-

US keeper Turner joins Lyon from Notts Forest, loaned to MLS

US keeper Turner joins Lyon from Notts Forest, loaned to MLS

-

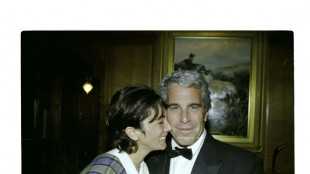

Epstein accomplice Maxwell moved to minimum security Texas prison

-

Sevastova shocks fourth-ranked Pegula to book date with Osaka

Sevastova shocks fourth-ranked Pegula to book date with Osaka

-

End of the chain gang? NFL adopts virtual measurement system

-

Deep lucky to escape Duckett 'elbow' as India get under England's skin

Deep lucky to escape Duckett 'elbow' as India get under England's skin

-

Search intensifies for five trapped in giant Chile copper mine

-

Trump orders firing of US official as cracks emerge in jobs market

Trump orders firing of US official as cracks emerge in jobs market

-

Trump deploys nuclear submarines in row with Russia

-

Colombian ex-president Uribe sentenced to 12 years house arrest

Colombian ex-president Uribe sentenced to 12 years house arrest

-

Wave of fake credentials sparks political fallout in Spain

-

Osaka ousts Ostapenko to reach WTA fourth round at Canada

Osaka ousts Ostapenko to reach WTA fourth round at Canada

-

Rovanpera emerges from home forests leading Rally of Finland

-

Exxon, Chevron turn page on legal fight as profits slip

Exxon, Chevron turn page on legal fight as profits slip

-

Prosecutors call for PSG's Achraf Hakimi to face rape trial

-

Missing Kenya football tickets blamed on govt protest fears

Missing Kenya football tickets blamed on govt protest fears

-

India's Krishna and Siraj rock England in series finale

-

Norris completes 'double top' in Hungary practice

Norris completes 'double top' in Hungary practice

-

MLB names iconic Wrigley Field as host of 2027 All-Star Game

-

Squiban doubles up at women's Tour de France

Squiban doubles up at women's Tour de France

-

International crew bound for space station

-

China's Qin takes 'miracle' second breaststroke gold at swim worlds

China's Qin takes 'miracle' second breaststroke gold at swim worlds

-

Siraj strikes as India fight back in England finale

-

Brewed awakening: German beer sales lowest on record

Brewed awakening: German beer sales lowest on record

-

Indonesia volcano belches six-mile ash tower

-

US promises Gaza food plan after envoy visit

US promises Gaza food plan after envoy visit

-

Musk's X accuses Britain of online safety 'overreach'

