key Fed speech

-

Israel pounds Gaza City after offensive gets green light

-

Fraser-Pryce seeks Brussels boost ahead of Tokyo worlds

Fraser-Pryce seeks Brussels boost ahead of Tokyo worlds

-

Asian markets mixed as investors await key speech

-

Ten hurt, 90 arrested as match abandoned following fan violence in Argentina

Ten hurt, 90 arrested as match abandoned following fan violence in Argentina

-

Indian heritage restorers piece together capital's past

-

Australian Rules player suspended for homophobic slur

Australian Rules player suspended for homophobic slur

-

Online behaviour under scrutiny as Russia hunts 'extremists'

-

Malaysia rules out return of F1 over costs

Malaysia rules out return of F1 over costs

-

German firm gives 'second life' to used EV batteries

-

Wallabies great Will Genia announces retirement at 37

Wallabies great Will Genia announces retirement at 37

-

South Africa spinner Subrayen cited for suspect bowling action

-

Menendez brothers face parole board seeking freedom after parents murders

Menendez brothers face parole board seeking freedom after parents murders

-

Weaponising the feed: Inside Kenya's online war against activists

| RBGPF | 0% | 73.27 | $ | |

| RYCEF | 1.36% | 13.94 | $ | |

| CMSC | 0.04% | 23.45 | $ | |

| AZN | 0.24% | 80.71 | $ | |

| BTI | 0.19% | 59.125 | $ | |

| RELX | -0.99% | 48.215 | $ | |

| RIO | 0.74% | 61.07 | $ | |

| GSK | 0.53% | 40.285 | $ | |

| BP | 0.01% | 33.885 | $ | |

| NGG | -0.94% | 71.41 | $ | |

| CMSD | -0.06% | 23.675 | $ | |

| VOD | -0.72% | 11.815 | $ | |

| BCC | -0.61% | 83.985 | $ | |

| JRI | -0.23% | 13.3 | $ | |

| BCE | -0.76% | 25.545 | $ | |

| SCS | -0.43% | 16.11 | $ |

Oil rises, stocks mixed as investors watch rates, conflict

Oil prices rose and stock markets diverged Wednesday as investors tracked the Israel-Iran conflict and a looming US interest rate decision.

Wall Street's main indices were mixed in early deals after the open as investors awaited the Federal Reserve rate decision and weighed the latest news from Iran.

Despite rising tensions after President Donald Trump called for Iran's surrender, "there has been no sense of panic from investors", said David Morrison, market analyst at financial services firm Trade Nation.

"As far as the US is concerned, events are taking place a long way from home," he said.

"But there's also a feeling that investors are betting on a short and sharp engagement, resulting in a more stable position across the Middle East than the one that currently exists."

In Europe, the London stock market rose but Paris and Frankfurt were down in afternoon deals after Asian equities closed in different directions.