-

France says it cannot save contraceptives US plans to destroy

France says it cannot save contraceptives US plans to destroy

-

Russian drone attacks on Ukraine hit all-time record in July

-

Stocks sink on Trump tariffs, US jobs data

Stocks sink on Trump tariffs, US jobs data

-

Newcastle reject Liverpool bid for Isak: reports

-

Cracks emerge in US jobs market as Fed officials sound warning

Cracks emerge in US jobs market as Fed officials sound warning

-

Douglass dedicates world gold to stricken US after 'rough' week

-

Senegal PM unveils economic recovery plan based on domestic resources

Senegal PM unveils economic recovery plan based on domestic resources

-

China's Qin milks 'miracle' second breaststroke gold at swim worlds

-

Swiss will try to negotiate way out of stiff US tariffs

Swiss will try to negotiate way out of stiff US tariffs

-

US job growth weaker than expected in July as unemployment rises

-

Miracle man Qin wins second worlds gold ahead of blockbuster

Miracle man Qin wins second worlds gold ahead of blockbuster

-

Budapest mayor questioned as a suspect over Pride march

-

Thai-Cambodian cyberwarriors battle on despite truce

Thai-Cambodian cyberwarriors battle on despite truce

-

UK top court to rule on multi-billion pound car loan scandal

-

World economies reel from Trump's tariffs punch

World economies reel from Trump's tariffs punch

-

French wine industry warns of 'brutal' impact from US tariffs

-

England openers run riot in India finale after Atkinson strikes

England openers run riot in India finale after Atkinson strikes

-

China's Qin wins 'miracle' second breaststroke gold at swim worlds

-

US envoy visits Gaza sites as UN says hundreds of aid-seekers killed

US envoy visits Gaza sites as UN says hundreds of aid-seekers killed

-

Steenbergen wins world 100m freestyle to deny O'Callaghan

-

Stocks slide as Trump's new tariff sweep offsets earnings

Stocks slide as Trump's new tariff sweep offsets earnings

-

HIV-positive Turkmen man fears deportation, torture

-

India collapse in England decider as Atkinson strikes

India collapse in England decider as Atkinson strikes

-

Outrage grows in France over US plan to destroy contraceptives

| RBGPF | 0.69% | 74.94 | $ | |

| CMSC | 0.09% | 22.87 | $ | |

| NGG | 1.99% | 71.82 | $ | |

| SCS | -1.47% | 10.18 | $ | |

| GSK | 1.09% | 37.56 | $ | |

| BP | -1.26% | 31.75 | $ | |

| CMSD | 0.34% | 23.35 | $ | |

| RELX | -0.58% | 51.59 | $ | |

| BTI | 1.23% | 54.35 | $ | |

| SCU | 0% | 12.72 | $ | |

| AZN | 1.16% | 73.95 | $ | |

| RIO | -0.2% | 59.65 | $ | |

| RYCEF | 0.14% | 14.2 | $ | |

| BCE | 1.02% | 23.57 | $ | |

| BCC | -0.55% | 83.35 | $ | |

| JRI | -0.23% | 13.1 | $ | |

| VOD | 1.37% | 10.96 | $ |

US shares reverse course as Fed signals likely March rate hike

Wall Street stocks ended mostly lower Wednesday after Federal Reserve Chair Jerome Powell signaled an interest rate hike is likely in March amid elevated inflation.

Europe's major indices ended the day with strong gains, and US stocks were solidly positive heading into Powell's news conference following the central bank's two-day policy meeting, but then stumbled, with the broad-based S&P falling 0.2 percent.

Meanwhile, the main international oil contract hit $90 a barrel amid continued geopolitical tensions in Ukraine, but later retreated.

In an unusually blunt comment for a central banker, Powell told reporters "the committee is of a mind to raise the federal funds rate at the March meeting."

But he said the recovery in the world's largest economy is strong enough that it can handle higher borrowing costs.

The comments cemented the Fed's policy pivot towards a focus on fighting inflation rather than shoring up the recovery from the Covid-19 crisis, setting up an end to the era of easy money that fueled Wall Street's record-setting run during the pandemic.

Fed officials continue to expect that the wave of rising prices, which hit a multi-decade high in 2021, will ease this year as factors like supply chain struggles, largely caused by the pandemic, begin to resolve.

But economists view the expected March rate hike as the first in a series, while the Fed also laid out plans to begin reducing the stockpile of bonds amassed as it tried to shore up the financial system during the pandemic.

Edward Moya, senior market analyst at OANDA, blamed Wall Street's downturn during the press conference on both fears of balance sheet normalization and on jitters about rate hikes.

"The more Powell talked during the (press conference), the more hawkish he sounded," Moya wrote.

- Oil risk premium -

The standoff on the Ukraine-Russia border continues to trouble markets, with Moscow building up troop numbers and the West led by the United States warning the risk of an invasion "remains imminent" and urging its citizens to leave Ukraine.

The West has threatened to impose severe sanctions on Russia in case it goes forward with an invasion.

Those tensions helped push the price of Brent crude above $90 for the first time since October 2014, though it later fell back.

"The fundamentals (of supply and demand) remain bullish for oil prices and the prospect of a Russian invasion of Ukraine will only increase the risk premium," OANDA analyst Craig Erlam told AFP.

"With the price now above $90 and gathering momentum once more, it may just be a matter of time until it's flirting with $100."

- Key figures around 2230 GMT -

New York - Dow: DOWN 0.4 percent at 34,168.09 (close)

New York - S&P 500: DOWN 0.2 percent at 4,349.93 (close)

New York - Nasdaq: FLAT at 13,542.12 (close)

EURO STOXX 50: UP 2.1 percent at 4,164.60 (close)

London - FTSE 100: UP 1.3 percent at 7,469.78 (close)

Paris - CAC 40: UP 2.1 percent at 6,981.96 (close)

Frankfurt - DAX: UP 2.2 percent at 15,459.39 (close)

Tokyo - Nikkei 225: DOWN 0.4 percent at 27,011.33 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 24,289.90 (close)

Shanghai - Composite: UP 0.7 percent at 3,455.67 (close)

Euro/dollar: DOWN at $1.1238 from $1.1305 late Tuesday

Pound/dollar: UP at $1.3458 from $1.3507

Euro/pound: DOWN at 83.45 pence from 83.66 pence

Dollar/yen: UP at 114.64 yen from 113.87 yen

Brent North Sea crude: UP 1.8 percent at $89.76 per barrel

West Texas Intermediate: UP 1.8 percent at $87.15 per barrel

burs/jmb-hs/cs

B.AbuZeid--SF-PST