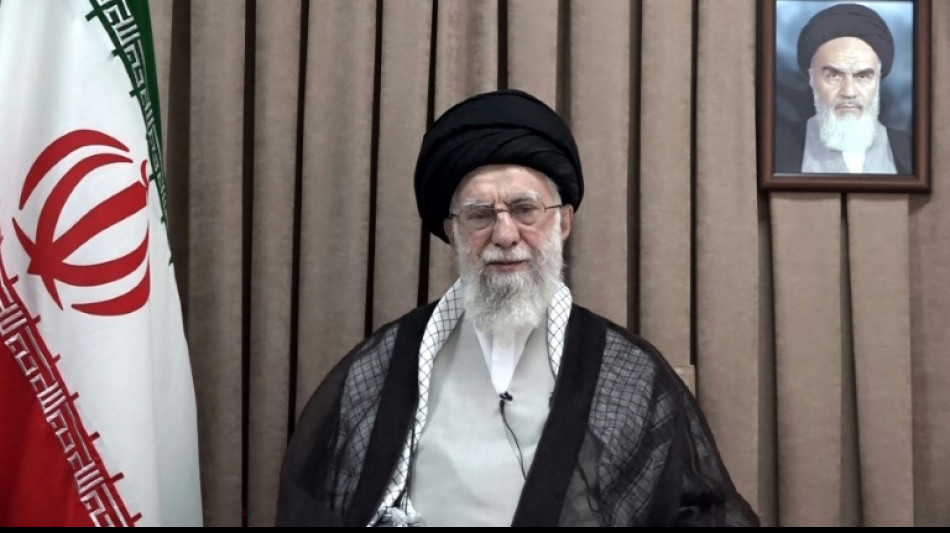

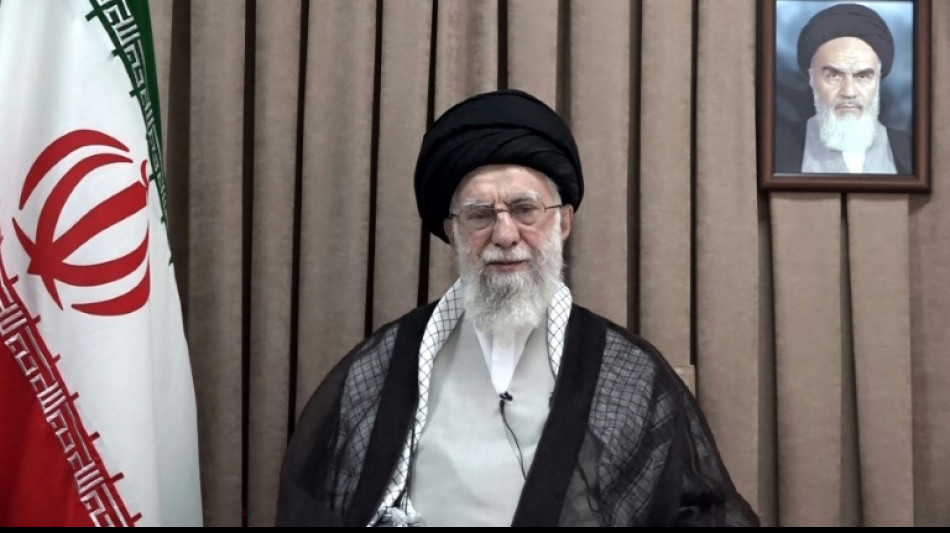

Oil prices rose after surging the previous day as Iran's supreme leader Ayatollah Ali Khamenei rejected Trump's call for an "unconditional surrender".

Six days into the conflict, Khamenei warned the United States would face "irreparable damage" if it intervenes in support of Israel.

Gas prices rose with concerns surrounding its supply.

Of particular concern is the possibility of Iran shutting off the Strait of Hormuz, through which around one fifth of global oil supply is transported.

"Global market direction remains clouded by tariffs, complicated by the Middle Eastern conflict and confounded by the lack of any obvious positive catalysts," said Richard Hunter, head of markets at Interactive Investor.

- Fed watch -

The Fed is widely expected to hold interest rates steady Wednesday, as officials gauge the impact of US tariffs on inflation.

The central bank has ignored calls from President Donald Trump to cut borrowing costs as the world's biggest economy faces pressure.

The US central bank will also release on Wednesday its rate and economic growth outlook for the rest of the year, which are expected to take account of Trump's tariff war.

Weak US retail sales and factory output data on Tuesday rekindled worries about the impact of tariffs on the economy but also provided hope that the Fed would still cut rates this year.

"The Fed would no doubt be cutting again by now if not for the uncertainty regarding tariffs and a recent escalation of tensions in the Middle East," said KPMG senior economist Benjamin Shoesmith.

In a busy week for monetary policy, Sweden's central bank cut its key interest rate on Wednesday to try and boost the country's economy, as it cited risks linked to trade tensions and the escalating conflict in the Middle East.

The Bank of England is expected to keep its key rate steady Thursday, especially after official data Wednesday showed UK annual inflation fell less than expected in May.

The Bank of Japan on Tuesday kept interest rates unchanged and said it would taper its purchase of government bonds at a slower pace, as trade uncertainty threatens to weigh on the world's number four economy.

- Key figures at around 1335 GMT -

Brent North Sea Crude: UP 1.3 percent at $77.41 per barrel

West Texas Intermediate: UP 1.3 percent at $74.24 per barrel

New York - Dow: UP 0.1 percent at 42,244.64 points

New York - S&P 500: FLAT at 5,984.80

New York - Nasdaq Composite: DOWN 0.1 percent at 19,503.61

London - FTSE 100: UP 0.2 at 8,848.38

Paris - CAC 40: DOWN 0.4 percent at 7,649.90

Frankfurt - DAX: DOWN 0.7 percent at 23,283.31

Tokyo - Nikkei 225: UP 0.9 percent at 38,885.15 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 23,710.69 (close)

Shanghai - Composite: FLAT at 3,388.81 (close)

New York - Dow: DOWN 0.7 percent at 42,215.80 (close)

Euro/dollar: UP at $1.1491 from $1.1488 on Tuesday

Pound/dollar: UP at $1.3437 from $1.3425

Dollar/yen: DOWN at 144.78 yen from 145.27 yen

Euro/pound: DOWN at 85.50 pence from 85.54 pence

burs-bcp-lth/rl

S.Barghouti--SF-PST